Elon Musk, Tesla, And Dogecoin: A Correlation In Recent Market Volatility

Table of Contents

Elon Musk's Influence on Dogecoin

Musk's Tweets and Dogecoin's Price

Elon Musk's tweets have a demonstrably significant impact on Dogecoin's price. His pronouncements, often whimsical and cryptic, can trigger dramatic price fluctuations. He's earned the nickname "Dogefather" due to his apparent influence.

- Examples: A single tweet mentioning Dogecoin can send its price soaring, while a negative comment or even a perceived lack of attention can lead to sharp declines. Several instances of this phenomenon have been well-documented, highlighting the extreme sensitivity of Dogecoin to Musk's social media activity.

- Market Manipulation Concerns: The power Musk wields over Dogecoin's price has raised concerns about potential market manipulation. Critics argue that his actions, while seemingly informal, could be construed as artificially influencing the market for personal gain or amusement. The lack of transparency and the decentralized nature of cryptocurrencies make regulation and oversight challenging in such scenarios.

- Keywords: Dogecoin price, Elon Musk tweets, market manipulation, cryptocurrency volatility, Dogefather, Dogecoin pump and dump.

Musk's Endorsement and Dogecoin Adoption

Musk's public endorsement of Dogecoin has significantly boosted its adoption rate and market capitalization. His influence extends beyond his immediate follower base, generating significant media coverage and attracting new investors.

- Increased Media Attention: Musk's association with Dogecoin has brought the cryptocurrency into the mainstream media spotlight, increasing its visibility and attracting a broader range of investors, both experienced and novice.

- Growth in Dogecoin Community: The increased interest has fueled the growth of the Dogecoin community, with more users actively trading and engaging with the cryptocurrency.

- Impact on Trading Volume: The volatility caused by Musk's actions also leads to substantially increased trading volume, further impacting the price and market capitalization.

- Keywords: Dogecoin adoption, market capitalization, Tesla Dogecoin payments, cryptocurrency investment, Dogecoin community.

The Tesla-Dogecoin Connection

Tesla's Stock Performance and Musk's Actions

A noticeable correlation exists between Tesla's stock price and Musk's activities related to Dogecoin. Positive sentiment towards Dogecoin often seems to translate into positive sentiment towards Tesla stock, and vice-versa, though the relationship isn't always linear.

- Simultaneous Price Movements: There have been instances where significant movements in Dogecoin's price are mirrored, albeit sometimes with a lag, by movements in Tesla's stock price, suggesting a shared investor sentiment.

- Analysis of Investor Sentiment: Investors who hold both Tesla stock and Dogecoin might be more sensitive to news about either asset, creating a feedback loop influencing both prices.

- Diversification Strategies: This interconnectedness highlights a significant risk for investors who hold both assets; a downturn in one could negatively affect the perception and price of the other. Diversification across different asset classes remains crucial for risk mitigation.

- Keywords: Tesla stock price, Tesla Dogecoin correlation, investor sentiment, stock market volatility, Tesla investment, Dogecoin investment.

The Impact of Musk's Business Decisions on Both Assets

Musk's business decisions concerning Tesla also influence the perception and price of both Tesla and Dogecoin. Major announcements about Tesla products or market expansions can impact investor sentiment towards both assets.

- Tesla Announcements: Positive news about Tesla tends to benefit both Tesla's stock price and Dogecoin, reflecting a positive overall sentiment towards Musk's enterprises. Conversely, negative news could affect both negatively.

- Investor Psychology: The intertwined nature of investor psychology regarding Musk's various ventures suggests a complex, interconnected market response. Investors' belief in Musk's overall success can influence their perception of both Tesla and Dogecoin.

- Keywords: Tesla announcements, investor psychology, market sentiment, cryptocurrency correlation, stock market correlation, Tesla innovation.

The Broader Implications of this Correlation

Risk and Volatility in Cryptocurrency Investments

Investing in cryptocurrencies, especially those heavily influenced by a single individual, carries significant risks. The unpredictable nature of the market, driven by factors like Musk's tweets, highlights the dangers of emotional investing.

- Unpredictable Nature of the Market: The Dogecoin market's reliance on Musk's actions creates a highly speculative environment, making long-term predictions difficult.

- Dangers of Emotional Investing: Investors swayed by Musk's pronouncements are particularly vulnerable to significant losses if sentiment shifts.

- Importance of Diversification: A well-diversified portfolio, including a range of assets unrelated to Musk's influence, can help mitigate the risks associated with investing in Dogecoin.

- Keywords: Cryptocurrency risk, investment risk, market volatility, diversification, responsible investing, cryptocurrency speculation.

Regulatory Scrutiny and Future Outlook

Musk's actions have raised questions about the need for greater regulatory oversight of cryptocurrencies. Government intervention could significantly impact both Dogecoin and Tesla.

- Potential Regulatory Changes: Increased scrutiny of Musk's influence on cryptocurrency markets could lead to regulatory changes aimed at preventing market manipulation and protecting investors.

- Impact of Government Intervention: Regulatory intervention could limit Musk's ability to influence cryptocurrency prices, potentially stabilizing the market but also potentially limiting its growth.

- Long-Term Predictions: The future trajectory of both Dogecoin and Tesla remains uncertain, depending largely on broader market trends, regulatory developments, and Musk's own actions.

- Keywords: Cryptocurrency regulation, SEC regulation, future of Dogecoin, future of Tesla, market prediction, cryptocurrency future.

