BSE Shares Surge: Earnings Boost Indian Bourse Rally

Table of Contents

Strong Q3 Earnings Drive Market Optimism

Positive Q3 earnings reports from numerous major companies listed on the BSE have been a primary catalyst for the recent market optimism. Robust profit growth and impressive revenue growth across various sectors have significantly boosted investor sentiment. This positive earnings season signals a healthy economic outlook and increased confidence in the long-term prospects of Indian businesses.

- Top-performing companies and their percentage growth: Reliance Industries saw a 25% increase in profits, while Infosys reported a 15% surge in revenue, significantly contributing to the BSE Sensex's upward trajectory. HDFC Bank also showcased strong performance, exceeding analyst expectations.

- Sectors showing strong earnings: The IT, banking, and FMCG sectors demonstrated particularly strong earnings growth, reflecting a diverse and robust economic landscape.

- Impact of positive earnings surprises on investor confidence: Positive earnings surprises have reignited investor confidence, leading to increased buying activity and pushing share prices higher across the BSE. This positive feedback loop reinforces the ongoing market rally.

Increased Foreign Institutional Investor (FII) Investments

The surge in BSE shares is also significantly fueled by a considerable increase in Foreign Institutional Investor (FII) investments. These global investors are increasingly viewing the Indian stock market as an attractive destination for portfolio investment, injecting substantial liquidity into the market. This influx of capital further strengthens the upward momentum.

- Quantifying FII investment: In the past month alone, FII investments have totalled [insert actual figures if available], indicating strong global confidence in the Indian economy.

- Reasons for increased FII interest: The attractive valuations of many BSE shares, coupled with India's robust economic growth prospects and positive government policies, are major factors driving increased FII interest.

- Impact of FII inflows on market liquidity and share prices: The substantial inflow of FII capital has improved market liquidity, allowing for smoother trading and contributing to the rise in share prices across the BSE.

Positive Economic Indicators Boost Investor Sentiment

Positive macroeconomic indicators further bolster investor confidence and fuel the rally in BSE shares. A healthy economic outlook, marked by improving GDP growth and controlled inflation, significantly contributes to the overall market sentiment. This positive economic environment encourages further investment in the Indian stock market.

- Key positive economic indicators: The recent GDP growth figures [insert actual figures if available] showcase the strength of the Indian economy. Furthermore, a decline in inflation [insert actual figures if available] indicates improved macroeconomic stability.

- Government's role in boosting economic confidence: Government initiatives aimed at stimulating economic growth and improving infrastructure have also played a crucial role in bolstering investor confidence.

- Impact of positive economic news on investor behavior: Positive economic news creates a positive feedback loop, driving investor optimism and encouraging further investment in BSE shares.

Sector-Specific Analysis of BSE Share Performance

The recent BSE share surge is not uniform across all sectors. However, several sectors have demonstrated exceptional performance, contributing significantly to the overall market rally.

- Top-performing sectors and their percentage growth: [Insert sector-specific data, e.g., The IT sector experienced a 20% increase, while the banking sector saw a 15% surge].

- Factors driving growth within each sector: [Explain the reasons behind the growth in specific sectors, e.g., Increased global demand for IT services drove the IT sector’s performance. Strong credit growth fueled the banking sector's surge].

Conclusion

The recent surge in BSE shares is a result of a powerful combination of factors: strong Q3 earnings, increased FII investments, and positive economic indicators. These factors have significantly boosted investor confidence, leading to a robust market rally and creating promising investment opportunities. The impressive performance of BSE shares reflects a positive outlook for the Indian economy.

The BSE shares surge presents compelling investment opportunities. Stay informed on the latest market trends and consider exploring the potential benefits of investing in the Indian stock market. Analyze the current performance of BSE shares and make informed investment decisions. Remember to conduct thorough research and seek professional financial advice before making any investment choices related to BSE shares.

