CoreWeave (CRWV) Stock Jump: Analyzing Tuesday's Price Increase

Table of Contents

Potential Factors Contributing to the CoreWeave (CRWV) Stock Jump

Several factors likely contributed to the significant increase in CoreWeave's stock price on Tuesday. Let's examine some of the key contributors:

Positive Market Sentiment Towards Cloud Computing

The cloud computing market is experiencing robust growth, fueled by increasing digital transformation initiatives across various industries. Recent reports project a continued upward trajectory for the cloud computing market, with significant expansion predicted in the coming years. This positive market sentiment spills over into individual cloud computing stocks, including CRWV.

- Industry Growth: Market research firms consistently point towards double-digit growth in the cloud infrastructure market. This positive outlook boosts investor confidence in companies like CoreWeave.

- Recent Reports: Positive analyst reports and news articles highlighting the potential of cloud computing solutions often drive increased investment in the sector. Any recent positive industry news would certainly have contributed to the overall positive sentiment.

- Data Center Demand: The increasing demand for data centers to support cloud services creates a favorable environment for companies providing cloud infrastructure, like CoreWeave. This underlying market driver is a significant factor in the overall positive outlook.

CoreWeave's Recent Developments and Announcements

In addition to broad market trends, specific events related to CoreWeave itself may have fueled the stock price increase. Analyzing recent announcements is crucial for understanding the CRWV stock jump.

- New Partnerships: Strategic alliances with major technology companies or enterprise clients can significantly impact a company's valuation. Any new partnerships announced around Tuesday would likely have played a role.

- Product Launches: The introduction of innovative products or services can attract new customers and boost revenue projections, positively impacting the stock price.

- Strong Financial Results: Superior-than-expected financial results, including revenue growth and profitability, often lead to increased investor confidence and a rise in stock price. Any positive financial news released around the time of the jump would be a key contributing factor.

- Significant Contracts: Securing large contracts with key clients demonstrates market demand and the company's ability to compete effectively, which can significantly impact investor perception.

Broad Market Trends and Investor Behavior

It's essential to consider the overall market conditions on Tuesday to gain a complete understanding of the CRWV stock price movement.

- Market Volatility: Days of increased market volatility can lead to significant price swings in individual stocks, regardless of company-specific news.

- Interest Rate Changes: Changes in interest rates can impact investor behavior and affect stock valuations across various sectors.

- Economic News: Positive economic indicators or announcements can trigger broader market optimism, impacting even individual stocks like CRWV.

- Investor Sentiment: Overall investor sentiment, whether optimistic or pessimistic, significantly influences stock prices. Speculation and short-term trading activity also play a role.

Analyzing the Sustainability of the CoreWeave (CRWV) Stock Increase

While Tuesday's surge was significant, assessing its long-term sustainability requires a careful evaluation of CoreWeave's prospects and potential challenges.

Long-Term Growth Prospects for CoreWeave

CoreWeave's long-term growth potential hinges on its ability to maintain its competitive advantage in the rapidly evolving cloud computing market.

- Competitive Advantage: CoreWeave needs to maintain a clear competitive advantage in terms of technology, pricing, and service to secure market share and achieve sustained growth. Aspects such as specialized services or particularly efficient infrastructure are important.

- Market Share Growth: Capturing a larger market share within the cloud computing industry is critical for long-term success. Expansion into new markets is also essential.

- Innovation and R&D: Continuous investment in research and development is vital for staying ahead of the competition and adapting to changing market demands. A focus on innovation is essential for long-term growth.

- Profitability and Scalability: Demonstrating consistent profitability and the ability to scale operations efficiently are essential for attracting investors and sustaining growth.

Potential Risks and Challenges

Several factors could hinder CoreWeave's continued growth and impact the sustainability of the recent stock price increase.

- Intense Competition: The cloud computing market is highly competitive, with established players and new entrants vying for market share.

- Economic Downturn: A broader economic slowdown could impact spending on cloud services, affecting CoreWeave's revenue growth.

- Technological Disruptions: Rapid technological advancements could render existing infrastructure obsolete, requiring significant investments to remain competitive.

- Regulatory Changes: Changes in regulations or policies related to data privacy or cybersecurity could pose challenges for CoreWeave.

Investment Strategies Considering the CoreWeave (CRWV) Stock Movement

Based on the analysis above, investors need to carefully consider their investment approach to CRWV stock.

Buy, Sell, or Hold Recommendations (Disclaimer):

Disclaimer: This is not financial advice. The following is purely observational analysis.

