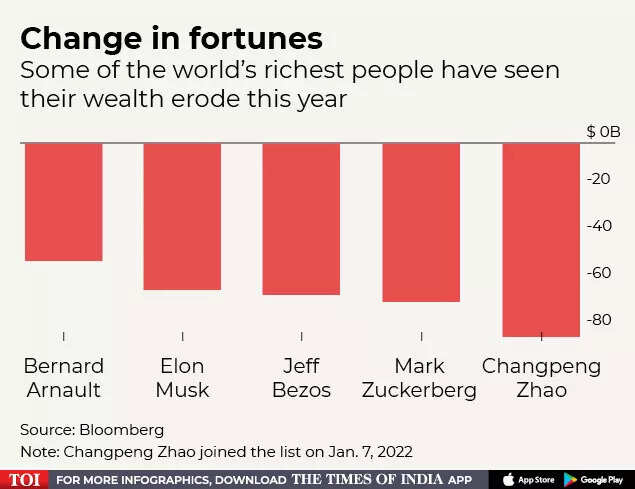

Estimating The Billions Lost By Elon Musk, Jeff Bezos, And Mark Zuckerberg Post-Trump Inauguration

Table of Contents

Elon Musk's Post-Inauguration Losses

The Trump administration's policies created significant uncertainty, directly influencing Elon Musk's net worth, primarily through the volatility of Tesla's stock price and indirect impacts on SpaceX's valuation.

Tesla Stock Volatility

Policy changes and general market uncertainty significantly impacted Tesla's stock price.

- Shifting Trade Policies: Trump's trade wars and tariffs impacted the global supply chain for electric vehicle components, increasing costs and creating uncertainty.

- Electric Vehicle Subsidies: Fluctuations in government support for electric vehicles affected Tesla's profitability and investor confidence.

- Stock Price Plunges: Tesla's stock experienced significant drops during periods of heightened political and economic uncertainty, directly impacting Musk's net worth. For example, [insert data and link to a reliable source showing a specific stock price drop and its correlation with a specific policy change]. [Insert relevant chart/graph here visualizing the stock price fluctuations during this period].

SpaceX Funding and Valuation

While SpaceX wasn't as directly affected by immediate policy changes as Tesla, the overall political climate and market uncertainty could have influenced investor sentiment and funding rounds.

- Investor Hesitation: The uncertain political climate might have led some potential investors to exercise caution, potentially slowing down SpaceX's fundraising or impacting its valuation.

- Government Contracts: Changes in government priorities and spending could have had indirect consequences for SpaceX's government contracts.

- Valuation Comparisons: Analyzing SpaceX's valuation before and after the inauguration can reveal any potential impact from the change in administration. [If possible, insert data and link to a reliable source].

Jeff Bezos's Amazon and Post-Inauguration Challenges

Jeff Bezos's wealth, largely tied to Amazon's success, faced significant headwinds during the Trump presidency. Trade wars and increased regulatory scrutiny presented major challenges.

Trade Wars and Tariffs

Trump's trade policies significantly impacted Amazon's international business and supply chains.

- Increased Import Costs: Tariffs imposed on various goods increased Amazon's import costs, affecting its profitability and consumer prices.

- Supply Chain Disruptions: Trade tensions disrupted global supply chains, causing delays and impacting Amazon's logistics.

- Financial Losses Estimates: While precise quantification is difficult, the impact of tariffs on Amazon's operations undoubtedly resulted in considerable financial losses. [Insert estimates from reputable financial news sources and links if available].

Regulatory Scrutiny and Antitrust Concerns

The Trump administration also saw increased regulatory pressure on Amazon, leading to antitrust concerns and legal battles.

- Antitrust Investigations: Amazon faced several antitrust investigations, scrutinizing its business practices and market dominance. [Mention specific examples of investigations].

- Legal Battles and Costs: Defending against these lawsuits incurred significant legal costs, potentially impacting Amazon's profitability.

- Stock Price Impact: The increased regulatory uncertainty likely contributed to fluctuations in Amazon's stock price, influencing Bezos's overall wealth. [Insert data and relevant chart/graph showing stock price correlation with regulatory news].

Mark Zuckerberg's Facebook and the Post-Inauguration Landscape

Mark Zuckerberg's fortune was also impacted by the post-inauguration climate, largely due to increased social media regulation and evolving public perception.

Social Media Regulation and Public Opinion

The social media landscape shifted dramatically, affecting Facebook's advertising revenue and stock price.

- Misinformation Concerns: Increased scrutiny over misinformation and its spread on Facebook led to regulatory pressure and public backlash.

- Privacy Concerns: Growing concerns over data privacy and Facebook's handling of user data resulted in fines and penalties. [Mention specific examples and quantify the financial impact, if available].

- Advertising Revenue Fluctuations: Changes in regulatory landscape and public perception impacted Facebook's advertising revenue, a major component of its profitability. [Include relevant data and sources].

Political Polarization and Brand Perception

The politically charged atmosphere fueled public backlash against Facebook, negatively impacting its brand perception and value.

- Negative Press Coverage: Facebook faced considerable negative press related to political polarization and its role in disseminating misinformation.

- User Engagement Changes: The controversies might have led to changes in user engagement and potentially affected user growth.

- Investor Confidence: The negative publicity and regulatory pressure likely impacted investor confidence, potentially affecting Facebook's stock price and Zuckerberg's net worth.

Conclusion

The post-Trump inauguration period witnessed significant financial losses for Elon Musk, Jeff Bezos, and Mark Zuckerberg. These losses were largely attributable to policy uncertainty, trade wars, increased regulatory scrutiny, and shifting public perception. The impact of these external factors underscores the vulnerability of even the wealthiest tech titans to unforeseen political and economic shifts. The analysis reveals that the political climate can have a profound influence on the fortunes of major tech CEOs and the stability of the global markets.

Key Takeaways: This analysis highlights the interconnectedness of political climate, economic policy, and the financial success of leading tech companies. The substantial losses experienced by Musk, Bezos, and Zuckerberg demonstrate the risks associated with operating in a volatile political environment.

Call to Action: Want to learn more about the impact of political climates on the net worth of tech giants? Explore more analyses on estimating the billions lost by Elon Musk, Jeff Bezos, and Mark Zuckerberg post-Trump inauguration, and delve deeper into the intricacies of market volatility and its effect on the world's wealthiest individuals.

Featured Posts

-

Arctic Comic Con 2025 Character Spotlights Ectomobile And Fan Interactions

May 09, 2025

Arctic Comic Con 2025 Character Spotlights Ectomobile And Fan Interactions

May 09, 2025 -

Wynne Evans Health Battle Illness Details And Potential Showbiz Comeback

May 09, 2025

Wynne Evans Health Battle Illness Details And Potential Showbiz Comeback

May 09, 2025 -

Phat Hien Va Xu Ly Kip Thoi Hanh Vi Bao Hanh Tre Em Tai Co So Giu Tre Tu Nhan

May 09, 2025

Phat Hien Va Xu Ly Kip Thoi Hanh Vi Bao Hanh Tre Em Tai Co So Giu Tre Tu Nhan

May 09, 2025 -

Where To Start A Business A Guide To The Countrys Best New Locations

May 09, 2025

Where To Start A Business A Guide To The Countrys Best New Locations

May 09, 2025 -

Judge Who Jailed Becker Heads Nottingham Attack Inquiry

May 09, 2025

Judge Who Jailed Becker Heads Nottingham Attack Inquiry

May 09, 2025