European Market Update: Tariff Hopes And LVMH's Sharp Drop

Table of Contents

Impact of Tariffs on the European Economy

The European Union's economic health is significantly influenced by the global trade environment, and tariffs play a crucial role. Understanding the current tariff landscape and the potential for tariff reduction is vital for assessing the European market's future.

Current Tariff Landscape

The current tariff landscape presents a mixed picture for European businesses. Ongoing trade disputes, particularly with the US, have resulted in tariffs on various goods. For example, the steel and aluminum tariffs imposed by the US have impacted European producers, leading to increased costs and reduced competitiveness.

- Key industries impacted: Steel, aluminum, agriculture, automotive.

- Types of tariffs imposed: Import duties, anti-dumping duties, countervailing duties.

- Overall economic consequences: Reduced trade volumes, increased prices for consumers, decreased profitability for businesses.

Data from Eurostat shows a noticeable decrease in trade volume between the EU and the US since the imposition of tariffs, confirming the negative economic consequences. Further analysis from the OECD highlights the ripple effect these tariffs have on related industries and supply chains.

Hopes for Tariff Reduction

Despite the current challenges, there are hopes for tariff reduction through ongoing negotiations and potential trade agreements. The EU is actively engaged in discussions to resolve trade disputes and create a more favorable trading environment.

- Ongoing negotiations: Discussions between the EU and the US on various trade issues are underway.

- Potential outcomes: A reduction or elimination of existing tariffs, the establishment of new trade agreements.

- Anticipated impact: Increased trade volume, lower prices for consumers, improved profitability for businesses.

However, achieving significant tariff reductions will depend on several factors, including political will and the willingness of both sides to compromise. Experts predict a positive but gradual decrease in tariffs, cautioning against overly optimistic forecasts.

LVMH's Stock Performance and Market Analysis

LVMH, a leading luxury goods conglomerate, has recently experienced a significant stock market downturn, prompting concerns about the broader health of the European economy and the luxury goods sector.

LVMH's Recent Stock Drop

LVMH's stock price has seen a considerable decline in recent weeks (specify timeframe and percentage drop using current data). This drop reflects a combination of factors and uncertainties in the European and global economic climate.

- Factors contributing to the downturn: Concerns about slowing global economic growth, reduced consumer spending in key markets (e.g., China), and the overall market sentiment.

