DAX Falls Below 24,000: Frankfurt Stock Market Closing Losses

Table of Contents

Key Factors Contributing to the DAX Decline

Several interconnected factors contributed to the DAX's sharp decline below 24,000. These factors span global economic headwinds, specific vulnerabilities within the German economy, and the performance of individual companies listed on the Frankfurt Stock Exchange.

Global Economic Uncertainty

Global economic uncertainty played a significant role in the DAX's fall. Rising inflation rates worldwide, coupled with aggressive interest rate hikes by central banks to combat inflation, are dampening economic growth and impacting investor sentiment. Geopolitical instability, particularly the ongoing war in Ukraine and its impact on energy prices, further exacerbates the situation.

- US Inflation Data: Higher-than-expected inflation figures in the US often trigger a sell-off in global markets, including the DAX, due to fears of sustained inflationary pressure.

- The War in Ukraine: The ongoing conflict significantly impacts energy prices and supply chains, creating uncertainty and negatively affecting investor confidence.

- Energy Crisis: The global energy crisis, particularly impacting Europe, leads to increased energy costs for businesses, reducing profitability and impacting economic growth. Inflation in the Eurozone recently reached 10%, impacting consumer spending and corporate profits significantly.

Concerns within the German Economy

The German economy, a significant driver of the DAX, faces several specific challenges contributing to the index decline. High energy prices, largely due to the war in Ukraine and reduced reliance on Russian gas, are severely impacting German manufacturers. Supply chain disruptions continue to hinder production, and fears of a potential recession Germany are growing.

- Automotive Industry Slowdown: The German automotive industry, a key component of the DAX, is facing challenges due to supply chain issues, high energy costs, and shifting consumer demand.

- High Energy Costs for Manufacturing: Soaring energy prices increase production costs for German manufacturers, impacting their profitability and competitiveness.

- Inflation Germany: High inflation erodes purchasing power and dampens consumer spending, negatively affecting the overall economic outlook.

Company-Specific Performance

Beyond macroeconomic factors, the performance of individual DAX companies also played a role in the index's fall. Disappointing earnings reports from several major companies and negative outlooks for future growth contributed to the sell-off.

- [Insert Name of Company 1]: [Link to news source] reported lower-than-expected quarterly earnings, citing challenges related to [specific issue].

- [Insert Name of Company 2]: [Link to news source] issued a profit warning, attributing the decline to [specific issue].

- [Insert Name of Company 3]: [Link to news source] announced a restructuring plan, fueling concerns about its long-term prospects.

Impact on Investors and the Market

The DAX's decline below 24,000 has significant implications for investors and the broader market.

Investor Sentiment and Volatility

The sharp drop in the DAX index has negatively impacted investor sentiment, leading to increased market volatility. Risk aversion is on the rise, with investors likely shifting towards safer assets.

- Increased Trading Volume: The decline has led to a surge in trading activity as investors react to the market downturn.

- Potential for Further Losses: The potential for further losses remains a significant concern for investors.

- Shifting Investment Strategies: Investors may be reevaluating their portfolios and adjusting their investment strategies in response to the increased uncertainty.

Potential Short-Term and Long-Term Implications

The short-term outlook for the DAX remains uncertain, with the potential for further market corrections. The long-term implications depend on how effectively the German government and the European Union address the challenges facing the economy. A prolonged period of low growth or recession could significantly impact investment portfolios and the overall economic health of Germany.

- Potential for Further Market Corrections: The market may experience further declines in the short term as investors digest the latest developments.

- Impact on Investment Portfolios: Investors holding DAX-related assets have likely seen a decrease in the value of their portfolios.

- Government Response: The German government's response to the economic challenges will significantly influence the long-term trajectory of the DAX.

Conclusion: Analyzing the DAX Fall Below 24,000

The DAX's fall below 24,000 is a result of a confluence of factors, including global economic uncertainty, specific weaknesses in the German economy, and disappointing performance from individual DAX companies. This decline has significantly impacted investor sentiment, leading to increased market volatility and raising concerns about short-term and long-term economic prospects. The potential for further market corrections remains a significant risk. To navigate these Frankfurt Stock Market fluctuations, staying informed is crucial. Subscribe to financial news, follow the DAX index performance closely, and consider consulting a financial advisor to manage your investments effectively in light of the DAX index decline. Understanding the complexities of German Stock Market movements is key to long-term investment success.

