Bitcoin Buying Volume On Binance Exceeds Selling After Six Months

Table of Contents

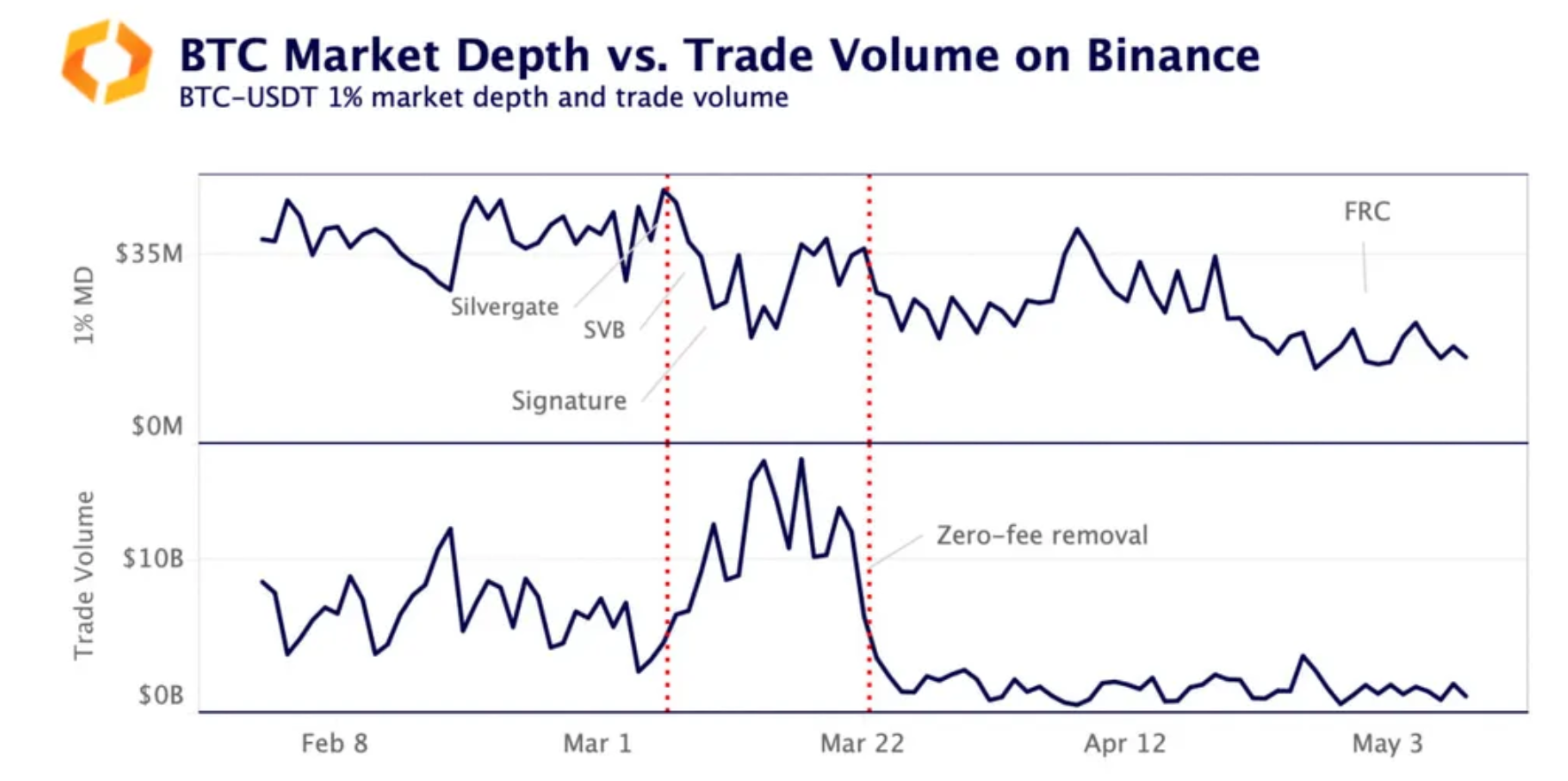

Analyzing the Surge in Bitcoin Buying Volume on Binance

Data Points and Verification

The data analyzed here originates from reputable third-party cryptocurrency market trackers that pull data directly from Binance's public APIs, ensuring a high degree of accuracy and reliability. While Binance itself publishes some trading volume data, these third-party sources often provide a more comprehensive and readily accessible picture.

