Evaluating Palantir Stock Before The May 5th Earnings Announcement

Table of Contents

Palantir's Recent Performance and Key Metrics

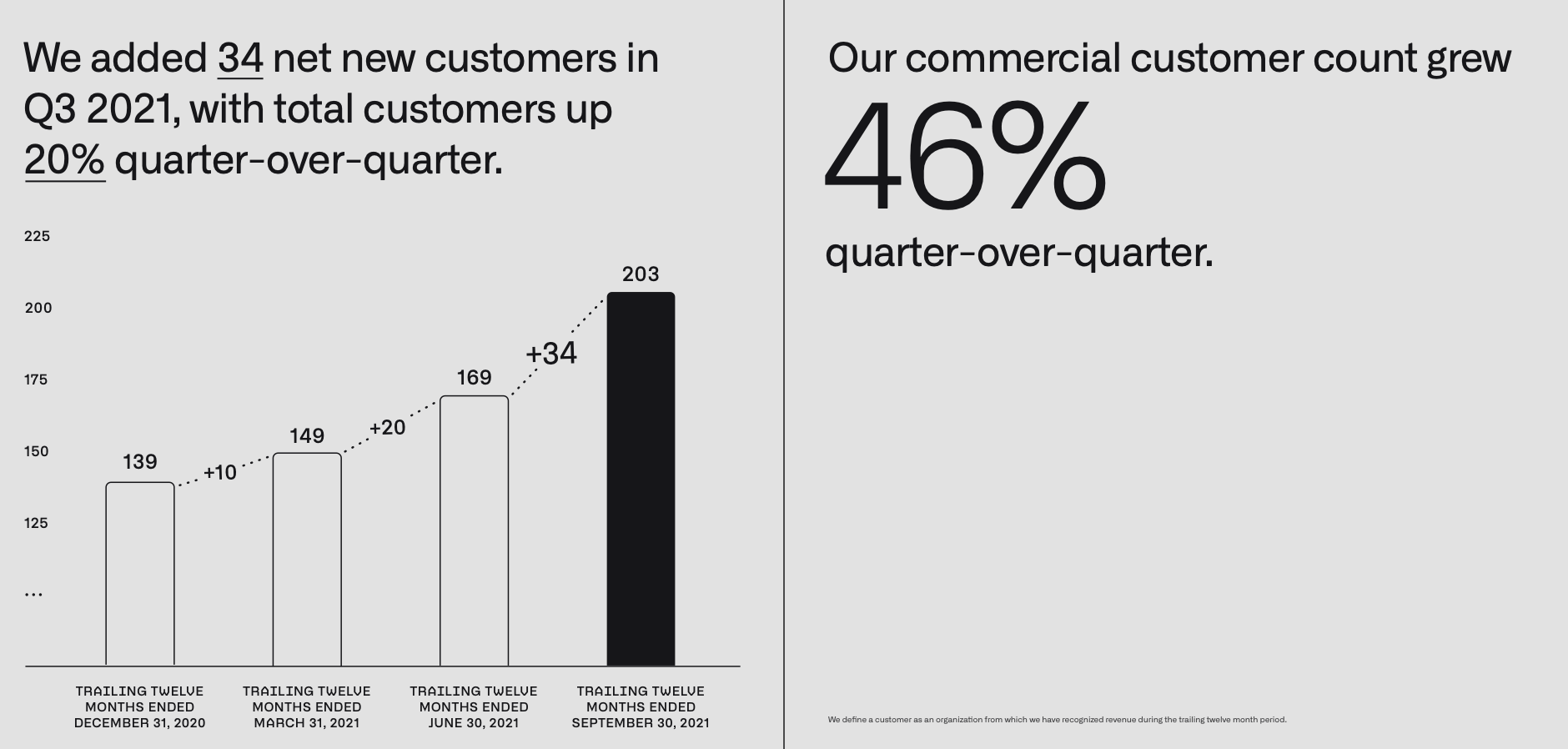

Analyzing Palantir's recent financial performance is crucial for any informed investment decision. Key metrics like revenue growth, profitability (operating margin, net income), and free cash flow provide a strong indication of the company's financial health and stability. Comparing these figures to previous quarters and analyst expectations paints a clearer picture of Palantir's trajectory.

-

Review revenue growth trends in both government and commercial sectors: Tracking the growth in both sectors helps gauge the diversification of Palantir's revenue streams and its ability to penetrate various markets. A strong and consistent growth across both sectors is a positive sign.

-

Assess the impact of any recent contracts or partnerships: New large government contracts or significant commercial partnerships can significantly influence Palantir's revenue and future outlook. Analyzing these developments helps understand their potential impact on future earnings.

-

Analyze changes in operating margin and profitability: Examining the operating margin and net income reveals Palantir's ability to manage costs and translate revenue into profit. Improvements in these areas demonstrate increased operational efficiency and financial strength.

-

Evaluate free cash flow generation and its implications for future investment: Free cash flow is a critical metric, indicating the amount of cash a company generates after accounting for capital expenditures. A healthy free cash flow supports future investments in research and development, acquisitions, and share buybacks, furthering growth.

Growth Prospects and Future Outlook for Palantir

Palantir's long-term growth potential hinges on several factors, including its position in the rapidly expanding data analytics sector, the increasing demand for AI-driven solutions, and its strategic partnerships. The company's plans for expansion into new markets and product offerings also play a vital role.

-

Assess the size and growth potential of the data analytics market: Understanding the market size and projected growth provides context for Palantir's potential. A large and rapidly growing market offers significant opportunities for expansion and increased market share.

