Canada's 2025 Economic Growth: OECD Prediction Of Stagnation, No Recession

Table of Contents

OECD's Prediction: Slow Growth, No Recession

The OECD projects a modest growth rate for the Canadian economy in 2025, significantly lower than previous years. While not predicting a recession, the forecast points towards a period of economic stagnation characterized by sluggish expansion. This prediction is a result of a complex interplay of global and domestic factors.

-

Global inflation impact on Canadian growth: Elevated global inflation continues to exert pressure on the Canadian economy, impacting consumer spending and investment decisions. The rising cost of goods and services reduces purchasing power, dampening overall economic activity.

-

Interest rate effects on investment and consumer spending: The Bank of Canada's interest rate hikes, aimed at curbing inflation, have a direct impact on borrowing costs for businesses and consumers. Higher interest rates discourage investment and reduce consumer spending, contributing to slower growth.

-

Impact of geopolitical instability on the Canadian economy: Geopolitical events, such as the ongoing war in Ukraine and increasing global tensions, create uncertainty in international markets. This uncertainty can negatively affect trade, investment flows, and overall economic confidence in Canada.

-

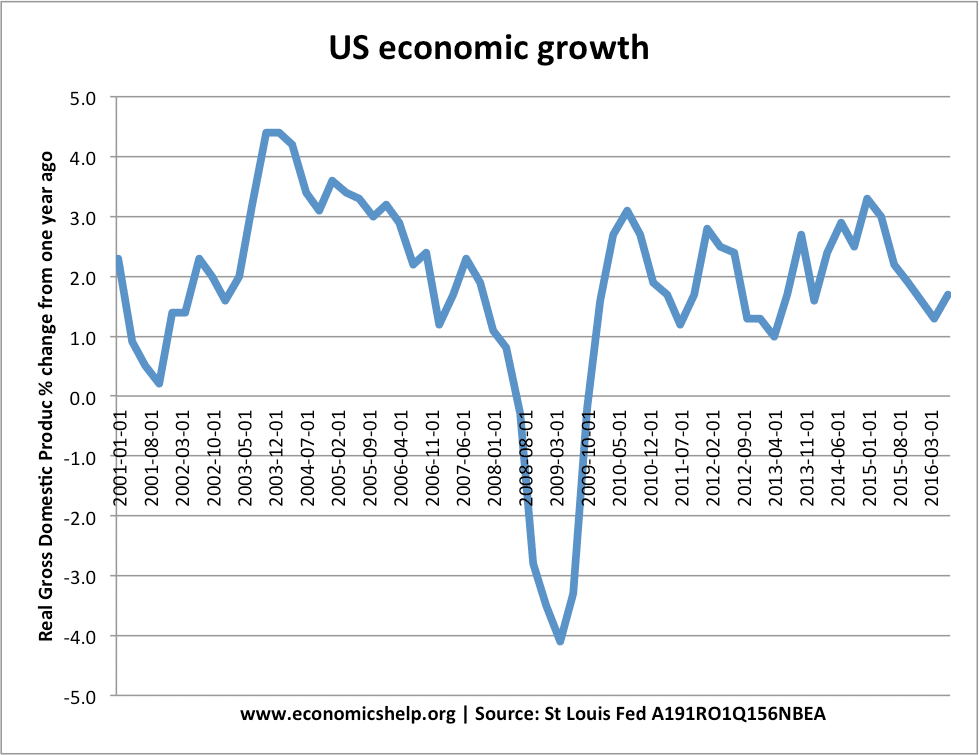

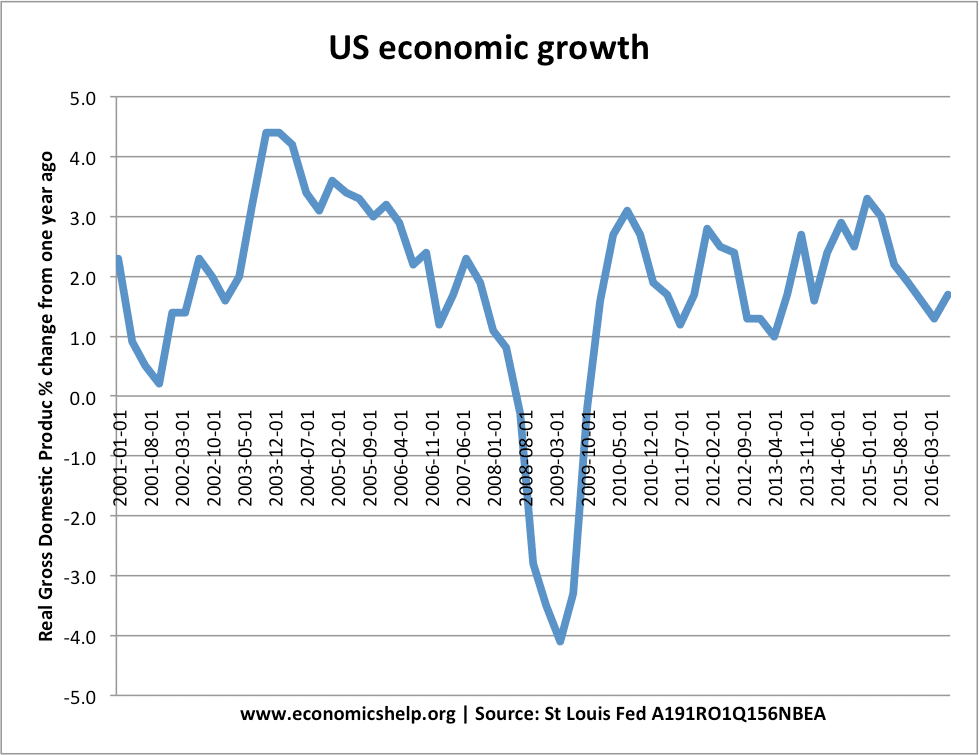

Comparison to previous years' growth rates: The projected growth rate for 2025 represents a considerable slowdown compared to previous years' performance, highlighting the challenging economic environment. A detailed comparison with past growth figures will further illustrate this slowdown.

Key Sectors Driving (or Hindering) Growth

The Canadian economy is diverse, and the projected stagnation won't impact all sectors equally. Some sectors are expected to perform relatively well, while others face significant challenges.

-

