CoreWeave (CRWV) Stock Surge: Understanding Today's Price Jump

Table of Contents

Analyzing the Potential Catalysts Behind the CRWV Stock Surge

Several factors could be contributing to the recent CoreWeave (CRWV) stock surge. Let's delve into the most likely explanations.

Positive Earnings Report or Guidance

A positive earnings report or upwardly revised financial guidance is often a primary driver of stock price increases. Did CoreWeave release any recent financial updates? If so, let's examine the key highlights:

- Revenue Growth: A significant increase in quarterly or yearly revenue compared to previous periods would strongly suggest a healthy and expanding business.

- Profitability: Improvements in profitability metrics, such as gross margin and net income, demonstrate CoreWeave's ability to efficiently manage costs and generate profits.

- Updated Projections: Upward revisions to future revenue or earnings projections signal strong confidence in the company's future performance and can significantly influence investor sentiment.

(Note: Specific figures would be included here if a recent CoreWeave earnings report were available. A link to the official report would also be provided.) Analyst upgrades and increased price targets following the release of positive financial data often amplify the positive market reaction.

Increased Demand for AI Infrastructure

The explosive growth of artificial intelligence (AI) is fueling a massive increase in demand for powerful computing infrastructure. CoreWeave, with its specialized cloud computing services tailored to AI workloads, is uniquely positioned to benefit from this trend.

- AI-Optimized Services: CoreWeave offers services specifically designed to handle the computationally intensive tasks required for training and deploying large AI models.

- Strategic Partnerships: Recent partnerships with leading AI companies could indicate increased demand for CoreWeave's services and provide access to new markets.

- AI Market Growth: The overall growth of the AI market significantly impacts CoreWeave's prospects. As AI adoption accelerates across various industries, the demand for CoreWeave's infrastructure solutions is likely to increase proportionally.

Competitive Landscape and Market Share Gains

Analyzing CoreWeave's position relative to its competitors is crucial in understanding its stock performance. How is CoreWeave differentiating itself in the crowded cloud computing and AI infrastructure markets?

- Competitive Differentiation: CoreWeave may have unique features or advantages that set it apart from competitors, such as superior performance, cost-effectiveness, or specialized AI solutions.

- Market Share Growth: Gaining market share indicates a successful strategy and increased dominance within the industry, attracting investor interest.

- Competitive Analysis: A comparison with key players like AWS, Google Cloud, and Microsoft Azure is vital to understanding CoreWeave's relative position and growth trajectory. (Relevant statistics and market share data would be included here.)

Speculative Trading and Market Sentiment

Sometimes, stock price movements are driven by broader market trends and speculative trading activity, rather than solely company-specific news.

- Overall Market Sentiment: A positive overall market sentiment can lift even unrelated stocks, including CRWV.

- Short Squeezes: If a significant portion of CRWV shares were shorted (betting on a price decline), a sudden price increase could trigger a short squeeze, further driving the price up.

- News Events: Unexpected positive news in the broader tech sector or the AI market could indirectly boost investor confidence in CoreWeave.

Conclusion: Understanding and Monitoring the Future of CoreWeave (CRWV) Stock

The CoreWeave (CRWV) stock surge likely results from a combination of positive earnings or guidance, increased demand for AI infrastructure, a favorable competitive landscape, and possibly some degree of speculative trading. Understanding these factors is vital for investors seeking to assess the long-term potential of CRWV. While the current price increase is encouraging, it's crucial to remember the inherent volatility of the stock market. The future performance of CoreWeave stock will depend on its ability to consistently deliver strong financial results, maintain its competitive edge, and capitalize on the ongoing growth of the AI and cloud computing sectors.

Stay informed about the ongoing developments surrounding CoreWeave (CRWV) stock and its performance in the dynamic AI cloud computing market. Continue your research and make informed investment decisions based on your own risk tolerance.