-

Analyze Palantir's competitive advantages in AI and data analytics: Palantir’s proprietary technology and its ability to process and analyze vast amounts of data are key competitive advantages. Analyzing these strengths against competitors is essential.

-

Evaluate the risk and reward associated with its government and commercial contracts: Government contracts offer stability but can be subject to political and budgetary changes. Commercial contracts offer growth potential but may be more volatile.

-

Discuss potential for expansion into new markets (e.g., healthcare, finance): Palantir's ability to leverage its technology across various sectors signifies its growth potential. Expansion into new markets offers diversification and reduces reliance on any single sector.

Competitive Landscape and Risks Associated with Palantir Stock

Understanding the competitive landscape is crucial for evaluating Palantir stock. Several companies offer similar data analytics and AI solutions, creating a competitive market. Moreover, investing in PLTR stock carries inherent risks.

-

Identify key competitors in the data analytics and AI markets: Competitors like AWS, Google Cloud, and Microsoft Azure offer comparable services, creating competition for Palantir.

-

Assess Palantir's competitive advantages and disadvantages: While Palantir boasts strong technology and government relationships, it faces competition from established tech giants with greater resources.

-

Discuss the risks associated with government contract reliance: A significant portion of Palantir's revenue comes from government contracts, making it susceptible to changes in government spending and policy.

-

Analyze the potential impact of economic downturns on Palantir's business: Economic downturns can impact both government and commercial spending, potentially affecting Palantir's revenue and profitability.

Analyzing Palantir's Valuation and Investment Considerations

Analyzing Palantir's valuation involves examining metrics like its Price-to-Sales ratio, market capitalization, and comparing it to its peers. This helps determine whether the current PLTR stock price reflects its true value.

-

Compare Palantir's valuation to its peers: Comparing Palantir's valuation multiples (e.g., Price-to-Sales ratio) to those of its competitors provides context for its relative valuation.

-

Analyze the impact of growth expectations on its valuation: Investors' expectations for future growth significantly impact Palantir's valuation. Higher growth expectations justify a higher valuation.

-

Discuss the risks and rewards of investing at the current price: Determining whether Palantir stock is overvalued or undervalued requires considering its growth prospects, risks, and comparing it with its peers.

-

Recommend a potential investment strategy: Based on your risk tolerance and investment goals, a suitable investment strategy (buy, sell, or hold) can be recommended. Remember to diversify your portfolio.

Conclusion

Evaluating Palantir stock before the May 5th earnings announcement demands a thorough analysis of its performance, growth prospects, competition, and valuation. Palantir presents substantial growth potential within the burgeoning data analytics and AI markets. However, investors must carefully weigh the inherent risks associated with its business model and market conditions. By considering the factors discussed, investors can make informed decisions regarding whether to buy, sell, or hold Palantir stock. Remember to conduct thorough research and consult a financial advisor before making any investment decisions. Continue to monitor Palantir's progress and market conditions after the May 5th earnings announcement for valuable insights into the future of Palantir stock. Stay informed about upcoming Palantir earnings reports and further analysis to make sound investment choices regarding your PLTR stock holdings.

Featured Posts

-

Analyzing The Impact Of Trumps Actions On Greenlands Ties With Denmark

May 10, 2025

Analyzing The Impact Of Trumps Actions On Greenlands Ties With Denmark

May 10, 2025 -

Uk Immigration Rules Tightened Fluent English Now Mandatory For Residency

May 10, 2025

Uk Immigration Rules Tightened Fluent English Now Mandatory For Residency

May 10, 2025 -

Indian Insurers Lobby For Less Stringent Bond Forward Rules

May 10, 2025

Indian Insurers Lobby For Less Stringent Bond Forward Rules

May 10, 2025 -

Understanding Jeanine Pirro Background Wealth And Impact

May 10, 2025

Understanding Jeanine Pirro Background Wealth And Impact

May 10, 2025 -

Benson Boone Denies Copying Harry Styles Is The Accusation Fair

May 10, 2025

Benson Boone Denies Copying Harry Styles Is The Accusation Fair

May 10, 2025

Latest Posts

-

Parad Pobedy Bez Gostey Zelenskiy V Odinochestve 9 Maya

May 10, 2025

Parad Pobedy Bez Gostey Zelenskiy V Odinochestve 9 Maya

May 10, 2025 -

Izolyatsiya Zelenskogo Otsutstvie Gostey Na 9 Maya

May 10, 2025

Izolyatsiya Zelenskogo Otsutstvie Gostey Na 9 Maya

May 10, 2025 -

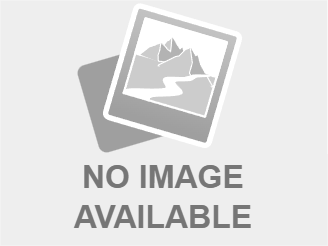

Noviy Krizis Bezhentsev Otsenka Riskov Dlya Germanii So Storony Ukrainy I S Sh A

May 10, 2025

Noviy Krizis Bezhentsev Otsenka Riskov Dlya Germanii So Storony Ukrainy I S Sh A

May 10, 2025 -

First Up Imf To Decide On Pakistans 1 3 Billion Loan Amidst Rising Tensions

May 10, 2025

First Up Imf To Decide On Pakistans 1 3 Billion Loan Amidst Rising Tensions

May 10, 2025 -

Germaniya Analiz Vozmozhnogo Uvelicheniya Chisla Ukrainskikh Bezhentsev Iz Za S Sh A

May 10, 2025

Germaniya Analiz Vozmozhnogo Uvelicheniya Chisla Ukrainskikh Bezhentsev Iz Za S Sh A

May 10, 2025