Brookfield's Strategic Response To Market Dislocation: Investing For Growth

Table of Contents

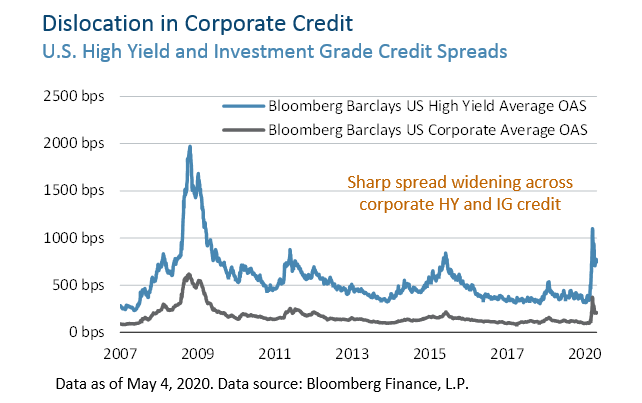

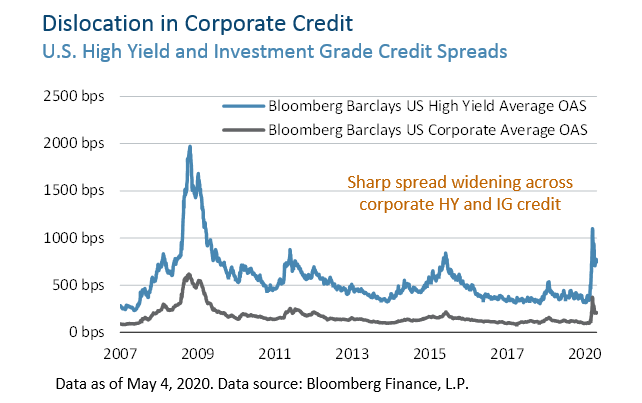

Market dislocations present both challenges and opportunities. This article examines Brookfield Asset Management's strategic response to recent market volatility, highlighting its approach to navigating uncertainty and identifying lucrative investment prospects for sustained growth. We will delve into Brookfield's resilient investment strategy, exploring its key sectors and emphasizing its long-term vision for capital appreciation. Understanding Brookfield's Strategic Response to Market Dislocation is crucial for investors seeking stability and growth in turbulent times.

Brookfield's Resilient Investment Strategy

Brookfield's success is rooted in its ability to weather market storms. Its strategic response to market dislocation relies on a multifaceted approach built on diversification, a long-term perspective, and active portfolio management.

Diversification Across Asset Classes

Brookfield's portfolio diversification is a cornerstone of its resilience. The company's investments span various asset classes, including real estate, infrastructure, renewable power, and private equity. This strategic diversification minimizes the impact of downturns within any single sector.

- Reduced exposure to single-sector volatility: By spreading investments across multiple sectors, Brookfield reduces its dependence on the performance of any one asset class. This significantly reduces overall portfolio risk.

- Enhanced portfolio resilience during market corrections: When one sector experiences a downturn, the strength of other sectors can offset losses, ensuring portfolio stability.

- Opportunities for counter-cyclical investment: Market dislocations create opportunities to acquire undervalued assets in struggling sectors, offering attractive entry points for long-term growth.

Long-Term Investment Horizon

Unlike many firms focused on short-term gains, Brookfield adopts a patient, long-term investment horizon. This allows them to ride out short-term market fluctuations and focus on the underlying value of their assets.

- Focus on fundamental value rather than short-term market sentiment: Brookfield's investment decisions are driven by in-depth analysis of fundamental value, rather than reacting to short-term market volatility.

- Ability to withstand market corrections and capitalize on distressed assets: Their long-term view enables them to withstand market corrections and even capitalize on distressed assets that are temporarily undervalued.

- Long-term value creation through operational improvements and strategic repositioning: Brookfield actively works to enhance the value of its assets through operational improvements, strategic repositioning, and long-term growth strategies.

Active Portfolio Management

Brookfield's success isn't passive. The company actively manages its assets, continuously seeking opportunities for improvement and optimization.

- Experienced operational teams focused on enhancing asset performance: Brookfield employs expert teams dedicated to optimizing the performance of each asset within its portfolio.

- Proactive approach to identifying and mitigating risks: Rigorous risk assessment and management are integrated into every aspect of Brookfield's investment process.

- Value-add strategies that increase asset profitability: The company actively pursues strategies to enhance the profitability of its assets, including renovations, operational improvements, and strategic repositioning.

Key Sectors and Investment Opportunities

Brookfield's strategic response to market dislocation also involves focusing on sectors offering resilience and long-term growth potential.

Real Estate

Brookfield's real estate investments demonstrate its ability to capitalize on market dislocations. The company targets undervalued assets in resilient sectors and prime locations.

- Acquisitions of distressed properties at discounted prices: Market downturns create opportunities to acquire high-quality real estate at significantly reduced prices.