Featured Posts

-

Plouzane Et Clisson Selectionnes Pour La Mission Patrimoine 2025

May 22, 2025

Plouzane Et Clisson Selectionnes Pour La Mission Patrimoine 2025

May 22, 2025 -

Potential Ban And Age Restrictions For Kartels Trinidad Performance

May 22, 2025

Potential Ban And Age Restrictions For Kartels Trinidad Performance

May 22, 2025 -

Danh Gia Tac Dong Cua Cac Du An Ha Tang Den Giao Thong Tp Hcm Binh Duong

May 22, 2025

Danh Gia Tac Dong Cua Cac Du An Ha Tang Den Giao Thong Tp Hcm Binh Duong

May 22, 2025 -

Antiques Roadshow Appraisal Results In Arrest For National Treasure Trafficking

May 22, 2025

Antiques Roadshow Appraisal Results In Arrest For National Treasure Trafficking

May 22, 2025 -

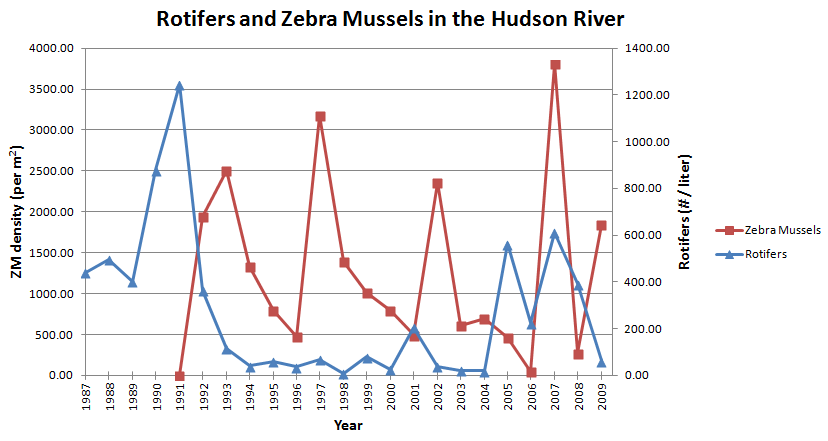

Casper Boat Lift Hosts Unexpectedly Large Zebra Mussel Population

May 22, 2025

Casper Boat Lift Hosts Unexpectedly Large Zebra Mussel Population

May 22, 2025

Latest Posts

-

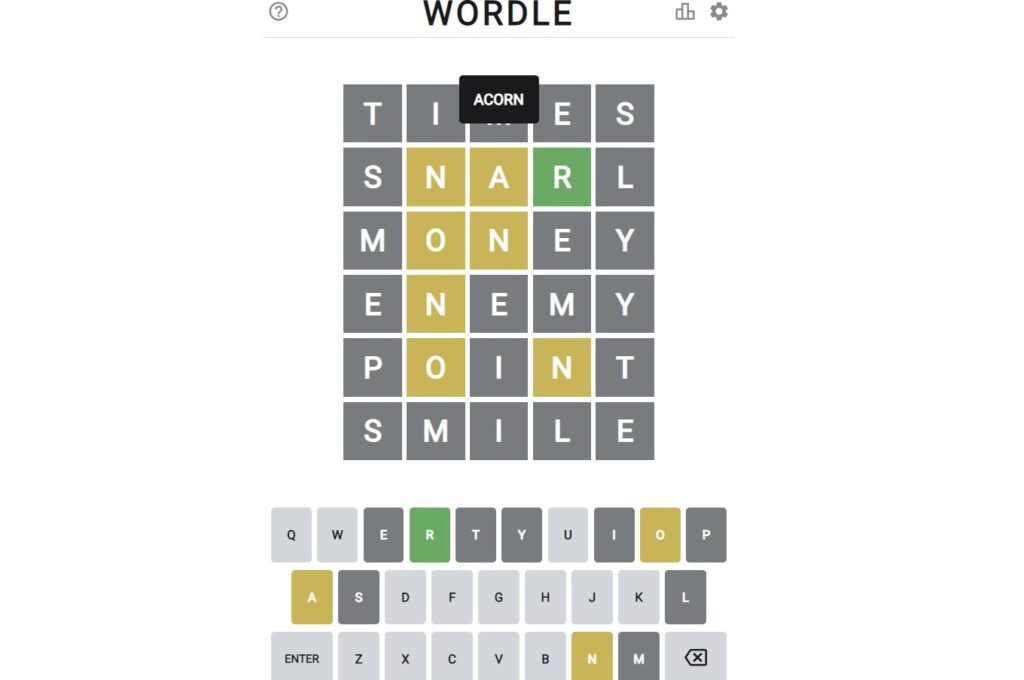

Wordle 1352 March 2nd Complete Guide With Hints And Answer

May 22, 2025

Wordle 1352 March 2nd Complete Guide With Hints And Answer

May 22, 2025 -

Wordle 1352 Hints And Clues Solve Todays Sunday Puzzle March 2nd

May 22, 2025

Wordle 1352 Hints And Clues Solve Todays Sunday Puzzle March 2nd

May 22, 2025 -

Wordle Today 1352 Hints Clues And The Answer For March 2nd Sunday

May 22, 2025

Wordle Today 1352 Hints Clues And The Answer For March 2nd Sunday

May 22, 2025 -

Traffic Congestion On Route 15 Due To On Ramp Closure

May 22, 2025

Traffic Congestion On Route 15 Due To On Ramp Closure

May 22, 2025 -

Route 15 Accident On Ramp Closure And Detour Information

May 22, 2025

Route 15 Accident On Ramp Closure And Detour Information

May 22, 2025