CAC 40 Market Update: Mixed Results For The Week Ending March 7, 2025

Table of Contents

Sector-Specific Performance Analysis

The week ending March 7, 2025, revealed a divergence in performance across various sectors within the CAC 40.

Technology Sector's Fluctuations

The technology sector displayed significant volatility. While some tech giants like Capgemini experienced moderate growth fueled by strong Q1 earnings reports, others, such as Worldline, faced minor dips attributed to concerns regarding regulatory changes in the European Union impacting data privacy. This resulted in mixed results for CAC 40 tech stocks, highlighting the sensitivity of the French tech market to both internal and external pressures.

- Capgemini: Experienced a 3% increase, driven by strong Q1 earnings.

- Worldline: Saw a 1% decrease, influenced by EU data privacy regulations.

- Key takeaway: The technology sector performance within the CAC 40 reflects the broader global tech landscape's susceptibility to regulatory shifts and evolving market trends.

Energy Sector's Steady Growth

The CAC 40 energy stocks demonstrated a relatively steady growth trajectory throughout the week. Companies like TotalEnergies benefited from sustained high global oil prices, driven by increased energy demand and geopolitical uncertainties. This positive trend suggests a robust energy sector outlook for the near future.

- TotalEnergies: Showed a consistent 2% increase, mirroring the global rise in oil prices.

- Engie: Experienced a modest 1% growth due to increased demand for renewable energy sources.

- Key takeaway: The energy sector’s stability underscores its resilience amidst global economic fluctuations and reinforces the importance of energy security in the current geopolitical climate. The impact of oil prices remains a significant driver of performance within this sector.

Financial Services' Mixed Results

The financial services sector presented mixed results, with CAC 40 banking stocks showing a somewhat subdued performance. While BNP Paribas and Société Générale experienced slight gains due to rising interest rates, the overall sector was impacted by concerns over a potential slowdown in economic growth. This highlights the sensitivity of the sector to broader interest rate impact and overall economic outlook.

- BNP Paribas: Registered a 0.5% increase, benefiting from rising interest rates.

- Société Générale: Showed a similar 0.5% increase, aligned with BNP Paribas' performance.

- Key takeaway: The financial services sector’s performance mirrors the broader macroeconomic environment and reflects the ongoing interplay between interest rate adjustments and economic growth projections.

Macroeconomic Factors Influencing the CAC 40

Several macroeconomic factors significantly influenced the CAC 40's performance during the observed week.

Inflation and Interest Rates

Inflation impact CAC 40 was evident this week. The persistently high inflation figures across Europe, coupled with the European Central Bank's (ECB) continued interest rate hikes, created uncertainty among investors. The ECB monetary policy, aimed at curbing inflation, inevitably impacts borrowing costs and investment decisions, thus affecting the CAC 40’s trajectory. The current inflation figures reflect ongoing economic challenges across the Eurozone and continue to be a key factor influencing investor sentiment. Analyzing interest rates France is crucial for understanding their impact on the French stock market.

Geopolitical Events and Their Influence

Geopolitical risks CAC 40 are significant. The ongoing geopolitical tensions in Eastern Europe and the uncertainty surrounding global trade agreements contributed to a degree of market uncertainty. Any escalation of these global market uncertainty factors could negatively influence investor confidence and impact the CAC 40's performance. Understanding the impact of specific international crises and international trade impact is essential for interpreting market movements.

Key Takeaways and Predictions for the CAC 40

The week ending March 7, 2025, revealed a mixed bag for the CAC 40. While certain sectors, such as energy, showed promising growth, others, like technology and financial services, experienced fluctuations influenced by macroeconomic factors and global events. The interplay between inflation, interest rates, and geopolitical uncertainty continues to shape the CAC 40 forecast. Based on current trends, a cautious approach to investment is advisable. The market's future direction hinges upon the resolution of these macroeconomic challenges and developments within specific sectors. Further market predictions will depend on future data releases and global events. Developing a sound investment strategy requires careful consideration of these factors.

Conclusion: Understanding the CAC 40 Market Update

This CAC 40 Market Update highlights the mixed results observed in the CAC 40 during the week ending March 7, 2025. The performance was largely driven by sector-specific trends, coupled with the influence of inflation, interest rates, and ongoing geopolitical uncertainties. Understanding these factors is crucial for making informed investment decisions. Stay tuned for our next CAC 40 market update to continue monitoring the performance of this vital index, providing you with ongoing CAC 40 analysis and keeping you abreast of developments in the French stock market update.