- Focus on essential real estate, such as logistics and multifamily housing: Brookfield prioritizes investments in properties with consistent demand, regardless of economic cycles.

- Value creation through renovations, repositioning, and improved management: Brookfield enhances the value of its real estate holdings through strategic renovations, repositioning, and improved property management.

Infrastructure

Investing in essential infrastructure provides stable, long-term returns, making it an ideal sector during economic uncertainty.

- Stable and inflation-protected returns: Infrastructure investments often generate predictable cash flows that are relatively insensitive to short-term economic fluctuations.

- Focus on essential services like utilities, transportation, and digital infrastructure: Brookfield targets infrastructure assets that provide essential services with enduring demand.

- Opportunities for long-term concessions and partnerships: The company actively seeks opportunities to participate in long-term concessions and public-private partnerships.

Renewable Power

The global shift towards sustainable energy presents significant opportunities. Brookfield is actively investing in renewable energy sources.

- Growing demand for sustainable energy solutions: The transition to a low-carbon economy is driving significant growth in the renewable energy sector.

- Long-term contracts and predictable revenue streams: Renewable energy projects often involve long-term power purchase agreements, providing stable and predictable revenue streams.

- Potential for significant growth in the renewable energy sector: Brookfield recognizes the immense long-term growth potential of the renewable energy market.

Managing Risk and Uncertainty

Brookfield's success hinges on its ability to effectively manage risk and adapt to changing market conditions.

Risk Mitigation Strategies

Brookfield employs robust risk mitigation strategies to protect its investments during market volatility.

- Thorough asset valuation and underwriting: A rigorous due diligence process ensures that investments are appropriately valued and meet Brookfield's risk tolerance.

- Stress testing of investment portfolios to assess resilience: Brookfield regularly stress-tests its portfolio to assess its resilience under various economic scenarios.

- Diversification across geographic regions and asset classes: Geographic and asset class diversification further mitigates risk.

Adaptability and Innovation

Brookfield's ability to adapt to evolving market conditions and embrace innovation is crucial to its long-term success.

- Continuous monitoring of market trends and emerging technologies: Brookfield stays abreast of market trends and emerging technologies to identify new investment opportunities.

- Investment in cutting-edge technologies to enhance operational efficiency: The company leverages technology to enhance the operational efficiency of its assets.

- Agile approach to capital allocation: Brookfield maintains an agile approach to capital allocation, allowing it to quickly adapt to changing market conditions.

Conclusion

Brookfield's strategic response to market dislocation demonstrates its commitment to long-term value creation. Its diversified portfolio, active portfolio management, and focus on resilient asset classes position it for continued growth even during periods of uncertainty. Understanding Brookfield's approach to market dislocations offers valuable insights for investors. To learn more about Brookfield’s investment strategies and how they are navigating current market conditions, explore their investor relations resources. Consider Brookfield's Strategic Response to Market Dislocation as a model for long-term investment success.

Featured Posts

-

Papez Francisek Na Trgu Sv Petra Pozdrav In Blagoslov Za Mesto In Svet

May 08, 2025

Papez Francisek Na Trgu Sv Petra Pozdrav In Blagoslov Za Mesto In Svet

May 08, 2025 -

Funeral Do Papa Francisco Fieis Aguardam Em Vigilia No Vaticano

May 08, 2025

Funeral Do Papa Francisco Fieis Aguardam Em Vigilia No Vaticano

May 08, 2025 -

Akuza E Uefa S Ndaj Arsenalit Per Ndeshjen Me Psg Cfare Ndodhi

May 08, 2025

Akuza E Uefa S Ndaj Arsenalit Per Ndeshjen Me Psg Cfare Ndodhi

May 08, 2025 -

Yann Sommer Thumb Injury Blow For Inter Milan Ahead Of Crucial Matches

May 08, 2025

Yann Sommer Thumb Injury Blow For Inter Milan Ahead Of Crucial Matches

May 08, 2025 -

Psg Fitore Minimaliste Celesi I Suksesit

May 08, 2025

Psg Fitore Minimaliste Celesi I Suksesit

May 08, 2025

Latest Posts

-

Simple Scary A Look At The Long Walks First Trailer

May 08, 2025

Simple Scary A Look At The Long Walks First Trailer

May 08, 2025 -

The Long Walk Trailer Stephen Kings Bleakest Story Hits The Big Screen

May 08, 2025

The Long Walk Trailer Stephen Kings Bleakest Story Hits The Big Screen

May 08, 2025 -

If The Monkey Is 2025s Worst Stephen King Movie It Ll Still Be A Great Year For King

May 08, 2025

If The Monkey Is 2025s Worst Stephen King Movie It Ll Still Be A Great Year For King

May 08, 2025 -

The Long Walk First Trailers Simple Horror Is Terrifying

May 08, 2025

The Long Walk First Trailers Simple Horror Is Terrifying

May 08, 2025 -

Glen Powells Physical And Mental Preparation For The Running Man

May 08, 2025

Glen Powells Physical And Mental Preparation For The Running Man

May 08, 2025