Canadian Homeownership: Navigating The High Down Payment Hurdle

Table of Contents

Understanding Down Payment Requirements in Canada

Before diving into strategies, it's crucial to understand the down payment landscape. The minimum down payment percentage in Canada varies depending on the purchase price of the home.

- Homes priced under $500,000: Require a minimum down payment of 5% on the first $500,000 and 10% on the portion above.

- Homes priced over $500,000: Require a minimum down payment of 5% on the first $500,000 and 10% on the portion above $500,000. For homes priced above $1 million, the down payment requirement increases to 20% of the portion exceeding $1 million.

The Canada Mortgage and Housing Corporation (CMHC) plays a significant role. CMHC insurance allows buyers with down payments less than 20% to secure a mortgage, but it comes with an insurance premium that increases the overall cost. First-time homebuyers often face different challenges and may qualify for certain government programs that alleviate the down payment burden, while repeat buyers may have different financial circumstances that influence their down payment capacity.

Bullet Points:

- Percentage Breakdown: 5% for the first $500,000 (for homes under $1 million), 10% for the portion above $500,000 (for homes under $1 million), 20% for the portion above $1 million.

- Cost of CMHC Insurance: Varies based on the down payment amount and the type of mortgage. Expect to pay a significant premium.

- Government Programs: The First-Time Home Buyers' Incentive is one example offering assistance to qualifying first-time homebuyers.

Strategies for Saving for a Down Payment

Saving for a down payment requires discipline and a well-defined plan. Here are some practical strategies:

- Budgeting: Create a detailed budget, meticulously tracking income and expenses. Identify areas where you can cut back.

- Cutting Expenses: Analyze your spending habits. Identify and eliminate unnecessary expenses such as subscriptions, eating out, or entertainment.

- Debt Reduction: Prioritize paying down high-interest debt (credit cards, lines of credit) before focusing solely on saving for a down payment. High debt can negatively affect your credit score and mortgage approval.

- Setting Realistic Goals: Set achievable savings goals and timelines. Break down the large goal into smaller, manageable milestones to stay motivated.

Saving Vehicles: Consider using high-interest savings accounts, Tax-Free Savings Accounts (TFSAs), or Registered Retirement Savings Plans (RRSPs) for your savings, depending on your individual financial situation and tax implications.

Bullet Points:

- Sample Budget Template: Use budgeting apps or create a spreadsheet to track income and expenses.

- Cutting Unnecessary Expenses: Cancel unused subscriptions, cook at home more often, limit entertainment spending.

- Pros and Cons of Savings Vehicles: Research the tax advantages and disadvantages of each saving option before making a decision.

Alternative Financing Options for a Down Payment

Saving the entire down payment can be challenging. Here are some alternatives:

- Family Assistance: Loans or gifts from family members can provide a significant boost. Remember to discuss the tax implications thoroughly.

- CMHC Insured Mortgages: Utilize CMHC insurance to access a mortgage with a smaller down payment, keeping in mind the associated premiums.

- Government Programs: Explore government-backed programs like the First-Time Home Buyers' Incentive, which may help reduce the required down payment.

Bullet Points:

- Requirements for Family Assistance: Formalize agreements in writing and consider legal advice.

- Types of CMHC Insured Mortgages: Understand the different options and choose the one that suits your circumstances.

- Eligibility Criteria for Government Programs: Review the specific requirements for each program to determine if you qualify.

Improving Your Credit Score for Better Mortgage Rates

A good credit score is crucial for obtaining favorable mortgage rates. Lenders assess your creditworthiness based on your score, impacting the interest rate you'll receive. Here’s how to improve your score:

- Pay Bills On Time: Consistent on-time payments are vital.

- Reduce Credit Card Debt: Keep credit utilization low (ideally below 30%).

- Monitor Credit Reports: Regularly check for errors and address them promptly.

Bullet Points:

- Factors Affecting Credit Scores: Payment history, amounts owed, length of credit history, new credit, and credit mix.

- Disputing Credit Report Errors: Contact the credit bureaus directly to challenge inaccuracies.

- Resources for Monitoring Credit Scores: Utilize free credit monitoring services or paid services for more in-depth analysis.

Achieving Canadian Homeownership: Overcoming the Down Payment Challenge

Securing Canadian homeownership requires careful planning, diligent saving, and a proactive approach to financing. By implementing the strategies discussed – budgeting effectively, exploring alternative financing options, and maintaining a healthy credit score – you can significantly increase your chances of achieving your homeownership goals. Remember that while the down payment hurdle may seem daunting, it's surmountable with dedication and strategic planning.

Start your journey towards Canadian homeownership today by implementing these strategies! Don't let the high down payment in Canada discourage you – with the right approach, your dream of owning a home can become a reality.

