Federal Debt's Growing Influence On The Housing Market

Table of Contents

Impact of Federal Debt on Interest Rates

A fundamental link exists between government borrowing and interest rates. When the government borrows heavily to finance its debt, it increases the demand for loanable funds. This increased demand, in turn, pushes interest rates higher. This dynamic has significant implications for the housing market.

Rising interest rates directly translate to higher mortgage rates. This makes homeownership less accessible for many, especially first-time homebuyers and those with lower incomes. The impact is amplified by the fact that mortgages are typically long-term loans, meaning even small increases in interest rates can significantly increase the total cost of homeownership over time.

- Increased demand for loans pushes rates up: The government competes with private borrowers for available capital, driving up interest rates across the board.

- The Federal Reserve's response to inflation (often linked to debt) impacts rates: To combat inflation, often exacerbated by high government spending and debt, the Federal Reserve may raise interest rates, further increasing mortgage rates.

- Higher mortgage rates lead to reduced affordability and lower demand: This results in a slowdown in the housing market, potentially leading to price corrections or stagnation.

Government Intervention and Housing Policies

Government intervention plays a crucial role in the housing market, through subsidies, tax credits, and programs supporting affordable housing. However, high federal debt creates budget constraints that directly affect the government's ability to fund these initiatives.

The increasing national debt forces difficult choices regarding government spending. This may lead to cuts in programs that support affordable housing, impacting vulnerable populations and reducing overall housing affordability. Furthermore, tax incentives for homebuyers, crucial for stimulating the market, could be reduced or eliminated entirely.

- Impact of budget cuts on programs like FHA loans and affordable housing initiatives: Reduced funding can limit access to affordable mortgages and diminish the availability of affordable housing units.

- Potential changes in tax incentives for homebuyers: Reductions or eliminations of tax credits can decrease homebuyer demand, particularly impacting first-time homebuyers.

- The effect of reduced government spending on infrastructure projects related to housing: Cuts in infrastructure spending can hinder the development of new housing units and negatively affect the quality of existing housing stock.

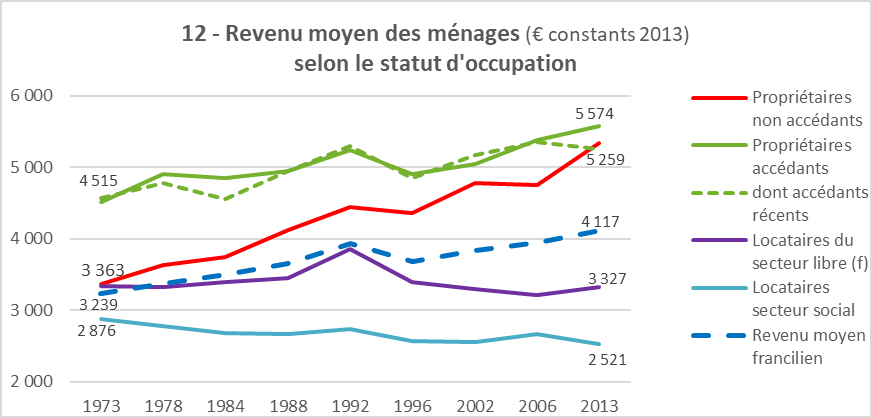

Inflation's Role and the Housing Market

The relationship between rising federal debt, inflation, and the housing market is intricate but undeniable. High levels of government borrowing can lead to an increased money supply, a key driver of inflation. This inflationary pressure affects the housing market in several ways.

Inflation erodes purchasing power, making homes less affordable. Simultaneously, inflation increases the cost of building materials (lumber, concrete, etc.) and labor, driving up house prices. This creates a double whammy for potential homebuyers: reduced buying power and escalating housing costs.

- Increased money supply due to government borrowing can fuel inflation: This is a classic macroeconomic principle where excessive money creation devalues currency.

- Inflation increases the cost of building materials and labor, driving up house prices: This makes both buying and building a home more expensive.

- Higher inflation reduces real wages, making it harder to qualify for a mortgage: Even if home prices remain stable, higher inflation can make it difficult for people to qualify for a mortgage due to decreased purchasing power.

