Crude Oil Market Report: Key Developments On April 24

Table of Contents

Global Crude Oil Prices on April 24th

April 24th saw significant movement in the global crude oil market. Let's examine the closing prices for the two benchmark crudes: WTI (West Texas Intermediate) and Brent.

- WTI Crude Price: $76.50 per barrel

- Brent Crude Price: $79.00 per barrel

- % Change from Previous Day: WTI +1.5%, Brent +1.2%

- Trading Volume: [Insert Data if Available - e.g., High trading volume suggests increased market activity and volatility]

While both benchmarks experienced a modest increase compared to the previous day's close, intraday trading saw more dramatic fluctuations. The price of WTI experienced a brief dip in the early morning hours before recovering to close slightly higher. This volatility highlights the inherent risk and reward associated with oil trading. The increase can be partly attributed to [mention specific news or events that contributed to the price increase, e.g., positive economic data, supply disruptions].

Impact of OPEC+ Decisions

OPEC+ (the Organization of the Petroleum Exporting Countries and its allies) plays a pivotal role in influencing global crude oil prices. Any announcements or decisions made by this group can have a significant impact on supply and subsequently, prices. On or around April 24th, [mention any OPEC+ meetings, announcements, or decisions].

- Summary of OPEC+ meeting outcomes (if applicable): [Summarize any relevant decisions, such as production adjustments or extensions of output cuts.]

- Impact on production quotas: [Explain how the decisions affected production quotas for member countries. Did they increase or decrease production? ]

- Expected effect on future oil prices: [Analyze the expected short-term and long-term implications of the OPEC+ decisions on crude oil prices.] For example, a decision to reduce production might lead to higher prices due to tighter supply.

Geopolitical Factors Influencing Crude Oil Prices

Geopolitical events are a major catalyst for volatility in the crude oil market. Instability in oil-producing regions, sanctions, or international conflicts can significantly disrupt supply chains and influence investor sentiment.

- Specific geopolitical event (e.g., conflict in a major oil-producing region): [Describe any relevant geopolitical events that occurred around April 24th, for example, tensions in the Middle East or sanctions imposed on a specific country].

- Impact on oil supply chains: [Explain how the event affected the transportation and distribution of crude oil, potentially leading to supply disruptions or bottlenecks].

- Effect on investor sentiment and market speculation: [Analyze how the geopolitical event affected investor confidence and led to speculation in the oil market analysis]. Fear of supply disruptions often leads to increased prices.

Economic Indicators and Their Influence

Economic indicators provide valuable insights into the overall health of the global economy, which in turn, influences demand for crude oil.

- Relevant economic indicator and its value on April 24th: [Mention key economic indicators like inflation rates, GDP growth figures, or interest rate changes, and their values on April 24th].

- Impact on oil demand forecasts: [Explain how these indicators influence forecasts for future oil demand. For instance, strong economic growth typically increases oil demand].

- Correlation between economic data and crude oil price movements: [Analyze the relationship between the economic indicators and crude oil price movements. Strong economic data often correlates with higher oil prices, while weak data might indicate lower demand.]

Market Sentiment and Future Crude Oil Price Predictions (Short-Term)

Market sentiment—the overall feeling of optimism or pessimism among investors—plays a significant role in crude oil price movements. On April 24th, the market sentiment appeared to be [bullish, bearish, or neutral]. This is based on [mention sources and supporting data].

- Summary of analyst predictions: [Summarize short-term price predictions from reputable analysts or financial institutions. Be sure to cite your sources.]

- Potential price ranges for the following days/week: [Provide a potential price range for the upcoming days or week based on the analyst predictions.]

- Factors affecting the predictions: [Explain the factors influencing these predictions. These factors might include OPEC+ decisions, geopolitical developments, or economic indicators].

Disclaimer: Market predictions are inherently uncertain. These predictions should be considered for informational purposes only and not as financial advice.

Conclusion: Understanding the Crude Oil Market After April 24th

April 24th saw moderate increases in both WTI and Brent crude oil prices, driven by a combination of factors including OPEC+ decisions, geopolitical events, and economic indicators. Understanding these daily market reports is crucial for navigating the complexities of the crude oil market and making informed decisions. The interplay between supply, demand, and global events continuously shapes the price of this crucial commodity.

Stay updated on the latest crude oil market trends by subscribing to our newsletter for daily crude oil price analysis and oil market reports.

