Buyer Budget Cuts Hit Fremantle: Q1 Revenue Falls 5.6%

Table of Contents

Analysis of Fremantle's Q1 Revenue Drop

Specific Figures and Breakdown

Fremantle reported a Q1 2024 revenue of [Insert Actual Figure Here], a 5.6% decrease compared to Q1 2023's revenue of [Insert Actual Figure Here]. While precise sector-specific breakdowns are pending further official releases, initial reports suggest a varied impact across different production areas.

- Television Production: [Insert Percentage Change and brief explanation, e.g., a 7% decrease attributed to reduced commissioning from major broadcasters].

- Film Production: [Insert Percentage Change and brief explanation, e.g., a 3% increase driven by strong performance of specific titles, offsetting the overall decline].

- Digital Production: [Insert Percentage Change and brief explanation, e.g., a 2% decrease due to reduced advertising revenue and tighter streaming budgets].

Specific projects impacted by budget cuts remain largely unconfirmed, though industry whispers suggest delays and potential cancellations of several planned series and film productions.

Impact of Buyer Budget Cuts

The primary driver of Fremantle's Q1 revenue decline is undeniably the contraction in buyer spending. Broadcasters, facing declining advertising revenue and increased competition from streaming platforms, are tightening their belts. Streaming services, meanwhile, are scrutinizing content spending to prioritize profitability and subscriber growth.

- Broadcasters: Reduced commissioning budgets for new programming due to declining advertising revenue and audience fragmentation.

- Streamers: Increased focus on cost efficiency and return on investment, leading to more selective commissioning strategies.

- Examples: [Insert examples if available, e.g., "The postponement of Season 3 of a flagship drama series due to budget constraints from a major broadcaster"].

- Restructuring: While not explicitly confirmed, potential cost-cutting measures such as layoffs or restructuring within Fremantle may become necessary to counteract the financial downturn.

Wider Implications for the Media Industry

Industry Trends

Fremantle's struggles reflect a broader trend of economic pressure within the media industry. Inflation, recessionary fears, and increased competition are all contributing to reduced buyer spending.

- Economic Factors: Inflation is increasing production costs, while a potential recession could further limit advertising and subscription revenue.

- Streaming Competition: The proliferation of streaming services has intensified competition, forcing traditional broadcasters and streaming platforms alike to re-evaluate their content spending.

- Future Outlook: The trend of buyer budget cuts is likely to continue in the near term unless significant economic shifts or industry consolidation occur.

Strategies for Fremantle (and the Industry) to Adapt

Fremantle, along with other media companies, needs to adapt to this new reality. Several strategies could prove crucial for navigating the current climate:

- Cost-Cutting Measures: Streamlining production processes, negotiating better deals with suppliers, and potentially reducing workforce (carefully and strategically).

- Efficient Production: Adopting more efficient production methods, exploring innovative technologies to reduce costs and improve workflows.

- Revenue Diversification: Expanding into new areas like branded content, licensing, and gaming to reduce reliance on traditional revenue streams.

- New Content Formats: Investing in new, cost-effective content formats like shorter-form video and interactive experiences that appeal to modern audiences.

- Distribution Channels: Exploring new distribution channels and partnerships to reach wider audiences and maximize revenue potential.

Investor Reactions and Stock Performance

Stock Market Response

Fremantle's Q1 revenue drop naturally impacted its stock price. [Insert details about the stock price change, including percentage and timeframe]. Investor sentiment is currently [Describe investor sentiment – cautious, concerned, etc.], with analysts offering mixed predictions for the future. [Include any relevant analyst quotes or predictions if available].

Fremantle's Response to Investors

Fremantle's leadership has [Describe their actions and statements to investors: press releases, conference calls, etc.]. Their strategy to address the revenue decline likely involves a combination of cost-cutting measures, exploring new revenue streams, and focusing on high-impact content.

Conclusion

Fremantle's 5.6% Q1 revenue decline underscores the significant impact of buyer budget cuts on the media industry. Reduced spending from broadcasters and streaming services, driven by economic factors and increased competition, is creating a challenging environment for production companies. Fremantle's response, and the adaptability of the wider industry, will be key to navigating this period of uncertainty. To stay updated on the latest developments affecting Fremantle and the impact of buyer budget cuts on the media industry, subscribe to our newsletter, follow industry news closely, and check back for updates on Fremantle's financial performance and strategic responses.