Featured Posts

-

The Ultimate Escape To The Country Property Buying Tips And Advice

May 24, 2025

The Ultimate Escape To The Country Property Buying Tips And Advice

May 24, 2025 -

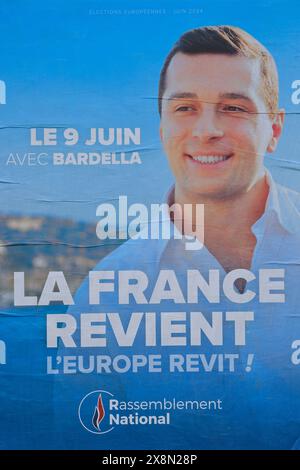

Frances Next Election Jordan Bardella And The Oppositions Prospects

May 24, 2025

Frances Next Election Jordan Bardella And The Oppositions Prospects

May 24, 2025 -

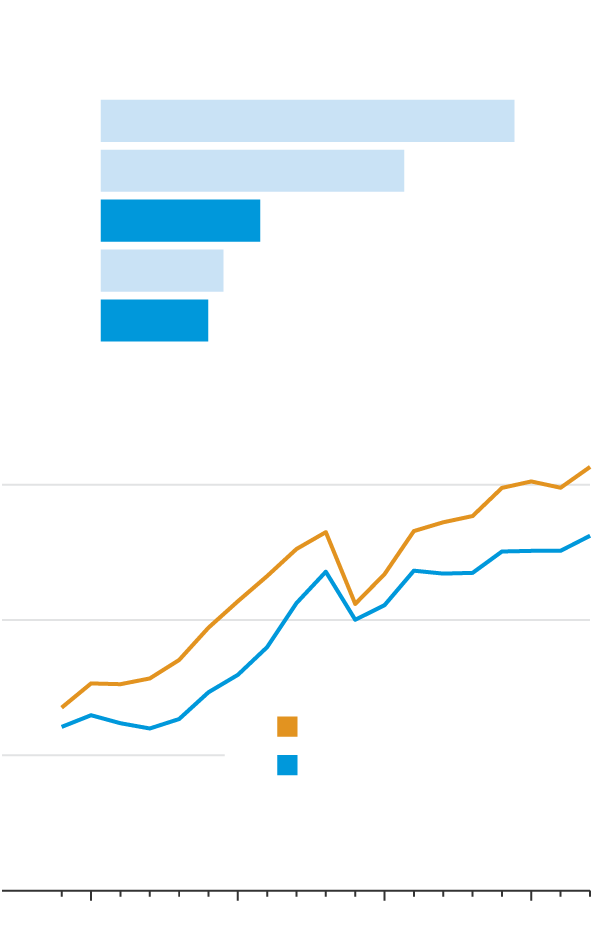

Amundi Msci World Ii Ucits Etf Dist Daily Nav And Its Implications

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Daily Nav And Its Implications

May 24, 2025 -

Euronext Amsterdam Stocks Jump 8 Following Trump Tariff Decision

May 24, 2025

Euronext Amsterdam Stocks Jump 8 Following Trump Tariff Decision

May 24, 2025 -

I M Still Waiting By The Phone A Heartbreak Story

May 24, 2025

I M Still Waiting By The Phone A Heartbreak Story

May 24, 2025

Latest Posts

-

Philips Annual General Meeting Of Shareholders Convened

May 24, 2025

Philips Annual General Meeting Of Shareholders Convened

May 24, 2025 -

Trade War Intensifies Amsterdam Stock Market Opens Down 7

May 24, 2025

Trade War Intensifies Amsterdam Stock Market Opens Down 7

May 24, 2025 -

Analyse Krijgt De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Een Vervolg

May 24, 2025

Analyse Krijgt De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Een Vervolg

May 24, 2025 -

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 24, 2025

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 24, 2025 -

Europese Aandelen Vs Wall Street Doorzetting Snelle Koerswijziging

May 24, 2025

Europese Aandelen Vs Wall Street Doorzetting Snelle Koerswijziging

May 24, 2025