Evaluating D-Wave Quantum Inc. (QBTS) For Investment

Table of Contents

Understanding D-Wave Quantum Inc.'s Business Model

D-Wave Quantum's business model centers on its unique approach to quantum computing: quantum annealing. Unlike gate-based quantum computers pursued by competitors like IBM and Google, D-Wave's systems are designed to solve specific optimization problems exceptionally efficiently. This specialized approach has implications for both the potential applications and the overall market opportunity.

-

Quantum Annealing Explained: Quantum annealing leverages quantum mechanics to find the lowest energy state of a system, representing the optimal solution to a complex problem. While not as versatile as gate-based models, it excels in tackling specific optimization challenges. This makes it suitable for various applications, but also limits its broad applicability.

-

The D-Wave Advantage System: D-Wave's flagship product, the Advantage system, boasts a significantly increased number of qubits compared to its predecessors, enhancing its computational power. Key features include improved connectivity between qubits, leading to more efficient problem-solving and a more robust architecture overall.

-

Applications of D-Wave Technology: Current applications focus on areas like logistics optimization, materials science research (discovering new materials), and financial modeling (portfolio optimization, fraud detection). Future applications could expand into areas such as drug discovery and artificial intelligence. This wide range of potential use cases is a key driver of investor interest in D-Wave Quantum.

-

Revenue Model and Financial Performance: D-Wave generates revenue through the sale of its quantum computers and cloud access to its systems, allowing clients to leverage its technology without significant upfront investment. Analyzing D-Wave's financial reports provides insight into its current performance and future prospects – which are crucial when evaluating QBTS.

