BigBear.ai Holdings (BBAI) Stock Plunge In 2025: Reasons And Analysis

Table of Contents

Macroeconomic Factors Contributing to the BBAI Stock Drop

Several macroeconomic headwinds significantly impacted BBAI's stock price in 2025. The confluence of these factors created a perfect storm for growth stocks, including BBAI.

Impact of Rising Interest Rates

Increased interest rates played a crucial role in the BBAI stock decline. Higher rates generally lead to decreased investor appetite for growth stocks like BBAI, which are often valued based on future earnings potential.

- Higher Discount Rates: Rising interest rates increase the discount rate used in discounted cash flow (DCF) models, reducing the present value of BBAI's projected future earnings. This directly impacts the company's valuation.

- Increased Borrowing Costs: Higher interest rates mean increased borrowing costs for BBAI, potentially impacting its ability to invest in research and development, expansion, and acquisitions – all crucial for a growth company in the competitive AI market.

- Shift in Investor Sentiment: Investors often shift their focus from growth stocks to more stable, higher-yield investments in a rising interest rate environment, leading to a sell-off in growth stocks like BBAI.

General Market Volatility and Recession Fears

The broader economic climate in 2025 was marked by significant volatility and growing concerns about a potential recession. This uncertainty significantly impacted investor sentiment and risk appetite.

- Economic Indicators: Negative indicators like falling consumer confidence, slowing GDP growth, and rising unemployment fueled recession fears, causing investors to flee riskier assets like BBAI stock.

- Flight to Safety: Investors typically seek safety in times of uncertainty, shifting their investments towards safer havens like government bonds and blue-chip stocks. This capital flight away from growth sectors negatively impacted BBAI.

- Market Corrections: The overall market correction further exacerbated BBAI's decline, as the general downward trend amplified the impact of company-specific challenges.

Geopolitical Instability and its Ripple Effect

Geopolitical instability in 2025 also contributed to the negative market sentiment and impacted BBAI's stock price.

- Global Uncertainty: Ongoing geopolitical tensions created uncertainty in the global economy, impacting investor confidence and increasing risk aversion.

- Supply Chain Disruptions: Geopolitical events can lead to supply chain disruptions, potentially impacting BBAI's operations and profitability.

- Reduced Investment: Uncertainty discourages investment in growth-oriented sectors, leading to a further decline in BBAI's stock price. For example, concerns about international trade and sanctions could have directly impacted BBAI's ability to secure contracts or expand into new markets.

Company-Specific Factors Impacting BBAI Stock Price

Beyond the macroeconomic challenges, several company-specific factors contributed to BBAI's stock plunge.

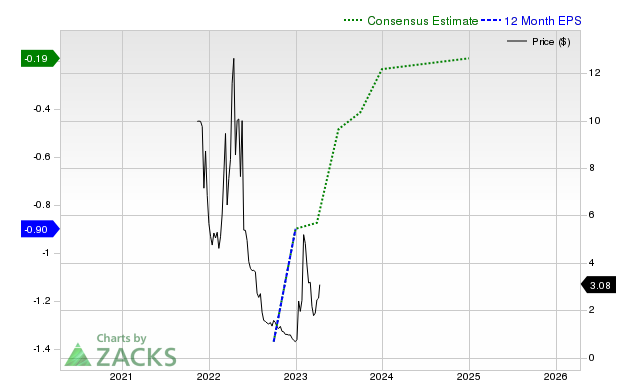

Missed Earnings Expectations and Revenue Shortfalls

BBAI's financial performance in the period leading up to the stock plunge significantly underperformed expectations, triggering a sell-off.

- Revenue Shortfalls: BBAI reported lower-than-expected revenue, indicating difficulties in securing and delivering contracts within the projected timeframe.

- Missed Earnings Targets: The company missed its earnings-per-share (EPS) targets, further undermining investor confidence.

- Reasons for Underperformance: Potential contributing factors could include increased competition, contract delays, difficulties in integrating acquisitions, or challenges in scaling operations. A detailed analysis of BBAI's financial statements would be necessary to pinpoint the exact cause.

Challenges in Expanding Market Share and Competition

BBAI faced intense competition in the rapidly evolving AI and data analytics market, hindering its ability to expand its market share.

- Competitive Landscape: The AI sector is fiercely competitive, with established players and numerous startups vying for market share.

- Market Penetration: BBAI's market penetration might have been lower than anticipated, limiting its revenue growth potential.

- Competitive Strategies: Competitors may have adopted more aggressive pricing strategies or offered more innovative solutions, putting pressure on BBAI's margins and market position.

