BigBear.ai (BBAI) Share Price Drops On Weak Q1 Results

Table of Contents

Q1 Earnings Miss Expectations: Key Factors Contributing to the BBAI Stock Drop

BigBear.ai's Q1 results fell significantly short of expectations, triggering the sharp drop in the BBAI share price. Several key factors contributed to this underperformance.

Revenue Shortfall:

BigBear.ai reported revenue figures considerably lower than analyst projections. Specifically:

- Government Contracts: A slowdown in securing new government contracts significantly impacted overall revenue. The company cited increased competition and delays in the procurement process as contributing factors.

- Commercial Sales: Revenue from commercial sales also underperformed, indicating challenges in penetrating the private sector AI market.

- Guidance Reduction: The company lowered its full-year revenue guidance, further dampening investor sentiment and impacting the BigBear.ai (BBAI) share price negatively. The revised guidance reflected the challenges faced in Q1 and a more conservative outlook for the remainder of the year. Previous quarterly revenue figures were cited to highlight the severity of the decline.

Increased Expenses and Lower Profit Margins:

Beyond the revenue shortfall, increased operating expenses squeezed profit margins, adding to the pressure on the BBAI share price.

- R&D Investments: Significant investments in research and development, while crucial for long-term growth, impacted short-term profitability. These expenses exceeded analyst expectations.

- Hiring Costs: Increased hiring to support growth initiatives also contributed to higher operating expenses.

- Margin Compression: The combination of lower revenue and higher expenses resulted in significantly compressed profit margins, impacting investor confidence in the company's ability to generate sustainable profits. Year-over-year comparisons of profit margins further emphasized this negative trend.

Impact of Macroeconomic Factors:

External macroeconomic factors also played a role in BigBear.ai's Q1 performance and the subsequent drop in the BigBear.ai (BBAI) share price.

- Government Spending Uncertainty: Uncertainty surrounding future government spending on AI and defense technologies created headwinds for the company's government contracting business.

- Inflationary Pressures: Rising inflation impacted both revenue generation and operating costs, further squeezing profitability.

- Increased Competition: The AI sector is highly competitive, with established players and numerous startups vying for market share.

Analyst Reactions and Future Outlook for BBAI Stock

The disappointing Q1 results prompted significant changes in analyst ratings and price targets for BBAI stock.

Analyst Ratings and Price Target Changes:

Several analysts downgraded their ratings on BigBear.ai, citing concerns about the revenue shortfall, increased expenses, and the overall weaker-than-expected performance. Price targets were also significantly lowered, reflecting the diminished outlook for the company's near-term performance. For example, [Analyst Name] at [Investment Firm] downgraded BBAI to "Sell" from "Hold," citing concerns about [Specific reason].

Investor Sentiment and Trading Volume:

Investor sentiment turned significantly negative following the earnings report, leading to a substantial increase in trading volume as investors reacted to the news. This heightened trading activity reflected the considerable uncertainty surrounding the future prospects of the company and the volatility in the BigBear.ai (BBAI) share price.

Potential for Recovery and Future Growth:

Despite the setbacks, BigBear.ai still possesses potential for recovery and future growth.

- Strategic Partnerships: The company's strategic partnerships with key players in the government and commercial sectors could drive future growth.

- Technological Innovation: BigBear.ai's investments in advanced AI technologies could position it for success in the long term.

- Government Spending: Increased government spending on AI could benefit the company's government contracting business.

How to Approach Investing in BigBear.ai (BBAI) Stock After the Q1 Report

Investing in BBAI after the Q1 report requires a careful assessment of the risks and opportunities.

Risk Assessment:

Investors should carefully assess the risks associated with investing in BBAI, including the possibility of further revenue shortfalls, persistent pressure on profit margins, and increased competition in the AI sector.

Long-Term vs. Short-Term Investment Strategy:

A long-term investment strategy might be suitable for investors with a higher risk tolerance who believe in BigBear.ai's long-term growth potential. Short-term investors, however, should proceed with caution given the current uncertainty.

Diversification and Risk Management:

Diversification and proper risk management are crucial for any investor considering BBAI stock. Don't put all your eggs in one basket.

Conclusion: Navigating the BigBear.ai (BBAI) Share Price Volatility

The weak Q1 results have created significant volatility in the BigBear.ai (BBAI) share price. The revenue shortfall, increased expenses, and negative analyst reactions all contributed to the decline. While the company has long-term potential, investors need to carefully assess the risks before investing. Conduct thorough research, understand the challenges, and consider your risk tolerance before making any investment decisions related to the BigBear.ai (BBAI) share price. Stay informed on the latest developments in the BigBear.ai (BBAI) share price and market trends for informed investment decisions.

Featured Posts

-

Kroyz Azoyl Telikos Champions League I Syneisfora Toy Giakoymaki

May 20, 2025

Kroyz Azoyl Telikos Champions League I Syneisfora Toy Giakoymaki

May 20, 2025 -

March 16 2025 Nyt Mini Crossword Clues Answers And Solutions

May 20, 2025

March 16 2025 Nyt Mini Crossword Clues Answers And Solutions

May 20, 2025 -

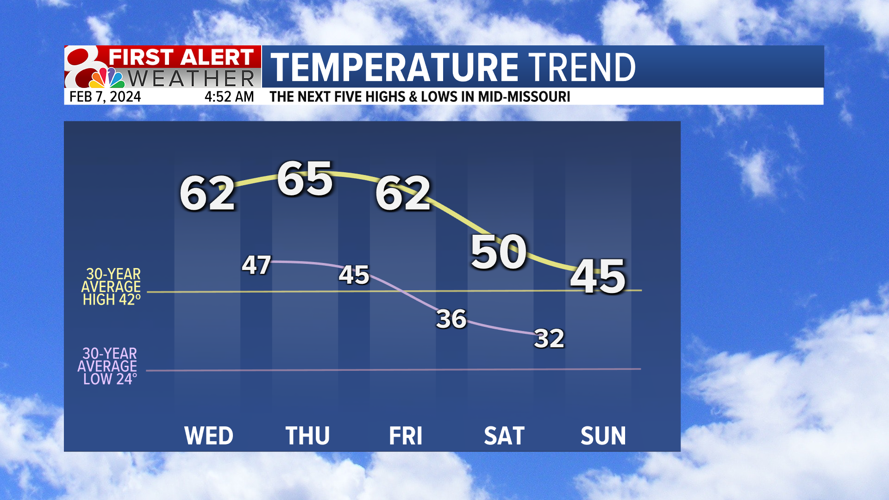

Enjoy Breezy And Mild Days Tips For Staying Comfortable

May 20, 2025

Enjoy Breezy And Mild Days Tips For Staying Comfortable

May 20, 2025 -

Le Nouveau Restaurant Rooftop Des Galeries Lafayette A Biarritz Presentation Par Imanol Harinordoquy Et Jean Michel Suhubiette

May 20, 2025

Le Nouveau Restaurant Rooftop Des Galeries Lafayette A Biarritz Presentation Par Imanol Harinordoquy Et Jean Michel Suhubiette

May 20, 2025 -

Mika Haekkinens Encouraging Words Is The F1 Door Still Open For Mick Schumacher

May 20, 2025

Mika Haekkinens Encouraging Words Is The F1 Door Still Open For Mick Schumacher

May 20, 2025