Despite Apple Price Target Cut, Wedbush's Bullish Outlook: Should You Invest?

Table of Contents

Wedbush's Rationale for a Bullish Apple Outlook

Despite the price target adjustment, Wedbush's analysts remain confident in Apple's long-term prospects. Their bullish outlook is primarily based on two key pillars: robust iPhone demand and substantial growth in Apple's services sector, coupled with significant untapped potential in emerging markets.

Strong iPhone Demand and Services Growth

Wedbush's positive outlook stems from the continued strength of iPhone sales and the impressive expansion of Apple's services revenue. Apple's ecosystem, encompassing Apple Music, iCloud, Apple TV+, and other services, is a significant driver of recurring revenue and strengthens customer loyalty.

- iPhone Sales: Recent reports indicate consistently strong iPhone sales, defying expectations of a significant slowdown. [Insert link to a relevant news article or financial report showcasing strong iPhone sales data]. This demonstrates the enduring demand for Apple's flagship product and its continued market share dominance.

- Apple Services Revenue Growth: Apple's services segment continues to show impressive year-over-year revenue growth, exceeding analysts' projections in recent quarters. [Insert link to a relevant financial report highlighting Apple services revenue growth]. This recurring revenue stream provides a stable foundation for Apple's overall financial performance.

- Future Product Launches: Anticipation for upcoming product launches, including potential advancements in AR/VR technology and new iterations of existing products, further fuels Wedbush's optimism. These innovations are expected to drive further sales and enhance Apple's overall market position.

Long-Term Growth Potential in Emerging Markets

Apple still has significant growth potential in developing economies. These markets represent a largely untapped customer base eager to upgrade to premium smartphones and embrace Apple's ecosystem.

- Market Penetration: Apple's market penetration in key emerging markets like India and Southeast Asia remains relatively low, indicating significant room for expansion. [Insert data or links supporting this claim].

- Projected Growth Rates: Analysts project substantial growth rates in these markets over the next several years, driven by increasing disposable incomes and rising smartphone adoption rates. [Insert relevant data or projections].

- Challenges: Expanding into new markets presents challenges, including navigating regulatory hurdles, adapting to local preferences, and competing with established players. However, Apple's brand recognition and premium positioning position it favorably to overcome these obstacles.

Valuation and Price Target Adjustments

While Wedbush maintains a bullish outlook, the price target adjustment reflects a recalibration of Apple's valuation in light of current macroeconomic conditions. It's crucial to understand the distinction between a price target (a specific price prediction) and the overall outlook (a longer-term assessment of the company's prospects).

- Price Target vs. Outlook: A price target is a short-to-medium term prediction, subject to market fluctuations. The bullish outlook, however, represents a longer-term confidence in Apple's fundamental strength and future growth.

- Market Conditions: Factors such as rising interest rates, persistent inflation, and global economic uncertainties can impact stock valuations, leading to adjustments in price targets even with a positive long-term outlook.

Counterarguments and Risks

Despite Wedbush's bullish stance, several counterarguments and potential risks warrant consideration.

Potential for Slowdown in iPhone Sales

Economic headwinds and increasing competition pose potential threats to iPhone sales growth.

- Economic Slowdown: A global economic slowdown could dampen consumer spending, impacting demand for premium products like iPhones.

- Competition: Intense competition from Android manufacturers, particularly in emerging markets, could erode Apple's market share.

- Supply Chain Disruptions: Geopolitical instability or unforeseen supply chain issues could disrupt iPhone production and availability.

Macroeconomic Factors and Their Impact

Broader macroeconomic factors significantly impact Apple's stock price.

- Inflation: High inflation erodes consumer purchasing power, potentially reducing demand for discretionary purchases like iPhones.

- Interest Rate Hikes: Rising interest rates increase borrowing costs for businesses and consumers, dampening investment and spending.

- Geopolitical Risk: Geopolitical uncertainties, such as trade wars or conflicts, can negatively impact Apple's supply chain and sales.

Should You Invest in Apple Stock?

Weighing the pros and cons is crucial before deciding whether to invest in Apple stock.

