BigBear.ai Holdings (BBAI) Stock: Exploring The 2025 Price Decrease

Table of Contents

BigBear.ai Holdings (BBAI) stock has experienced significant volatility since its inception. This article explores potential factors contributing to a possible price decrease in 2025, examining market trends, company performance, and financial forecasts to provide a comprehensive analysis of the BBAI stock outlook. We will delve into the key factors that might influence the BigBear.ai (BBAI) stock price in the coming years, offering insights for investors considering this potentially volatile investment.

Market Trends Impacting BBAI Stock Price

Competitive Landscape

The AI and data analytics sector is fiercely competitive. Understanding the competitive landscape is crucial for predicting the BigBear.ai (BBAI) stock price. Several major players dominate the market, posing challenges to BBAI's growth.

- Key Competitors: Companies like Palantir Technologies (PLTR), IBM (IBM), and smaller, specialized AI firms offer similar services and compete for the same contracts.

- Market Share: BBAI faces an uphill battle gaining significant market share against established giants with larger resources and brand recognition. Their market share growth will be a key indicator of future stock performance.

- Competitive Threats: Competitors constantly innovate, introducing new products and services that could erode BBAI's market position and impact the BigBear.ai (BBAI) stock price negatively. For example, the release of a competing product with superior capabilities could significantly impact investor confidence.

- Industry News: Closely following industry news and reports, such as those from Gartner or IDC, provides valuable insight into emerging trends and the competitive landscape. Analyzing these reports helps assess BBAI's relative position and its prospects for future growth.

Macroeconomic Factors

Broader economic conditions significantly impact investor sentiment towards technology stocks, including BBAI.

- Interest Rate Hikes: Rising interest rates increase borrowing costs for companies, potentially slowing growth and impacting BBAI's ability to invest in R&D and expansion. This could translate to lower profitability and affect the BigBear.ai (BBAI) stock price.

- Inflation: High inflation erodes purchasing power and can lead to reduced spending on non-essential goods and services, impacting demand for BBAI's offerings. This macroeconomic factor will directly influence the BigBear.ai (BBAI) stock price.

- Recessionary Fears: Concerns about a potential recession often lead investors to move towards safer investments, potentially causing a sell-off in riskier tech stocks like BBAI. The BigBear.ai (BBAI) stock price is very susceptible to these broader market fears.

- Government Regulations: Government regulations on data privacy and AI ethics can impact the operational costs and growth prospects of companies like BBAI. Stricter regulations might lead to higher compliance costs and affect their overall profitability.

BigBear.ai's (BBAI) Financial Performance and Projections

Revenue Growth and Profitability

Analyzing BBAI's financial statements is crucial for assessing its long-term viability and predicting the BigBear.ai (BBAI) stock price.

- Key Financial Metrics: Investors should monitor BBAI's revenue growth, net income, gross margin, and debt-to-equity ratio. Consistent profitability is vital for sustained stock price growth.

- Industry Benchmarks: Comparing BBAI's performance to industry averages and key competitors helps gauge its relative strength and identify areas for improvement.

- Financial Risks: High levels of debt or inconsistent profitability pose significant risks to BBAI's financial health and future growth prospects, potentially impacting the BigBear.ai (BBAI) stock price.

Contract Wins and Client Acquisition

Securing new contracts and acquiring new clients is essential for BBAI's revenue growth.

- Contract Analysis: The size and type of contracts won, along with the identity of key clients, provide insights into BBAI's market penetration and growth potential. Larger, long-term contracts indicate a more stable future for the BigBear.ai (BBAI) stock price.

- Sales Pipeline: Analyzing the pipeline of future contracts helps predict BBAI's revenue growth and its potential impact on the stock price. A robust sales pipeline signifies strong future prospects.

- Client Acquisition Challenges: Difficulties in acquiring new clients, particularly in a competitive market, could hinder BBAI's revenue growth and negatively impact the BigBear.ai (BBAI) stock price.

Investor Sentiment and Market Volatility

Analyst Ratings and Price Targets

Analyst ratings and price targets provide valuable insights into investor sentiment towards BBAI.

