Euronext Amsterdam Stocks Soar: Trump's Tariff Relief Fuels 8% Increase

Table of Contents

Trump's Tariff Relief Announcement and its Impact

The Trump administration's decision to significantly reduce tariffs on certain goods imported from the European Union had an immediate and profound impact on businesses listed on Euronext Amsterdam. This move, largely seen as a de-escalation of the US-EU trade war, injected much-needed confidence into the market.

-

Specific Tariff Relief Measures: The announcement included a reduction in tariffs on various goods, including specific agricultural products, manufactured goods, and certain technology components. Details were released via official press statements and official government channels.

-

Direct Impact on Euronext Amsterdam Businesses: Companies heavily reliant on US-EU trade, particularly those involved in export-oriented industries, benefited immensely. The reduction in tariffs lowered their production costs and improved their competitiveness in the US market.

-

Benefiting Companies: Several companies listed on Euronext Amsterdam saw immediate and substantial gains. For example, [Insert Example Company A] saw its stock price increase by X%, while [Insert Example Company B] experienced a Y% surge. These gains directly reflect the positive impact of reduced tariffs on their profitability and bottom line.

-

Data Points: A detailed breakdown of stock price changes for key companies affected by the tariff relief is crucial for a thorough analysis. This data should be presented in charts and graphs for easier understanding. Keywords: Trump administration, tariff reduction, trade war, economic impact, market volatility, US-EU trade.

Analysis of the 8% Increase in Euronext Amsterdam Stocks

The 8% increase in Euronext Amsterdam stocks wasn't solely driven by tariff relief; it was a confluence of factors playing out in a volatile global market.

-

Significant Contributors: While tariff reduction was a primary driver, investor sentiment played a crucial role. The positive news sparked a wave of optimism, encouraging investors to buy stocks, pushing prices higher.

-

Investor Sentiment and Market Speculation: Market speculation also amplified the effect. Investors anticipated further positive developments in US-EU trade relations, further fueling the buying spree.

-

Global Economic Context: The broader global economic climate also influenced the increase. While specifics need to be analyzed, a generally positive outlook on the global economy likely enhanced investor confidence.

-

Visual Representation: Charts and graphs illustrating the stock price movements during this period will provide a clear and concise visual representation of the market’s dramatic shift. Keywords: stock price analysis, market trends, investor confidence, economic indicators, market capitalization, stock performance.

Sectors Most Affected by the Tariff Relief

The tariff relief didn't impact all sectors equally. Certain industries experienced disproportionately large gains.

-

Technology Sector: The technology sector, with its significant reliance on international trade and supply chains, benefitted tremendously from the tariff reduction. Companies producing semiconductors and other tech components experienced considerable growth.

-

Manufacturing and Agriculture: Manufacturing and agriculture, similarly tied to global trade flows, also saw significant increases. The reduction in trade barriers directly translated into increased profitability for many companies in these sectors.

-

Case Studies: Analyzing specific companies within each sector that benefited most will provide valuable insights. For instance, ASML Holding N.V., a leading producer of lithography systems for the semiconductor industry, likely experienced significant gains due to the tariff relief impacting the tech sector. Keywords: sector performance, industry analysis, specific company examples (e.g., ASML, Unilever), market share, competitive advantage.

Potential Long-Term Implications for Euronext Amsterdam

The short-term surge raises questions about the potential for sustained growth in the Euronext Amsterdam market.

-

Sustained Growth Potential: The tariff relief could indeed lead to sustained growth, particularly if the positive trade relations between the US and EU continue. This could attract further foreign investment.

-

Risks and Uncertainties: However, numerous uncertainties remain. Geopolitical instability, economic downturns, and unforeseen changes in trade policy could all negatively impact future performance.

-

Impact on Foreign Investment: The improved trade environment and market optimism might attract increased foreign investment into Euronext Amsterdam, further boosting its long-term growth.

-

Market Attractiveness: The recent surge enhances Euronext Amsterdam's attractiveness as an investment destination, drawing in more investors both domestically and internationally. Keywords: long-term outlook, future growth, market prediction, investment opportunities, risk assessment, market stability.

Conclusion: Understanding the Euronext Amsterdam Stock Market Surge

The 8% surge in Euronext Amsterdam stocks underscores the significant impact of Trump's tariff relief on the European market. The analysis revealed a complex interplay of factors, including direct tariff benefits, investor sentiment, market speculation, and the broader global economic climate. While the short-term outlook appears positive, potential risks and uncertainties remain. Understanding these dynamics is crucial for navigating the Euronext Amsterdam market and making informed investment decisions.

To stay informed about future developments and potential investment opportunities within the Euronext Amsterdam stock market, continue to monitor Euronext Amsterdam stocks closely. Further reading on US-EU trade relations and global economic forecasts will provide valuable context for future market analysis. Keywords: Euronext Amsterdam stocks, market analysis, investment strategy, stock market trends, financial news.