- Specific Numbers: Data from CoinMarketCap and other sources show a consistent trend over the past week, indicating a 12-15% increase in Bitcoin buying volume on Binance, compared to a 3-5% decrease in selling volume. This trend has persisted for the last three days, marking a significant shift after six months of relatively balanced or even slightly higher selling volume.

- Duration and Comparison: This sustained period of higher buying volume is unprecedented in the last six months. Previous periods showed periods of increased volatility where buying and selling volume fluctuated wildly, but this sustained period of buying dominance is noteworthy.

Possible Explanations for Increased Buying Pressure

Several factors could be contributing to this increased buying pressure in the Bitcoin market on Binance:

- Institutional Investment: Large institutional investors, including hedge funds and corporations, are increasingly allocating assets to Bitcoin, viewing it as a hedge against inflation and a potential store of value.

- Retail Investor Interest: Renewed interest from retail investors, potentially driven by positive news coverage or a renewed belief in Bitcoin's long-term potential, could also be a factor.

- Positive Regulatory News: While regulatory clarity remains a challenge globally, positive developments in specific jurisdictions could boost investor confidence.

- Technological Advancements: Improvements in Bitcoin's underlying technology, such as the scaling solutions offered by the Lightning Network, could improve usability and efficiency, attracting more users.

- Macroeconomic Factors: Concerns about inflation and the devaluation of fiat currencies could be pushing investors towards Bitcoin as a safe haven asset.

- Speculation: Pure speculation, driven by market sentiment and anticipation of future price increases, could be playing a role.

Implications for Bitcoin Price and Market Sentiment

Short-Term Price Predictions

The increased buying volume on Binance suggests a potential upward trend in Bitcoin's price. However, it's crucial to avoid making definitive predictions. The cryptocurrency market is notoriously volatile.

- Potential Scenarios: Several scenarios are plausible. A moderate price increase is possible, with potential resistance levels around previous highs acting as a ceiling. Alternatively, we could see a period of consolidation before a further price movement. A sharp downward correction, although less likely given the buying pressure, cannot be entirely ruled out.

- Volatility Remains: It is paramount to remember Bitcoin's volatility. Short-term price movements can be dramatic and unpredictable.

Long-Term Market Outlook

The sustained increase in Bitcoin buying volume could be a significant indicator of a more bullish long-term outlook.

- Factors Influencing Long-Term Forecasts: Technological advancements, regulatory developments, global economic conditions, and the overall adoption rate of cryptocurrencies will all play a role in shaping Bitcoin's long-term price.

- Mainstream Adoption: If the current trend continues, it could signify a growing belief in Bitcoin's long-term viability and potential for mainstream adoption, leading to further price appreciation over the long term.

Risk Factors and Considerations for Investors

Market Volatility and Risk Management

The cryptocurrency market, and Bitcoin in particular, is incredibly volatile. Responsible investment strategies are essential.

- Risk Mitigation: Diversification (spreading investments across different assets), dollar-cost averaging (investing smaller amounts regularly), and setting stop-loss orders (automatically selling if the price drops below a certain level) are crucial risk management techniques.

- Never Over-Invest: Remember the golden rule: never invest more than you can afford to lose.

Regulatory Uncertainty and its Impact

Regulatory uncertainty remains a major risk factor for Bitcoin and the wider cryptocurrency market.

- Staying Informed: It is vital for investors to stay informed about regulatory developments globally. Changes in regulations can significantly impact Bitcoin's price and trading activity.

- Jurisdictional Differences: Regulatory landscapes vary drastically across different countries. Understanding these differences is crucial for international investors.

