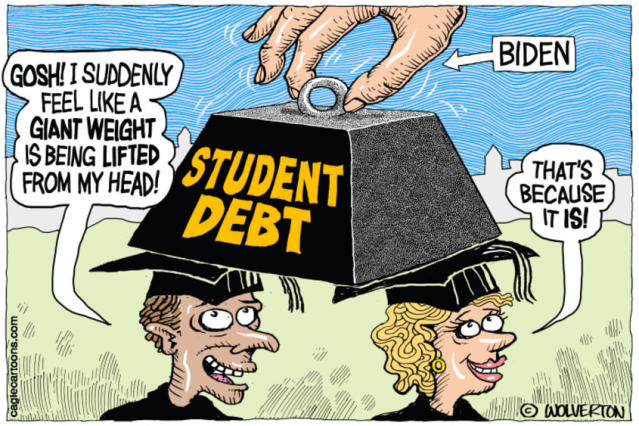

Buying A House With Student Loan Debt: Is It Possible?

Table of Contents

Assessing Your Financial Situation

Before even thinking about browsing houses, a thorough assessment of your financial situation is crucial. This involves understanding your debt-to-income ratio, analyzing your credit score, and creating a realistic budget that accommodates both your student loan payments and homeownership aspirations.

Understanding Your Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) is a crucial factor lenders consider when evaluating your mortgage application. It represents the percentage of your gross monthly income that goes towards debt repayment. Student loan payments significantly impact your DTI. A high DTI can make it harder to qualify for a mortgage.

- Calculating DTI: Add up all your monthly debt payments (including student loans, credit cards, car loans, etc.) and divide by your gross monthly income.

- Ideal DTI for Mortgage Approval: Lenders generally prefer a DTI below 43%, but some may accept higher ratios depending on other factors.

- Strategies to Lower DTI:

- Aggressively pay down high-interest debt.

- Increase your income through a raise, side hustle, or a higher-paying job.

- Explore options for student loan refinancing to lower your monthly payments.

Analyzing Your Credit Score

Your credit score is another critical factor influencing mortgage approval. A higher credit score signifies lower risk to lenders, leading to better interest rates and increased approval chances. Your student loan repayment history directly impacts your credit score. Consistent on-time payments improve your score; late payments can severely damage it.

- Steps to Improve Credit Score: Pay bills on time, keep credit utilization low, maintain a mix of credit accounts, and monitor your credit reports regularly.

- Resources for Checking Credit Reports: You can obtain your free credit reports annually from AnnualCreditReport.com.

- Impact of Late Payments: Late payments can significantly lower your credit score, impacting your chances of getting approved for a mortgage.

Creating a Realistic Budget

Creating a detailed budget is paramount. This should include all your expenses, such as rent, utilities, food, transportation, student loan payments, and entertainment. This will help you determine how much you can realistically afford to spend on a mortgage.

- Budgeting Tools and Apps: Numerous budgeting apps (Mint, YNAB, Personal Capital) can help you track your spending and create a comprehensive budget.

- Strategies for Saving Money: Identify areas where you can cut back on expenses to accelerate your savings for a down payment.

- Prioritizing Expenses: Focus on essential expenses and strategically reduce discretionary spending.

Exploring Mortgage Options

Once you have a clear understanding of your financial situation, it's time to explore different mortgage options. Two common types are conventional loans and FHA loans.

Conventional Loans vs. FHA Loans

Conventional loans are offered by private lenders and usually require a higher credit score and a larger down payment. FHA loans are insured by the Federal Housing Administration, making them more accessible to borrowers with lower credit scores and smaller down payments. This can be particularly advantageous for those managing student loan debt.

- Conventional Loans: Generally require a higher credit score (typically 620 or above), and down payments can range from 3% to 20%.

- FHA Loans: More lenient credit score requirements (often as low as 500), and require a smaller down payment (as low as 3.5%).

- Advantages and Disadvantages: Weigh the pros and cons of each loan type based on your individual financial circumstances.

Government Assistance Programs

Several government programs can assist borrowers with student loan debt in achieving homeownership. Research programs available in your area to see if you qualify.

- Eligibility Requirements: Each program has specific eligibility requirements regarding income, credit score, and the type of loan.

