BofA's View: Why Current Stock Market Valuations Shouldn't Deter Investors

Table of Contents

BofA's Bullish Outlook Despite High Valuations

BofA maintains a relatively positive market sentiment, even with elevated valuations. Their analysts point to several factors underpinning this optimistic view, often expressed in their published research reports and analyst commentary. This bullish outlook isn't blind optimism; it's based on careful analysis of economic indicators and market trends.

- Undervalued Sectors: BofA identifies specific sectors, such as technology focused on AI or renewable energy, as potentially undervalued and poised for significant growth in the coming years. These sectors, they argue, offer compelling investment opportunities despite the overall market valuation levels.

- Economic Indicators: BofA's positive outlook is informed by their projections for key economic indicators. For example, they might forecast a moderation in inflation, leading to less aggressive interest rate hikes by central banks. This more stable economic environment, they believe, supports continued market growth. Their predictions on interest rates are crucial to their valuation assessments.

- Caveats and Conditions: It's crucial to note that BofA's positive outlook isn't unconditional. They acknowledge potential risks and downsides, such as geopolitical instability or unexpected economic shocks. Their projections often include scenarios outlining potential challenges and how they might impact market performance.

Addressing the Valuation Concerns: A Deeper Dive

The concern over high stock market valuations is understandable. Many traditional metrics suggest the market is expensive compared to historical averages. However, BofA counters this by offering several nuanced perspectives.

- Justifications for Higher Valuations: BofA might argue that higher valuations are justified by factors such as robust corporate earnings growth, driven by technological innovation and increased productivity. The ongoing digital transformation and the rise of new technologies are cited as factors driving strong future earnings expectations.

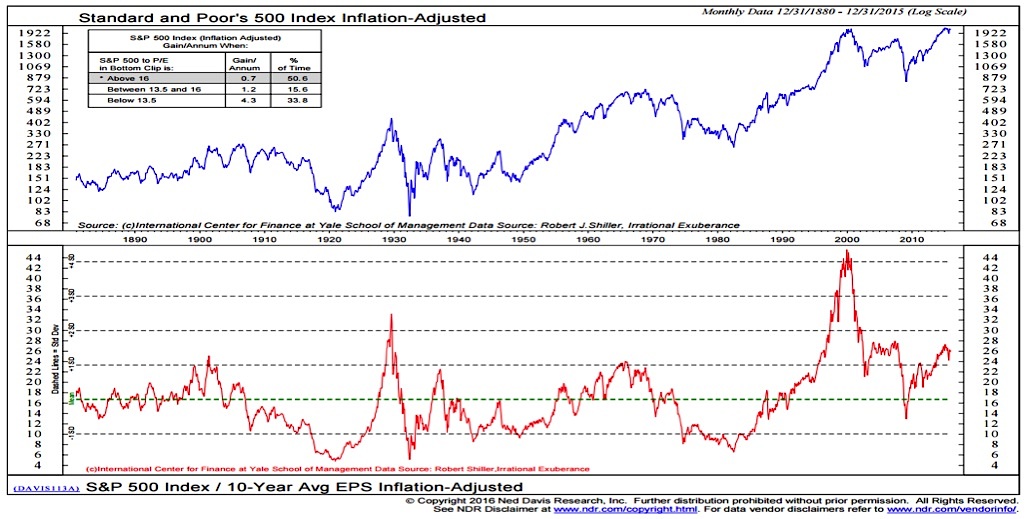

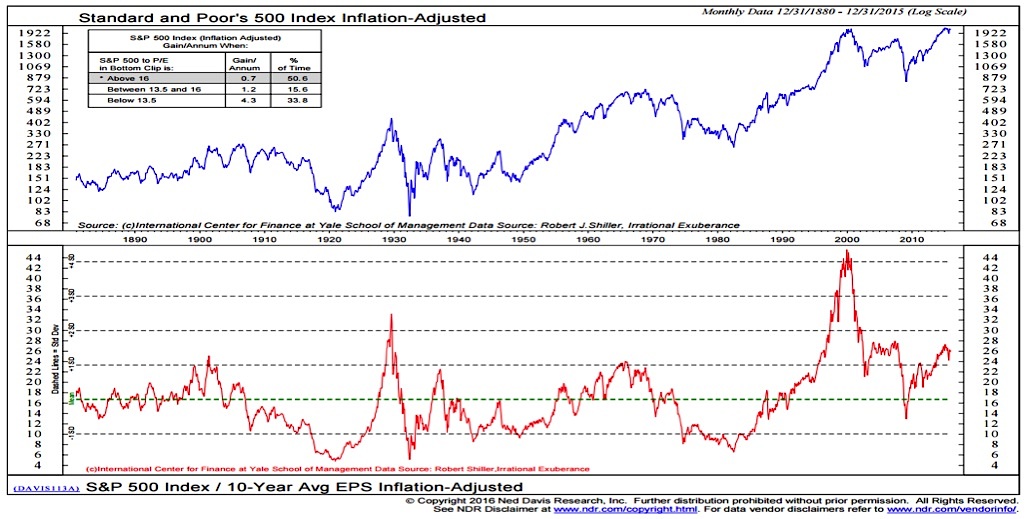

- Historical Context: While current valuations might seem high compared to historical averages, BofA likely contextualizes this by comparing them to valuations during periods of similar economic growth or technological disruption. Such comparisons provide a more balanced perspective, highlighting the unique characteristics of the current market environment.

- Alternative Valuation Metrics: BofA may also utilize alternative valuation metrics, such as cyclically adjusted price-to-earnings (CAPE) ratio or other forward-looking measures, which might paint a less alarming picture than traditional price-to-earnings ratios. These alternative metrics offer a more nuanced view of the current market's true value.