- Consensus Opinion: Summarizing the consensus opinion from multiple analysts gives a broader perspective on BBAI's future prospects. A downward revision in price targets often reflects negative sentiment.

- Analyst Reports: Detailed analyst reports provide in-depth insights into the factors driving their ratings and price targets, providing valuable information to investors.

- Impact on Investor Behavior: Analyst sentiment significantly influences investor behavior. Positive ratings often encourage buying, while negative ratings can lead to selling pressure.

News and Media Coverage

News and media coverage can significantly influence investor sentiment and the BigBear.ai (BBAI) stock price.

- Positive/Negative News: Positive news, such as major contract wins or successful product launches, can boost investor confidence and drive up the stock price. Conversely, negative news can trigger sell-offs.

- Social Media Impact: Social media and online forums play a significant role in shaping investor sentiment, often amplifying positive or negative news and potentially leading to increased market volatility.

- News Monitoring: Staying informed about news and media coverage related to BBAI is essential for making informed investment decisions.

Conclusion

This analysis explored several key factors that could contribute to a potential decrease in BigBear.ai Holdings (BBAI) stock price in 2025. Understanding the competitive landscape, BBAI's financial performance, and broader macroeconomic factors is crucial for investors. While the future is inherently uncertain, a comprehensive assessment of these elements provides a more informed approach to managing risk and making investment decisions regarding BigBear.ai (BBAI) stock. Continue your research on the BigBear.ai (BBAI) stock price and stay informed about market developments to make sound investment choices. Remember to consult with a financial advisor before making any investment decisions regarding BigBear.ai (BBAI) stock.

Featured Posts

-

Ghana Cote D Ivoire Visite Du President Mahama Un Pas Vers Une Diplomatie Renforcee

May 20, 2025

Ghana Cote D Ivoire Visite Du President Mahama Un Pas Vers Une Diplomatie Renforcee

May 20, 2025 -

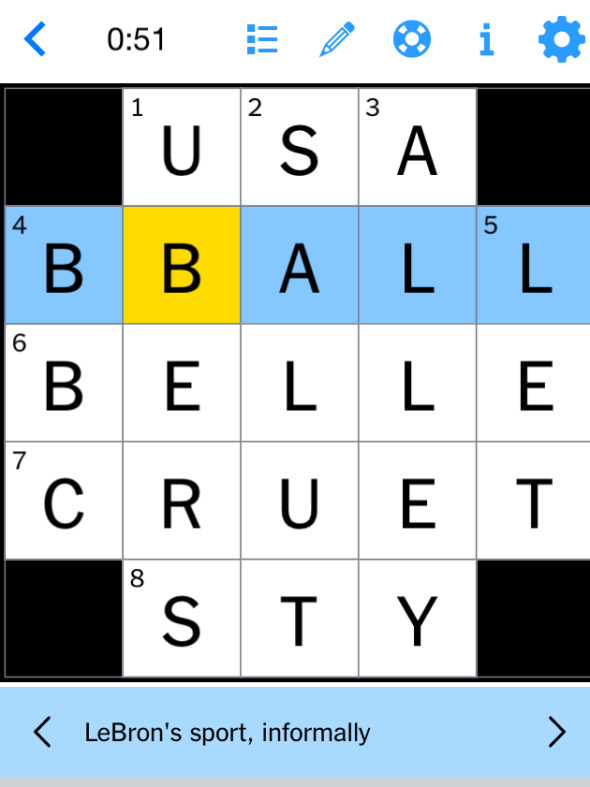

Solve The Nyt Mini Crossword March 13 Answers

May 20, 2025

Solve The Nyt Mini Crossword March 13 Answers

May 20, 2025 -

Alito And Roberts Two Decades On The Supreme Court Bench

May 20, 2025

Alito And Roberts Two Decades On The Supreme Court Bench

May 20, 2025 -

Nyt Mini Crossword Solutions For March 13 Expert Tips And Complete Answers

May 20, 2025

Nyt Mini Crossword Solutions For March 13 Expert Tips And Complete Answers

May 20, 2025 -

Urgence Securite A La Gaite Lyrique La Mairie De Paris Saisie

May 20, 2025

Urgence Securite A La Gaite Lyrique La Mairie De Paris Saisie

May 20, 2025