Featured Posts

-

Family Devastated Unprovoked Racist Murder Leaves Loved Ones Grieving

May 10, 2025

Family Devastated Unprovoked Racist Murder Leaves Loved Ones Grieving

May 10, 2025 -

Bangkok Post Reports Surge In Advocacy For Transgender Equality

May 10, 2025

Bangkok Post Reports Surge In Advocacy For Transgender Equality

May 10, 2025 -

Bondi Under Fire Senate Democrats Allege Hidden Epstein Documents

May 10, 2025

Bondi Under Fire Senate Democrats Allege Hidden Epstein Documents

May 10, 2025 -

Young Thugs Uy Scuti Album Release Date Teased

May 10, 2025

Young Thugs Uy Scuti Album Release Date Teased

May 10, 2025 -

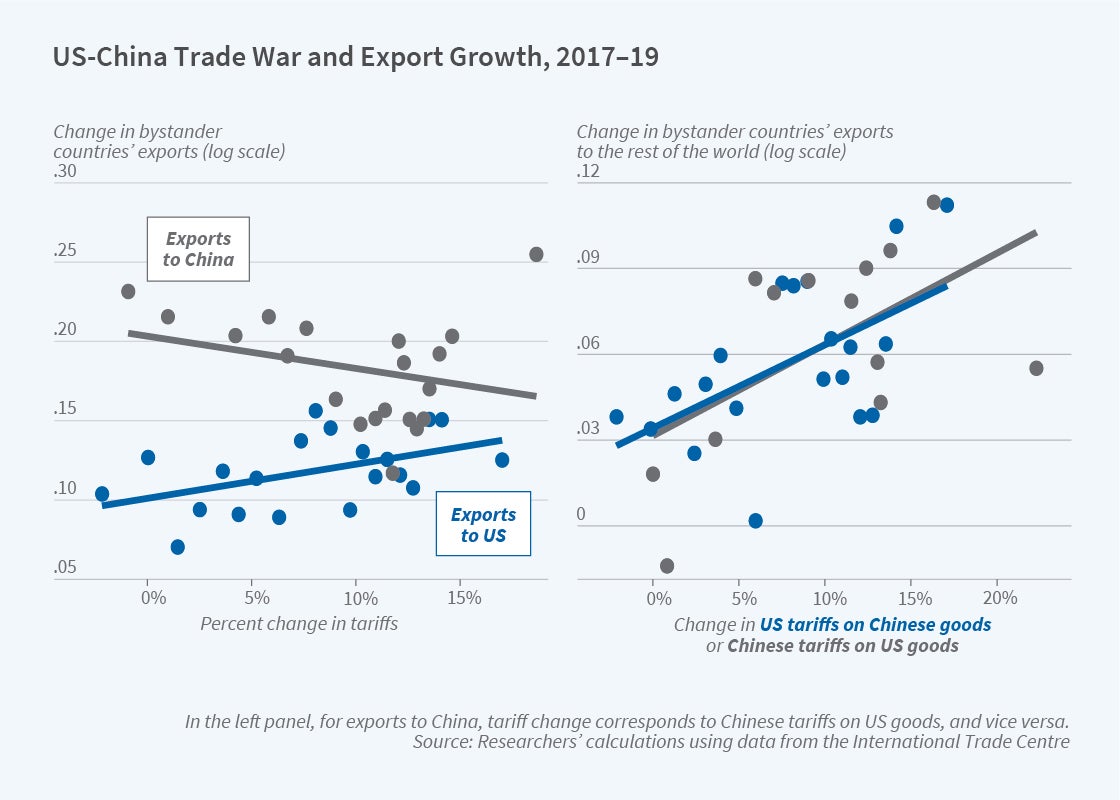

Chinese Goods And The Trade War The Impact On Bubble Blasters And Beyond

May 10, 2025

Chinese Goods And The Trade War The Impact On Bubble Blasters And Beyond

May 10, 2025

Latest Posts

-

Short And Sweet A Top Stephen King Show You Can Stream In Under 5 Hours

May 10, 2025

Short And Sweet A Top Stephen King Show You Can Stream In Under 5 Hours

May 10, 2025 -

5 Hour Stephen King Binge The Perfect Short Series For Streaming

May 10, 2025

5 Hour Stephen King Binge The Perfect Short Series For Streaming

May 10, 2025 -

Golden Knights Beat Blue Jackets Hills 27 Saves Key To Victory

May 10, 2025

Golden Knights Beat Blue Jackets Hills 27 Saves Key To Victory

May 10, 2025 -

Stephen Kings Best Short Tv Series A Binge Worthy 5 Hour Watch

May 10, 2025

Stephen Kings Best Short Tv Series A Binge Worthy 5 Hour Watch

May 10, 2025 -

Hills Stellar Goaltending Propels Golden Knights To 4 0 Win Over Blue Jackets

May 10, 2025

Hills Stellar Goaltending Propels Golden Knights To 4 0 Win Over Blue Jackets

May 10, 2025