Economic Pressures Mount: The Federal Reserve's Decision On Interest Rates

Table of Contents

Inflationary Pressures and the Fed's Mandate

The Federal Reserve's dual mandate requires it to strive for both price stability and maximum employment. Currently, inflation, as measured by the Consumer Price Index (CPI) and the Producer Price Index (PPI), remains a significant concern. High inflation erodes purchasing power, impacting consumer spending and business investment. This decrease in consumer confidence can lead to a slowdown in economic growth. Several factors contribute to this inflationary pressure:

-

Supply chain disruptions: The lingering effects of the pandemic and geopolitical events continue to constrain global supply chains, leading to shortages and increased prices.

-

Energy price volatility: Fluctuations in global energy markets, particularly related to oil and natural gas, significantly influence inflation across various sectors.

-

Wage growth: While wage increases benefit workers, excessively rapid wage growth can contribute to a wage-price spiral, further fueling inflation.

-

Specific inflation data points: While recent data shows a slight cooling of inflation, it remains above the Fed's target of 2%. Close monitoring of CPI and PPI is crucial.

-

Impact on different income groups: Low-income households are disproportionately affected by inflation, as a larger portion of their income is spent on necessities whose prices rise more sharply.

-

Inflation expectations: The Fed closely watches inflation expectations—what consumers and businesses anticipate inflation to be in the future. If these expectations become unanchored, inflation can become self-fulfilling.

Unemployment and the Labor Market

The labor market presents another significant challenge for the Federal Reserve. While unemployment rates are currently relatively low, the relationship between interest rate hikes and potential job losses is complex. Raising interest rates cools down the economy, which can lead to job losses. The Fed aims for a "soft landing"—slowing economic growth enough to curb inflation without triggering a recession and widespread job losses. However, achieving a soft landing is notoriously difficult.

- Current unemployment statistics: While the unemployment rate is low, it's important to monitor for any significant shifts.

- Job growth numbers and sectors: Analyzing job growth across different sectors helps understand the health of the economy and potential areas of weakness.

- Potential impact on different demographics: Younger workers and those in less secure positions are often more vulnerable to job losses during economic downturns.

Global Economic Uncertainty and its Influence

The Federal Reserve's decisions are not made in isolation. Global economic factors significantly influence its choices. Geopolitical instability, such as the ongoing war in Ukraine, and the ongoing energy crisis in Europe create uncertainty and ripple effects across global markets.

- Examples of geopolitical events: The war in Ukraine has disrupted energy supplies and created significant uncertainty in global markets.

- Impact of global supply chain disruptions: Global supply chain disruptions continue to impact production and pricing across various industries.

- Currency exchange rate fluctuations: Fluctuations in currency exchange rates can affect the price of imported goods and influence inflation.