Analysis of the resource sector's contribution to GDP: The resource sector, particularly energy and mining, is expected to contribute positively to GDP growth. However, global demand fluctuations and price volatility remain significant risks.

-

Technological advancements and their effect on economic growth: The technology sector, including software development and artificial intelligence, is likely to experience continued growth, driving innovation and contributing to productivity gains.

-

Challenges faced by the housing market and its ripple effects: The Canadian housing market, after a period of significant growth, is now facing challenges due to higher interest rates and tighter lending conditions. This slowdown has broad ripple effects on the economy, affecting related industries like construction and real estate.

-

The role of government policies in supporting or hindering specific sectors: Government policies, including fiscal and monetary measures, play a crucial role in shaping the performance of different sectors. Targeted support programs for specific industries can help mitigate challenges and stimulate growth.

Potential Risks and Uncertainties

The OECD's prediction, while valuable, is subject to various uncertainties and potential risks.

-

Sensitivity analysis of the OECD's prediction to various factors: A sensitivity analysis reveals the extent to which the prediction is vulnerable to changes in key variables like global economic conditions, inflation rates, and geopolitical developments.

-

Discussion on potential downside risks to the Canadian economy: A deeper recession, more persistent inflation, or unforeseen geopolitical crises could significantly worsen the outlook, potentially leading to a more severe economic downturn than currently anticipated.

-

Exploration of possible scenarios and their impact on growth: Different scenarios need to be considered, ranging from optimistic to pessimistic, to help businesses and investors prepare for various possibilities and develop robust strategies.