Changes in Management or Corporate Strategy

Any significant changes in BBAI's management or corporate strategy during this period could have also contributed to the stock plunge. This would require further investigation into specific events at the company during 2025.

- Leadership Changes: A change in CEO or other key leadership positions could have created uncertainty and impacted investor confidence.

- Strategic Shifts: Any abrupt changes in the company's strategic direction could have raised questions about its future prospects.

- Impact on Investor Sentiment: Such changes often lead to increased volatility and uncertainty, prompting investors to sell their shares.

Conclusion: Analyzing the BBAI Stock Plunge and Future Outlook

The BBAI stock plunge in 2025 was a result of a complex interplay of macroeconomic headwinds and company-specific challenges. Rising interest rates, market volatility, geopolitical instability, missed earnings expectations, intense competition, and potential internal changes all contributed to the significant decline.

The future outlook for BBAI stock remains uncertain. While there's potential for recovery, particularly if the company addresses its internal challenges and the macroeconomic environment improves, significant risks remain. Investors need to carefully monitor BBAI's financial performance, competitive landscape, and the overall economic climate to make informed decisions.

Understanding the factors behind the BigBear.ai Holdings (BBAI) stock plunge is crucial for informed investment decisions. Continue researching BBAI stock and other relevant market indicators – including interest rate forecasts, economic growth projections, and geopolitical risk assessments – to make sound investment choices. Further research into BBAI's financial statements and industry analysis will provide a more complete picture.

