Bitcoin's Potential: A Growth Investor's 1,500% Prediction

Table of Contents

Bitcoin's Growing Adoption and Institutional Investment

The rising tide of Bitcoin's price is significantly fueled by its increasing acceptance among institutional and retail investors. This widespread adoption signifies a monumental shift in how Bitcoin is perceived within the financial world.

Increased Institutional Adoption

Large financial institutions, hedge funds, and corporations are increasingly recognizing Bitcoin's potential. This institutional embrace is a powerful catalyst for price appreciation.

-

Examples of Institutional Adoption: MicroStrategy, a business intelligence company, has amassed a significant Bitcoin reserve, demonstrating a strong belief in its long-term value. Tesla, the electric vehicle giant, also made headlines with its Bitcoin investment, further validating its legitimacy in the eyes of mainstream finance. Other notable players include BlackRock, Fidelity, and several others actively exploring Bitcoin investment strategies.

-

Statistics on Increasing Institutional Holdings: Data from various sources indicates a consistent upward trend in Bitcoin holdings by major financial institutions. These figures underscore the growing confidence in Bitcoin as a viable asset class for diversification and potential profit generation. While precise figures fluctuate, the overall trend is undeniably positive.

-

How Institutional Adoption Drives Price Increases: Increased demand from institutional investors directly impacts Bitcoin's price. Their substantial investments create upward pressure, driving the price higher as supply remains relatively constrained. This effect is amplified by the influence these large players have on market sentiment.

Retail Investor Interest

Alongside institutional investors, the growing number of individual investors adopting Bitcoin plays a crucial role in its price appreciation. Accessibility and ease of use are making Bitcoin investment increasingly mainstream.

-

Statistics on Growing Bitcoin Ownership: The number of Bitcoin wallets continues to grow, reflecting the expanding base of retail investors. While precise ownership figures are challenging to obtain, various surveys and reports consistently show increasing adoption worldwide.

-

Factors Driving Retail Investment: The ease of buying and holding Bitcoin through various exchanges and platforms, coupled with its potential for high returns, attracts a growing number of retail investors. Furthermore, the perception of Bitcoin as a hedge against inflation and a potential pathway to financial freedom drives further adoption.

-

Positive Media Coverage and Influencer Endorsements: Positive media coverage and endorsements from prominent figures have increased Bitcoin's visibility and appeal to a wider audience, encouraging more individuals to explore Bitcoin investment.

Bitcoin's Scarcity and Deflationary Nature

Bitcoin's inherent scarcity and deflationary properties are fundamental to its long-term value proposition and potential for significant price appreciation. These characteristics differentiate it from traditional fiat currencies.

Limited Supply

Bitcoin's fixed supply of 21 million coins is a key factor driving its potential for long-term growth. This finite supply creates scarcity, a core principle in economics that influences value.

-

Comparison to Fiat Currencies: Unlike fiat currencies, which central banks can print without limit, leading to inflation, Bitcoin's limited supply prevents debasement. This inherent scarcity is a powerful driver of its value.

-

How Scarcity Drives Up Value: As demand increases and the supply remains fixed, the price of Bitcoin is naturally driven upward. This fundamental principle of supply and demand is a major factor contributing to Bitcoin's potential for exponential growth.

Deflationary Properties

Bitcoin's deflationary nature contrasts sharply with inflationary fiat currencies. This characteristic makes it an attractive hedge against inflation and a store of value.

-

How Deflation Impacts Bitcoin's Value: While deflation can have negative consequences in traditional economies, in the context of a scarce asset like Bitcoin, it can drive up its value as its purchasing power increases over time.

-

Bitcoin as a Store of Value: Many investors view Bitcoin as a store of value, similar to gold, protecting their wealth from inflation and economic uncertainty. This perception significantly contributes to its price appreciation.

Technological Advancements and Network Effects

Ongoing technological advancements and the strengthening network effect further bolster Bitcoin's potential for growth.

Layer-2 Solutions

Scalability challenges are being addressed through innovative Layer-2 solutions such as the Lightning Network. These technologies enhance Bitcoin's capabilities.

