Buffett's Apple Investment: Navigating The Impact Of Trump-Era Tariffs

Table of Contents

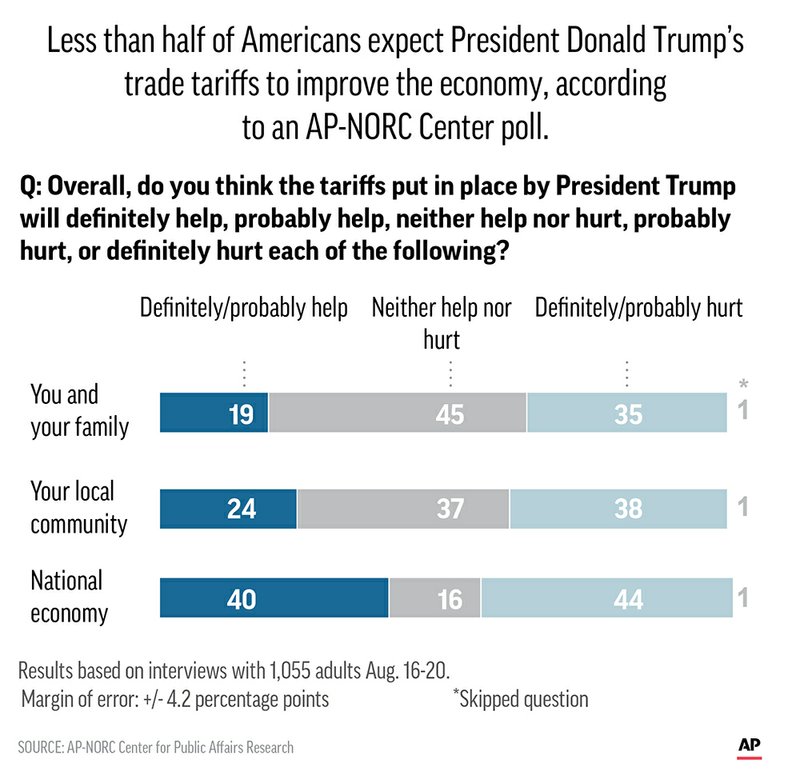

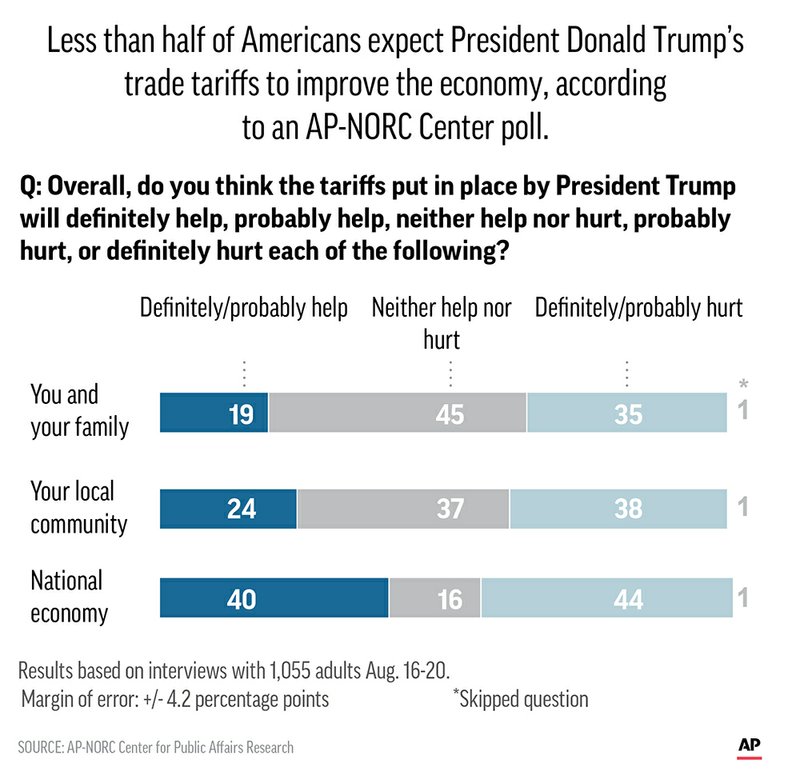

The Trump Administration's Tariffs and Their Impact on Apple

The Trump administration implemented a series of tariffs, primarily targeting Chinese imports, significantly impacting numerous industries, including technology. These Apple tariffs, part of a broader trade war, increased import duties on various components crucial for Apple's product manufacturing. These tariffs, specifically those impacting Chinese-manufactured goods, directly affected Apple's supply chain and profitability.

- Specific Tariffs: The tariffs varied over time, ranging from 10% to 25% on various products and components. This included tariffs on finished goods like iPhones and iPads, as well as crucial components like memory chips and displays sourced from China.

- Products Affected: The tariffs affected virtually all Apple products, from iPhones and Macs to AirPods and Apple Watches. The percentage increase in import costs varied depending on the specific product and its component sourcing.

