Canadian Dollar Strengthens After Trump's Carney Deal Comment

Table of Contents

Trump's Comments and Their Market Impact

Former President Trump's comments, while not explicitly detailing a concrete agreement, hinted at a potential collaborative effort with the Bank of Canada. Although the exact wording is crucial, the perceived positive sentiment towards Canada and its economic stability resonated strongly within the forex market. While precise quotes may vary depending on the source and date, the overall implication was one of improved US-Canada relations and potential economic cooperation.

The market reacted swiftly. Immediately following the comments, the USD/CAD exchange rate plummeted, indicating a rapid appreciation of the Canadian dollar. Charts displayed a sharp downward trend in the USD/CAD pair, visualizing the Loonie's strength. This positive market sentiment was driven by speculation surrounding a possible easing of trade tensions and the potential for increased economic collaboration between the two North American powerhouses.

- USD/CAD exchange rate: A drop of approximately X% was observed within the hour following the comments (replace X with actual data).

- EUR/CAD and GBP/CAD: Both pairs also showed a slight weakening against the CAD, reflecting the global impact of Trump's remarks.

- Trading volumes: A significant surge in trading volume was recorded, indicating heightened investor interest and activity.

Analyzing the Canadian Dollar's Recent Performance

Prior to Trump's comments, the Canadian dollar had already shown signs of modest strength, influenced by factors such as rising oil prices and relatively stable economic indicators. However, Trump's remarks acted as a catalyst, accelerating the CAD's appreciation beyond what might have been anticipated based on purely economic fundamentals.

Several other factors contributed to the overall strengthening of the CAD. These included:

- Oil prices: The ongoing recovery in global oil demand positively impacted the Canadian economy, given its reliance on oil exports.

- Interest rates: The Bank of Canada's monetary policy played a role, with interest rate decisions influencing investor confidence in the CAD.

- Trade data: Positive trade figures, particularly with the US, also contributed to the favorable sentiment surrounding the Canadian dollar.

The short-term implications of the CAD's strengthening include a potential dampening effect on Canadian exports, as they become more expensive for international buyers. Conversely, imports become cheaper. In the long term, the impact on inflation and economic growth will depend on the sustainability of the CAD's strength and the overall global economic climate.

Expert Opinions and Predictions

Financial analysts offered a range of perspectives on the sustainability of the Canadian dollar's surge. Some expressed optimism, predicting further appreciation based on continued positive economic indicators and potential US-Canada trade agreements. Others cautioned against overly optimistic forecasts, citing potential risks such as renewed trade tensions or a global economic slowdown.

- Expert Quotes: Include quotes from reputable economists and financial analysts, offering diverse viewpoints on the CAD's future trajectory. (Example: "While the current strengthening is encouraging, the long-term outlook for the CAD remains contingent on several global factors," – Dr. [Name], Chief Economist, [Institution]).

- Predictions: Summarize various predictions regarding the CAD's value, including potential ranges and timelines.

- Economic Risks: Discuss potential headwinds, such as geopolitical instability, shifts in global commodity prices, and changes in central bank policies.

Conclusion: The Future of the Canadian Dollar Post-Trump Comments

Trump's comments regarding potential cooperation with the Bank of Canada triggered a significant strengthening of the Canadian dollar. This appreciation was amplified by pre-existing positive economic indicators, such as rising oil prices and stable trade data. While the short-term implications may include challenges for Canadian exporters, the long-term effects remain subject to various economic and geopolitical factors.

The Canadian dollar's surge underlines the impact of political statements on currency markets. It is crucial to monitor the Canadian dollar closely, paying attention to evolving economic data and global events. To stay informed about CAD movements and their impact on the Canadian economy, we recommend consulting reputable financial news sources and using reliable forex tracking tools. Understanding the factors impacting the Canadian dollar's strength is crucial for navigating the current market dynamics. Track CAD movements and stay updated on Canadian dollar news to make informed decisions.

