Can Palantir Reach A Trillion-Dollar Valuation By 2030?

Table of Contents

Palantir's Growth Trajectory and Market Potential

Analyzing Past Performance and Future Projections

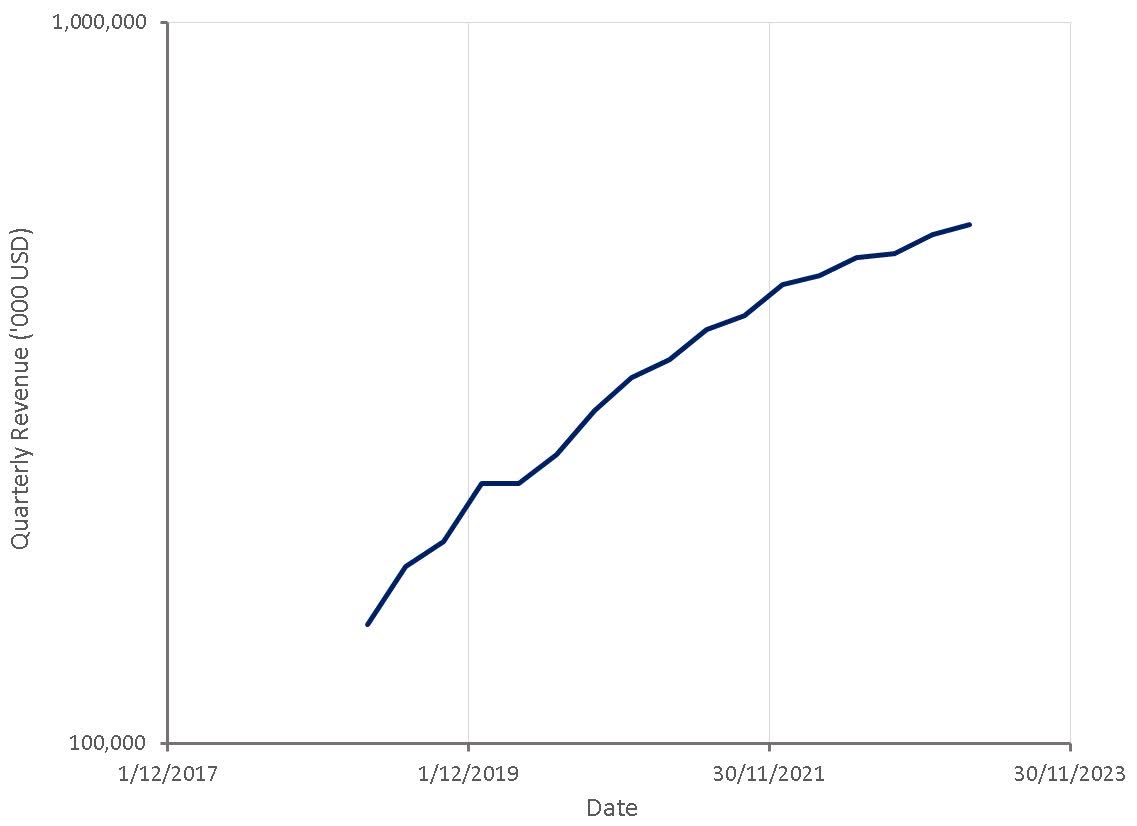

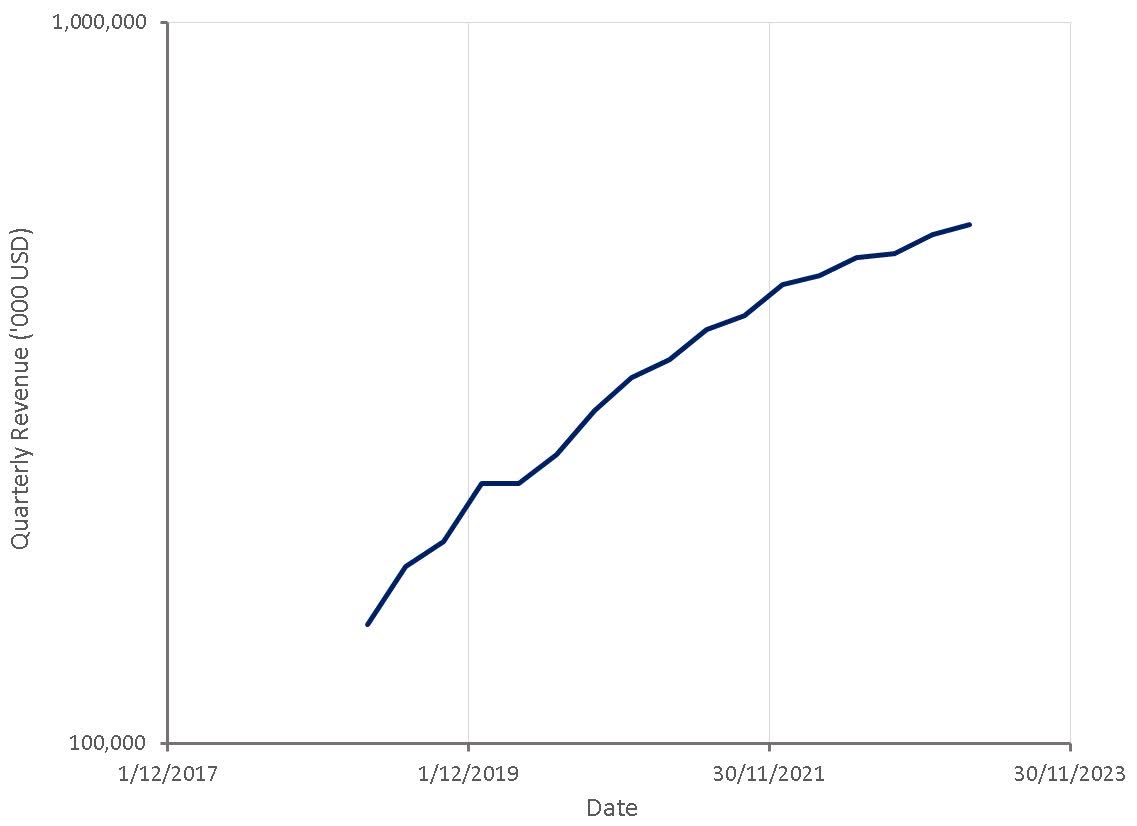

Palantir's revenue growth has been impressive in recent years, showcasing its ability to secure lucrative contracts in both the government and commercial sectors. Analyzing Palantir revenue figures reveals a consistent upward trend, although growth rates have fluctuated. Comparing these rates to industry benchmarks is crucial to assessing its performance relative to competitors. For example, while specific financial data requires accessing official reports and financial news sources, we can observe that consistent year-on-year growth, coupled with expanding client bases, suggests a positive outlook for Palantir stock. Projecting future Palantir growth requires careful consideration of current market trends, the competitive landscape, and the successful execution of its strategic initiatives. Analyzing past performance in conjunction with realistic market forecasts allows for a more informed projection.

- Past Performance: Analyze publicly available financial reports to extract key data points.

- Future Projections: Use established financial modeling techniques and consider market growth predictions.

- Key Metrics: Track Palantir revenue, earnings, and customer acquisition costs to gauge growth and profitability.

Expanding Market Share in Government and Commercial Sectors

Palantir operates primarily within two key market segments: government and commercial. The government sector, particularly in national security and intelligence, has historically been a significant driver of Palantir government contracts. However, the company's Palantir commercial clients are rapidly expanding, encompassing various industries such as finance, healthcare, and energy. The potential for growth within both sectors is substantial. While companies like AWS and Microsoft Azure present significant competition in the data analytics market, Palantir’s focus on highly secure, tailored solutions gives it a competitive edge. Further expansion into emerging markets and leveraging strategic partnerships can significantly boost its market share.

- Government Sector: Focus on securing large-scale contracts with government agencies and expanding existing relationships.