The information presented here should not be interpreted as a recommendation to buy, sell, or hold CRWV stock. Any investment decision should be based on your own thorough research and risk tolerance. Consult with a qualified financial advisor before making any investment decisions. The recent price increase may be a short-term fluctuation or reflect genuine underlying strength, but thorough due diligence is paramount.

Potential Strategies (Disclaimer: Not Financial Advice): Based on the factors discussed, an investor might consider a "hold" strategy if confident in CoreWeave's long-term potential, but with awareness of the risks. A "buy" strategy might be considered only after thorough due diligence and risk assessment. A "sell" strategy might be considered if the investor's risk tolerance is low.

Conclusion: Understanding the CoreWeave (CRWV) Stock Jump

Tuesday's CoreWeave (CRWV) stock jump resulted from a confluence of factors, including positive market sentiment towards cloud computing, CoreWeave's own developments, and broader market trends. While the short-term increase is noteworthy, investors should carefully consider both the potential for long-term growth and the inherent risks before making any investment decisions. Remember to conduct thorough due diligence, consult with a financial advisor, and monitor the CoreWeave stock price and industry news for further insights. Stay informed about future developments in CoreWeave (CRWV) stock and the broader cloud computing market to make well-informed investment decisions. Continue to monitor the CoreWeave stock price for further insights.

Featured Posts

-

Trans Australia Run The Pursuit Of A New World Record

May 22, 2025

Trans Australia Run The Pursuit Of A New World Record

May 22, 2025 -

Liverpool Fc News Jeremie Frimpong Transfer Update Agreement Reached Contact Pending

May 22, 2025

Liverpool Fc News Jeremie Frimpong Transfer Update Agreement Reached Contact Pending

May 22, 2025 -

Emergency Response Underway After Box Truck Crash On Route 581

May 22, 2025

Emergency Response Underway After Box Truck Crash On Route 581

May 22, 2025 -

Xay Dung Cau Ma Da Thuc Day Kinh Te Xa Hoi Dong Nai

May 22, 2025

Xay Dung Cau Ma Da Thuc Day Kinh Te Xa Hoi Dong Nai

May 22, 2025 -

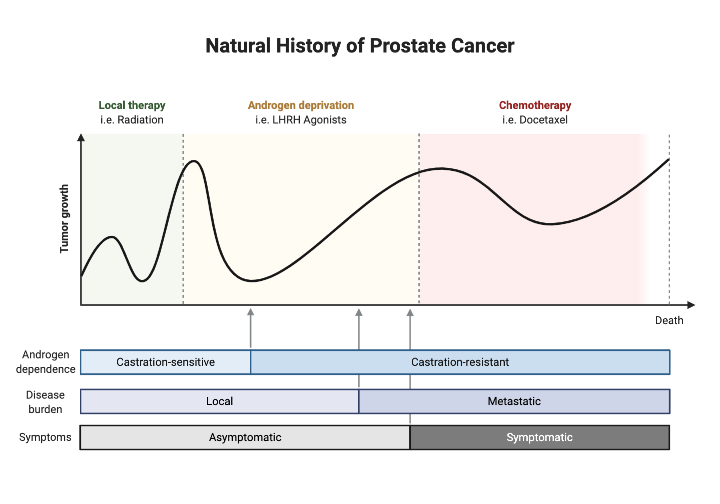

President Bidens Prostate Cancer History A 2014 Update

May 22, 2025

President Bidens Prostate Cancer History A 2014 Update

May 22, 2025

Latest Posts

-

Tribute To Adam Ramey Dropout Kings Singer Passes

May 22, 2025

Tribute To Adam Ramey Dropout Kings Singer Passes

May 22, 2025 -

Remembering Adam Ramey Dropout Kings Vocalist Dies

May 22, 2025

Remembering Adam Ramey Dropout Kings Vocalist Dies

May 22, 2025 -

Death Of Dropout Kings Singer Adam Ramey Confirmed

May 22, 2025

Death Of Dropout Kings Singer Adam Ramey Confirmed

May 22, 2025 -

Dropout Kings Frontman Adam Ramey Cause Of Death And Fan Reactions

May 22, 2025

Dropout Kings Frontman Adam Ramey Cause Of Death And Fan Reactions

May 22, 2025 -

Steelers News Kipers Unexpected Rodgers Take Shakes Up Draft Outlook

May 22, 2025

Steelers News Kipers Unexpected Rodgers Take Shakes Up Draft Outlook

May 22, 2025