BofA's View: Addressing Investor Concerns About High Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Valuations

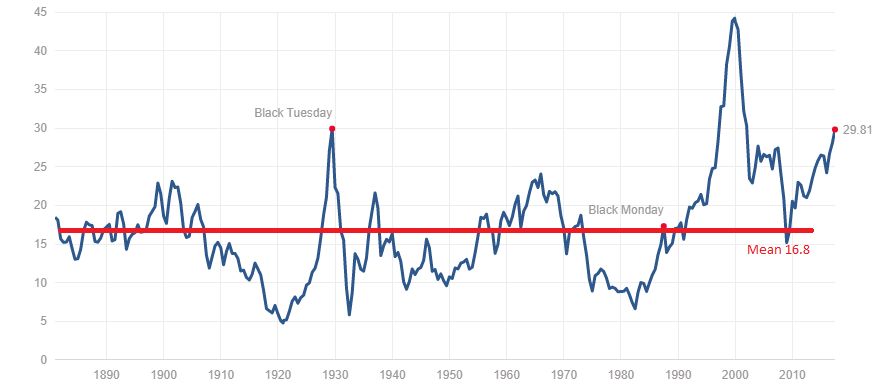

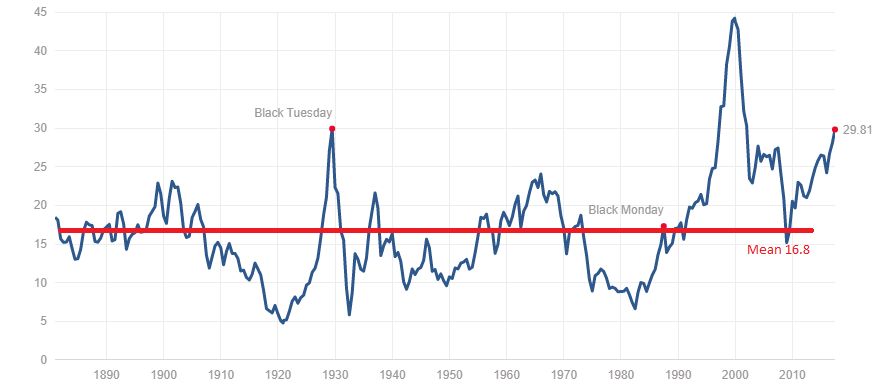

BofA regularly publishes reports assessing the state of the market, providing investors with crucial data and analysis. Their evaluations consider various indices, including the S&P 500 and Nasdaq, employing key metrics such as the price-to-earnings ratio (P/E), price-to-sales ratio (P/S), and the cyclically adjusted price-to-earnings ratio (CAPE) to gauge valuations.

- BofA's Findings: Recent BofA reports may suggest the market is currently overvalued, fairly valued, or potentially slightly undervalued depending on the specific metric used and the time period analyzed. It's crucial to consult their latest publications for the most up-to-date assessment.

- Sector-Specific Valuations: BofA's analysis often highlights specific sectors showing signs of overvaluation (e.g., certain technology sub-sectors during periods of high growth) and others appearing undervalued (e.g., value stocks during periods of market uncertainty).

- Quantitative Data: BofA supports its valuations with extensive quantitative data, including historical comparisons, industry benchmarks, and forward-looking earnings estimates. This detailed analysis helps investors understand the nuances of the market's overall health.

Identifying Key Risks Highlighted by BofA

High valuations inherently carry risks. BofA typically identifies several key concerns, emphasizing the impact of macroeconomic factors.

- Market Correction or Bear Market: The risk of a significant market downturn is always present, especially when valuations are elevated. BofA's analysis likely considers the probability and potential severity of such an event.

- Rising Interest Rates: Increased interest rates can negatively impact stock valuations, particularly for growth stocks that rely on future earnings discounted back to present value. BofA assesses the potential impact of interest rate hikes on various sectors.

- Sector-Specific Risks: Certain sectors are more vulnerable to economic downturns than others. BofA's reports often highlight risks within specific industries based on their sensitivity to interest rate changes, inflation, and other macroeconomic factors.