Analyzing D-Wave Quantum's Financial Performance and Growth Potential

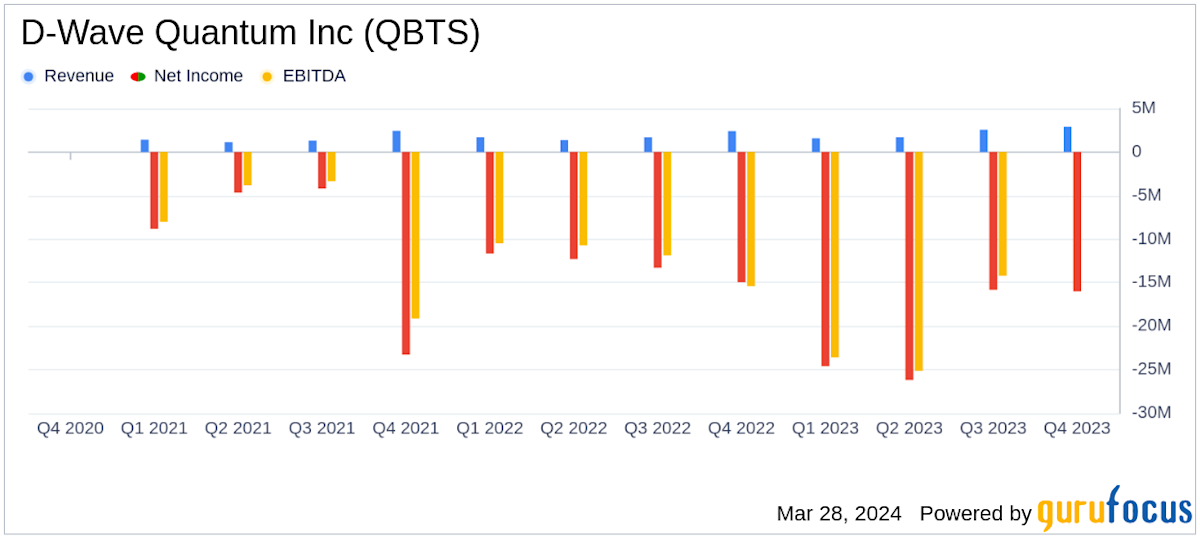

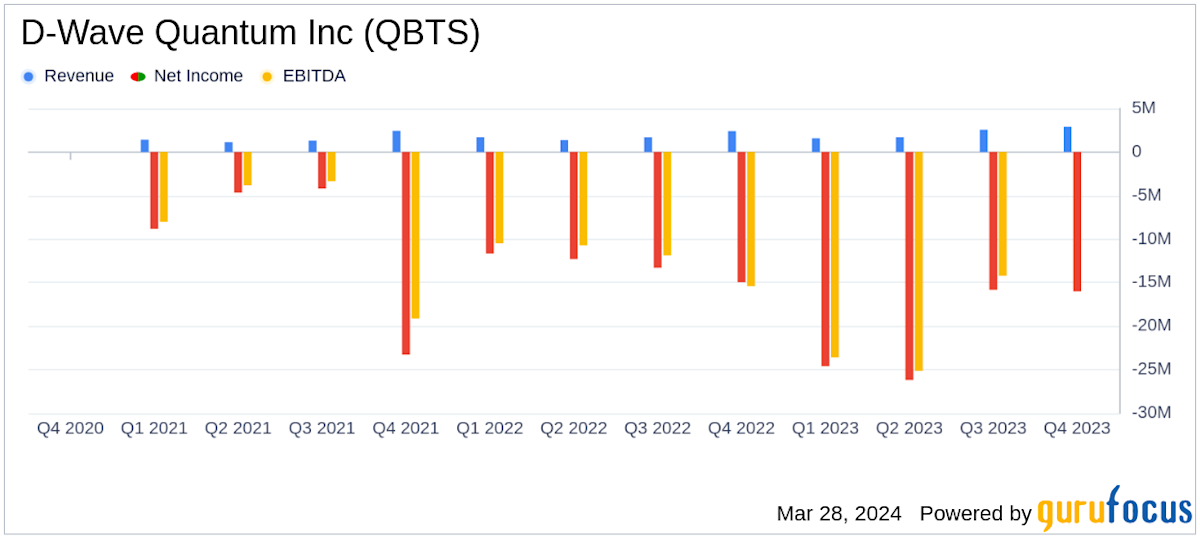

Evaluating QBTS requires a thorough analysis of its financial performance and growth potential. As a relatively young company in a rapidly developing sector, assessing its financial statements requires careful consideration of its stage of development. Profitability may not be the immediate focus, but revenue growth, along with the overall trajectory of the quantum computing market, offers vital clues.

-

Review of Financial Reports: Examining D-Wave’s revenue, expenses, and overall profitability is key. Understanding the source of revenue (hardware sales, cloud access, etc.) is vital in assessing future earning potential.

-

Key Financial Ratios: While traditional metrics like P/E ratio might not be entirely relevant at this stage, other indicators like revenue growth rate and burn rate (rate of cash outflow) provide crucial insights into the company's financial health.

-

Quantum Computing Market Growth: The projected growth of the global quantum computing market is a significant factor. Estimates vary, but forecasts predict exponential growth over the next decade, positioning D-Wave for substantial market share, if it can maintain its technological edge and expand its client base.

-

Investment Risks: Investing in QBTS involves significant risk. The stock price is likely to be volatile, reflecting the uncertainties inherent in a high-growth, early-stage technology company. Competition from established tech giants and the possibility of unforeseen technological breakthroughs could also impact D-Wave's future prospects. D-Wave valuation should be considered carefully in light of these risks.

Competitive Landscape and Technological Advancements

D-Wave operates in a competitive landscape dominated by tech giants like IBM, Google, and Rigetti Computing, each pursuing different approaches to quantum computing. Understanding D-Wave's competitive positioning is vital to assess its long-term prospects.

-

Comparing D-Wave to Competitors: D-Wave's focus on quantum annealing differentiates it from competitors primarily focused on gate-based quantum computing. While gate-based systems offer greater versatility, D-Wave's approach excels in specific optimization problems. The strengths and weaknesses of each approach must be carefully considered.