Featured Posts

-

Us Bands Glastonbury Gig Unconfirmed But Fans Are Buzzing

May 25, 2025

Us Bands Glastonbury Gig Unconfirmed But Fans Are Buzzing

May 25, 2025 -

Snelle Marktdraai Europese Aandelen Een Diepgaande Analyse

May 25, 2025

Snelle Marktdraai Europese Aandelen Een Diepgaande Analyse

May 25, 2025 -

Your Guide To Bbc Big Weekend 2025 Sefton Park Tickets

May 25, 2025

Your Guide To Bbc Big Weekend 2025 Sefton Park Tickets

May 25, 2025 -

2 Fall On Amsterdam Stock Exchange Following Trumps Tariff Announcement

May 25, 2025

2 Fall On Amsterdam Stock Exchange Following Trumps Tariff Announcement

May 25, 2025 -

Complete Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms Confirmed

May 25, 2025

Complete Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms Confirmed

May 25, 2025

Latest Posts

-

New Orleans Jail Escape Attempt Inmates Used Hair Trimmers Source Reveals

May 25, 2025

New Orleans Jail Escape Attempt Inmates Used Hair Trimmers Source Reveals

May 25, 2025 -

Thames Waters Executive Bonus Scheme A Case Study In Corporate Governance

May 25, 2025

Thames Waters Executive Bonus Scheme A Case Study In Corporate Governance

May 25, 2025 -

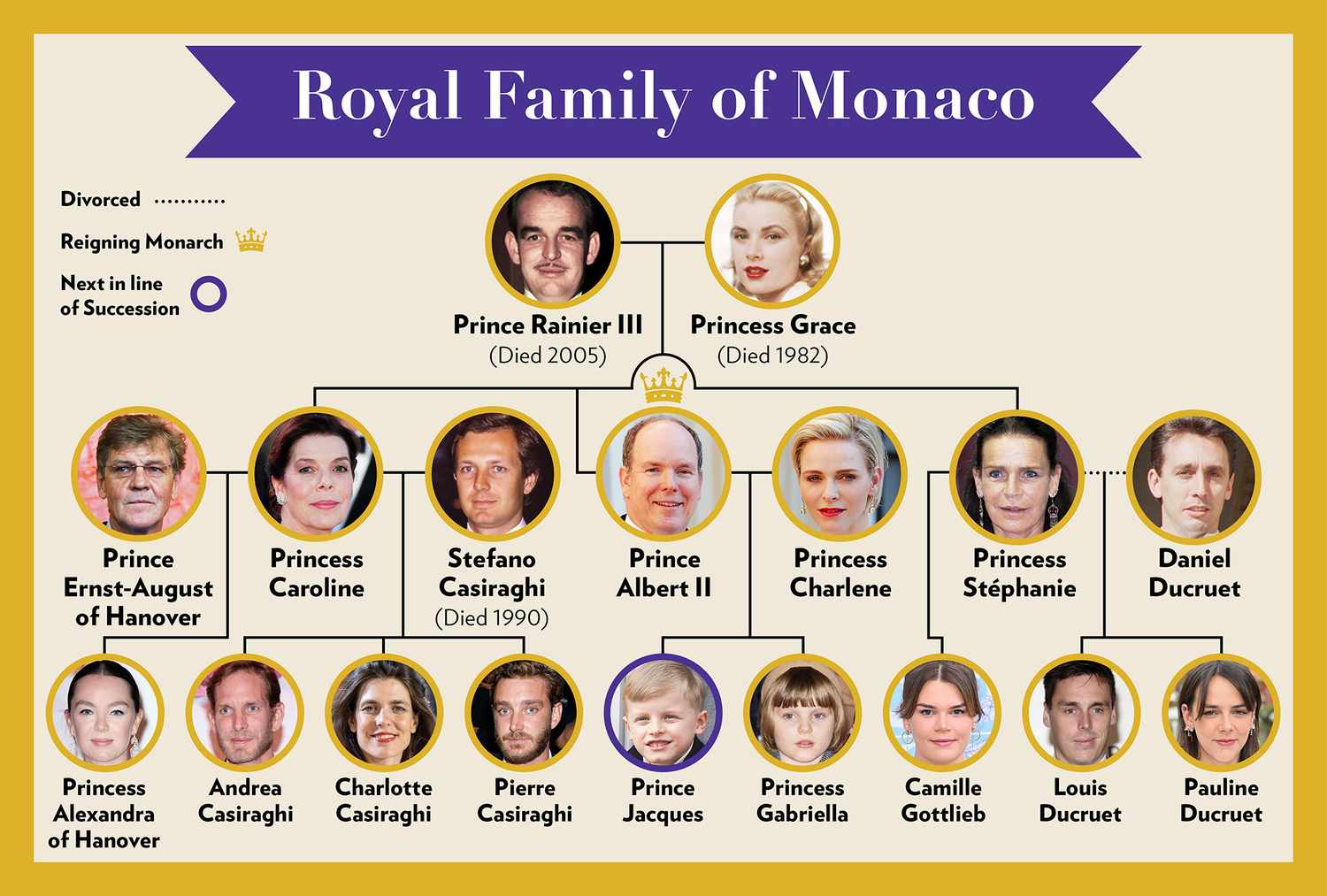

Investigation Into Monacos Royal Finances A Corruption Scandal Unfolds

May 25, 2025

Investigation Into Monacos Royal Finances A Corruption Scandal Unfolds

May 25, 2025 -

Cold Case Solved Georgia Husband Charged In Wifes Death Nannys Disappearance After 19 Years

May 25, 2025

Cold Case Solved Georgia Husband Charged In Wifes Death Nannys Disappearance After 19 Years

May 25, 2025 -

Thames Water Executive Bonuses Fuel Public Anger And Calls For Reform

May 25, 2025

Thames Water Executive Bonuses Fuel Public Anger And Calls For Reform

May 25, 2025