Euro Futures Climb Amidst US Market Weakness: Swissquote Bank Perspective

Table of Contents

US Market Weakness: The Primary Catalyst

Recent declines in major US indices like the Dow Jones, S&P 500, and Nasdaq have significantly impacted global markets, creating a ripple effect that has boosted the Euro. This weakness stems from several converging factors:

- Negative Economic Indicators: High inflation figures, persistent interest rate hikes by the Federal Reserve, and slowing economic growth have fueled investor concerns about a potential recession.

- Geopolitical Events: Ongoing geopolitical instability, including the war in Ukraine and rising global tensions, further contributes to market uncertainty and risk aversion.

- Shifting Investor Sentiment: The combination of negative economic data and geopolitical risks has led to a significant shift in investor sentiment, with many moving towards safer assets, indirectly benefiting the Euro.

The correlation between US market performance and Euro strength is demonstrably inverse. When US markets decline, investors often seek havens, and the Euro, backed by the relatively stable Eurozone economy, frequently benefits from this flight to safety. (Insert relevant chart/graph here illustrating the inverse relationship between US indices and Euro Futures prices)

Strengthening Euro: Factors Contributing to the Climb in Euro Futures

The Euro's relative strength compared to the US dollar is not solely a reaction to US market weakness. Several positive factors within the Eurozone are also playing a crucial role:

- Positive Economic Data: While challenges remain, the Eurozone has shown signs of resilience with positive GDP growth in certain sectors and relatively robust employment figures in several key member states.

- European Central Bank (ECB) Monetary Policy: The ECB's measured approach to monetary policy, while tackling inflation, has instilled a degree of confidence among investors.

- Shifting Investor Confidence: The perceived stability of the Eurozone, combined with the aforementioned US market weakness, has led to a gradual but noticeable shift in investor confidence, driving demand for the Euro.

These positive developments are directly contributing to increased demand for Euro Futures contracts. This increased demand, coupled with the safe-haven appeal of the Euro during times of global uncertainty, fuels the ongoing climb.

Swissquote Bank's Market Analysis and Insights

Swissquote Bank, a leading financial institution, offers valuable insights into the current Euro Futures market. Their analysis emphasizes the interplay between US market weakness and the Eurozone's relative strength as the primary driver of the current trend.

- Swissquote's Analysis: Swissquote's experts highlight the confluence of factors discussed above, emphasizing the significance of investor sentiment shifts and the safe-haven demand for the Euro.

- Swissquote's Predictions: (Insert Swissquote Bank's predictions or forecasts regarding Euro Futures, citing the source).

- Swissquote's Trading Strategies: (Summarize any recommended trading strategies suggested by Swissquote Bank, emphasizing responsible trading practices.)

Swissquote Bank's expertise and reputation provide valuable context and credibility to the analysis of this complex market dynamic.

Implications for Investors: Navigating the Euro Futures Market

The current trend in Euro Futures presents both opportunities and risks for investors. Understanding these nuances is crucial for informed decision-making:

- Profiting from the Trend: Investors can potentially profit from the upward trend in Euro Futures through various trading strategies, such as long positions or using options contracts. (Mention specific strategies but caution against overly aggressive approaches).

- Risks Associated with Trading: Trading Euro Futures carries inherent risks, including volatility and the potential for significant losses due to leverage.

- Risk Management: Employing robust risk management techniques, such as setting stop-loss orders and diversifying your portfolio, is crucial to mitigate potential losses.

Thorough market research, careful risk assessment, and a well-defined trading plan are essential before engaging in Euro Futures trading.

Conclusion

The climb in Euro Futures is predominantly attributed to the weakness in the US market, combined with a relatively stronger Eurozone economy and the insightful analysis provided by Swissquote Bank. Understanding the factors influencing Euro Futures prices is vital for making informed investment decisions. Stay informed on the latest developments in the Euro Futures market by regularly checking Swissquote Bank's analysis and resources. Monitor your Euro Futures positions closely and adapt your trading strategies accordingly. Learn more about trading Euro Futures with Swissquote Bank today!

Featured Posts

-

New Uber Pet Service Delhi And Mumbai Cities Covered

May 19, 2025

New Uber Pet Service Delhi And Mumbai Cities Covered

May 19, 2025 -

The Socioeconomic Impact Of Popular Rave Music Festivals

May 19, 2025

The Socioeconomic Impact Of Popular Rave Music Festivals

May 19, 2025 -

Visit Orlando 2025 Event Pictures And Travel Guide

May 19, 2025

Visit Orlando 2025 Event Pictures And Travel Guide

May 19, 2025 -

Tragedy At Fsu Unveiling The Background Of A Shooting Victims Father

May 19, 2025

Tragedy At Fsu Unveiling The Background Of A Shooting Victims Father

May 19, 2025 -

Reaccion De Alfonso Arus A La Eleccion De Melody Para Eurovision 2025 En Arusero

May 19, 2025

Reaccion De Alfonso Arus A La Eleccion De Melody Para Eurovision 2025 En Arusero

May 19, 2025

Latest Posts

-

Kaysima Pagkypria Sygkrisi Timon Kai Pratirion

May 19, 2025

Kaysima Pagkypria Sygkrisi Timon Kai Pratirion

May 19, 2025 -

Pratiria Kaysimon Kypros Breite Ta Pio Oikonomika

May 19, 2025

Pratiria Kaysimon Kypros Breite Ta Pio Oikonomika

May 19, 2025 -

Fthina Kaysima Kypros Sygkritiki Anazitisi Pratirion

May 19, 2025

Fthina Kaysima Kypros Sygkritiki Anazitisi Pratirion

May 19, 2025 -

Times Kaysimon Kypros Odigos Gia Tin Eksoikonomisi

May 19, 2025

Times Kaysimon Kypros Odigos Gia Tin Eksoikonomisi

May 19, 2025 -

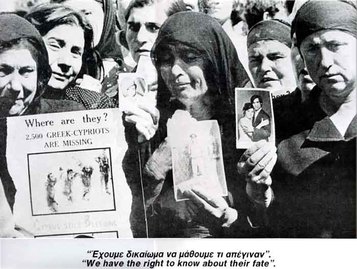

To Kypriako Zitima Kateynasmos I Antiparathesi

May 19, 2025

To Kypriako Zitima Kateynasmos I Antiparathesi

May 19, 2025