Bitcoin's Critical Juncture: Price Levels And Analysis

Table of Contents

Key Price Levels to Watch

Understanding support and resistance levels is crucial for Bitcoin trading. Support levels represent prices where buying pressure is strong enough to prevent further price declines, while resistance levels indicate price points where selling pressure outweighs buying pressure, hindering upward momentum. Identifying these levels helps traders anticipate potential price reversals and manage risk effectively.

Historical Support & Resistance

Bitcoin's history is marked by significant price points that have acted as recurring support or resistance. Analyzing these levels provides valuable insights into potential future price movements.

- $20,000: This level has historically acted as both strong support and resistance, highlighting its psychological significance. Breaks above and below this level have often led to substantial price movements.

- $30,000: A similar psychological barrier, this price point has frequently served as a crucial support or resistance level.

- $60,000: This level represented a significant all-time high, subsequently acting as strong resistance after the initial peak.

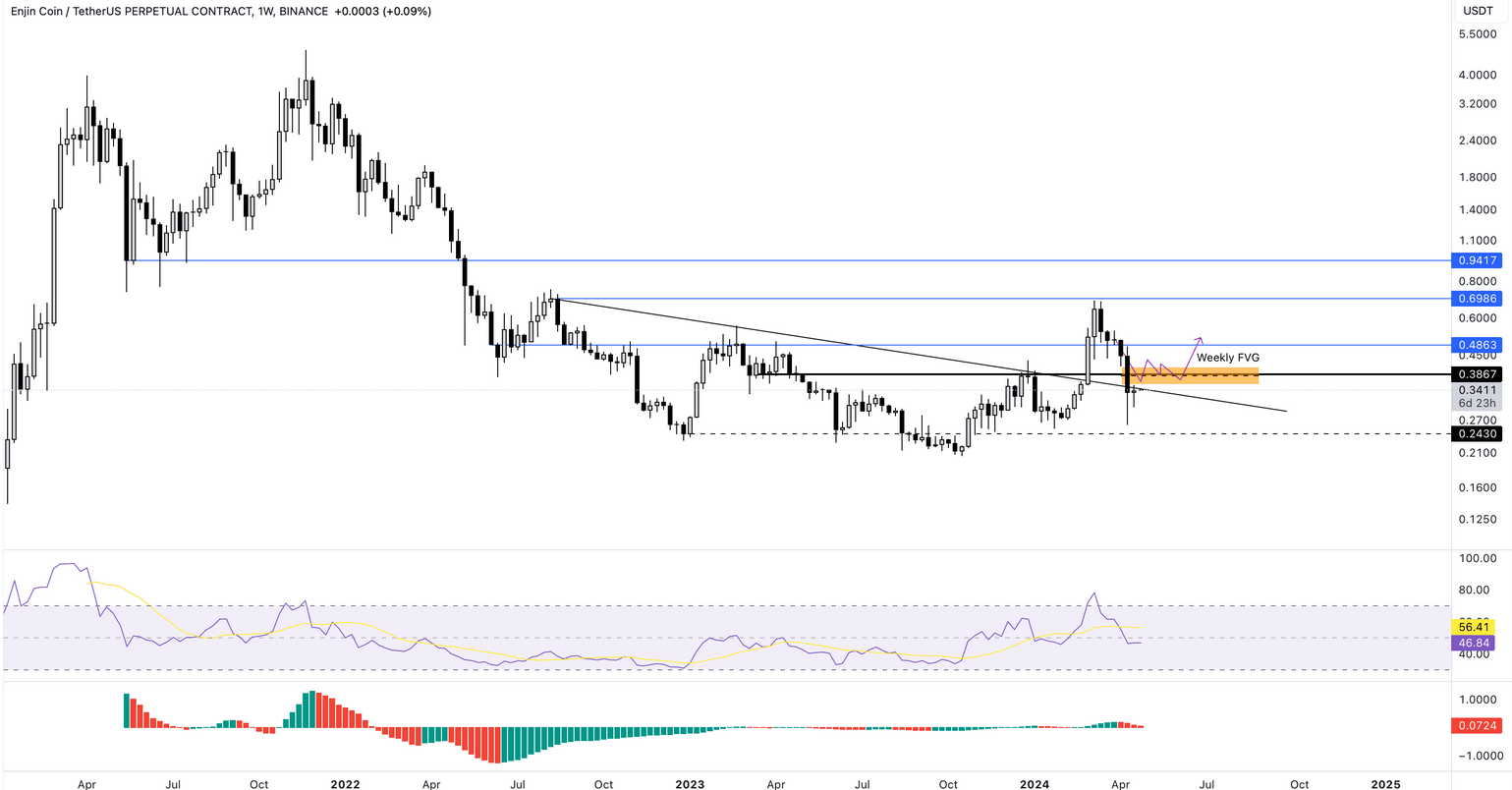

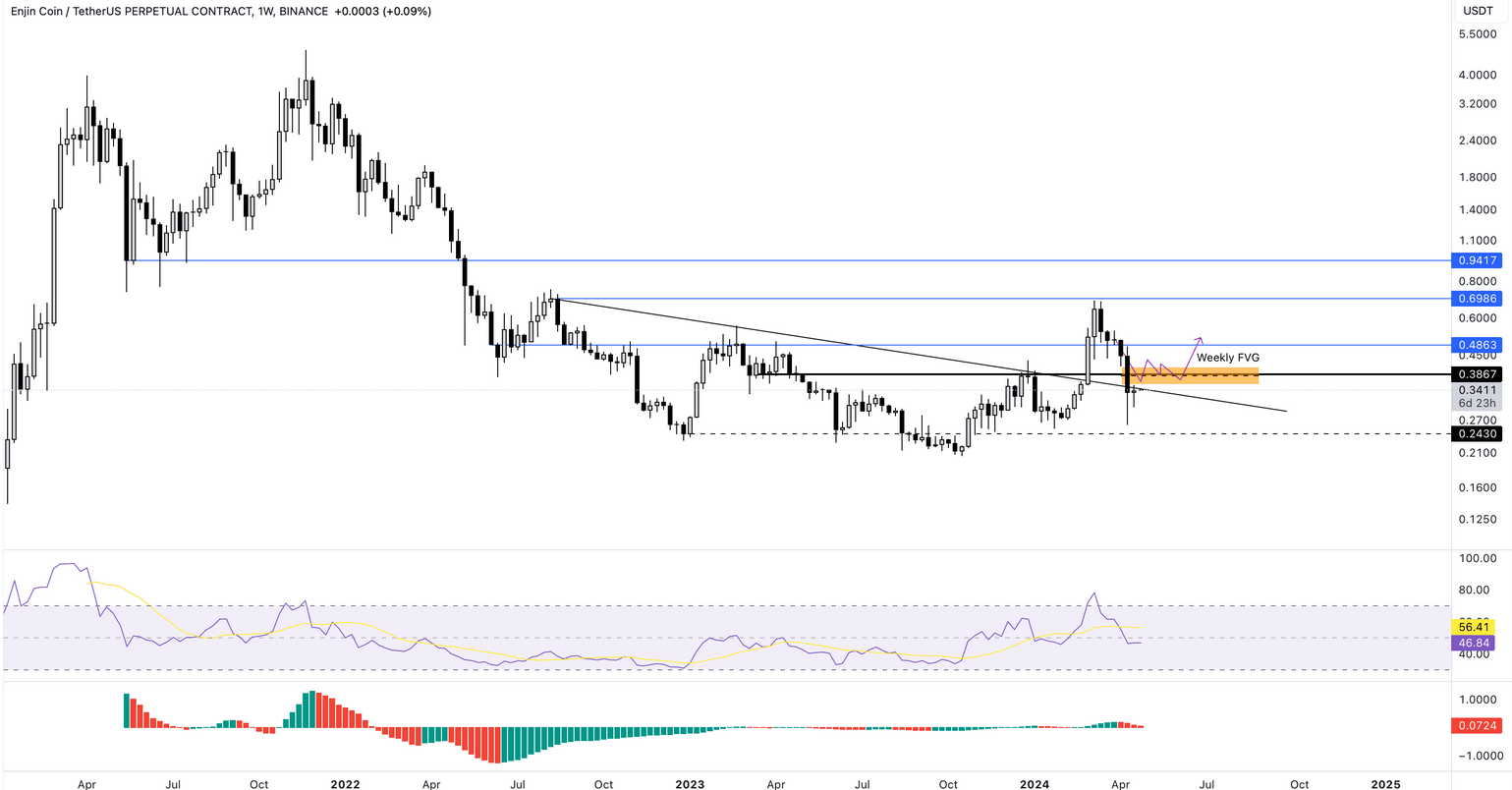

[Insert a Bitcoin price chart here visually displaying the $20k, $30k, and $60k levels and their historical significance. Clearly label support and resistance zones.]

Analyzing the Bitcoin price chart reveals patterns and trends related to these support and resistance levels. Understanding these historical Bitcoin support levels and Bitcoin resistance levels is key to predicting future price action.