The Power of Long-Term Investing

BofA strongly emphasizes the importance of a long-term investment strategy. Short-term market fluctuations, including periods of high valuations, are seen as normal occurrences within a longer-term upward trend.

- Benefits of Market Corrections: Long-term investors can benefit from market corrections and periods of volatility. Such periods often present buying opportunities, allowing investors to acquire assets at discounted prices. This is a crucial element of BofA's advice to long-term investors.

- Long-Term Return Potential: Despite current valuations, BofA highlights the significant potential for long-term returns in the stock market. The historical record demonstrates the power of compounding returns over time, even during periods of high valuations followed by market corrections.

- Diversification's Importance: BofA undoubtedly stresses the importance of diversification as a crucial risk mitigation strategy. A diversified portfolio across various asset classes and sectors can help reduce the impact of market volatility and individual stock performance fluctuations.

BofA's Specific Investment Recommendations (if applicable)

While specific investment recommendations should always come with the appropriate disclaimers and professional financial advice, if BofA has publicly shared any, they might include:

- Sector Focus: BofA might recommend focusing on sectors they believe are poised for growth, such as technology, healthcare, or renewable energy, citing the reasons outlined in their research.

- Rationale for Recommendations: The rationale behind any specific recommendations would be directly linked to their overall market outlook and analysis of economic indicators, as well as individual company fundamentals.

- Investment Risk Disclaimer: It's paramount to emphasize that all investments carry risk, and past performance is not indicative of future results. Any investment decisions should be made after careful consideration of individual risk tolerance and financial goals.

Conclusion: Why You Shouldn't Let Current Stock Market Valuations Deter You

BofA's perspective on current stock market valuations provides a compelling counterpoint to the prevailing anxieties of many investors. By acknowledging the concerns around high valuations while highlighting the potential for long-term growth, they encourage a measured and strategic approach to investing. They emphasize the importance of a long-term perspective, diversification to mitigate risk, and focusing on sectors with robust growth potential. Don't let high valuations deter you – explore BofA's market analysis today! [Link to relevant BofA resources]. BofA's insights into current stock market valuations offer valuable guidance for investors looking to navigate the complexities of the current market. Learn more now!

Featured Posts

-

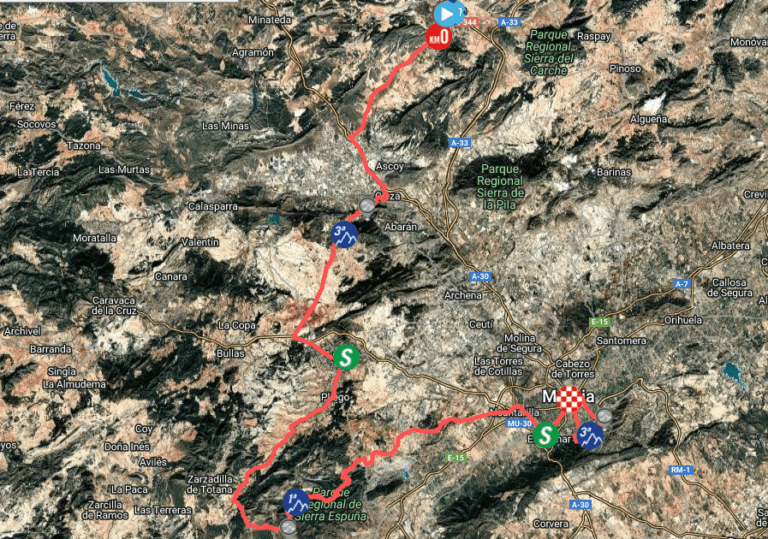

45 Vuelta Ciclista A La Region De Murcia Christen Se Impone

May 04, 2025

45 Vuelta Ciclista A La Region De Murcia Christen Se Impone

May 04, 2025 -

Impending Transportation Department Layoffs Details For May

May 04, 2025

Impending Transportation Department Layoffs Details For May

May 04, 2025 -

Farage Backs Snp Reforms Stance On Upcoming Holyrood Election

May 04, 2025

Farage Backs Snp Reforms Stance On Upcoming Holyrood Election

May 04, 2025 -

Section 230 And Banned Chemicals A Judges Ruling On E Bay Listings

May 04, 2025

Section 230 And Banned Chemicals A Judges Ruling On E Bay Listings

May 04, 2025 -

Get 100 Rebate On Hpc Ev Charging This Raya With Shell Recharge

May 04, 2025

Get 100 Rebate On Hpc Ev Charging This Raya With Shell Recharge

May 04, 2025

Latest Posts

-

Lizzo And Myke Wright A Look At Their Relationship His Career And Finances

May 04, 2025

Lizzo And Myke Wright A Look At Their Relationship His Career And Finances

May 04, 2025 -

Lizzo Shows Off Weight Loss Results A Social Media Dance Celebration

May 04, 2025

Lizzo Shows Off Weight Loss Results A Social Media Dance Celebration

May 04, 2025 -

Myke Wright Lizzos Partner His Career Net Worth And Relationship

May 04, 2025

Myke Wright Lizzos Partner His Career Net Worth And Relationship

May 04, 2025 -

Lizzos Weight Loss Journey Celebrating Slimmer Curves With Social Media Dance

May 04, 2025

Lizzos Weight Loss Journey Celebrating Slimmer Curves With Social Media Dance

May 04, 2025 -

Who Is Lizzo Dating All About Boyfriend Myke Wright

May 04, 2025

Who Is Lizzo Dating All About Boyfriend Myke Wright

May 04, 2025