Chart Analysis: Bitcoin's Path To A 10x Price Increase

Table of Contents

Bitcoin has captivated investors for years, and the dream of a 10x price increase remains a tantalizing possibility. But is it realistic? This detailed chart analysis explores the potential pathways leading to a 10x Bitcoin price surge, examining key indicators, historical trends, and market forces influencing this volatile cryptocurrency. We'll delve into crucial factors that could propel Bitcoin towards this ambitious target, offering insights into Bitcoin price prediction and the potential for a 10x Bitcoin return.

Historical Bitcoin Price Trends and Patterns

Analyzing previous bull and bear cycles reveals recurring patterns crucial for Bitcoin price prediction. Understanding these historical trends helps assess the likelihood of a 10x Bitcoin price increase.

-

Examining Percentage Increases: Previous bull runs have shown exponential growth. The 2017 bull run saw a price increase of over 1,000%, while the 2021 bull run saw significant gains, although not reaching the same percentage increase. Analyzing these past percentages offers insight into potential future growth trajectories. [Insert relevant chart visualizing percentage increases during past bull runs].

-

Identifying Support and Resistance Levels: Historical data identifies key price levels acting as support (where buying pressure outweighs selling) and resistance (where selling pressure outweighs buying). Identifying these levels is critical for understanding potential price reversals and targets. [Insert chart illustrating key support and resistance levels from past cycles].

-

Timeframes Involved: Past bull runs have lasted several months to even years. Understanding the timeframe of past cycles is crucial for realistic Bitcoin price prediction. [Insert chart showing duration of past bull and bear cycles].

-

Logarithmic Growth and Exponential Increases: Bitcoin's price history often displays logarithmic growth, suggesting the potential for exponential price increases, particularly during bull markets. This pattern, observed repeatedly, supports the possibility of a 10x price increase, although the timeframe remains uncertain.

On-Chain Metrics and Indicators Suggesting Future Growth

On-chain metrics provide valuable insights into Bitcoin's underlying network activity, offering strong signals for Bitcoin price prediction.

-

Adoption Rate and Network Growth: Increasing adoption, measured by the number of active addresses, transaction volume, and the growth of the Lightning Network, strongly correlates with price appreciation. Higher adoption generally leads to increased demand and price pressure. [Insert chart showing Bitcoin network growth metrics].

-

Halving Events and Supply Dynamics: Bitcoin's halving events, which reduce the rate of new coin creation, historically lead to bull markets. The reduced supply combined with increasing demand often results in a price surge. [Insert chart illustrating the impact of halving events on Bitcoin's price].

-

NVT Ratio, MVRV, and Miner Behavior: Metrics like the Network Value to Transaction Ratio (NVT), Market Cap to Realized Cap ratio (MVRV), and miner behavior (hash rate, mining profitability) are valuable indicators for assessing market valuations and potential price movements. Analyzing these metrics helps gauge potential overbought or oversold conditions. [Insert charts visualizing these on-chain metrics].

-

Correlation with Price: Historical data shows a strong correlation between many of these on-chain metrics and Bitcoin's price. Understanding these correlations is essential for accurate Bitcoin price prediction.

Macroeconomic Factors and Their Influence on Bitcoin's Price

Global economic conditions heavily influence Bitcoin's price, serving as a critical factor in any Bitcoin price prediction.

-

Inflation and Monetary Policy: Bitcoin's value proposition as a hedge against inflation gains significance during periods of high inflation and loose monetary policy. As fiat currencies lose value, investors might turn to Bitcoin as a store of value, boosting demand. [Include relevant news articles and economic data].

-

Geopolitical Events and Regulations: Geopolitical instability and uncertain regulatory environments can impact Bitcoin's price volatility. Positive regulatory developments in major economies can trigger price increases, while negative news can lead to temporary dips. [Include relevant news articles and regulatory updates].

-

Institutional Adoption and Mainstream Media: Increasing institutional adoption by large corporations and investment firms significantly drives price appreciation. Likewise, positive mainstream media coverage boosts public awareness and potentially increases demand. [Include relevant news articles on institutional adoption and media coverage].

-

Bitcoin as Inflation Hedge: The limited supply of Bitcoin, coupled with its decentralized nature, positions it as a potential hedge against inflation. This factor becomes increasingly relevant in uncertain economic times.

Technical Analysis: Chart Patterns and Trading Signals

Technical analysis tools provide valuable insights into potential price movements, helping refine Bitcoin price prediction.

-

Support and Resistance Levels: Chart patterns like head and shoulders, triangles, and double tops/bottoms identify key support and resistance levels. Breakouts from these patterns often indicate significant price movements. [Insert chart illustrating technical chart patterns and support/resistance levels].

-

Moving Averages and Indicators: Moving averages (MAs), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) gauge momentum and potential trend reversals. These indicators help identify buy and sell signals. [Insert chart showing technical indicators].

-

Fibonacci Retracements and Extensions: Fibonacci retracements and extensions project potential price targets based on historical price movements. These tools are helpful in identifying potential price objectives. [Insert chart showing Fibonacci retracements and extensions].

-

Predictive Power of Technical Indicators: While not perfect, technical analysis tools, used in conjunction with fundamental analysis, improve the accuracy of Bitcoin price prediction.