Current Market Sentiment and Technical Indicators

Gauging current market sentiment – whether bullish, bearish, or neutral – is critical. This sentiment is reflected in various technical indicators:

- Relative Strength Index (RSI): Measures the magnitude of recent price changes to evaluate overbought or oversold conditions. A high RSI suggests potential overbought conditions and a possible price correction.

- Moving Average Convergence Divergence (MACD): Identifies momentum changes by comparing two moving averages. Bullish crossovers (MACD line crossing above the signal line) often precede upward price movements.

- Moving Averages (MA): Provide an average price over a specific period, smoothing out price fluctuations and identifying trends. Crossovers between different moving averages can signal potential trend changes.

[Insert a chart or table summarizing current values for these indicators and their implications for Bitcoin price movements.] Understanding Bitcoin technical analysis, Bitcoin indicators, and Bitcoin market sentiment is essential for navigating the market.

Psychological Price Levels

Round numbers like $20,000, $30,000, and $50,000 act as significant psychological barriers, influencing investor behavior. These Bitcoin psychological levels often trigger buying or selling pressure, leading to temporary price fluctuations. While not inherently fundamental, these levels can significantly impact short-term price movements and trading strategies. Understanding the role of Bitcoin price psychology is crucial for short-term traders.

Macroeconomic Factors Influencing Bitcoin Price

Bitcoin's price is intricately linked to broader macroeconomic conditions.

Inflation and Bitcoin as a Hedge

High inflation rates often drive investors towards assets perceived as inflation hedges. Bitcoin, with its limited supply, is viewed by some as a potential hedge against inflation. [Include data comparing inflation rates and Bitcoin's price performance to illustrate this correlation]. This perception can influence demand and, consequently, Bitcoin's price. The role of Bitcoin as a store of value is becoming increasingly relevant in inflationary environments.

Regulatory Landscape and its Impact

Government policies and regulations significantly impact Bitcoin adoption and price. Stringent regulations can stifle growth, while supportive policies can boost adoption and increase demand. [Provide specific examples of regulatory actions and their impact in different countries]. Monitoring Bitcoin regulation and Bitcoin government policy is crucial for navigating the potential risks and opportunities.

Institutional Adoption and Market Liquidity

Increased institutional investment, through corporations and funds, boosts Bitcoin's liquidity and reduces price volatility. [Discuss the impact of Bitcoin ETFs and other institutional vehicles]. The growing involvement of institutional players adds to Bitcoin's legitimacy and stability. This Bitcoin institutional adoption contributes to a more mature and less volatile market.

Predicting Future Bitcoin Price Levels

Accurately predicting Bitcoin's price is challenging due to its inherent volatility and the complexity of influencing factors.