- Impact on Profitability and Market Share: The increased import duties led to higher production costs for Apple. While Apple absorbed some of these costs, the increased prices on some products may have impacted sales volume and market share to a certain degree. Analyzing Apple's financial statements from this period reveals fluctuations in revenue and profit margins, indicating a direct correlation between the tariffs and Apple's financial performance. Precise figures depend on detailed financial analysis, but the overall trend suggests a negative, albeit likely mitigated, impact.

Berkshire Hathaway's Response to the Tariffs

Berkshire Hathaway, under Buffett's leadership, faced the challenge of managing the Apple tariffs impact on their significant Apple investment. While specific details of their internal strategy remain undisclosed, several likely approaches can be inferred.

- Possible Strategies: Berkshire Hathaway likely employed a combination of strategies to mitigate the risk. These could have included careful monitoring of the situation, analysis of Apple's responses, and possibly some degree of hedging against further tariff escalation. Diversification across other sectors within Berkshire Hathaway's portfolio would have also reduced the overall impact of Apple-specific risks. Lobbying efforts to influence trade policy, although not directly confirmed, are a possibility.

- Public Statements: While Buffett rarely comments on short-term market fluctuations, his public statements during this period generally reflected confidence in Apple's long-term prospects and resilience despite the supply chain disruption caused by the tariffs. This confidence likely reassured investors.

The Long-Term Effects on Apple and Berkshire Hathaway

The long-term impact of the tariffs on Apple and Berkshire Hathaway is a subject of ongoing analysis. However, certain conclusions can be drawn.

- Apple's Adaptation: Apple demonstrated significant adaptability. They likely diversified their supply chains, exploring alternative sourcing options outside of China to reduce their reliance on tariff-affected regions. The impact on pricing strategies and manufacturing locations may be seen in their subsequent decisions regarding production and distribution.

- Performance Comparison: Comparing Apple's performance before, during, and after the tariff period reveals a complex picture. While there was a short-term negative impact, Apple's overall growth trajectory remained relatively strong. This suggests a successful adaptation to the changed geopolitical landscape.

- Lessons Learned: The Trump-era tariffs underscored the significance of geopolitical risk in investment planning. Investors learned the importance of considering the potential impact of unexpected global events on their portfolio returns. This experience emphasized the need for robust risk management strategies and portfolio diversification to mitigate potential losses from similar unforeseen circumstances.

Alternative Investment Strategies in a Volatile Market

In situations marked by trade uncertainty, investors should consider alternative investment strategies. Investment diversification across various sectors, geographies, and asset classes helps mitigate the impact of specific risks. Risk management techniques, such as hedging and options trading, can further safeguard portfolios. Exploring alternative investments like real estate, infrastructure, or private equity can provide additional diversification and potential returns.

Conclusion

The Trump-era tariffs presented a significant challenge to Apple, indirectly impacting Berkshire Hathaway's substantial Buffett's Apple investment. However, analysis suggests Apple and Berkshire Hathaway successfully navigated these challenges through adaptation and diversified strategies. The experience highlights the crucial importance of understanding geopolitical risk when making investment decisions. Robust risk management strategies are essential to protect portfolios from similar unexpected events. Learn more about navigating the complexities of global trade and its impact on investments by exploring further resources on [link to relevant resources]. Understand how to mitigate risks associated with Buffett's Apple investment and similar holdings in a volatile global market. Start diversifying your portfolio today to better withstand unexpected events.

Featured Posts

-

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025 -

The Kyle And Teddi Dog Walking Incident A Heated Dispute

May 24, 2025

The Kyle And Teddi Dog Walking Incident A Heated Dispute

May 24, 2025 -

San Hejmo Line Up Komplette Besetzung Essener Fans In Ekstase

May 24, 2025

San Hejmo Line Up Komplette Besetzung Essener Fans In Ekstase

May 24, 2025 -

Predicciones Astrologicas Horoscopo Semanal Del 11 Al 17 De Marzo De 2025

May 24, 2025

Predicciones Astrologicas Horoscopo Semanal Del 11 Al 17 De Marzo De 2025

May 24, 2025 -

Amundi Msci World Ex Us Ucits Etf Acc Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Ex Us Ucits Etf Acc Understanding Net Asset Value Nav

May 24, 2025

Latest Posts

-

Bianca Andreescu Defeats Elena Rybakina In Straight Sets At Italian Open

May 24, 2025

Bianca Andreescu Defeats Elena Rybakina In Straight Sets At Italian Open

May 24, 2025 -

Ezhednevnye Goroskopy I Predskazaniya

May 24, 2025

Ezhednevnye Goroskopy I Predskazaniya

May 24, 2025 -

Uspekh Rybakinoy Vykhod V Tretiy Krug Rimskogo Turnira

May 24, 2025

Uspekh Rybakinoy Vykhod V Tretiy Krug Rimskogo Turnira

May 24, 2025 -

Elena Rybakina Proshla Vo Vtoroy Krug V Rime

May 24, 2025

Elena Rybakina Proshla Vo Vtoroy Krug V Rime

May 24, 2025 -

Rybakina Pomogaet Yunym Tennisistkam Kazakhstana

May 24, 2025

Rybakina Pomogaet Yunym Tennisistkam Kazakhstana

May 24, 2025