Weighing the Pros and Cons

- Pros: Strong fundamentals, significant growth potential in services and emerging markets, strong brand loyalty, and a history of innovation.

- Cons: Valuation concerns given current market conditions, macroeconomic risks, potential for slower iPhone sales growth, and competitive pressures.

Ultimately, the decision rests on your risk tolerance and investment strategy. Consider your personal financial situation, diversification strategy, and long-term investment goals.

Conclusion

Despite the recent Apple price target cut by some analysts, Wedbush's maintained bullish outlook on Apple stock offers a compelling investment narrative. While macroeconomic headwinds and competitive pressures exist, Apple's strong fundamentals, robust services revenue, and growth potential in emerging markets remain significant strengths. Should you invest in Apple stock? The decision depends entirely on your individual risk tolerance and investment strategy. Conduct thorough due diligence, potentially consult a financial advisor, and remember to diversify your investment portfolio before making any investment decisions.

Featured Posts

-

Bangladeshs Economic Growth Strategy In Europe A Focus On Collaboration

May 25, 2025

Bangladeshs Economic Growth Strategy In Europe A Focus On Collaboration

May 25, 2025 -

South Floridas Ferrari Challenge A Weekend Of High Octane Racing

May 25, 2025

South Floridas Ferrari Challenge A Weekend Of High Octane Racing

May 25, 2025 -

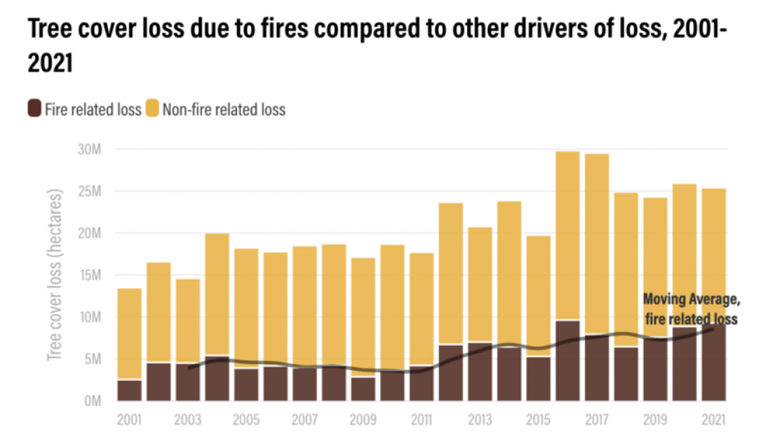

Wildfires Intensify Global Forest Loss Setting A New Record

May 25, 2025

Wildfires Intensify Global Forest Loss Setting A New Record

May 25, 2025 -

Amsterdam Stock Market Three Days Of Losses Totaling 11

May 25, 2025

Amsterdam Stock Market Three Days Of Losses Totaling 11

May 25, 2025 -

Porsche 911 80 Millio Forintert Egyedi Extrak

May 25, 2025

Porsche 911 80 Millio Forintert Egyedi Extrak

May 25, 2025

Latest Posts

-

Rio Tinto Addresses Concerns About The Pilbaras Environmental State

May 25, 2025

Rio Tinto Addresses Concerns About The Pilbaras Environmental State

May 25, 2025 -

Pilbaras Environmental Impact A Clash Between Rio Tinto And Andrew Forrest

May 25, 2025

Pilbaras Environmental Impact A Clash Between Rio Tinto And Andrew Forrest

May 25, 2025 -

The Pilbara Debate Rio Tintos Response To Environmental Concerns

May 25, 2025

The Pilbara Debate Rio Tintos Response To Environmental Concerns

May 25, 2025 -

Sses Strategic Review 3 Billion In Spending Cuts Announced

May 25, 2025

Sses Strategic Review 3 Billion In Spending Cuts Announced

May 25, 2025 -

Rio Tinto And The Pilbara Addressing Claims Of Environmental Damage

May 25, 2025

Rio Tinto And The Pilbara Addressing Claims Of Environmental Damage

May 25, 2025