Brexit's Toll: The Struggle Of UK Luxury Exports To The EU Market

Table of Contents

Increased Bureaucracy and Customs Delays

Brexit introduced complex customs procedures, leading to increased processing times and significant delays at borders. This impacts the time-sensitive nature of luxury goods deliveries and increases logistical costs. The intricate paperwork and stringent customs checks add layers of complexity to the already delicate process of exporting high-value, often perishable, items. This has had a knock-on effect on the entire supply chain.

- Lengthy customs declarations and documentation requirements: Exporters now face mountains of paperwork, requiring specialist knowledge and often leading to costly errors.

- Increased risk of goods being held up at customs: Delays can lead to missed delivery deadlines, damaging brand reputation and potentially rendering goods unsaleable (especially perishable items like cosmetics or certain foods).

- Higher transportation costs due to delays and rerouting: Delays necessitate more expensive transport options and increased storage fees, eating into profit margins.

- Damage to perishable luxury goods during prolonged transit: The extended transit times increase the risk of damage to temperature-sensitive or fragile luxury goods, leading to significant financial losses.

- Difficulty in tracking shipments effectively: The increased complexity of the process makes it harder to track shipments accurately, adding to the stress and uncertainty for businesses.

Tariffs and Increased Costs

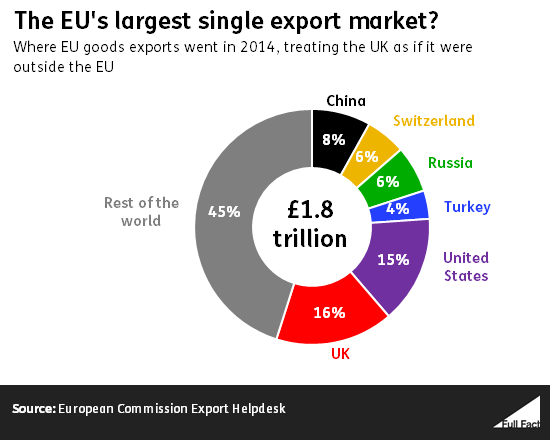

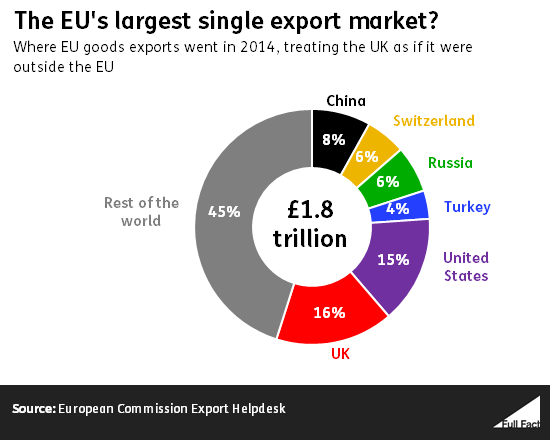

The imposition of tariffs on certain luxury goods exported from the UK to the EU has directly increased the price for consumers, impacting competitiveness and potentially reducing demand. This reduced profitability also affects investment in the sector. The added costs make it harder for UK luxury brands to compete effectively with their EU counterparts.

- Higher prices make UK luxury goods less attractive compared to EU competitors: Consumers are more likely to choose cheaper alternatives from within the EU, reducing market share for UK exporters.

- Reduced profit margins for UK exporters: The cost of tariffs significantly impacts profitability, forcing businesses to either absorb the losses or pass the increased costs on to customers.

- Increased pressure to absorb costs or pass them on to the consumer: Neither option is ideal: absorbing costs erodes profits, while passing them on can reduce demand.

- Loss of market share to EU-based luxury brands: The price increase gives EU competitors a clear advantage, potentially leading to a significant decline in market share for UK luxury goods.

- Potential for reduced investment in UK luxury production: Reduced profitability can lead to decreased investment in research, development, and innovation within the UK luxury sector.

Supply Chain Disruptions and Shortages

The complexities of the new trading relationship have created significant disruptions to the supply chain for UK luxury goods, impacting the availability of raw materials and timely delivery to EU markets. Just-in-time inventory management strategies have become much more challenging, leading to increased stockholding costs and vulnerability to disruptions.

- Difficulties sourcing raw materials from the EU: The added bureaucracy and potential delays make it more difficult and expensive to source essential materials from the EU.

- Increased lead times for production and delivery: The complexities of customs and logistics contribute to longer lead times, affecting production schedules and potentially impacting customer satisfaction.

- Higher stockholding costs to mitigate supply chain risks: Businesses are forced to hold larger inventories to buffer against potential supply chain disruptions, which increases warehousing and storage costs.

- Increased vulnerability to supply chain disruptions: The entire system is now more fragile and susceptible to further disruptions, creating a challenging and uncertain business environment.

- Potential impact on product quality and availability: Disruptions to the supply chain can impact the quality and availability of both raw materials and finished goods, impacting the reputation and profitability of UK luxury brands.

The Impact on Smaller Luxury Businesses

Smaller luxury businesses (SMEs) in the UK are disproportionately affected by these challenges, lacking the resources and expertise of larger corporations to navigate the new regulatory landscape. This increases the risk of business failure. The administrative burden and increased costs place a disproportionate strain on smaller businesses.

- Increased administrative burden for smaller companies: SMEs often lack the dedicated staff and resources to manage the increased paperwork and complexities of post-Brexit trade.

- Limited access to specialist advice and support: Smaller businesses may struggle to access the specialist advice and support needed to navigate the complexities of the new trading environment.

- Higher costs relative to revenue for SMEs: The added costs of tariffs, customs, and logistics represent a larger proportion of their revenue compared to larger businesses.

- Greater risk of business closure: The combined impact of these challenges puts smaller luxury businesses at a significantly higher risk of closure.

- Need for targeted government support for SMEs: Targeted government support and assistance are crucial to help smaller luxury businesses survive and thrive in the post-Brexit environment.

Conclusion:

Brexit has undeniably placed a significant burden on UK luxury exports to the EU market. Increased bureaucracy, tariffs, and supply chain disruptions are impacting profitability, competitiveness, and the long-term sustainability of the industry. Addressing these challenges requires a multifaceted approach, including government support for businesses, simplification of customs procedures, and proactive strategies to mitigate supply chain risks. Understanding the full impact of Brexit on UK luxury exports is crucial for developing effective solutions and safeguarding the future of this vital sector. Continue reading to learn more about strategies for navigating the challenges of Brexit and UK luxury exports to the EU, and discover how your business can thrive despite the difficulties.

Featured Posts

-

Will The Trans Australia Run World Record Be Toppled

May 21, 2025

Will The Trans Australia Run World Record Be Toppled

May 21, 2025 -

Transparency In Trumps Aerospace Deals A Detailed Examination

May 21, 2025

Transparency In Trumps Aerospace Deals A Detailed Examination

May 21, 2025 -

Razvod Vanje Mijatovic Istina O Navodnim Problemima S Tezinom

May 21, 2025

Razvod Vanje Mijatovic Istina O Navodnim Problemima S Tezinom

May 21, 2025 -

Les Grands Fusains De Boulemane Debat Anime Au Book Club Le Matin

May 21, 2025

Les Grands Fusains De Boulemane Debat Anime Au Book Club Le Matin

May 21, 2025 -

From Reddit Viral Story To Hollywood The True Story Behind The Missing Girl Movie

May 21, 2025

From Reddit Viral Story To Hollywood The True Story Behind The Missing Girl Movie

May 21, 2025