- Application Processes: The application processes can vary widely between programs.

- Benefits of Such Programs: These programs can offer lower interest rates, down payment assistance, or other financial incentives.

Strategies for Success

Buying a house with student loan debt requires a proactive approach. Here are some strategies that can significantly increase your chances of success.

Aggressive Student Loan Repayment

Before applying for a mortgage, consider aggressively paying down your student loan debt. This can improve your DTI and credit score, making you a more attractive borrower.

- Different Repayment Plans: Explore different repayment plans (standard, graduated, income-driven) to find the best option for your financial situation.

- Benefits and Drawbacks of Each: Carefully weigh the benefits and drawbacks of each plan before choosing one.

- Exploring Refinancing Options: Refinancing your student loans might lower your interest rate and monthly payments, freeing up more money for a down payment.

Saving for a Larger Down Payment

Saving a larger down payment is crucial. A larger down payment reduces your loan amount, leading to lower monthly mortgage payments and improving your chances of mortgage approval.

- Practical Saving Strategies: Implement strict budgeting, cut unnecessary expenses, and explore additional income streams.

- Setting Realistic Financial Goals: Set realistic saving goals and track your progress regularly.

Seeking Professional Advice

Seeking professional advice from financial advisors and mortgage brokers is highly recommended. They can provide personalized guidance tailored to your specific situation.

- The Value of Personalized Financial Guidance: Financial advisors can help you create a comprehensive financial plan, addressing your student loan debt and homeownership goals.

- Finding Reputable Professionals: Thoroughly research and verify the credentials of any financial advisor or mortgage broker you consider.

Conclusion

Buying a house with student loan debt is challenging but entirely achievable. By carefully assessing your financial situation, exploring different mortgage options, and implementing strategic repayment plans and saving strategies, you can significantly increase your chances of success. Remember that seeking professional guidance is invaluable throughout this process. Start planning your homeownership journey today, even with student loans! Use the strategies outlined above to successfully buy a house while managing your student loan debt! Utilize online mortgage calculators and financial planning tools to estimate your affordability and create a personalized plan for buying a house with student loan debt.

Featured Posts

-

Angel Reeses Ss 25 Reebok Collection A Closer Look

May 17, 2025

Angel Reeses Ss 25 Reebok Collection A Closer Look

May 17, 2025 -

Tuerkiye Nin Subat 2024 Doenemi Uluslararasi Yatirim Pozisyonu Analiz Ve Yorumlar

May 17, 2025

Tuerkiye Nin Subat 2024 Doenemi Uluslararasi Yatirim Pozisyonu Analiz Ve Yorumlar

