Dutch Central Bank Probes ABN Amro's Bonus System

Table of Contents

The DNB's Concerns Regarding ABN Amro's Bonus Structure

The DNB's investigation into the ABN Amro bonus system centers around several key concerns related to the structure and potential consequences of the incentive program. Specifically, the DNB has expressed apprehension about:

- Excessive Risk-Taking Incentives: The DNB is reportedly concerned that certain elements of the bonus structure may have inadvertently incentivized excessive risk-taking by employees, potentially jeopardizing the financial stability of the bank. This is a critical issue given the systemic importance of ABN Amro within the Dutch financial system.

- Lack of Transparency: Opacity in the bonus system's design and implementation is another significant concern. The DNB believes that a lack of transparency can make it difficult to assess the fairness and effectiveness of the system, potentially contributing to conflicts of interest. This lack of clarity also hinders external oversight and accountability.

- Potential Conflicts of Interest: Concerns have been raised about the potential for conflicts of interest within the ABN Amro bonus system. The DNB is investigating whether the structure creates situations where employees' personal interests might outweigh their fiduciary duty to the bank and its stakeholders.

- Non-Compliance with Dutch Banking Regulations: The DNB's investigation is also examining whether ABN Amro's bonus system fully complies with existing Dutch banking regulations and guidelines related to executive compensation and risk management. Breaches of these regulations could lead to significant penalties.

The DNB's stated concerns highlight potential flaws in the ABN Amro bonus system that could contribute to systemic risk. Further investigation may reveal instances where the bonus system incentivized undesirable behaviors, such as reckless lending or inadequate risk assessment.

Potential Consequences for ABN Amro

The DNB's investigation into the ABN Amro bonus system carries significant potential consequences for the bank. These include:

- Financial Penalties (Fines): If the investigation finds that ABN Amro has violated Dutch banking regulations, the bank could face substantial financial penalties in the form of fines. The amount of these fines would depend on the severity and nature of the violations.

- Reputational Damage: Even without significant fines, the investigation itself can cause reputational damage to ABN Amro. Negative publicity surrounding the investigation could erode investor confidence and damage the bank's brand image.

- Changes to the Bonus System (Restructuring, Increased Transparency): The DNB is likely to demand significant changes to ABN Amro's bonus system. This could involve a complete restructuring of the system to eliminate identified flaws and ensure greater transparency and alignment with best practices.

- Impact on Employee Morale and Retention: Changes to the bonus system may also affect employee morale and retention. Concerns about the fairness and competitiveness of the revised system could lead to employee dissatisfaction and potential talent flight.

The potential legal challenges associated with the DNB's findings add another layer of uncertainty to the future of ABN Amro's operations.

Wider Implications for the Dutch Banking Sector

The DNB's investigation into the ABN Amro bonus system has far-reaching implications for the broader Dutch banking sector. The ripple effects could include:

- Increased Regulatory Scrutiny of Other Banks' Bonus Systems: The investigation is likely to trigger increased regulatory scrutiny of bonus systems at other Dutch banks. Regulators may conduct similar reviews to identify and address potential risks.

- Potential for Broader Reforms in Dutch Banking Regulations: The findings could lead to broader reforms in Dutch banking regulations concerning executive compensation and risk management. The DNB might advocate for stricter rules and increased oversight to prevent similar situations in the future.

- Impact on Investor Confidence in the Dutch Banking Sector: Negative news related to the investigation could affect investor confidence in the Dutch banking sector as a whole. Investors might become more cautious about investing in Dutch banks, potentially leading to reduced capital inflows.

This increased scrutiny will affect how Dutch banks design and manage their compensation systems going forward.

Comparison with International Best Practices in Banking Compensation

To better understand the ABN Amro situation, comparing its bonus practices with international best practices is crucial. Many countries, including the UK and the US, have implemented reforms to align executive compensation with long-term value creation and minimize excessive risk-taking. These best practices often include:

- Long-Term Incentive Plans: These plans reward executives based on the bank's performance over a longer period, reducing the incentive for short-term gains at the expense of long-term stability.

- Clawback Provisions: Clawback provisions allow banks to recover bonuses paid to executives if their actions later prove to be detrimental to the bank's financial health.

- Transparency and Disclosure: Increased transparency and disclosure requirements are essential for ensuring accountability and building investor confidence.

The investigation highlights the need for ABN Amro and other Dutch banks to adopt international best practices, promoting ethical considerations and transparency within their bonus structures.

