Dragon Den: A Showdown Leads To Surprising Investment Decision

Table of Contents

The Entrepreneurs' Pitch: A Detailed Analysis

The Business Idea and its Uniqueness

EcoStraws presented a compelling business idea: manufacturing and distributing completely biodegradable and compostable straws. Their focus on sustainability, a growing concern globally, provided a strong competitive advantage in a market increasingly conscious of environmental impact.

- Key features: Made from sustainably sourced bamboo, fully compostable, aesthetically pleasing design, various sizes and colors.

- Market research: They presented data highlighting the growing demand for eco-friendly alternatives to plastic straws, citing statistics on plastic waste and consumer preference shifts.

- Unique Selling Points (USPs): Superior biodegradability compared to competitors, competitive pricing, and strong commitment to ethical sourcing.

The Presentation and Delivery

The EcoStraws founders delivered a confident and engaging presentation. They expertly used visuals to showcase their product and its benefits, maintaining eye contact with the Dragons and effectively answering their challenging questions.

- Strengths: Clear and concise explanation of the business model, strong command of financial data, effective use of storytelling to connect with the Dragons.

- Weaknesses: Some minor hesitation during the Q&A, potentially underestimating the initial investment needed for scaling production.

Financial Projections and Viability

EcoStraws presented robust financial projections, detailing their revenue model, cost structure, and profit margins. Their projections demonstrated a clear path to profitability within a reasonable timeframe, crucial for securing Dragon Den investment.

- Key financial figures: Projected revenue growth of 30% year-on-year, detailed cost breakdown (materials, manufacturing, marketing), healthy profit margins.

- Funding request: £200,000 for expansion of production facilities and marketing campaigns.

- Use of funds: Specific allocation of funds for each aspect of the business growth plan, showcasing a well-thought-out strategy.

The Dragons' Reactions and Debates: A Clash of Perspectives

Initial Reactions and Concerns

The Dragons' initial reactions were mixed. Deborah Meaden expressed concern about the scalability of the business and the potential challenges of securing consistent supply of raw materials. Peter Jones, however, was impressed by the social impact of the product and its market potential.

- Deborah Meaden: Highlighted potential supply chain risks and questioned the long-term viability of the business model.

- Peter Jones: Praised the product's innovation and its alignment with current consumer trends, showcasing a potential high return on investment.

- Touker Suleyman: Focused on the pricing strategy and potential for profit margins.

The Negotiation Process

The negotiation was intense. Deborah initially offered a lower investment amount with stricter terms, while Peter proposed a higher investment with a larger equity stake. The entrepreneurs skilfully navigated these opposing viewpoints, ultimately securing a deal that addressed the Dragons' concerns.

- Offers: Deborah offered £150,000 for 40% equity, Peter offered £200,000 for 50% equity.

- Counter-offers and compromises: EcoStraws negotiated a deal with Peter Jones for £175,000 in exchange for 45% equity, addressing his concerns about return on investment.

Unforeseen Challenges and Risks

The Dragons highlighted several potential risks. Competition from established players in the eco-friendly product market presented a significant challenge. Securing a reliable and sustainable supply chain was another key concern.

- Market risks: Competition from established brands, potential shifts in consumer preferences.

- Financial risks: Potential for lower-than-projected sales, challenges in scaling production efficiently.

- Operational risks: Supply chain disruptions, potential quality control issues.

The Surprising Investment Decision: Reasons and Implications

The Chosen Dragon(s) and Investment Terms

Peter Jones ultimately invested £175,000 in EcoStraws in exchange for a 45% equity stake. This was surprising, given Deborah's initial skepticism.

- Investment terms: Clear agreement outlining equity distribution, milestones, and exit strategies. Specific clauses for future funding rounds.

Reasons Behind the Unexpected Decision

Peter Jones's investment decision stemmed from his belief in the long-term potential of the business despite the risks. He recognized the growing demand for sustainable products and the strength of the EcoStraws team.

- Key factors: Strong market potential, the entrepreneurs' passion and commitment, potential for significant social impact.

Long-Term Impact on the Business

Peter Jones's investment will significantly boost EcoStraws' production capacity and marketing efforts. This will likely accelerate its growth trajectory and establish it as a major player in the eco-friendly straw market.

- Expected growth: Rapid expansion into new markets, potentially including international distribution.

- Challenges of scaling: Maintaining quality control as production increases, managing supply chain complexities.

Conclusion: Learning from the Dragon Den Investment Showdown

This Dragon Den episode showcased a surprising investment decision driven by a blend of entrepreneurial vision, compelling product, and shrewd negotiation. The Dragons' initial skepticism and subsequent investment highlight the importance of thorough market research, a robust business plan, and the ability to effectively address investors' concerns. Learn from this Dragon Den investment by carefully studying the EcoStraws pitch, analyzing the Dragons' perspectives, and understanding the factors that ultimately led to the investment. Watch the full episode [link to video] and share your thoughts in the comments. Secure your own Dragon Den-style investment by meticulously planning your business strategy, creating a compelling pitch, and being prepared to handle tough questions from potential investors. Analyze this Dragon Den case study to gain valuable insights that can be applied to your own entrepreneurial journey.