May 17, 2025 -

Seattle Mariners And Oakland Athletics Injury Report March 27 30

May 17, 2025

Seattle Mariners And Oakland Athletics Injury Report March 27 30

May 17, 2025 -

China Market Headwinds Challenges Facing Bmw Porsche And Competitors

May 17, 2025

China Market Headwinds Challenges Facing Bmw Porsche And Competitors

May 17, 2025 -

Tom Thibodeau How Fixing Old Flaws Saved The Knicks From Disaster

May 17, 2025

Tom Thibodeau How Fixing Old Flaws Saved The Knicks From Disaster

May 17, 2025

Latest Posts

-

Donald Trumps Family Welcoming Baby Alexander Boulos

May 17, 2025

Donald Trumps Family Welcoming Baby Alexander Boulos

May 17, 2025 -

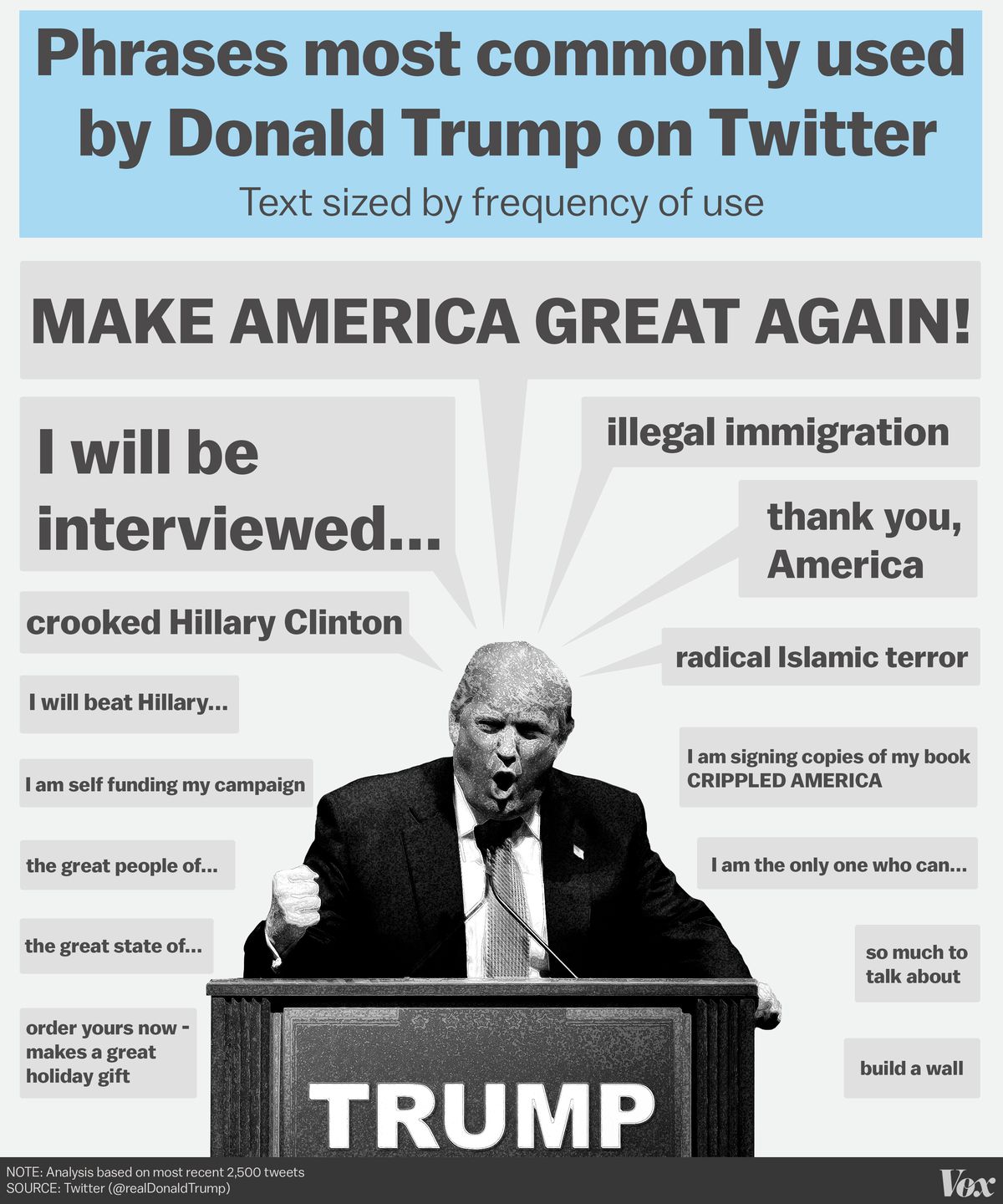

Donald Trump And The Politics Of Scandal Analyzing The Impact Of Multiple Affairs And Sexual Misconduct Claims

May 17, 2025

Donald Trump And The Politics Of Scandal Analyzing The Impact Of Multiple Affairs And Sexual Misconduct Claims

May 17, 2025 -

Tiffany Trump And Michael Boulos Welcome First Child Expanding The Trump Family Tree

May 17, 2025

Tiffany Trump And Michael Boulos Welcome First Child Expanding The Trump Family Tree

May 17, 2025 -

The 2016 Election Did Allegations Of Multiple Affairs And Sexual Misconduct Affect Donald Trumps Victory

May 17, 2025

The 2016 Election Did Allegations Of Multiple Affairs And Sexual Misconduct Affect Donald Trumps Victory

May 17, 2025 -

Donald Trumps Family Grows Tiffany And Michaels Son Alexander

May 17, 2025

Donald Trumps Family Grows Tiffany And Michaels Son Alexander

May 17, 2025