Big Oil's Production Stance Ahead Of OPEC+ Meeting

Table of Contents

Analyzing the Current Oil Market Landscape

The current oil market is characterized by considerable volatility. Several factors are at play, influencing crude oil prices and creating uncertainty for consumers and producers alike.

-

Volatile Crude Oil Prices: Crude oil prices have seen significant fluctuations in recent months, driven by a complex interplay of supply and demand factors, geopolitical events, and investor sentiment. This price instability impacts everything from transportation costs to the profitability of various industries.

-

Global Oil Demand Projections: Global oil demand projections vary depending on the source and the economic forecasts they are based on. Strong economic growth in certain regions, particularly in Asia, contributes to increased energy consumption and higher oil demand. Conversely, economic slowdowns or recessions can dampen demand.

-

Geopolitical Risks and Oil Supply: Geopolitical instability remains a major factor influencing oil supply. Conflicts, sanctions, and political tensions in key oil-producing regions can lead to disruptions in production and exports, creating price spikes. The ongoing conflict in Ukraine, for example, has had a significant impact on global energy markets.

-

Supply Chain Disruptions: Supply chain bottlenecks and logistical challenges continue to affect the efficient production and distribution of oil. These disruptions can lead to temporary shortages and contribute to price increases.

Big Oil's Production Capacity and Potential

Major oil companies possess significant production capacity, but their utilization rates and future production plans are crucial factors affecting the oil market.

-

Production Capacity of Major Players: Companies like Saudi Aramco, ExxonMobil, Shell, and BP have vast oil reserves and substantial production capabilities. Saudi Aramco, in particular, holds significant sway over global oil supply due to its immense production capacity and spare capacity.

-

Current Utilization Rates: The current utilization rate of these companies' production capacities varies. Some may be operating at near-maximum capacity, while others might have significant spare capacity available.

-

Spare Production Capacity: The existence of spare production capacity is critical for market stability. This capacity can be brought online quickly to address supply shortages caused by unexpected disruptions or increased demand. However, the strategic deployment of this spare capacity is a key decision point for Big Oil.

-

Financial Incentives: The decision to increase or decrease production is heavily influenced by profitability. High oil prices incentivize increased production, while low prices can lead to production cuts to avoid losses.

Predicting OPEC+'s Decision and its Impact

OPEC+'s decision on production levels will have a significant impact on the global oil market and energy security.

-

Potential OPEC+ Decisions: The cartel could decide to increase, decrease, or maintain current production levels. Each decision will have drastically different consequences for oil prices and market stability.

-

Influencing Factors: Several factors influence OPEC+'s decision-making, including the current state of the global economy, oil demand projections, geopolitical considerations, and the individual interests of member states.

-

Oil Price Forecasts: Forecasting the impact of OPEC+'s decisions on oil prices is challenging due to the inherent volatility of the market and the many unpredictable factors at play. However, a production cut is generally expected to lead to higher prices, while an increase could lead to lower prices.

-

Consequences for Energy Security and Market Stability: OPEC+'s decision will directly affect global energy security and market stability. A decision that exacerbates existing supply constraints could lead to higher prices, potentially impacting economic growth and consumer welfare. Conversely, a decision to increase production could help alleviate price pressures and enhance market stability.

The Role of Russia in OPEC+ Decisions

Russia plays a significant role within the OPEC+ alliance, and its actions significantly impact the group's decision-making process.

-

Russian Influence: Russia is a major oil producer and holds considerable influence within the OPEC+ alliance. Its decisions concerning production significantly impact the overall output of the group.

-

Impact of Sanctions: Western sanctions against Russia have impacted its oil production and export capabilities, adding complexity to the OPEC+ equation. This has created both opportunities and challenges for other OPEC+ members.

-

Potential for Disagreements: The differing interests and priorities of OPEC+ member states, particularly regarding Russia’s role and the impact of sanctions, can lead to internal disagreements and complicate the process of reaching a consensus on production levels.