Featured Posts

-

Klas Recognizes Nrc Health As The Best In Healthcare Experience Management

May 01, 2025

Klas Recognizes Nrc Health As The Best In Healthcare Experience Management

May 01, 2025 -

Investing In Ripple Xrp Understanding The Risks And Rewards

May 01, 2025

Investing In Ripple Xrp Understanding The Risks And Rewards

May 01, 2025 -

The Future Of French Rugby A Six Nations 2025 Perspective

May 01, 2025

The Future Of French Rugby A Six Nations 2025 Perspective

May 01, 2025 -

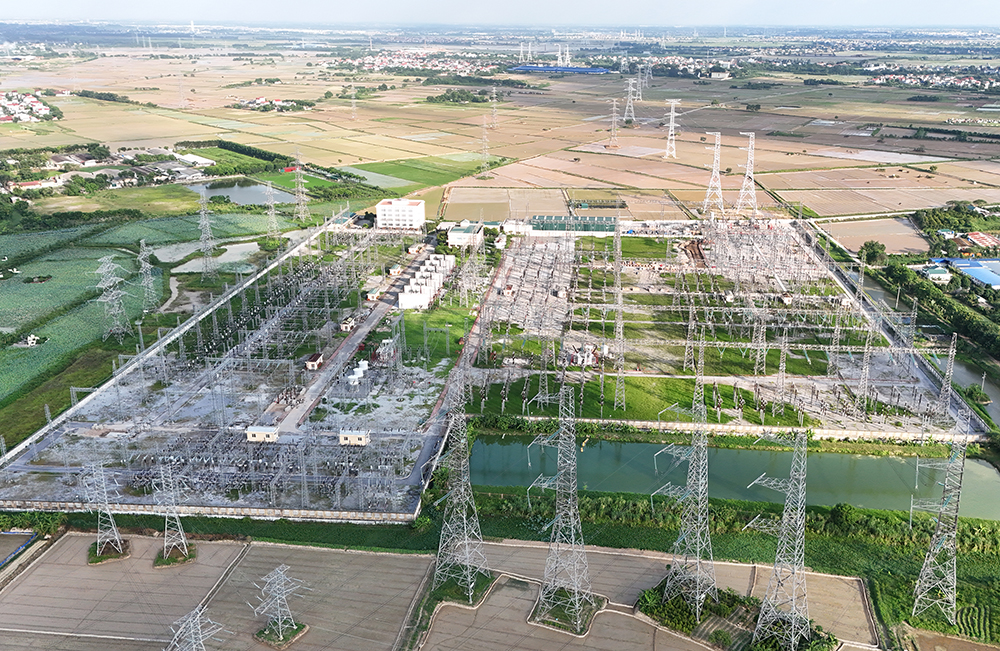

Hanh Trinh Cua Cong Nhan Dien Luc Mien Nam Tai Du An 500k V Mach 3

May 01, 2025

Hanh Trinh Cua Cong Nhan Dien Luc Mien Nam Tai Du An 500k V Mach 3

May 01, 2025 -

Crisis In De Tbs Zorg Onacceptabel Lange Wachttijden

May 01, 2025

Crisis In De Tbs Zorg Onacceptabel Lange Wachttijden

May 01, 2025

Latest Posts

-

Is A Minority Government Bad News For The Canadian Dollar A Strategists View

May 01, 2025

Is A Minority Government Bad News For The Canadian Dollar A Strategists View

May 01, 2025 -

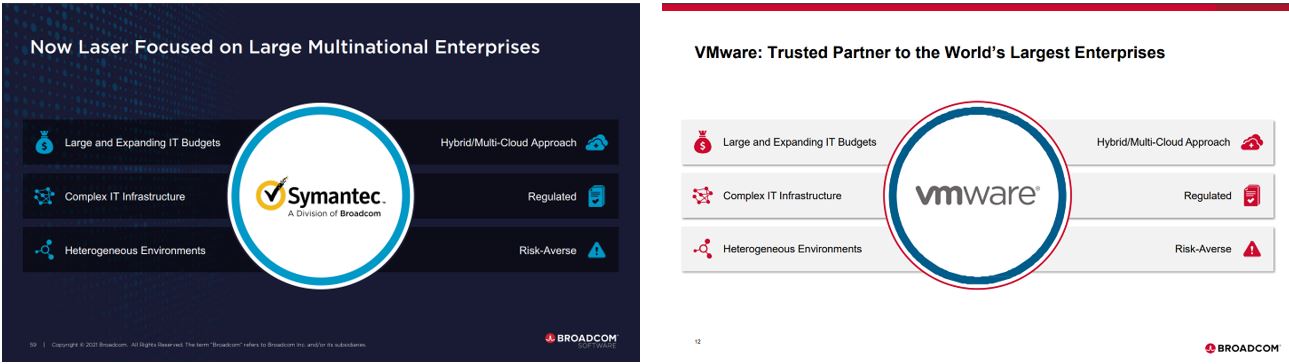

At And T Condemns Broadcoms Proposed 1 050 V Mware Price Surge

May 01, 2025

At And T Condemns Broadcoms Proposed 1 050 V Mware Price Surge

May 01, 2025 -

Broadcoms V Mware Acquisition At And T Highlights A 1 050 Cost Increase

May 01, 2025

Broadcoms V Mware Acquisition At And T Highlights A 1 050 Cost Increase

May 01, 2025 -

Election Uncertainty And Its Potential Effect On The Canadian Dollar

May 01, 2025

Election Uncertainty And Its Potential Effect On The Canadian Dollar

May 01, 2025 -

Extreme Price Hike Broadcoms V Mware Acquisition Faces At And T Backlash

May 01, 2025

Extreme Price Hike Broadcoms V Mware Acquisition Faces At And T Backlash

May 01, 2025