-

How Layer-2 Solutions Address Scalability Concerns: Layer-2 solutions process transactions off-chain, reducing the load on the main Bitcoin blockchain and increasing transaction speed and efficiency.

-

Impact on Transaction Fees and Usability: Layer-2 solutions significantly reduce transaction fees and improve overall usability, making Bitcoin more accessible to a wider range of users.

Growing Network Effect

The expanding network of users and developers strengthens Bitcoin's security and overall value proposition.

-

Metcalfe's Law and its Application to Bitcoin: Metcalfe's Law, which states that the value of a network is proportional to the square of the number of connected users, applies strongly to Bitcoin. As the number of users grows, the network's value and resilience increase exponentially.

-

Importance of Network Effects in Driving Long-Term Growth: The growing network effect is a key driver of Bitcoin's long-term growth, ensuring its continued relevance and adoption.

Global Economic Uncertainty and Safe-Haven Status

Growing global economic uncertainty has propelled Bitcoin's adoption as a safe-haven asset.

Geopolitical Instability

Global instability and geopolitical risks often drive investors towards Bitcoin due to its decentralized and censorship-resistant nature.

-

Examples of Recent Global Events Impacting Bitcoin's Price: Periods of geopolitical tension often see increased demand for Bitcoin, reflecting its appeal as a hedge against uncertainty.

-

Bitcoin's Decentralized and Censorship-Resistant Nature: Bitcoin's decentralized nature, free from government control or manipulation, makes it attractive to investors seeking protection from potential economic or political turmoil.

Inflationary Pressures

Rising inflation worldwide further increases the appeal of Bitcoin as a hedge against inflation.

-

Statistics on Global Inflation Rates: Many countries are experiencing rising inflation rates, making investors seek alternative assets to preserve their purchasing power.

-

Bitcoin's Limited Supply as an Inflation Hedge: Bitcoin's fixed supply makes it a compelling hedge against inflationary pressures, safeguarding investors' wealth from the erosion of purchasing power.

Conclusion

Bitcoin's potential for significant growth is supported by strong underlying factors. The increasing institutional and retail adoption, its inherent scarcity and deflationary nature, continuous technological advancements, and its role as a safe-haven asset all point towards a bullish outlook. While the 1,500% prediction is ambitious, the arguments presented demonstrate a compelling case for Bitcoin's remarkable potential for price appreciation. While past performance is not indicative of future results, the potential for Bitcoin's growth is undeniable. Explore the possibilities of Bitcoin's potential and consider adding it to your diversified investment portfolio today. Don't miss out on this potential opportunity to benefit from Bitcoin's growth. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Sms Dolandiriciligi Sikayetler Neden Artiyor Ve Nasil Korunabilirsiniz