Featured Posts

-

Millions Stolen Hacker Targets Executive Office365 Accounts

May 07, 2025

Millions Stolen Hacker Targets Executive Office365 Accounts

May 07, 2025 -

Zendayas Half Sister Exposes Family Rift A Shocking Revelation

May 07, 2025

Zendayas Half Sister Exposes Family Rift A Shocking Revelation

May 07, 2025 -

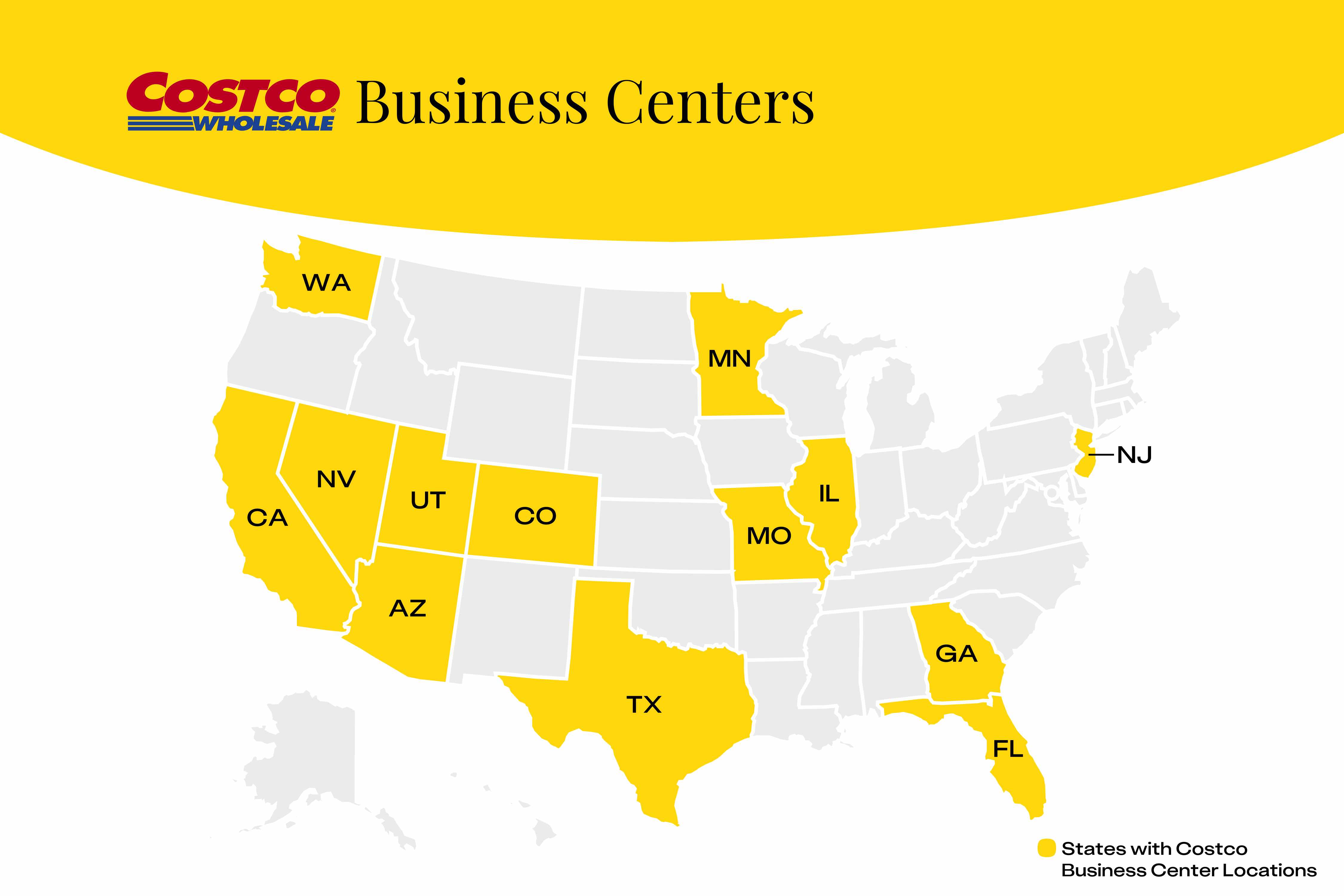

The Countrys Best New Business Locations A Detailed Map And Analysis

May 07, 2025

The Countrys Best New Business Locations A Detailed Map And Analysis

May 07, 2025 -

Stephen Curry Injury Update Steve Kerr Offers Hopeful Timeline For Return

May 07, 2025

Stephen Curry Injury Update Steve Kerr Offers Hopeful Timeline For Return

May 07, 2025 -

Hawkgirl Actor Discusses Superman Suit And Flight Scenes

May 07, 2025

Hawkgirl Actor Discusses Superman Suit And Flight Scenes

May 07, 2025

Latest Posts

-

Donate Your Cavs Tickets A New And Improved Process

May 07, 2025

Donate Your Cavs Tickets A New And Improved Process

May 07, 2025 -

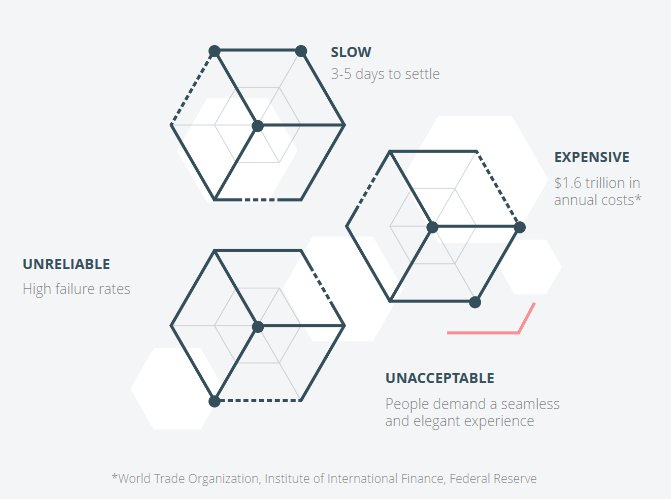

Should You Invest In Xrp Ripple Now A Comprehensive Analysis

May 07, 2025

Should You Invest In Xrp Ripple Now A Comprehensive Analysis

May 07, 2025 -

New Platform For Cavs Ticket Donations Now Available

May 07, 2025

New Platform For Cavs Ticket Donations Now Available

May 07, 2025 -

The Risks And Rewards Of Investing In Xrp Ripple Today

May 07, 2025

The Risks And Rewards Of Investing In Xrp Ripple Today

May 07, 2025 -

Understanding Xrp Ripple And Its Potential For Financial Growth

May 07, 2025

Understanding Xrp Ripple And Its Potential For Financial Growth

May 07, 2025