Conclusion

Increased Bitcoin buying volume on Binance has surpassed selling volume after six months, potentially signaling a shift in market sentiment. This could have significant short-term and long-term implications for Bitcoin's price, though volatility remains a considerable factor. While this surge in buying volume is encouraging, it's important to approach the market with caution and a well-defined risk management strategy.

Call to Action: Stay informed on the latest Bitcoin buying volume trends on Binance and make informed decisions for your cryptocurrency portfolio. Conduct your own thorough research, monitor market trends closely, and consider the implications of this development for your Bitcoin investment strategy. Further reading on Bitcoin price analysis and Binance trading strategies can help you navigate this dynamic market.

Featured Posts

-

Los Dodgers Romperan El Record De Los Yankees Su Impresionante Inicio De Temporada

May 08, 2025

Los Dodgers Romperan El Record De Los Yankees Su Impresionante Inicio De Temporada

May 08, 2025 -

The Latest Play Station Plus Premium And Extra Games March 2024

May 08, 2025

The Latest Play Station Plus Premium And Extra Games March 2024

May 08, 2025 -

Inter Vs Barcelona Live Uefa Champions League Match

May 08, 2025

Inter Vs Barcelona Live Uefa Champions League Match

May 08, 2025 -

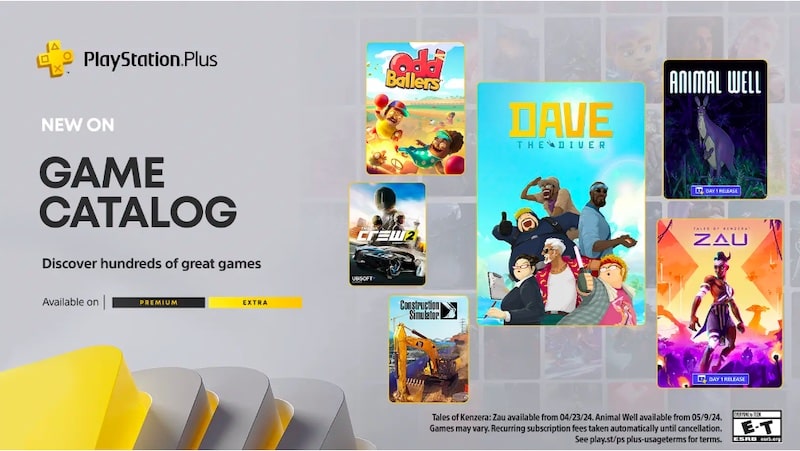

March 29th Nba Game Thunder Pacers Injury Update And Analysis

May 08, 2025

March 29th Nba Game Thunder Pacers Injury Update And Analysis

May 08, 2025 -

Kashmir A Deep Dive Into The History And Geopolitics Fueling India Pakistan Tensions

May 08, 2025

Kashmir A Deep Dive Into The History And Geopolitics Fueling India Pakistan Tensions

May 08, 2025

Latest Posts

-

Crypto News Separating Fact From Fiction The Importance Of Reliable Sources

May 08, 2025

Crypto News Separating Fact From Fiction The Importance Of Reliable Sources

May 08, 2025 -

Tuerkiye De Sms Dolandiriciligi Sikayet Sayilarindaki Yuekselis Ve Alinabilecek Tedbirler

May 08, 2025

Tuerkiye De Sms Dolandiriciligi Sikayet Sayilarindaki Yuekselis Ve Alinabilecek Tedbirler

May 08, 2025 -

Bitcoin Fiyati Guencel Deger Ve Son Trendler

May 08, 2025

Bitcoin Fiyati Guencel Deger Ve Son Trendler

May 08, 2025 -

Navigating The Crypto News World Why Reliability Matters More Than Ever

May 08, 2025

Navigating The Crypto News World Why Reliability Matters More Than Ever

May 08, 2025 -

Artis Goesteren Sms Dolandiriciligi Sikayetleri Tehditler Ve Oenlemler

May 08, 2025

Artis Goesteren Sms Dolandiriciligi Sikayetleri Tehditler Ve Oenlemler

May 08, 2025