Conclusion

The correlation between Elon Musk, Tesla, and Dogecoin's price volatility is undeniable. Musk's actions significantly impact the market, creating both opportunities and considerable risks. The unpredictable nature of this interplay underscores the importance of informed decision-making and robust risk management strategies in cryptocurrency investments. Understanding the intricacies of this dynamic is crucial for navigating the volatile landscape of the cryptocurrency market. Continue learning about the intricacies of this dynamic interplay to make informed decisions about your investments in Elon Musk, Tesla, and Dogecoin. Stay informed and invest wisely!

Featured Posts

-

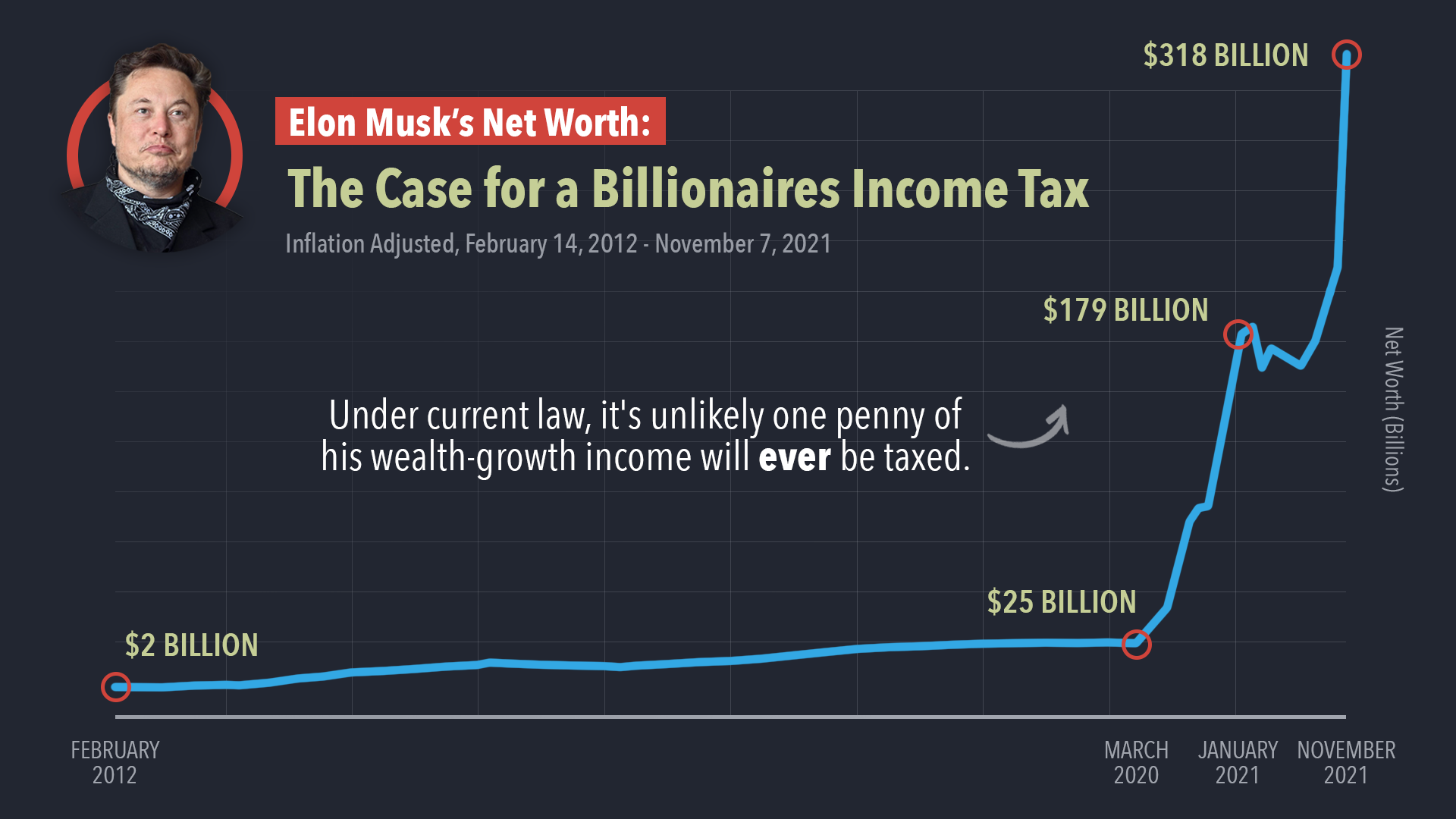

Elon Musks Wealth Strategies Investments And Business Acumen

May 09, 2025

Elon Musks Wealth Strategies Investments And Business Acumen

May 09, 2025 -

New Totalitarian Threat Lais Warning In Ve Day Speech

May 09, 2025

New Totalitarian Threat Lais Warning In Ve Day Speech

May 09, 2025 -

La Landlord Price Gouging The Aftermath Of The Fires And A Celebritys Response

May 09, 2025

La Landlord Price Gouging The Aftermath Of The Fires And A Celebritys Response

May 09, 2025 -

Woman Accused Of Impersonating Madeleine Mc Cann Charged With Stalking

May 09, 2025

Woman Accused Of Impersonating Madeleine Mc Cann Charged With Stalking

May 09, 2025 -

Rio Ferdinand Changes His Mind New Prediction For Psg Vs Arsenal Champions League Final

May 09, 2025

Rio Ferdinand Changes His Mind New Prediction For Psg Vs Arsenal Champions League Final

May 09, 2025