- Recessionary Concerns: BofA's economic forecasts play a key role in assessing the likelihood of a recession and its potential impact on stock market valuations. Their outlook influences their recommendations for investors.

BofA's Perspective on Opportunities in the Current Market

Despite high valuations, BofA often identifies investment opportunities. Their analysis highlights sectors and asset classes that might offer attractive returns while mitigating risk.

- Defensive Sectors: Sectors less sensitive to economic cycles (e.g., consumer staples, healthcare) are often viewed as more resilient during periods of market uncertainty. BofA may recommend allocating a portion of your portfolio to such sectors.

- Value Investing Strategies: BofA might favor value investing, focusing on companies trading below their intrinsic value, as a means of potentially outperforming the market during periods of high valuations.

- Dividend Investing: High-dividend stocks can provide a stable income stream, particularly valuable in volatile markets. BofA may highlight attractive dividend-paying stocks or funds.

- Specific Stock Recommendations: BofA's analysts often provide specific stock recommendations or sector preferences based on their valuations and risk assessments. Remember to conduct your own thorough due diligence before making investment decisions.

BofA's Recommended Investment Strategies

Navigating high stock market valuations requires a strategic approach. BofA typically advises investors to:

- Diversify: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) helps mitigate risk.

- Assess Risk Tolerance: Understanding your risk tolerance is critical to making appropriate investment choices. BofA emphasizes the importance of aligning your portfolio with your risk profile.

- Asset Allocation: BofA's recommendations for asset allocation will likely depend on factors such as your investment horizon, risk tolerance, and financial goals.

- Long-Term vs. Short-Term Horizons: BofA may suggest different strategies depending on your investment timeframe. Long-term investors may have a higher tolerance for risk compared to short-term investors.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

BofA's analysis of high stock market valuations provides valuable insights for investors. Their assessment, identification of risks and opportunities, and recommended investment strategies offer a framework for navigating this complex market environment. By understanding BofA's perspective on high stock market valuations, investors can make more informed choices, mitigating risk and potentially maximizing returns. Learn more about mitigating risk in this high-valuation market with BofA's expert insights and refine your investment strategy accordingly.

Featured Posts

-

Stock Market Defies Recession Fears Investors Expect Continued Growth

May 06, 2025

Stock Market Defies Recession Fears Investors Expect Continued Growth

May 06, 2025 -

Patrick Schwarzeneggers Nudity The Schwarzenegger Familys Reaction

May 06, 2025

Patrick Schwarzeneggers Nudity The Schwarzenegger Familys Reaction

May 06, 2025 -

Deep In Abandoned Gold Mines A Toxic Legacy

May 06, 2025

Deep In Abandoned Gold Mines A Toxic Legacy

May 06, 2025 -

Gigi Hadids 30th Birthday Instagram Post Confirms Romance With Bradley Cooper

May 06, 2025

Gigi Hadids 30th Birthday Instagram Post Confirms Romance With Bradley Cooper

May 06, 2025 -

Assessing The Impact Of Trumps Tariffs On Us Manufacturing

May 06, 2025

Assessing The Impact Of Trumps Tariffs On Us Manufacturing

May 06, 2025

Latest Posts

-

When Do The Celtics Begin Their Eastern Conference Semifinals Run

May 06, 2025

When Do The Celtics Begin Their Eastern Conference Semifinals Run

May 06, 2025 -

Celtics Eastern Conference Semifinals Game Start Date

May 06, 2025

Celtics Eastern Conference Semifinals Game Start Date

May 06, 2025 -

Where To Watch The Celtics Vs Heat Game On February 10th

May 06, 2025

Where To Watch The Celtics Vs Heat Game On February 10th

May 06, 2025 -

Celtics Vs Heat Live Stream February 10th Game Information

May 06, 2025

Celtics Vs Heat Live Stream February 10th Game Information

May 06, 2025 -

Celtics Vs Heat Tip Off Time Tv Channel And Live Stream February 10th

May 06, 2025

Celtics Vs Heat Tip Off Time Tv Channel And Live Stream February 10th

May 06, 2025