BofA On Stock Market Valuations: A Reason For Investor Confidence

Table of Contents

BofA's Methodology and Key Findings

BofA's assessment of stock market valuations employs a multifaceted approach, combining several established methods. Their rigorous analysis incorporates:

- Discounted Cash Flow (DCF) analysis: Predicting future cash flows of companies to determine their intrinsic value.

- Price-to-Earnings (P/E) ratio analysis: Comparing a company's stock price to its earnings per share.

- Market Cap-to-GDP ratio: Comparing the total market capitalization of stocks to the nation's gross domestic product.

BofA's key findings, based on this comprehensive BofA valuation model, suggest that current valuations, while not dirt cheap, are not excessively expensive either. Their analysis points to a more nuanced picture than many headlines suggest. Specific data points, while not publicly released in full detail, generally indicate:

- Moderately elevated P/E ratios: Slightly above historical averages, but not at bubble levels seen in previous market peaks.

- Market Cap-to-GDP ratio: Within a reasonable range, indicating a relatively balanced relationship between market size and economic output.

- Sector-specific variations: BofA's report highlights certain sectors, such as technology and consumer discretionary, as potentially overvalued, while others, like energy and financials, appear more attractively priced. This granular analysis is crucial for strategic investment decisions.

Factors Supporting BofA's Positive Outlook

BofA's positive outlook isn't solely based on valuation metrics; it's underpinned by several broader macroeconomic factors:

Economic Growth Projections

BofA projects moderate but sustainable economic growth for the coming years. Their forecasts, while acknowledging potential headwinds, anticipate continued expansion driven by factors like:

- Resilient consumer spending.

- Strong corporate investment.

- Continued global recovery (albeit at a slower pace than previously anticipated).

Interest Rate Expectations

BofA anticipates a continued, albeit more measured, pace of interest rate hikes by central banks. While acknowledging the impact on borrowing costs, the firm believes that the current rate trajectory is manageable and unlikely to trigger a significant economic downturn.

Inflation Outlook

BofA's analysis suggests that inflation, while still elevated, is likely to gradually decline over the coming quarters, easing pressure on corporate profits and consumer spending.

Geopolitical Risks

BofA acknowledges significant geopolitical uncertainties, including the ongoing war in Ukraine and increasing tensions in other regions. However, their valuation model incorporates a range of potential geopolitical scenarios, demonstrating a robust assessment of potential risks.

Addressing Potential Counterarguments and Risks

It's crucial to acknowledge potential counterarguments to BofA's optimistic outlook. Critics might point to:

- Higher-than-expected inflation: Persistent inflation could significantly impact corporate profitability and depress valuations.

- Recessionary risks: A deeper-than-anticipated economic slowdown could trigger a sharper market correction.

- Unexpected geopolitical events: Unforeseen events could negatively impact investor sentiment and market performance.

BofA addresses these risks by incorporating various downside scenarios into their models, allowing for a more balanced and nuanced analysis. Their assessment isn’t a prediction of flawless market performance, but rather a reasoned evaluation that takes potential headwinds into account.

Investment Implications and Strategies Based on BofA's Analysis

Based on their findings, BofA suggests a cautious but opportunistic investment strategy:

- Diversification: Spreading investments across various sectors and asset classes to mitigate risk.

- Sector rotation: Shifting investments from potentially overvalued sectors (like certain technology stocks) to undervalued ones (like energy or financials), based on individual company analysis and risk assessment.

- Long-term perspective: Maintaining a long-term investment horizon to weather short-term market fluctuations.

Remember, this is not financial advice. Specific stock recommendations should always be made in consultation with a qualified financial advisor. The insights from BofA’s stock market valuation analysis should inform your investment strategy, not dictate it.

Conclusion: BofA Stock Market Valuations: A Call to Action for Confident Investing

BofA's comprehensive analysis of stock market valuations provides valuable insights for investors navigating current market uncertainties. While acknowledging potential risks, their findings suggest that current valuations aren't excessively high and that moderate economic growth could support further market gains. The detailed methodology employed, coupled with a thoughtful consideration of economic forecasts and geopolitical risks, contributes to a more balanced perspective.

By understanding BofA's assessment of market valuations, investors can make more informed decisions. We encourage you to delve deeper into BofA's reports and consult with a financial advisor to tailor your investment strategy based on this analysis and your individual risk tolerance. Don't let market volatility paralyze you; leverage the insights from BofA stock market valuations to build a more confident investment plan.