Conclusion

The Dutch Central Bank's investigation into the ABN Amro bonus system reveals significant concerns about the potential for excessive risk-taking and lack of transparency within the bank's compensation practices. The potential consequences for ABN Amro are substantial, including financial penalties, reputational damage, and system restructuring. Furthermore, the investigation has broader implications for the Dutch banking sector, potentially leading to increased regulatory scrutiny and reforms. The case underscores the critical need for robust and ethical compensation practices within the financial sector, emphasizing the importance of aligning incentives with long-term value creation and mitigating risks. Further investigation into similar bonus systems is essential to ensure financial stability and prevent excessive risk-taking. Stay informed about updates on this investigation and its impact on the ABN Amro bonus system and the broader financial landscape.

Featured Posts

-

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Next Steps

May 22, 2025

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Next Steps

May 22, 2025 -

Sse Announces 3 Billion Reduction In Spending Plan

May 22, 2025

Sse Announces 3 Billion Reduction In Spending Plan

May 22, 2025 -

I Pretended To Be A Missing Girl A Viral Reddit Story And Its Hollywood Adaptation

May 22, 2025

I Pretended To Be A Missing Girl A Viral Reddit Story And Its Hollywood Adaptation

May 22, 2025 -

G 7 To Debate Lowering Tariffs On Chinese Goods Impact On Global Trade

May 22, 2025

G 7 To Debate Lowering Tariffs On Chinese Goods Impact On Global Trade

May 22, 2025 -

Lucy Connollys Racial Hatred Conviction Confirmed

May 22, 2025

Lucy Connollys Racial Hatred Conviction Confirmed

May 22, 2025

Latest Posts

-

Thames Water Executive Bonuses A Closer Look At The Controversy

May 22, 2025

Thames Water Executive Bonuses A Closer Look At The Controversy

May 22, 2025 -

Open Ai Texas Data Center A 11 6 Billion Investment Boost

May 22, 2025

Open Ai Texas Data Center A 11 6 Billion Investment Boost

May 22, 2025 -

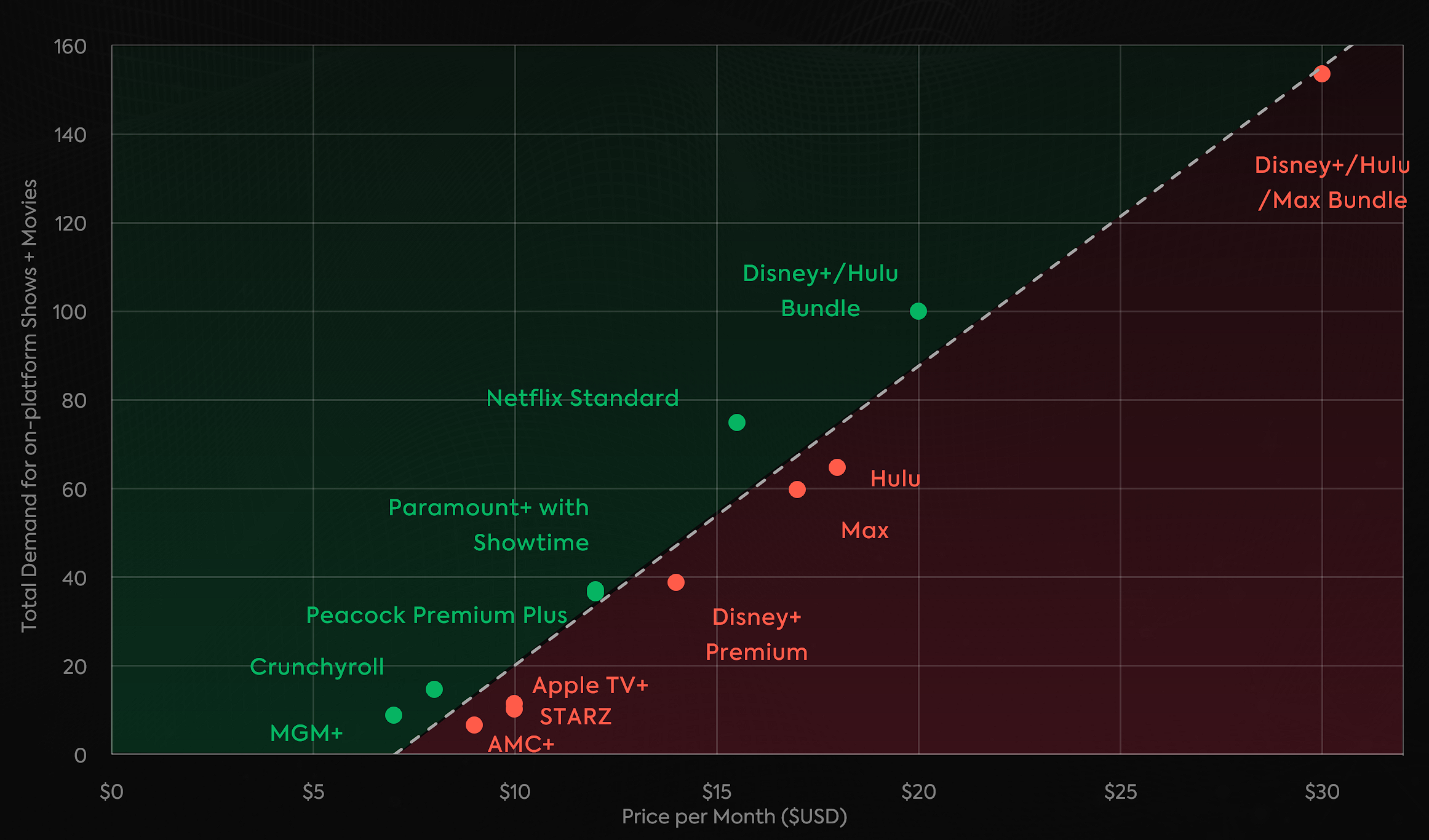

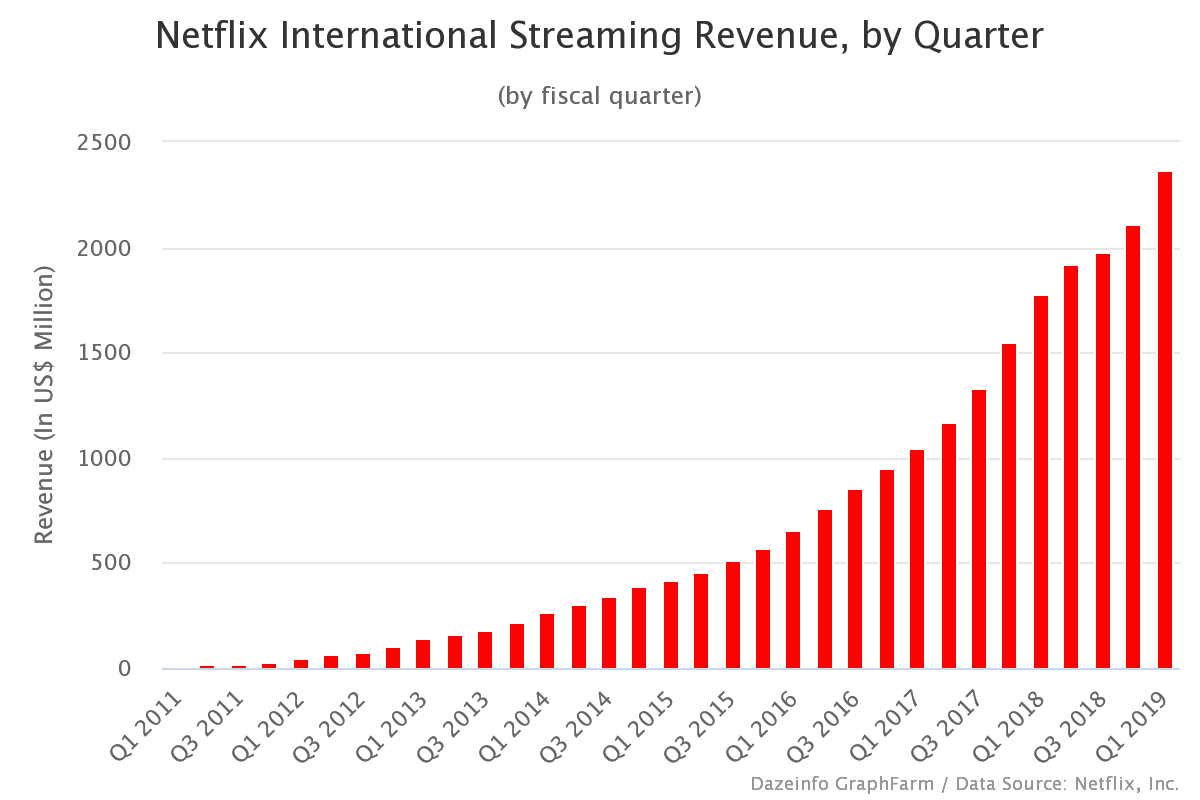

The Evolving Economics Of Streaming Impacts On Creators And Consumers

May 22, 2025

The Evolving Economics Of Streaming Impacts On Creators And Consumers

May 22, 2025 -

Streaming Revenue Models Good News For Creators Challenges For Viewers

May 22, 2025

Streaming Revenue Models Good News For Creators Challenges For Viewers

May 22, 2025 -

11 6 Billion Investment Fuels Open Ais Texas Data Center Expansion

May 22, 2025

11 6 Billion Investment Fuels Open Ais Texas Data Center Expansion

May 22, 2025