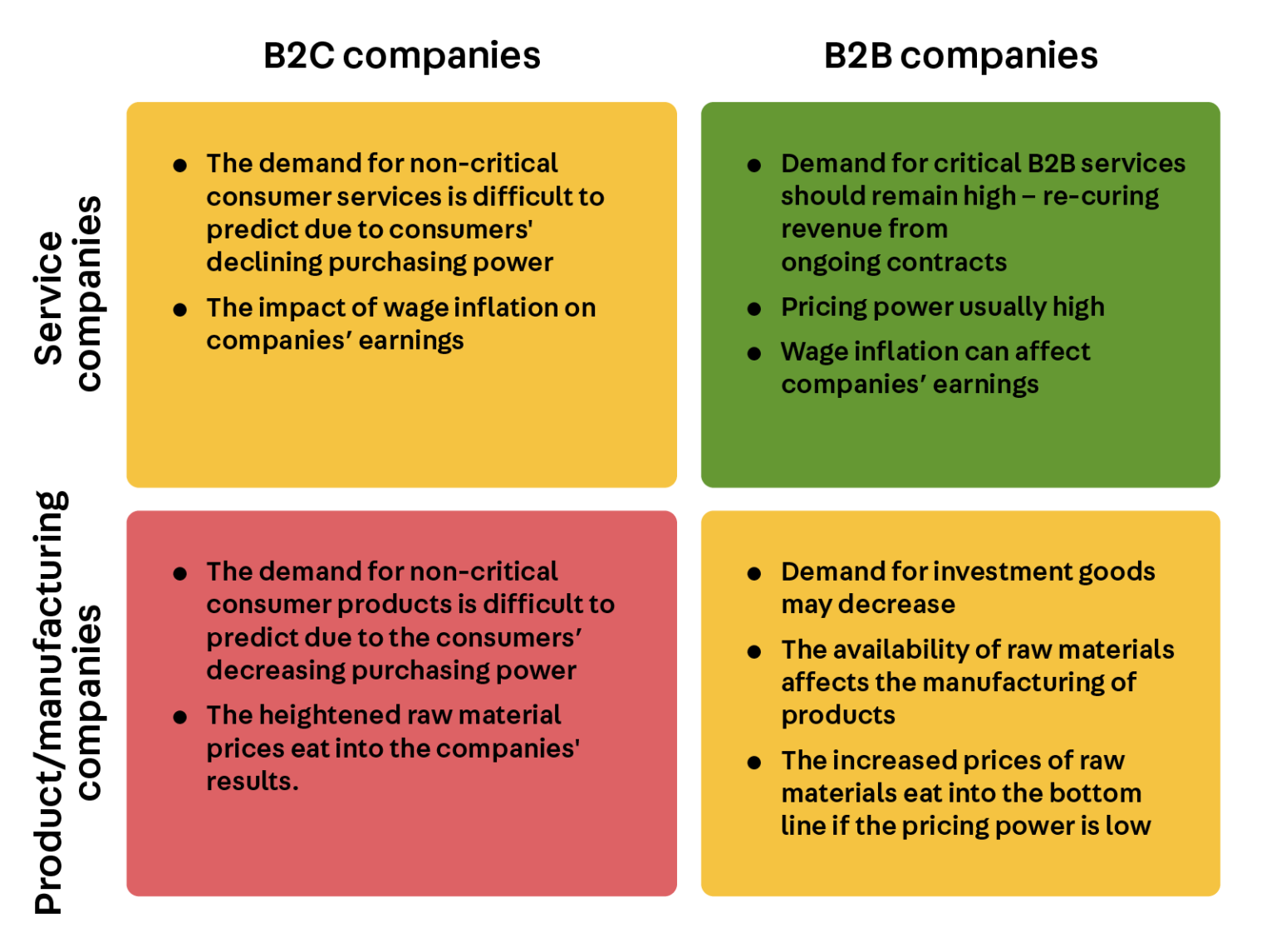

Investor Behavior and Market Volatility

Uncertainty surrounding high federal debt significantly impacts investor confidence in the real estate market. Investors, anticipating potential economic instability, may become hesitant to invest in real estate, fearing price corrections or decreased returns.

This hesitancy can lead to decreased housing supply, potentially exacerbating existing affordability issues. The reduced investment can also create market volatility, with prices fluctuating more dramatically than in periods of greater economic stability. Rental markets are also affected, as decreased investment reduces the availability of rental properties.

- Investors may become hesitant to invest in real estate due to economic uncertainty: This can lead to a decrease in new construction and renovations.

- This can lead to decreased housing supply and potential price corrections: A shortage of housing can further drive up prices.

- The impact on rental markets due to decreased investment: Reduced investment in rental properties can lead to increased rental costs and decreased availability.

Conclusion

Escalating federal debt exerts a considerable influence on the housing market, impacting affordability, interest rates, government policies, and market stability. Higher debt leads to increased interest rates, making homeownership less accessible. Budget constraints limit government intervention, potentially reducing support for affordable housing initiatives. Inflation, often linked to high debt, erodes purchasing power and drives up housing costs. Finally, economic uncertainty reduces investor confidence, impacting housing supply and creating market volatility. Understanding the growing influence of federal debt on the housing market is crucial for making informed decisions about your financial future. Stay informed about economic developments and consider seeking expert advice to navigate this complex landscape.