Conclusion

The upcoming OPEC+ meeting is of paramount importance for the global energy market. Big Oil's production decisions, influenced by various factors including current oil prices, global demand, geopolitical events, and the internal dynamics of OPEC+, will significantly shape oil prices and global energy security in the coming months. Understanding the current market landscape, Big Oil's capacity, and OPEC+'s likely strategies is crucial for navigating the complexities of the energy sector.

Call to Action: Stay informed about the latest developments surrounding Big Oil's production stance and the OPEC+ meeting by regularly checking our website for updates and insightful analyses on the global oil market and the future of energy. Learn more about the intricacies of Big Oil's production strategies and their impact on the global energy landscape.

Featured Posts

-

Eneco Inaugure Son Immense Parc De Batteries A Au Roeulx Un Projet Belge Majeur

May 04, 2025

Eneco Inaugure Son Immense Parc De Batteries A Au Roeulx Un Projet Belge Majeur

May 04, 2025 -

These Electric Motors A Path To Reducing Chinas Global Dominance

May 04, 2025

These Electric Motors A Path To Reducing Chinas Global Dominance

May 04, 2025 -

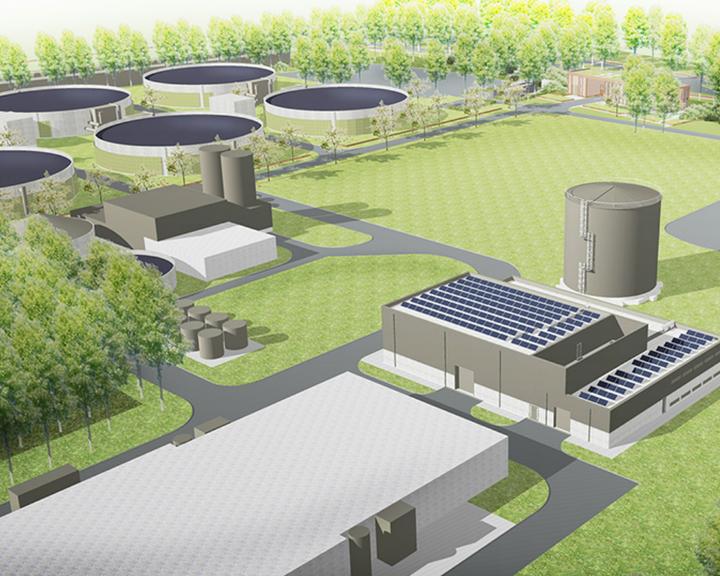

Utrechts Wastewater Plant Installs Netherlands Biggest Heat Pump

May 04, 2025

Utrechts Wastewater Plant Installs Netherlands Biggest Heat Pump

May 04, 2025 -

Nigel Farages Shrewsbury Visit Flat Cap G And T And Attack On Conservative Road Plans

May 04, 2025

Nigel Farages Shrewsbury Visit Flat Cap G And T And Attack On Conservative Road Plans

May 04, 2025 -

Macron Intensifie La Pression Sur Moscou Les Prochains Jours Decisifs

May 04, 2025

Macron Intensifie La Pression Sur Moscou Les Prochains Jours Decisifs

May 04, 2025

Latest Posts

-

Golds Unexpected Dip Analyzing Two Straight Weeks Of Losses In 2025

May 04, 2025

Golds Unexpected Dip Analyzing Two Straight Weeks Of Losses In 2025

May 04, 2025 -

2025 Gold Slump Facing First Double Digit Weekly Losses

May 04, 2025

2025 Gold Slump Facing First Double Digit Weekly Losses

May 04, 2025 -

Gold Market Update Back To Back Weekly Losses For 2025

May 04, 2025

Gold Market Update Back To Back Weekly Losses For 2025

May 04, 2025 -

Morning Coffee Oilers Canadiens Game Preview And Predictions

May 04, 2025

Morning Coffee Oilers Canadiens Game Preview And Predictions

May 04, 2025 -

Gold Prices Two Consecutive Weekly Declines In 2025

May 04, 2025

Gold Prices Two Consecutive Weekly Declines In 2025

May 04, 2025