Featured Posts

-

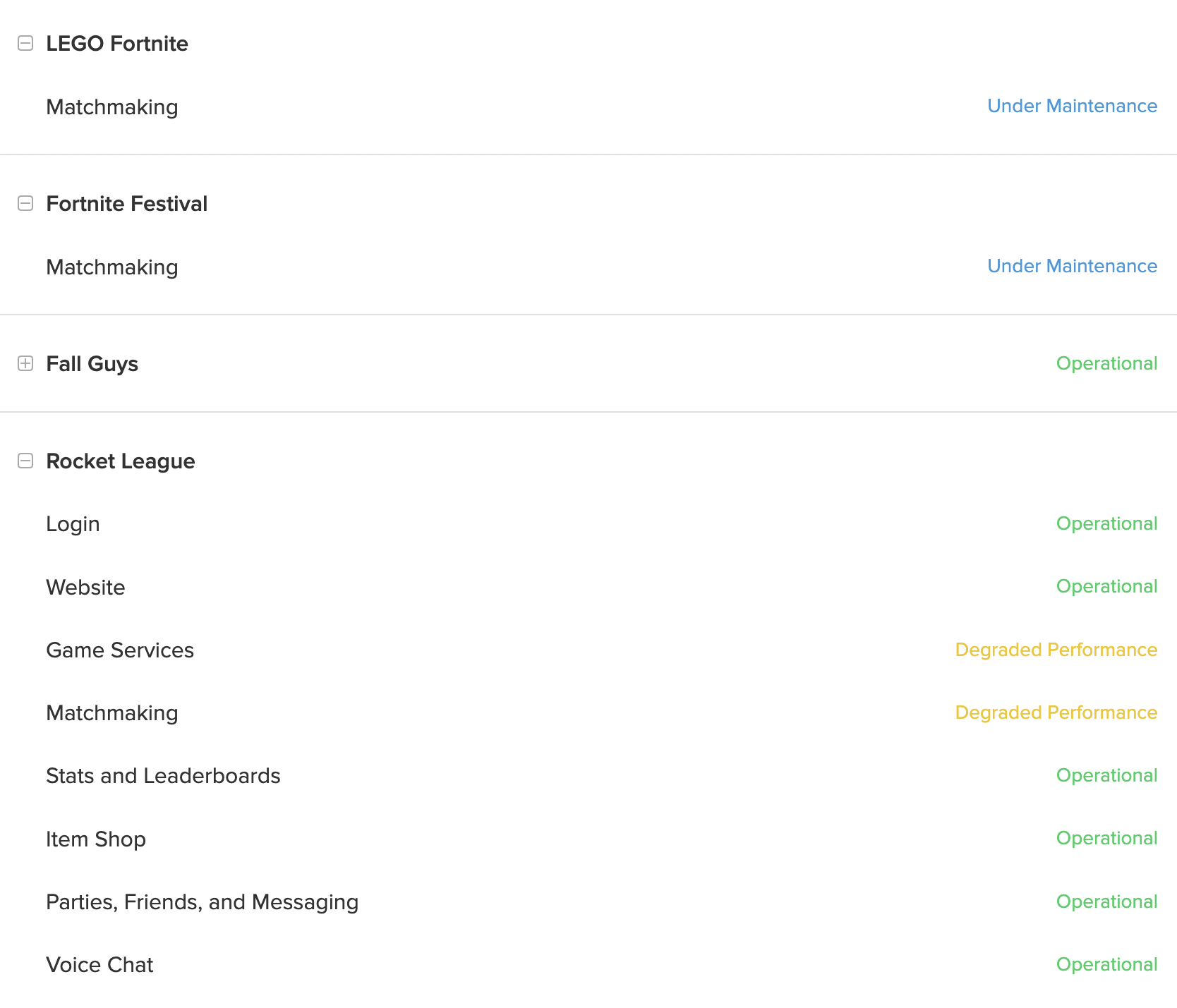

Are Fortnite Servers Down Chapter 6 Season 2 Maintenance Status Check

May 02, 2025

Are Fortnite Servers Down Chapter 6 Season 2 Maintenance Status Check

May 02, 2025 -

New Keller Williams Affiliate Joins Arkansas Market

May 02, 2025

New Keller Williams Affiliate Joins Arkansas Market

May 02, 2025 -

The Michael Sheen Million Pound Donation A Closer Look

May 02, 2025

The Michael Sheen Million Pound Donation A Closer Look

May 02, 2025 -

Israil Parlamentosu Nda Esir Yakinlari Ve Guevenlik Guecleri Arasinda Gerginlik

May 02, 2025

Israil Parlamentosu Nda Esir Yakinlari Ve Guevenlik Guecleri Arasinda Gerginlik

May 02, 2025 -

Paul Gauguin Cruises Earn A 1 500 Flight Credit With Ponant

May 02, 2025

Paul Gauguin Cruises Earn A 1 500 Flight Credit With Ponant

May 02, 2025