May 08, 2025

Sms Dolandiriciligi Sikayetler Neden Artiyor Ve Nasil Korunabilirsiniz

May 08, 2025 -

Rezultati I Pjeses Se Dyte Si Psg Shenoi Fitoren Minimaliste

May 08, 2025

Rezultati I Pjeses Se Dyte Si Psg Shenoi Fitoren Minimaliste

May 08, 2025 -

Nevero Aten Presvrt Seged Triumfira Nad Pariz Vo L Sh

May 08, 2025

Nevero Aten Presvrt Seged Triumfira Nad Pariz Vo L Sh

May 08, 2025 -

Did Saturday Night Live Make Counting Crows Famous A Look Back

May 08, 2025

Did Saturday Night Live Make Counting Crows Famous A Look Back

May 08, 2025 -

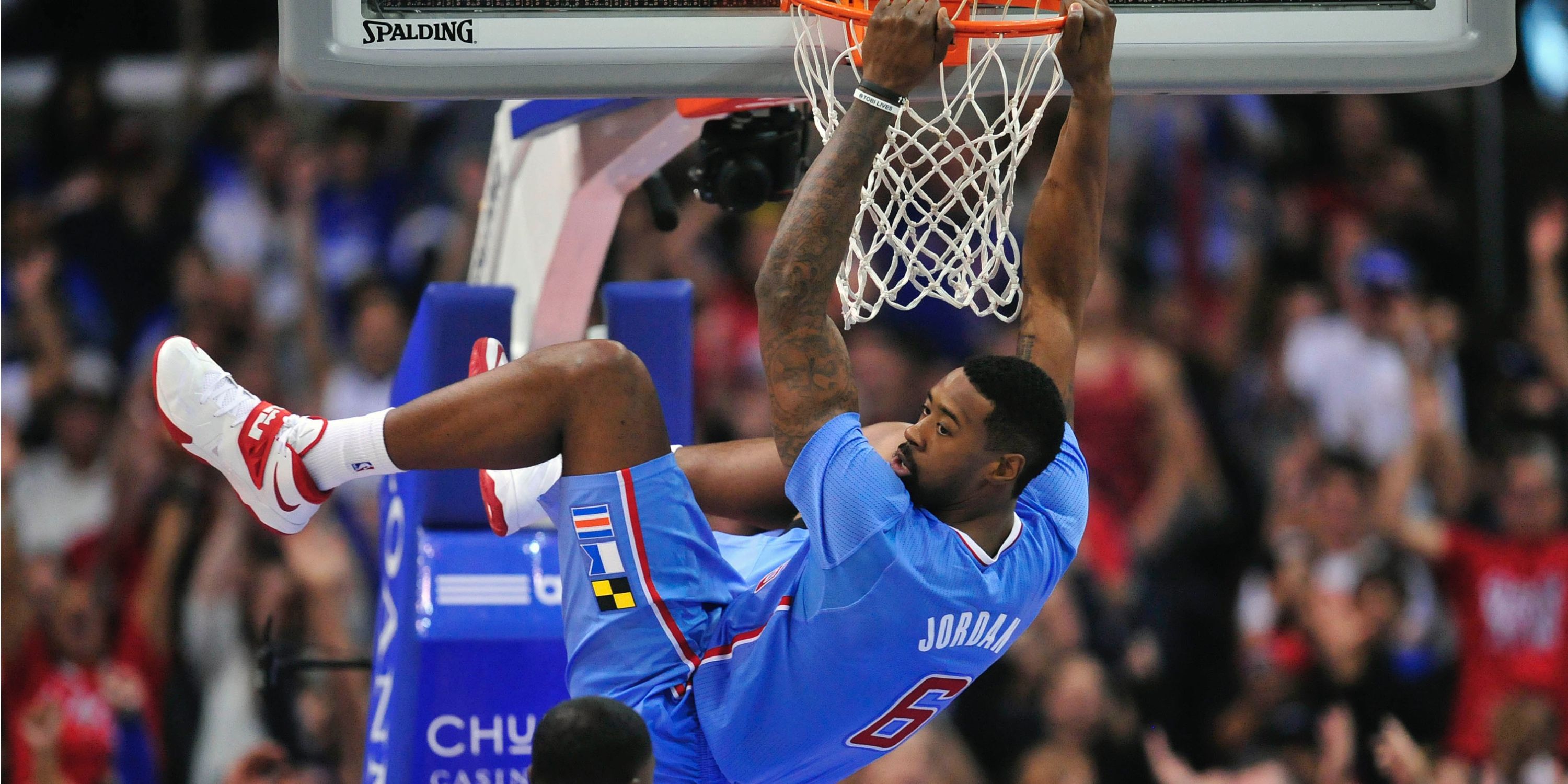

De Andre Jordan Makes Nba History In Nuggets Bulls Game

May 08, 2025

De Andre Jordan Makes Nba History In Nuggets Bulls Game

May 08, 2025

Latest Posts

-

Top Krypto Stories Of All Time

May 08, 2025

Top Krypto Stories Of All Time

May 08, 2025 -

The European Digital Identity Wallet What You Need To Know

May 08, 2025

The European Digital Identity Wallet What You Need To Know

May 08, 2025 -

Superman James Gunns Dcu Movie An Imminent Release

May 08, 2025

Superman James Gunns Dcu Movie An Imminent Release

May 08, 2025 -

Coming Soon Your Guide To The European Digital Identity Wallet

May 08, 2025

Coming Soon Your Guide To The European Digital Identity Wallet

May 08, 2025 -

Krypto The Superdog Steals The Show In New 5 Minute Superman Preview

May 08, 2025

Krypto The Superdog Steals The Show In New 5 Minute Superman Preview

May 08, 2025