-

Mention of contingency planning for businesses and investors: Businesses and investors should actively develop contingency plans to mitigate the impact of potential negative scenarios on their operations and investments.

Government Policies and Their Impact

Government policies, both fiscal and monetary, have a substantial influence on the overall economic trajectory.

-

Review of current government spending and its effect on growth: Current government spending programs and their impact on stimulating economic activity need close examination. Are they effectively targeting growth sectors and mitigating economic vulnerabilities?

-

Analysis of the impact of monetary policy on interest rates and inflation: The Bank of Canada's monetary policy actions, including interest rate adjustments, need to be assessed in terms of their effectiveness in controlling inflation without significantly hindering economic growth.

-

Effectiveness of government support programs for businesses: The effectiveness of existing government support programs for businesses requires evaluation to determine their impact on job creation, investment, and overall economic resilience.

-

Potential future policy changes and their predicted outcomes: Analyzing potential future policy changes and their anticipated effects on economic growth is crucial for long-term planning and strategic decision-making.

Conclusion: Navigating Canada's 2025 Economic Landscape

The OECD's prediction for Canada's 2025 economic outlook suggests a period of economic stagnation without a recession. This outlook is shaped by a combination of global economic uncertainties, sector-specific challenges, and the impact of government policies. While the resource and technology sectors show potential for growth, the housing market and other sectors face headwinds. The prediction’s sensitivity to various factors necessitates cautious optimism and proactive adaptation. Businesses and investors need to develop strategies to navigate this slower growth environment. Understanding the nuances of the Canada 2025 economic outlook is critical for success. Learn more about the potential for economic stagnation in Canada and plan strategically for the challenges and opportunities ahead. Don't wait; prepare for Canada's 2025 economic landscape today.

Featured Posts

-

Hailee Steinfelds Professional Look On Good Morning America

May 28, 2025

Hailee Steinfelds Professional Look On Good Morning America

May 28, 2025 -

Ven Man Bi Mat Kho Bau 13 Trieu Usd Cuoc San Lung Kho Bau Cua Rau Den

May 28, 2025

Ven Man Bi Mat Kho Bau 13 Trieu Usd Cuoc San Lung Kho Bau Cua Rau Den

May 28, 2025 -

Exploring The Angel Margarita Hailee Steinfeld And Premium Beers Group

May 28, 2025

Exploring The Angel Margarita Hailee Steinfeld And Premium Beers Group

May 28, 2025 -

Haliburtons Current Injury Playing Status For Nets Vs Pacers Game

May 28, 2025

Haliburtons Current Injury Playing Status For Nets Vs Pacers Game

May 28, 2025 -

Analyzing Kyle Stowers Journaling Practices His Marlins Rise

May 28, 2025

Analyzing Kyle Stowers Journaling Practices His Marlins Rise

May 28, 2025

Latest Posts

-

Beware Fake Ticket Sellers Ticketmaster Issues Urgent Warning

May 30, 2025

Beware Fake Ticket Sellers Ticketmaster Issues Urgent Warning

May 30, 2025 -

Virtual Venue De Ticketmaster Asegurate De Tener La Mejor Vista

May 30, 2025

Virtual Venue De Ticketmaster Asegurate De Tener La Mejor Vista

May 30, 2025 -

Kawasaki Ninja Price Drop R45 000 Savings

May 30, 2025

Kawasaki Ninja Price Drop R45 000 Savings

May 30, 2025 -

Ticketmaster Issues Warning Avoid Fake Ticket Sellers And Protect Your Money

May 30, 2025

Ticketmaster Issues Warning Avoid Fake Ticket Sellers And Protect Your Money

May 30, 2025 -

Compra Inteligente Ticketmaster Lanza Vista Previa De Asientos Virtual Venue

May 30, 2025

Compra Inteligente Ticketmaster Lanza Vista Previa De Asientos Virtual Venue

May 30, 2025