- Commercial Sector: Target key industries with tailored solutions, leveraging the scalability and flexibility of its platform.

- Competitive Advantage: Highlight Palantir's specialization in high-security data analytics and its strong relationships with key decision-makers.

The Role of Innovation and Technological Advancements

Palantir's commitment to research and development is central to its long-term growth strategy. Ongoing investments in Palantir AI and Palantir machine learning capabilities are transforming its data integration platform, enabling the development of more sophisticated and powerful analytical tools. The integration of advanced technologies positions Palantir to capitalize on emerging trends and maintain a technological edge. The ability to adapt and integrate new technologies quickly is critical in this rapidly evolving landscape.

- AI and Machine Learning: Continuous investment and integration of these technologies enhance data analysis capabilities and expand market opportunities.

- New Product Development: Introduction of new features and modules to existing platforms expands functionality and attracts new clients.

- Technological Edge: Maintaining a leading-edge technological position ensures Palantir remains competitive and attractive to both government and commercial clients.

Challenges and Risks to Reaching a Trillion-Dollar Valuation

Competition and Market Saturation

The data analytics market is highly competitive. Key Palantir competitors include established tech giants like Microsoft, Amazon, and Google, each possessing substantial resources and market presence. Increased competition and potential market share analysis reveals the need for Palantir to maintain its innovative edge and expand into new market segments to mitigate risks. The threat of data analytics competition intensifying necessitates continuous investment in innovation and strategic partnerships.

Economic and Geopolitical Factors

Global economic conditions significantly impact Palantir's growth. Economic downturns can lead to reduced government spending and cautious commercial investment, impacting Palantir global expansion plans. Geopolitical instability and regulatory changes in various regions also pose risks. Successful Palantir global expansion requires navigating complex political landscapes and adapting to shifting regulatory environments.

Financial Sustainability and Profitability

Achieving a trillion-dollar valuation requires consistent Palantir profitability and financial sustainability. Analyzing Palantir financial performance metrics, including revenue growth, operating margins, and cash flow, is crucial in determining its ability to sustain its ambitious growth trajectory. Excessive debt or financial instability could severely hamper its ability to achieve its long-term goals. Careful management of financial resources and effective investment strategies are essential for long-term stability.

Conclusion: Palantir's Trillion-Dollar Trajectory: A Realistic Goal?

Whether Palantir can reach a trillion-dollar valuation by 2030 is a complex question. While its strong growth trajectory, significant market potential, and commitment to technological innovation present compelling arguments in favor of this ambitious goal, significant challenges related to competition, economic uncertainty, and geopolitical factors remain. A balanced assessment considering both the opportunities and risks is necessary. Further research into Palantir stock analysis, coupled with an understanding of its competitive landscape and financial performance, is crucial for informed decision-making regarding investing in Palantir. We encourage you to conduct your own in-depth research and share your thoughts on Palantir's future prospects in the comments below. Do you believe Palantir can achieve this ambitious valuation?

Featured Posts

-

Formacioni Me I Mire I Gjysmefinaleve Te Liges Se Kampioneve Dominimi I Psg Se

May 09, 2025

Formacioni Me I Mire I Gjysmefinaleve Te Liges Se Kampioneve Dominimi I Psg Se

May 09, 2025 -

Golden Knights Win Adin Hills Stellar Performance Shutouts Columbus

May 09, 2025

Golden Knights Win Adin Hills Stellar Performance Shutouts Columbus

May 09, 2025 -

Changes To Uk Student Visas Impact On Pakistani Students And Asylum Claims

May 09, 2025

Changes To Uk Student Visas Impact On Pakistani Students And Asylum Claims

May 09, 2025 -

Palantir Technologies Stock Buy Sell Or Hold

May 09, 2025

Palantir Technologies Stock Buy Sell Or Hold

May 09, 2025 -

Bitcoin Market Rebound Opportunities And Risks For Investors

May 09, 2025

Bitcoin Market Rebound Opportunities And Risks For Investors

May 09, 2025