Potential Outcomes of the Interest Rate Decision

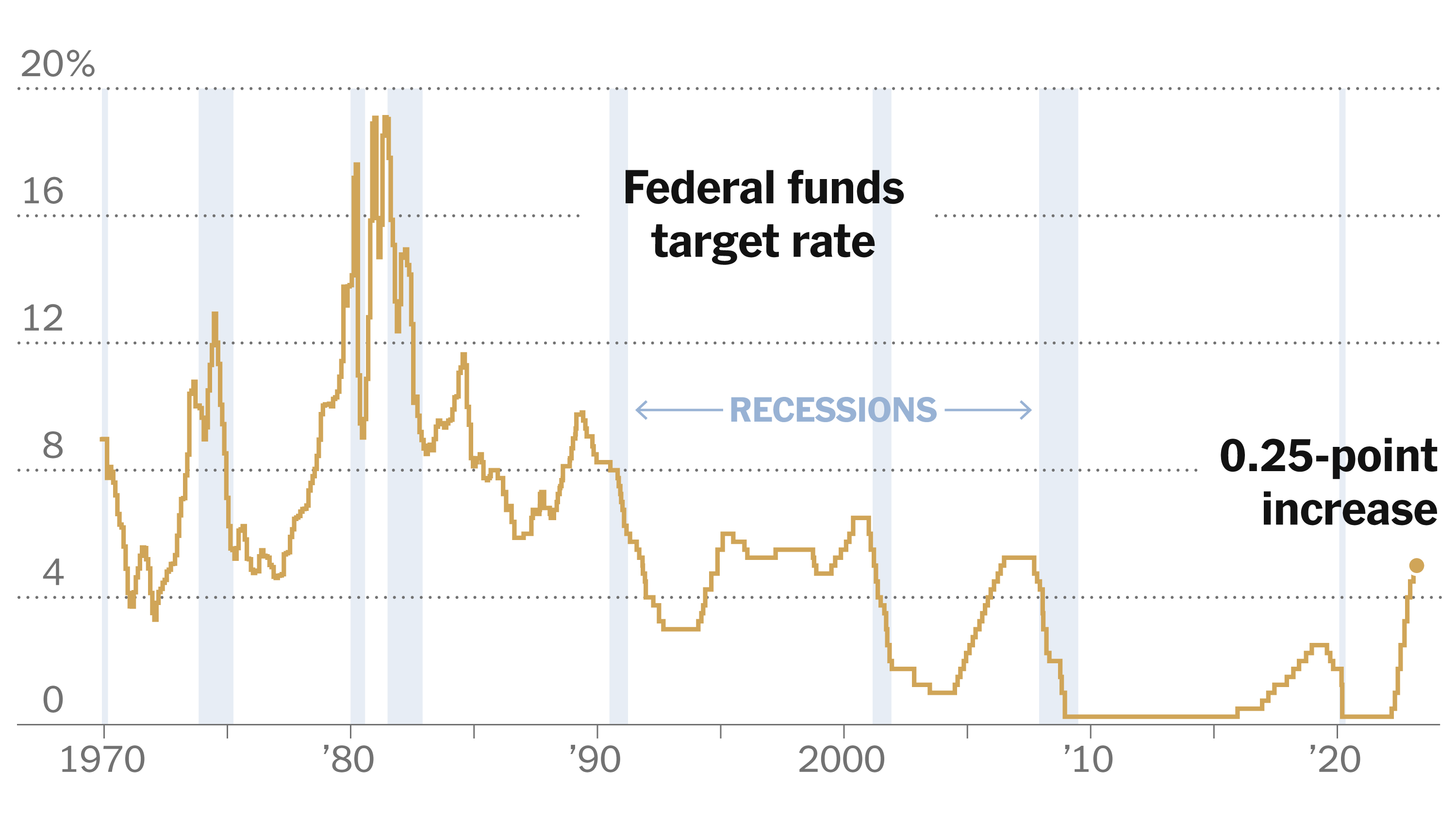

The Federal Reserve faces several options: a rate hike, a rate pause, or even a rate cut. Each scenario carries distinct economic consequences.

-

Rate hike: A rate hike aims to curb inflation but risks slowing economic growth and potentially triggering a recession.

-

Rate pause: A pause allows the Fed to assess the impact of previous rate hikes before making further adjustments.

-

Rate cut: A rate cut would stimulate economic growth but could exacerbate inflationary pressures.

-

Potential impact on the housing market: Interest rate hikes typically lead to higher mortgage rates, cooling down the housing market.

-

Impact on consumer borrowing and spending: Higher interest rates increase borrowing costs, potentially reducing consumer spending.

-

Effects on the stock market and investor sentiment: Interest rate decisions can significantly impact investor sentiment and stock market performance.

The Federal Reserve's Interest Rate Decision: What Lies Ahead?

The Federal Reserve's decision on interest rates is a complex balancing act, influenced by the intricate interplay of inflation, unemployment, and global economic uncertainty. The potential outcomes—a rate hike, pause, or cut—each have significant implications for the US and global economies. The challenge lies in navigating these competing pressures to achieve the Fed's dual mandate. Staying informed about the Federal Reserve's decisions and their impact on the economy is crucial. Follow reputable financial news sources and continue to learn about Federal Reserve interest rate decisions and their influence on economic pressures to make informed decisions about your own financial well-being.

Featured Posts

-

Apples Ai Innovation Integration And The Path Ahead

May 09, 2025

Apples Ai Innovation Integration And The Path Ahead

May 09, 2025 -

Cowherds Persistent Attacks On Jayson Tatums Game

May 09, 2025

Cowherds Persistent Attacks On Jayson Tatums Game

May 09, 2025 -

Nhl 2024 25 Key Storylines For The Remaining Season

May 09, 2025

Nhl 2024 25 Key Storylines For The Remaining Season

May 09, 2025 -

Colin Cowherd And Jayson Tatum A History Of Disagreement

May 09, 2025

Colin Cowherd And Jayson Tatum A History Of Disagreement

May 09, 2025 -

Zolotaya Malina Kto Iz Zvezd Poluchil Antinagradu Vklyuchaya Dakotu Dzhonson

May 09, 2025

Zolotaya Malina Kto Iz Zvezd Poluchil Antinagradu Vklyuchaya Dakotu Dzhonson

May 09, 2025