Featured Posts

-

Severe Delays On M56 Near Cheshire Deeside Border After Accident

May 25, 2025

Severe Delays On M56 Near Cheshire Deeside Border After Accident

May 25, 2025 -

The 10 Fastest Ferrari Production Models At Fiorano

May 25, 2025

The 10 Fastest Ferrari Production Models At Fiorano

May 25, 2025 -

Philips Announces 2025 Annual General Meeting Of Shareholders Agenda

May 25, 2025

Philips Announces 2025 Annual General Meeting Of Shareholders Agenda

May 25, 2025 -

Musk In Vetta La Nuova Classifica Forbes Degli Uomini Piu Ricchi Del Mondo 2025

May 25, 2025

Musk In Vetta La Nuova Classifica Forbes Degli Uomini Piu Ricchi Del Mondo 2025

May 25, 2025 -

Aktienmarkt Frankfurt Dax Entwicklung Und Futures Verfall Am 21 Maerz 2025

May 25, 2025

Aktienmarkt Frankfurt Dax Entwicklung Und Futures Verfall Am 21 Maerz 2025

May 25, 2025

Latest Posts

-

Dylan Farrows Allegations Sean Penns Skepticism

May 25, 2025

Dylan Farrows Allegations Sean Penns Skepticism

May 25, 2025 -

Sean Penn Questions Woody Allens Alleged Sexual Abuse Of Dylan Farrow

May 25, 2025

Sean Penn Questions Woody Allens Alleged Sexual Abuse Of Dylan Farrow

May 25, 2025 -

Sean Penn Casts Doubt On Woody Allens Alleged Abuse Of Dylan Farrow

May 25, 2025

Sean Penn Casts Doubt On Woody Allens Alleged Abuse Of Dylan Farrow

May 25, 2025 -

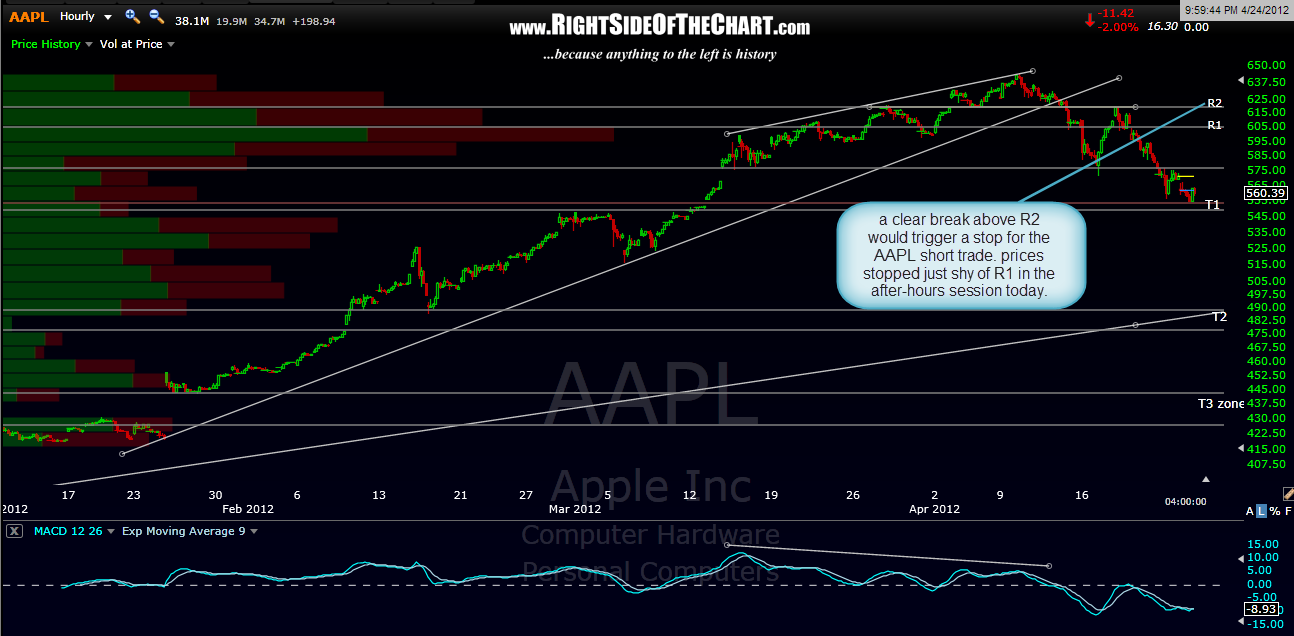

Investing In Apple Aapl Navigating Crucial Price Levels

May 25, 2025

Investing In Apple Aapl Navigating Crucial Price Levels

May 25, 2025 -

Understanding Key Price Levels For Apple Stock Aapl Investors

May 25, 2025

Understanding Key Price Levels For Apple Stock Aapl Investors

May 25, 2025