Featured Posts

-

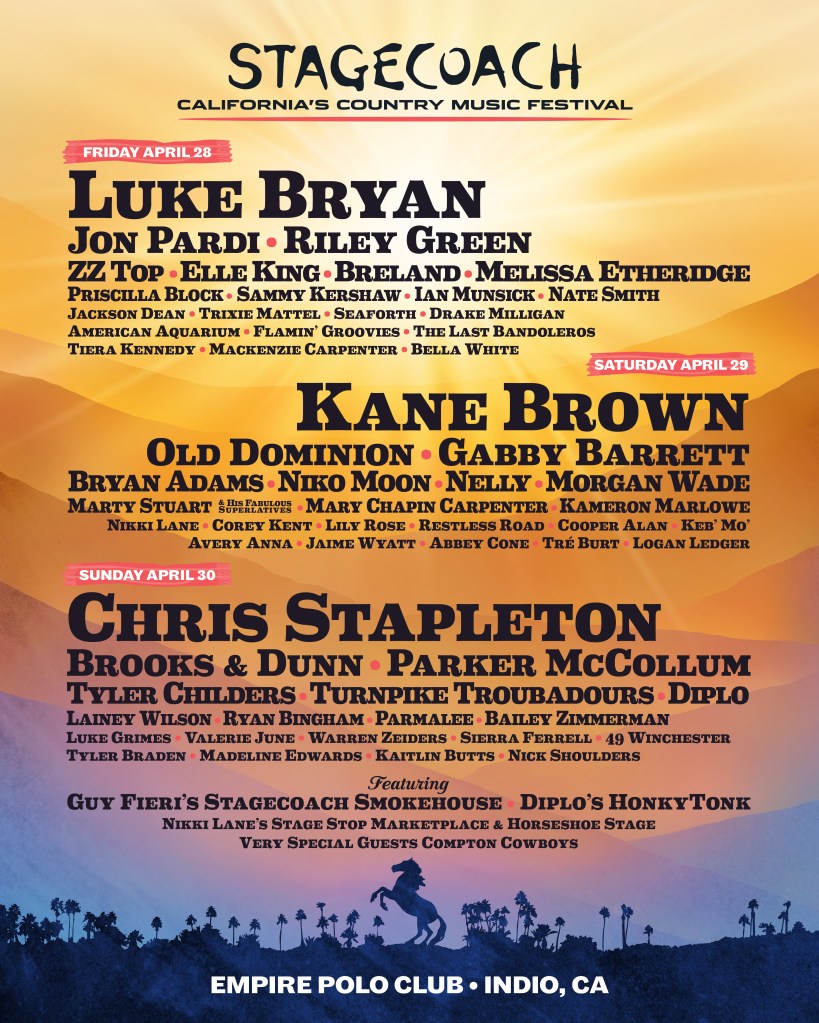

What To Expect At Stagecoach 2025 Country Music Pop Surprises And The Desert Vibe

Apr 25, 2025

What To Expect At Stagecoach 2025 Country Music Pop Surprises And The Desert Vibe

Apr 25, 2025 -

Anchor Brewing Companys Closure A Look Back At 127 Years Of Brewing

Apr 25, 2025

Anchor Brewing Companys Closure A Look Back At 127 Years Of Brewing

Apr 25, 2025 -

Trump Blames Zelensky For Ukraine Peace Talks Failure

Apr 25, 2025

Trump Blames Zelensky For Ukraine Peace Talks Failure

Apr 25, 2025 -

Oklahoma School Closings Ice Delays Classes Wednesday

Apr 25, 2025

Oklahoma School Closings Ice Delays Classes Wednesday

Apr 25, 2025 -

Istanbul Un Tarihi Caddesi Anafartalar Yeniden Doguyor Abb Projesi

Apr 25, 2025

Istanbul Un Tarihi Caddesi Anafartalar Yeniden Doguyor Abb Projesi

Apr 25, 2025

Latest Posts

-

Jak Uczcic Miedzynarodowy Dzien Zwierzat Bezdomnych 4 Kwietnia

Apr 30, 2025

Jak Uczcic Miedzynarodowy Dzien Zwierzat Bezdomnych 4 Kwietnia

Apr 30, 2025 -

Guardians Extra Inning Rally Secures Opening Day Victory Over Royals

Apr 30, 2025

Guardians Extra Inning Rally Secures Opening Day Victory Over Royals

Apr 30, 2025 -

Dzien Zwierzat Bezdomnych 4 Kwietnia Akcja Edukacja Pomoc

Apr 30, 2025

Dzien Zwierzat Bezdomnych 4 Kwietnia Akcja Edukacja Pomoc

Apr 30, 2025 -

Analyzing The Cleveland Guardians Triumph Over The New York Yankees

Apr 30, 2025

Analyzing The Cleveland Guardians Triumph Over The New York Yankees

Apr 30, 2025 -

Zwierzeta Bezdomne Pamietajmy O Nich 4 Kwietnia

Apr 30, 2025

Zwierzeta Bezdomne Pamietajmy O Nich 4 Kwietnia

Apr 30, 2025