-

D-Wave's Innovation Pipeline: The pace of technological advancements in quantum computing is extremely rapid. D-Wave's ability to innovate and adapt to this evolving landscape will determine its long-term success. Analyzing their research and development efforts is essential.

-

Disruptive Technologies: The field of quantum computing is prone to unexpected breakthroughs. The emergence of entirely new technologies or significant improvements in existing approaches could significantly impact D-Wave's competitive position.

Evaluating QBTS as an Investment: Risks and Rewards

Investing in QBTS presents a high-risk, high-reward proposition. The potential returns are significant, given the projected growth of the quantum computing market, but so are the risks.

-

Strengths and Weaknesses: D-Wave's strengths include its early mover advantage in quantum annealing, a growing client base, and a strong intellectual property portfolio. Weaknesses include the niche nature of its technology and the intense competition in the quantum computing market.

-

Investment Strategies and Risk Tolerance: Investing in QBTS is suitable for long-term investors with a high-risk tolerance. A diversified investment strategy is essential to mitigate potential losses. Short-term speculation in QBTS is extremely risky given the volatility of the stock.

-

Due Diligence and Further Research: Before investing, conduct thorough due diligence. Analyze D-Wave's financial reports, examine industry reports on quantum computing market growth, and understand the competitive landscape.

Conclusion

Investing in D-Wave Quantum Inc. (QBTS) presents a unique opportunity to participate in the burgeoning quantum computing revolution. While the potential rewards are substantial, the risks are considerable. This analysis highlights the importance of thorough due diligence, careful consideration of your investment strategy, and an understanding of the inherent volatility of investing in this high-growth, early-stage technology sector. Before making any investment decisions regarding D-Wave Quantum, we strongly encourage further research into D-Wave's financial reports and other publicly available information. The future of quantum computing is bright, and D-Wave is positioned to play a significant role, but careful consideration of all factors is paramount. Thoroughly research the D-Wave Quantum investment opportunity before making any decisions.

Featured Posts

-

Nyt Mini Crossword April 13 Answers And Solution

May 20, 2025

Nyt Mini Crossword April 13 Answers And Solution

May 20, 2025 -

Nyt Mini Crossword March 13 2025 Complete Answers

May 20, 2025

Nyt Mini Crossword March 13 2025 Complete Answers

May 20, 2025 -

Napad Na Detsu U Bi Kh Tadi Optuzhu E Shmita Za Podstitsanje Nasilja

May 20, 2025

Napad Na Detsu U Bi Kh Tadi Optuzhu E Shmita Za Podstitsanje Nasilja

May 20, 2025 -

Hmrc Website Unavailable Extensive Service Disruption In The Uk

May 20, 2025

Hmrc Website Unavailable Extensive Service Disruption In The Uk

May 20, 2025 -

Kaellman Ja Hoskonen Loppu Puola Uralle

May 20, 2025

Kaellman Ja Hoskonen Loppu Puola Uralle

May 20, 2025

Latest Posts

-

The Future Of Aj Styles In Wwe Contract Talks And Speculation

May 20, 2025

The Future Of Aj Styles In Wwe Contract Talks And Speculation

May 20, 2025 -

Huuhkajien Uusi Valmennus Ja Mm Karsinnat

May 20, 2025

Huuhkajien Uusi Valmennus Ja Mm Karsinnat

May 20, 2025 -

Aj Styles Contract Situation A Wwe Update

May 20, 2025

Aj Styles Contract Situation A Wwe Update

May 20, 2025 -

Huuhkajat Mm Karsintoihin Uusi Valmennusstrategia

May 20, 2025

Huuhkajat Mm Karsintoihin Uusi Valmennusstrategia

May 20, 2025 -

Backstage News Whats Next For Aj Styles In Wwe

May 20, 2025

Backstage News Whats Next For Aj Styles In Wwe

May 20, 2025