Featured Posts

-

June 1st Hulu Update All Alien Movies Now Streaming

May 27, 2025

June 1st Hulu Update All Alien Movies Now Streaming

May 27, 2025 -

Isw Putin Ne Gotoviy Do Kompromisiv U Peregovorakh Z Ukrayinoyu

May 27, 2025

Isw Putin Ne Gotoviy Do Kompromisiv U Peregovorakh Z Ukrayinoyu

May 27, 2025 -

Best Shows To Stream This Weekend Nine Perfect Strangers Siren And Others

May 27, 2025

Best Shows To Stream This Weekend Nine Perfect Strangers Siren And Others

May 27, 2025 -

Nora Fatehis Brother In Laws Confession Bmw And Sukesh Chandrashekhar Extortion Case

May 27, 2025

Nora Fatehis Brother In Laws Confession Bmw And Sukesh Chandrashekhar Extortion Case

May 27, 2025 -

Cheryl Hines Ultimatum To Robert F Kennedy Jr Following Sexting Scandal

May 27, 2025

Cheryl Hines Ultimatum To Robert F Kennedy Jr Following Sexting Scandal

May 27, 2025

Latest Posts

-

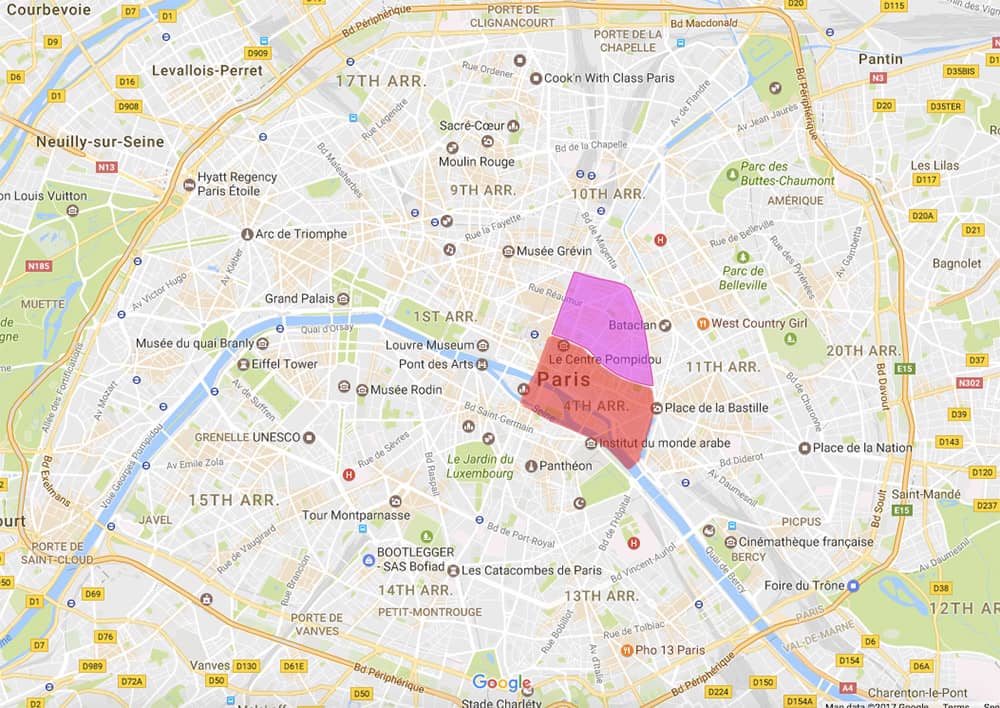

Discover The Best Areas To Stay In Paris A Neighborhood Guide

May 30, 2025

Discover The Best Areas To Stay In Paris A Neighborhood Guide

May 30, 2025 -

Programme De Cooperation France Vietnam Pour Une Mobilite Durable

May 30, 2025

Programme De Cooperation France Vietnam Pour Une Mobilite Durable

May 30, 2025 -

Paris Neighborhood Guide Top Areas To Explore

May 30, 2025

Paris Neighborhood Guide Top Areas To Explore

May 30, 2025 -

Partenariat France Vietnam Construire Une Mobilite Durable Ensemble

May 30, 2025

Partenariat France Vietnam Construire Une Mobilite Durable Ensemble

May 30, 2025 -

Mobilite Durable Au Vietnam Le Role De La Cooperation Francaise

May 30, 2025

Mobilite Durable Au Vietnam Le Role De La Cooperation Francaise

May 30, 2025