Featured Posts

-

Robin Roberts Getting Fancy Comment Sparks Debate Following Gma Layoffs

May 20, 2025

Robin Roberts Getting Fancy Comment Sparks Debate Following Gma Layoffs

May 20, 2025 -

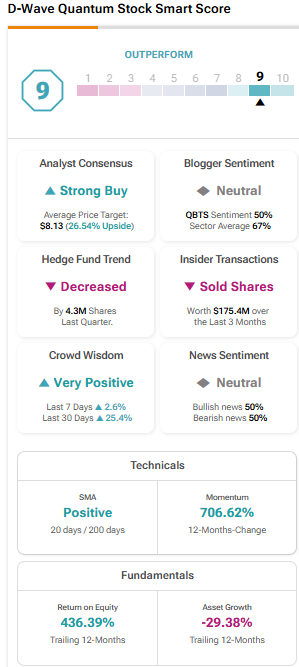

D Wave Quantum Qbts Stock Mondays Significant Decrease Explained

May 20, 2025

D Wave Quantum Qbts Stock Mondays Significant Decrease Explained

May 20, 2025 -

Efimereyontes Iatroi Patras Savvatokyriako 10 11 Maioy 2024

May 20, 2025

Efimereyontes Iatroi Patras Savvatokyriako 10 11 Maioy 2024

May 20, 2025 -

Arsenal Transfer News Gunners Battle Liverpool For Premier League Star

May 20, 2025

Arsenal Transfer News Gunners Battle Liverpool For Premier League Star

May 20, 2025 -

Chinese Grand Prix 2023 Hamilton Leclerc Incident Analysis

May 20, 2025

Chinese Grand Prix 2023 Hamilton Leclerc Incident Analysis

May 20, 2025

Latest Posts

-

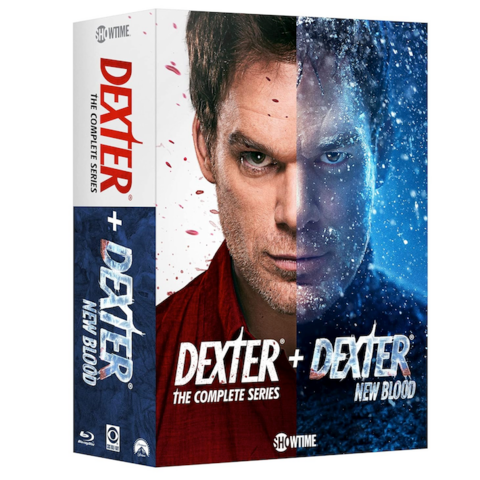

The Impact Of Original Sins Finale On Dexters Treatment Of Debra Morgan

May 21, 2025

The Impact Of Original Sins Finale On Dexters Treatment Of Debra Morgan

May 21, 2025 -

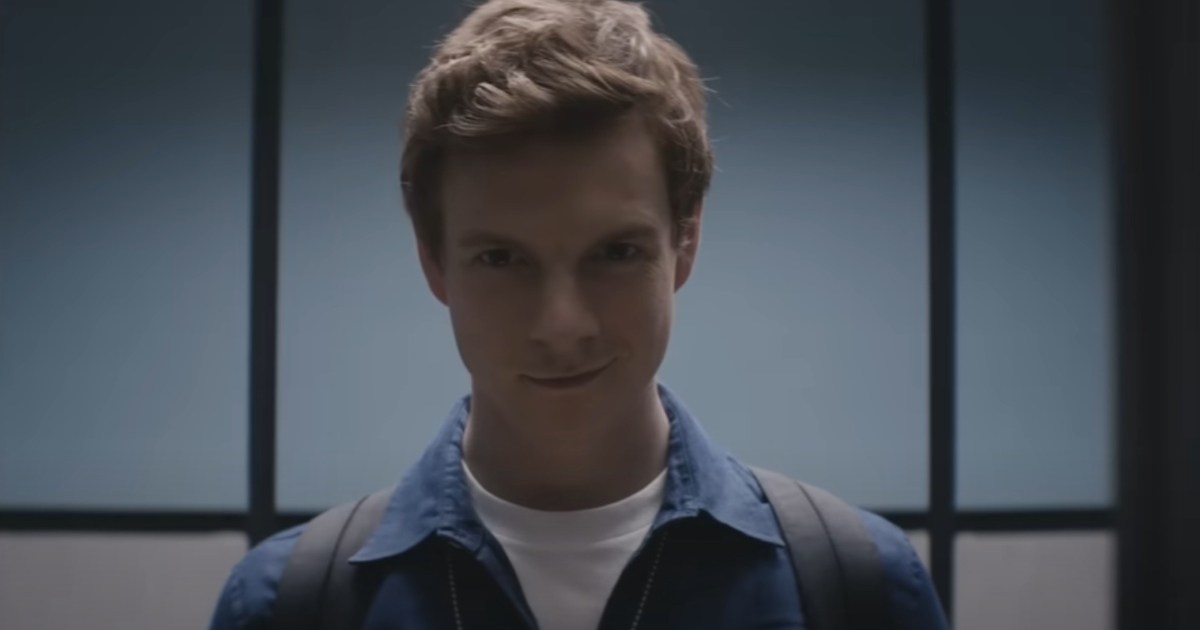

Analyzing Fan Response To Dexter Resurrections Villain

May 21, 2025

Analyzing Fan Response To Dexter Resurrections Villain

May 21, 2025 -

Dexter Original Sin Steelbook Blu Ray Specs Release Date And Where To Buy

May 21, 2025

Dexter Original Sin Steelbook Blu Ray Specs Release Date And Where To Buy

May 21, 2025 -

Gumball Moves To Hulu And Disney What To Expect

May 21, 2025

Gumball Moves To Hulu And Disney What To Expect

May 21, 2025 -

Original Sin Season 1 A Re Evaluation Of Dexters Debra Morgan Arc

May 21, 2025

Original Sin Season 1 A Re Evaluation Of Dexters Debra Morgan Arc

May 21, 2025