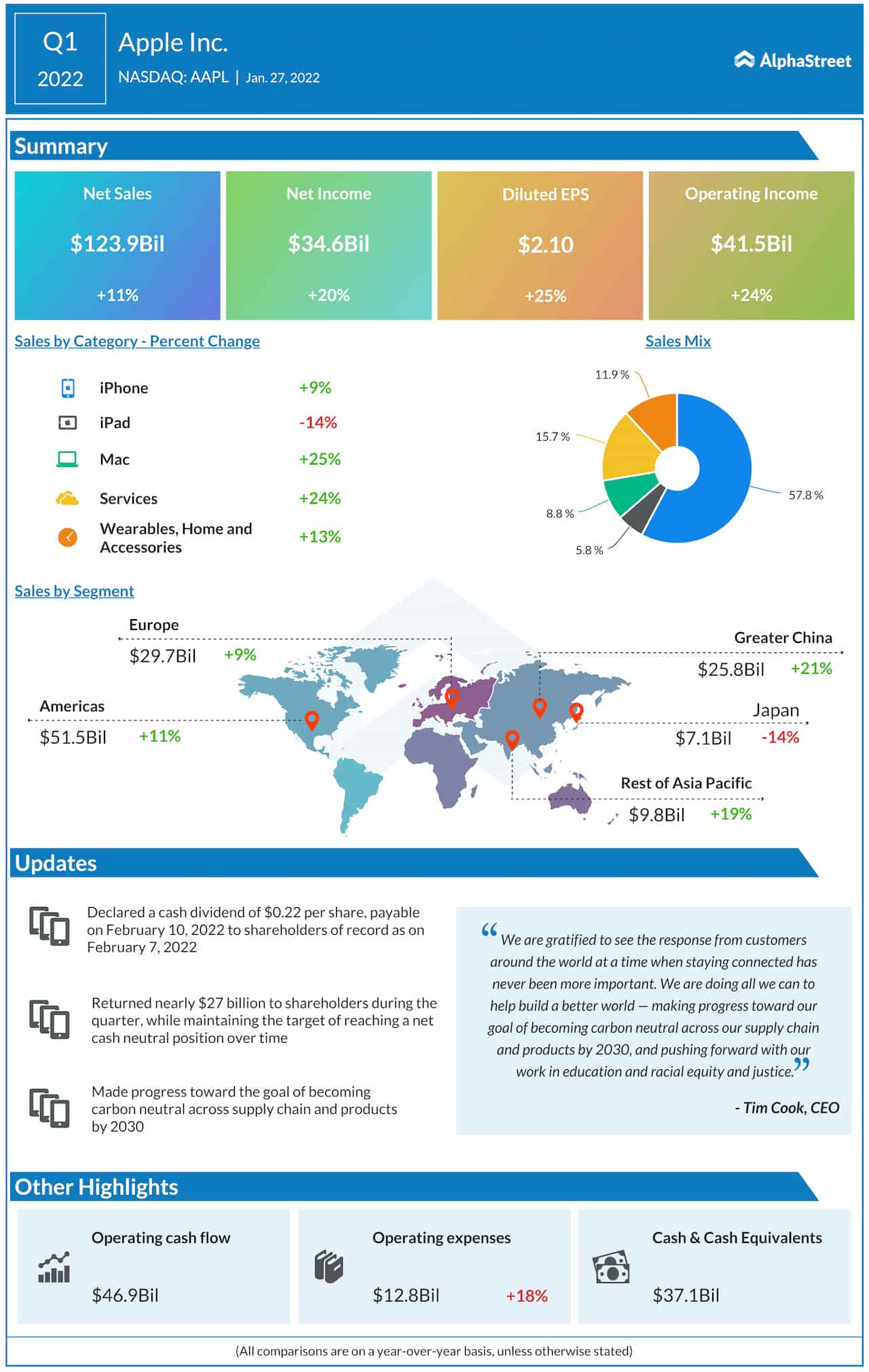

- (Include a chart or graph visually representing the stock performance).

This data clearly shows the significant drop in LVMH's stock price.

Implications for the Luxury Goods Sector

The decline in LVMH's stock price has significant implications for the broader luxury goods sector in Europe. It signals a potential slowdown in consumer spending and heightened market uncertainty.

- Potential ripple effects: Other luxury brands may experience similar performance drops, impacting their profitability and investment attractiveness.

- Overall market impact: The downturn could lead to decreased investment in the luxury sector, impacting jobs and economic growth in related industries.

Industry analysts at Morgan Stanley predict a moderate recovery in the luxury sector in the coming months, but warn that the volatility remains a significant challenge.

Overall European Market Outlook and Predictions

Assessing the overall European market outlook requires considering various economic indicators and geopolitical factors.

Economic Growth Projections

Current economic forecasts for the European Union suggest moderate growth, but with significant risks.

- Key indicators: GDP growth is projected to be (insert current projections from reputable sources like IMF or OECD), inflation rate at (insert current data), and unemployment rate at (insert current data).

- Potential risks and opportunities: Geopolitical instability, energy prices, and technological disruptions pose significant risks, while investments in green technologies and digitalization present opportunities.

Investor Sentiment and Market Confidence

Investor sentiment and market confidence are crucial indicators of the European market’s health.

- Factors influencing investor confidence: Geopolitical events (e.g., the war in Ukraine), interest rate hikes by the European Central Bank, and regulatory changes all influence investor sentiment.

- Overall sentiment: (Assess whether the current sentiment is optimistic, pessimistic, or neutral based on current market data and expert opinions.)

The current mixed signals require a cautious approach in assessing the European market's future.

Conclusion: European Market Update: Navigating Uncertain Times

This European market update highlights the complex interplay between tariffs, the performance of major companies like LVMH, and the overall economic outlook. The impact of tariffs on the European economy is undeniable, and while hopes for tariff reduction exist, navigating the current uncertainties requires careful analysis. LVMH's recent stock drop underscores the vulnerabilities within the luxury goods sector and reflects broader market concerns. The overall European market outlook is projected to be moderate, yet volatility and uncertainty persist.

Stay informed on the latest developments in the European market by subscribing to our newsletter for regular updates on tariffs, LVMH stock performance, and the overall economic outlook. Further resources for in-depth European market analysis can be found at [link to relevant resources, e.g., Eurostat, OECD].

Featured Posts

-

Kerings Financial Report Sales Down Guccis New Era Begins

May 24, 2025

Kerings Financial Report Sales Down Guccis New Era Begins

May 24, 2025 -

Trillery I Pavel I Vzglyad Fedora Lavrova Na Chelovecheskuyu Tyagu K Ostrym Oschuscheniyam

May 24, 2025

Trillery I Pavel I Vzglyad Fedora Lavrova Na Chelovecheskuyu Tyagu K Ostrym Oschuscheniyam

May 24, 2025 -

Your Guide To Bbc Radio 1 Big Weekend Tickets

May 24, 2025

Your Guide To Bbc Radio 1 Big Weekend Tickets

May 24, 2025 -

Vecher Pamyati Sergeya Yurskogo Teatr Mossoveta

May 24, 2025

Vecher Pamyati Sergeya Yurskogo Teatr Mossoveta

May 24, 2025 -

Konchita Vurst O Favoritakh Evrovideniya 2025 Goda

May 24, 2025

Konchita Vurst O Favoritakh Evrovideniya 2025 Goda

May 24, 2025

Latest Posts

-

Apple Stock Outlook Analyzing Q2 Results And Future Growth

May 24, 2025

Apple Stock Outlook Analyzing Q2 Results And Future Growth

May 24, 2025 -

Apple Stock Q2 Earnings I Phone Sales Boost Profits

May 24, 2025

Apple Stock Q2 Earnings I Phone Sales Boost Profits

May 24, 2025 -

Apple Stock Performance Exceeding Q2 Expectations

May 24, 2025

Apple Stock Performance Exceeding Q2 Expectations

May 24, 2025 -

I Phone Ai I Phone

May 24, 2025

I Phone Ai I Phone

May 24, 2025 -

Berkshire Hathaways Apple Holdings The Impact Of Ceo Transition

May 24, 2025

Berkshire Hathaways Apple Holdings The Impact Of Ceo Transition

May 24, 2025