Chime's IPO Filing Highlights Strong Revenue Growth In Digital Banking Sector

Table of Contents

Chime's Financial Performance: A Deep Dive into Revenue Growth

Chime's IPO filing offers a detailed look at its remarkable financial performance. The numbers paint a picture of sustained and significant revenue growth, year over year. This section will analyze key performance indicators (KPIs) and break down the sources of this impressive growth.

Detailed Revenue Breakdown

While specific figures are subject to change pending the IPO's completion, the filing indicates substantial revenue increases across multiple service areas. This includes:

- Transaction Fees: Revenue from debit card transactions, ATM fees (where applicable), and other transaction-related charges shows strong growth, reflecting the increasing usage of Chime's services.

- Interest Income: Revenue generated from interest earned on customer deposits is also expected to be a significant contributor, demonstrating the scale of Chime's customer base and the funds under management.

- Subscription Revenue: Revenue from premium services or subscription-based features, if any, will further contribute to the overall growth.

Growth Drivers

Several factors have contributed to Chime's impressive revenue growth:

- Increased customer base: Chime has successfully attracted a large and rapidly growing customer base, primarily through its user-friendly app and compelling value proposition.

- Successful product launches: New features and product offerings, such as enhanced debit cards, credit-building tools, and potentially investment options, have attracted new users and increased engagement with existing customers.

- Effective marketing strategies: Chime's targeted marketing campaigns have effectively reached its target demographic, driving customer acquisition and brand awareness.

- Expanding financial product offerings: The expansion of its product offerings beyond basic banking services positions Chime for continued growth and revenue diversification.

Comparison to Competitors

While direct revenue comparisons with competitors like Current and Revolut are difficult without access to their complete financial data, Chime’s growth trajectory appears to be amongst the strongest in the rapidly evolving digital banking market. Further analysis will be needed once all competitors' financial data is publicly available for a truly comparative evaluation.

Chime's Business Model and Competitive Advantages in the Digital Banking Market

Chime's success is built on a unique business model that leverages several key competitive advantages. Its fee-free banking model, mobile-first approach, and commitment to technological innovation have set it apart from traditional banks.

Fee-Free Banking and its Impact

Chime's commitment to fee-free banking is a major driver of its customer acquisition. By eliminating common banking fees, Chime attracts customers frustrated by the hidden charges associated with traditional banking. This strategy resonates particularly well with younger demographics and those seeking affordable financial services.

Mobile-First Approach and User Experience

Chime's mobile-first strategy places the user experience at the forefront. Its intuitive and user-friendly mobile app has been instrumental in its success. The seamless user interface and convenient features make banking easy and accessible, fostering customer loyalty.

Technological Innovation and Automation

Chime's investment in technology and automation has led to significant efficiencies and improved customer service. Automated systems streamline processes, reduce operational costs, and enable quicker response times, contributing to a positive customer experience.

Implications of Chime's Success for the Future of Digital Banking

Chime's growth has significant implications for the future of the digital banking landscape. Its success underscores the shifting consumer preferences and the increasing competition within the sector.

Increased Competition and Innovation

Chime's success is driving increased competition and encouraging innovation among established and emerging players in the digital banking sector. This competitive pressure will likely lead to further advancements in technology, user experience, and product offerings.

Shifting Consumer Preferences

Chime's popularity reflects a broader shift in consumer preferences toward digital banking solutions. Consumers are increasingly demanding convenient, transparent, and fee-free financial services, forcing traditional banks to adapt or risk losing market share.

Regulatory Considerations

The regulatory environment for digital banks is constantly evolving. Chime's success will undoubtedly influence regulatory discussions and policies related to digital banking, fintech, and consumer protection.

Conclusion

Chime's IPO filing underscores the remarkable growth potential within the digital banking sector. The company's strong revenue growth, fueled by its innovative business model and customer-centric approach, positions it as a leader in this rapidly evolving market. Understanding Chime's success is critical for investors and industry participants alike. Stay informed about the latest developments in digital banking and Chime's continued growth by following our updates. Learn more about the exciting world of Chime IPO and digital banking investments.

Featured Posts

-

Sinner Makes Italian Open Last 16 Osakas Tournament Ends

May 14, 2025

Sinner Makes Italian Open Last 16 Osakas Tournament Ends

May 14, 2025 -

Top Company News Highlights Monday 1 Am Et Update

May 14, 2025

Top Company News Highlights Monday 1 Am Et Update

May 14, 2025 -

Alexis Kohler Un Nouveau Chapitre A La Societe Generale En Tant Que Directeur General Adjoint

May 14, 2025

Alexis Kohler Un Nouveau Chapitre A La Societe Generale En Tant Que Directeur General Adjoint

May 14, 2025 -

Nottingham Forest Injury Update Awoniyis Status Revealed

May 14, 2025

Nottingham Forest Injury Update Awoniyis Status Revealed

May 14, 2025 -

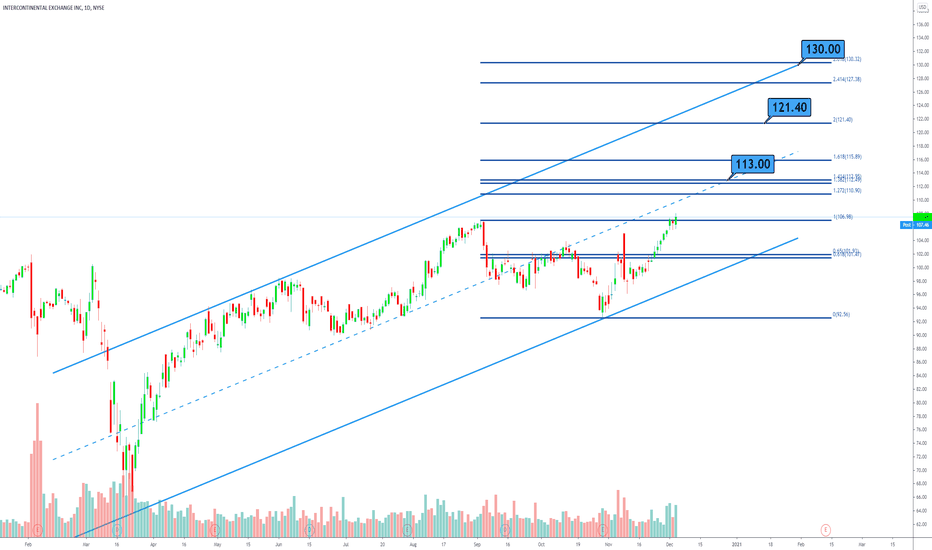

Nyse Owner Ice Reports Higher Than Expected First Quarter Profits

May 14, 2025

Nyse Owner Ice Reports Higher Than Expected First Quarter Profits

May 14, 2025