Various Prediction Models

Several approaches attempt to predict Bitcoin's price:

- Technical Analysis: Utilizes charts and indicators to identify patterns and predict future price movements.

- Fundamental Analysis: Focuses on underlying factors like adoption rates, regulatory changes, and macroeconomic conditions.

- On-Chain Analysis: Analyzes data from the Bitcoin blockchain to gauge network activity and predict price trends.

Each approach has strengths and weaknesses; combining different methods can improve prediction accuracy, though certainty remains elusive. Understanding Bitcoin price prediction and Bitcoin forecasting is crucial but should be approached with caution.

Potential Scenarios and Risk Assessment

Various price scenarios are possible:

- Bullish: Continued price increases driven by factors like increased institutional adoption and wider acceptance.

- Bearish: Price declines potentially triggered by regulatory crackdowns or macroeconomic downturns.

- Sideways: Consolidation within a range, suggesting indecision in the market.

Conducting a thorough Bitcoin risk assessment is vital. The high volatility inherent in the Bitcoin market demands a cautious approach.

Conclusion

Bitcoin's current price levels are influenced by a complex interplay of factors. Precise prediction is impossible, but by analyzing historical Bitcoin price levels, technical indicators, macroeconomic trends, and regulatory developments, investors can make informed decisions. Understanding key support and resistance levels, along with the broader market sentiment, is critical for navigating this volatile asset. Stay informed about the latest developments to make the most of the opportunities and mitigate risks in the dynamic world of Bitcoin price levels. Keep monitoring these factors to stay ahead in the ever-changing landscape of Bitcoin price levels.

Featured Posts

-

Can The Thunder Overcome The Grizzlies Game Preview And Analysis

May 08, 2025

Can The Thunder Overcome The Grizzlies Game Preview And Analysis

May 08, 2025 -

1 050 Price Hike At And Ts Outrage Over Broadcoms V Mware Acquisition

May 08, 2025

1 050 Price Hike At And Ts Outrage Over Broadcoms V Mware Acquisition

May 08, 2025 -

Exclusive Malaysia Seeks Extradition Of Disgraced Ex Goldman Partner In 1 Mdb Scandal

May 08, 2025

Exclusive Malaysia Seeks Extradition Of Disgraced Ex Goldman Partner In 1 Mdb Scandal

May 08, 2025 -

1 Mdb Scandal Exclusive Details On Malaysias Pursuit Of Ex Goldman Partner

May 08, 2025

1 Mdb Scandal Exclusive Details On Malaysias Pursuit Of Ex Goldman Partner

May 08, 2025 -

Bitcoin Price Prediction Analyst Sees Rally Potential May 6th Chart

May 08, 2025

Bitcoin Price Prediction Analyst Sees Rally Potential May 6th Chart

May 08, 2025

Latest Posts

-

Brezilya Bitcoin Maas Oedemelerini Yasallastiriyor Yeni Bir Doenem Basliyor Mu

May 08, 2025

Brezilya Bitcoin Maas Oedemelerini Yasallastiriyor Yeni Bir Doenem Basliyor Mu

May 08, 2025 -

Kripto Para Duesuesue Yatirimci Tepkileri Ve Gelecek Tahminleri

May 08, 2025

Kripto Para Duesuesue Yatirimci Tepkileri Ve Gelecek Tahminleri

May 08, 2025 -

Yatirimcilar Neden Kripto Paralarini Satiyor Piyasa Duesuesuenuen Etkisi

May 08, 2025

Yatirimcilar Neden Kripto Paralarini Satiyor Piyasa Duesuesuenuen Etkisi

May 08, 2025 -

Kripto Piyasasi Duesuesue Ve Yatirimci Satislari Detayli Analiz

May 08, 2025

Kripto Piyasasi Duesuesue Ve Yatirimci Satislari Detayli Analiz

May 08, 2025 -

Counting Crows Snl Appearance A Career Turning Point

May 08, 2025

Counting Crows Snl Appearance A Career Turning Point

May 08, 2025