Featured Posts

-

Abba Voyage Behind The Scenes Of The Setlist Revisions

May 19, 2025

Abba Voyage Behind The Scenes Of The Setlist Revisions

May 19, 2025 -

Anchor Brewing Companys Closure A Legacy Ends After 127 Years

May 19, 2025

Anchor Brewing Companys Closure A Legacy Ends After 127 Years

May 19, 2025 -

Les Prix Immobiliers En France Visualisation Cartographique Des Donnees Notariales

May 19, 2025

Les Prix Immobiliers En France Visualisation Cartographique Des Donnees Notariales

May 19, 2025 -

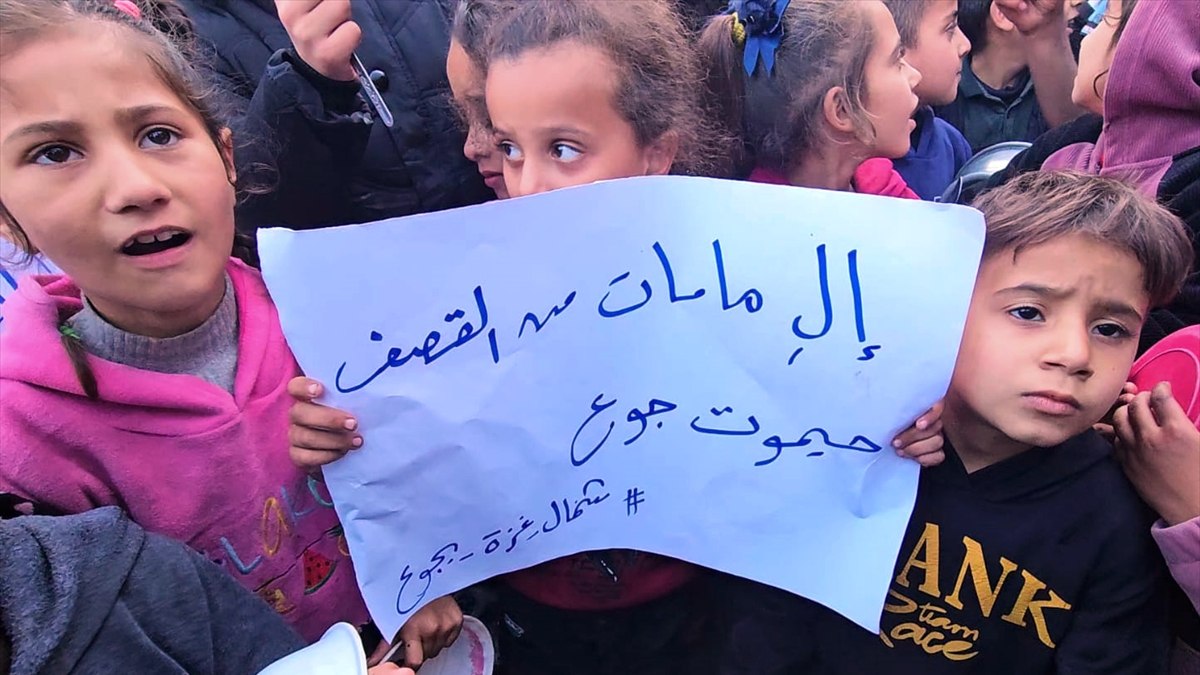

Gazze De Yasam Muecadelesi Veren Filistinlilerin Hikayeleri

May 19, 2025

Gazze De Yasam Muecadelesi Veren Filistinlilerin Hikayeleri

May 19, 2025 -

Is Uber Recession Proof Analyzing The Stocks Resilience

May 19, 2025

Is Uber Recession Proof Analyzing The Stocks Resilience

May 19, 2025

Latest Posts

-

Londons Parks Under Siege Mark Rylances Powerful Protest Against Music Festivals

May 20, 2025

Londons Parks Under Siege Mark Rylances Powerful Protest Against Music Festivals

May 20, 2025 -

Rylances Outrage The High Cost Of London Music Festivals On Parks

May 20, 2025

Rylances Outrage The High Cost Of London Music Festivals On Parks

May 20, 2025 -

Is It A Prison Camp Rylances Critique Of Londons Music Festival Scene

May 20, 2025

Is It A Prison Camp Rylances Critique Of Londons Music Festival Scene

May 20, 2025 -

Music Festivals Under Fire Rylances Condemnation Of London Park Conditions

May 20, 2025

Music Festivals Under Fire Rylances Condemnation Of London Park Conditions

May 20, 2025 -

Mark Rylances Criticism Of Music Festivals Effect On Londons Green Spaces

May 20, 2025

Mark Rylances Criticism Of Music Festivals Effect On Londons Green Spaces

May 20, 2025