Featured Posts

-

Dzhennifer Lourens Druge Materinstvo Ta Simeyne Zhittya

May 20, 2025

Dzhennifer Lourens Druge Materinstvo Ta Simeyne Zhittya

May 20, 2025 -

Tko Je Gina Maria Schumacher Kci Michaela Schumachera

May 20, 2025

Tko Je Gina Maria Schumacher Kci Michaela Schumachera

May 20, 2025 -

Shmit I Napad Na Detsu Tadi Osu U E Utanje Visokog Predstavnika

May 20, 2025

Shmit I Napad Na Detsu Tadi Osu U E Utanje Visokog Predstavnika

May 20, 2025 -

Huuhkajien Yllaetykset Avauskokoonpanossa Merkittaeviae Muutoksia

May 20, 2025

Huuhkajien Yllaetykset Avauskokoonpanossa Merkittaeviae Muutoksia

May 20, 2025 -

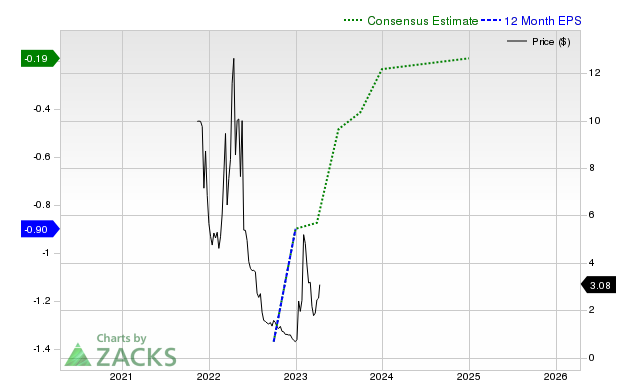

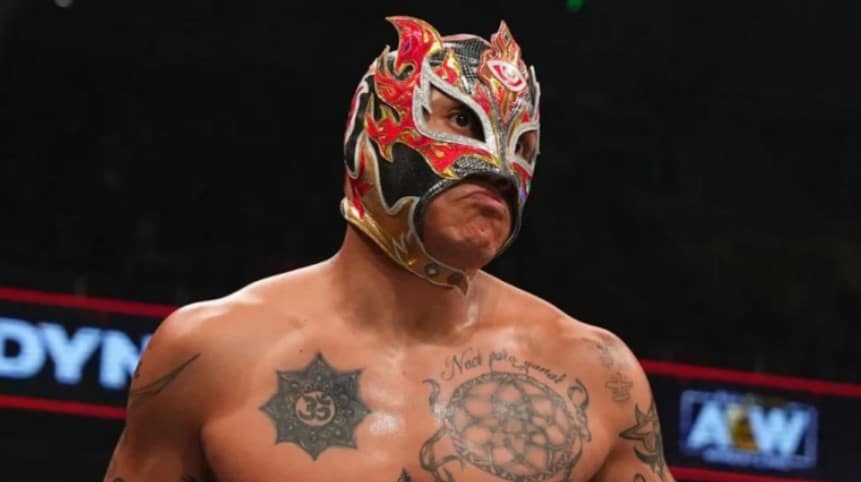

Former Aew Star Rey Fenix New Wwe Ring Name And Smack Down Arrival

May 20, 2025

Former Aew Star Rey Fenix New Wwe Ring Name And Smack Down Arrival

May 20, 2025

Latest Posts

-

Kroyz Azoyl Telikos Champions League I Syneisfora Toy Giakoymaki

May 20, 2025

Kroyz Azoyl Telikos Champions League I Syneisfora Toy Giakoymaki

May 20, 2025 -

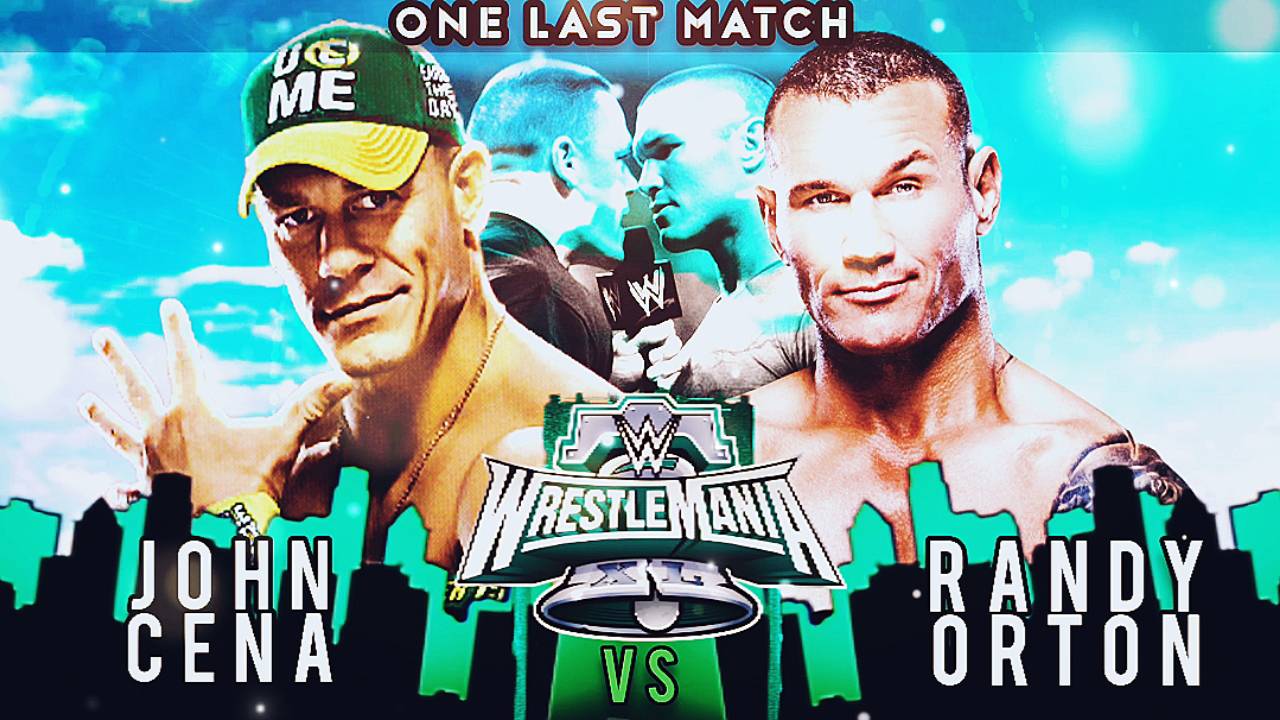

John Cena Vs Randy Orton Feud Brewing Plus Bayleys Injury Update

May 20, 2025

John Cena Vs Randy Orton Feud Brewing Plus Bayleys Injury Update

May 20, 2025 -

Giakoymakis Iroiki Prokrisi Gia Tin Kroyz Azoyl Ston Teliko

May 20, 2025

Giakoymakis Iroiki Prokrisi Gia Tin Kroyz Azoyl Ston Teliko

May 20, 2025 -

Prokrisi Gia Tin Kroyz Azoyl Xari Ston Giakoymaki Telikos Champions League

May 20, 2025

Prokrisi Gia Tin Kroyz Azoyl Xari Ston Giakoymaki Telikos Champions League

May 20, 2025 -

Giakoymakis I Kroyz Azoyl Ston Teliko Istoriki Prokrisi

May 20, 2025

Giakoymakis I Kroyz Azoyl Ston Teliko Istoriki Prokrisi

May 20, 2025