Conclusion

While predicting the precise timing of a 10x Bitcoin price increase is impossible, a comprehensive analysis of historical trends, on-chain metrics, macroeconomic factors, and technical analysis suggests that such growth is not outside the realm of possibility. By carefully monitoring these indicators, investors can better position themselves to capitalize on the potential for substantial returns in the Bitcoin market. Continue to research and analyze Bitcoin chart analysis to stay informed on the path to a potential 10x Bitcoin price increase. Understanding these key factors is crucial for navigating the complexities of this dynamic market and making informed decisions about your Bitcoin price prediction.

Featured Posts

-

Champions League Semi Final Arsenals Chances Against Psg

May 08, 2025

Champions League Semi Final Arsenals Chances Against Psg

May 08, 2025 -

Compact Productivity The Microsoft Surface Pro 12

May 08, 2025

Compact Productivity The Microsoft Surface Pro 12

May 08, 2025 -

Cardinal Decisions A Look At The Papal Candidate Dossiers

May 08, 2025

Cardinal Decisions A Look At The Papal Candidate Dossiers

May 08, 2025 -

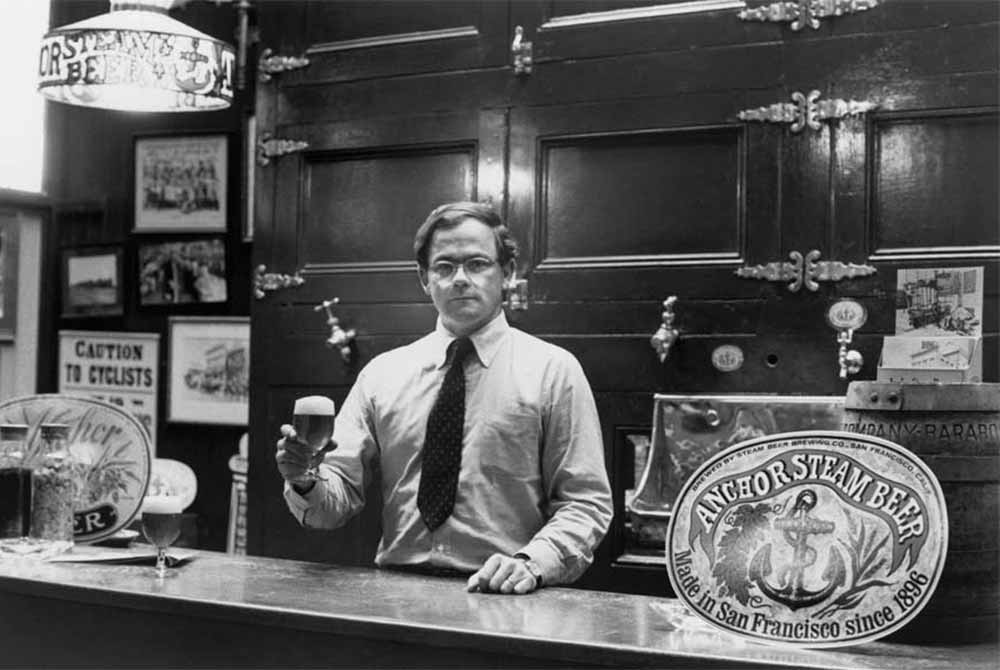

127 Years Of Brewing History Concludes Anchor Brewing Companys Closure

May 08, 2025

127 Years Of Brewing History Concludes Anchor Brewing Companys Closure

May 08, 2025 -

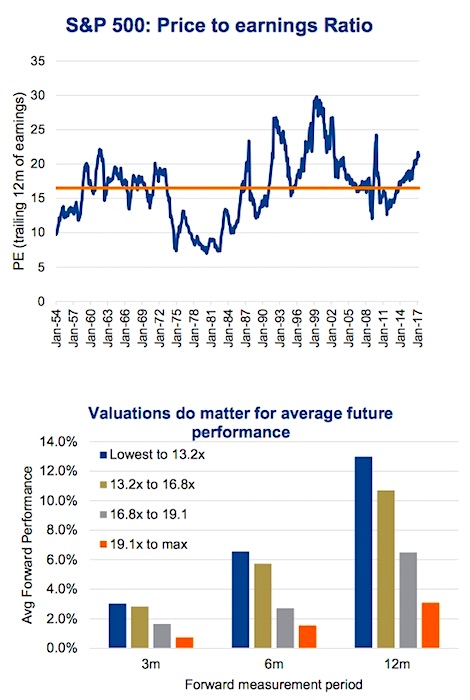

Investor Concerns About High Stock Market Valuations A Bof A Response

May 08, 2025

Investor Concerns About High Stock Market Valuations A Bof A Response

May 08, 2025

Latest Posts

-

La Geometrie Des Corneilles Une Intelligence Inattendue

May 08, 2025

La Geometrie Des Corneilles Une Intelligence Inattendue

May 08, 2025 -

Saturday Night Live And Counting Crows A Career Defining Moment

May 08, 2025

Saturday Night Live And Counting Crows A Career Defining Moment

May 08, 2025 -

Capacites Cognitives Des Corneilles Elles Surpassent Les Babouins En Geometrie

May 08, 2025

Capacites Cognitives Des Corneilles Elles Surpassent Les Babouins En Geometrie

May 08, 2025 -

Le Pouvoir Geometrique Insoupconne Des Corneilles Une Etude Fascinante

May 08, 2025

Le Pouvoir Geometrique Insoupconne Des Corneilles Une Etude Fascinante

May 08, 2025 -

Les Corneilles Des Capacites Geometriques Surprenantes Superieures Meme Aux Babouins

May 08, 2025

Les Corneilles Des Capacites Geometriques Surprenantes Superieures Meme Aux Babouins

May 08, 2025