Crypto Trader's Profitable $TRUMP Short Results In White House Dinner

Table of Contents

The $TRUMP Meme Coin Phenomenon

The sudden emergence and meteoric rise of the '$TRUMP' meme coin is a perfect example of the speculative frenzy that can grip the cryptocurrency market. Fueled by social media hype and its connection to a prominent political figure, the coin's value experienced wild swings, attracting both seasoned investors and novice traders alike. Market sentiment surrounding the $TRUMP coin was highly volatile, often shifting dramatically in response to news cycles and political events.

- Brief history: The $TRUMP coin was launched in [Insert hypothetical launch date], initially priced at a negligible amount. Its value quickly skyrocketed as social media discussions amplified its potential.

- Key factors contributing to volatility: The coin's price was heavily influenced by news related to the namesake political figure, social media trends (memes, tweets, etc.), and overall market speculation. Any positive or negative news concerning the figure directly impacted the coin's value.

- Social media influence: Online forums and social media platforms played a critical role in driving the $TRUMP coin's price. Viral memes, influencer endorsements, and coordinated buying/selling activities significantly impacted market sentiment and price fluctuations.

The Trader's Short-Selling Strategy

Recognizing the inherent volatility and speculative nature of the $TRUMP coin, the trader employed a short-selling strategy. This involved borrowing and selling the coin, hoping to buy it back at a lower price later, pocketing the difference as profit. This daring move required a deep understanding of cryptocurrency market mechanics and robust risk management.

- Technical analysis: The trader likely utilized various technical analysis indicators, such as moving averages, RSI, and volume analysis, to identify potential price reversal points and predict the coin's downward trajectory.

- Risk assessment and mitigation: A crucial aspect of the strategy was implementing effective risk management techniques. This could have involved setting stop-loss orders to limit potential losses if the price unexpectedly surged and diversifying their portfolio to mitigate overall risk.

- Position size and entry/exit strategies: The trader likely carefully calculated their position size, ensuring it was within their risk tolerance. Their exit strategy would have involved precisely timing the repurchase of the $TRUMP coin at a lower price to maximize profit.

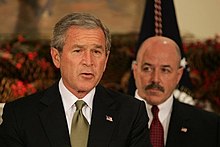

The Unexpected White House Dinner Invitation

The trader's successful $TRUMP short-selling venture garnered significant media attention, ultimately leading to an invitation to a White House dinner. The exact reasons behind this invitation remain somewhat unclear, but several possibilities exist. It could be attributed to their financial acumen, highlighting the growing influence of cryptocurrency in the economy, or possibly a result of pre-existing political connections.

- Dinner details: [Insert hypothetical details about the dinner, attendees, etc.].

- Reasons for invitation: The invitation could represent an attempt by the administration to understand the cryptocurrency market better, potentially leading to future collaborations or policy discussions.

- Future implications: This event signals a growing awareness and interest in the cryptocurrency space within high-level political circles, possibly influencing future cryptocurrency regulation and policy.

Ethical Considerations and Future Implications

The ethical considerations surrounding short-selling, particularly in volatile markets like crypto, are important. While it can be a profitable strategy, it can also contribute to market instability. The $TRUMP coin's case raises questions about market manipulation and the impact on investor confidence.

- Potential for market manipulation: The trader's actions, while legal, raise questions about whether large-scale short selling could potentially influence or manipulate prices.

- Impact on investor confidence: The rapid price fluctuations and the possibility of market manipulation can erode investor confidence, particularly for novice traders.

- Future regulatory developments: This event may prompt further discussions and potentially stricter regulations regarding short selling and cryptocurrency trading in general.

Conclusion: Learning from the Crypto Trader's Profitable $TRUMP Short

This extraordinary story of a Crypto Trader's Profitable $TRUMP Short demonstrates the high-reward, high-risk nature of cryptocurrency trading. The trader's success hinges on their deep understanding of market dynamics, skillful application of short-selling strategies, and meticulous risk management. While replicating this specific feat might be improbable, the underlying principles remain valuable.

While replicating this trader's success with a $TRUMP short might be unlikely, understanding the principles of shrewd crypto trading and effective risk management is crucial for navigating this volatile market. Start your journey towards profitable cryptocurrency investments today!

Featured Posts

-

Stranger Things Season 5 The Urgent Need For A Release Date Announcement

May 29, 2025

Stranger Things Season 5 The Urgent Need For A Release Date Announcement

May 29, 2025 -

Rotten Tomatoes Praises A24s Bring Her Back A Horror Movie Review Roundup

May 29, 2025

Rotten Tomatoes Praises A24s Bring Her Back A Horror Movie Review Roundup

May 29, 2025 -

Real Madrids Victory Against Celta Vigo Mbappes Key Performance In La Liga

May 29, 2025

Real Madrids Victory Against Celta Vigo Mbappes Key Performance In La Liga

May 29, 2025 -

Woede Bij Clubicoon Ajax Negeert Hem Volledig

May 29, 2025

Woede Bij Clubicoon Ajax Negeert Hem Volledig

May 29, 2025 -

Allegations Of Organ Harvesting In Joshlin Smith Case Court Proceedings

May 29, 2025

Allegations Of Organ Harvesting In Joshlin Smith Case Court Proceedings

May 29, 2025

Latest Posts

-

Exploring Bernard Keriks Family Hala Matli And Their Children

May 31, 2025

Exploring Bernard Keriks Family Hala Matli And Their Children

May 31, 2025 -

Bernard Kerik A Look At His Wife Hala Matli And Family Life

May 31, 2025

Bernard Kerik A Look At His Wife Hala Matli And Family Life

May 31, 2025 -

Banksy In Dubai A World News Report On The Inaugural Exhibition

May 31, 2025

Banksy In Dubai A World News Report On The Inaugural Exhibition

May 31, 2025 -

Bernard Kerik 9 11 Nyc Police Commissioner Passes Away

May 31, 2025

Bernard Kerik 9 11 Nyc Police Commissioner Passes Away

May 31, 2025 -

Authenticating A Possible Banksy A Westcliff Bournemouth Case Study

May 31, 2025

Authenticating A Possible Banksy A Westcliff Bournemouth Case Study

May 31, 2025