Finance Loans 101: Your Complete Guide To Applying For Loans

Table of Contents

Understanding Different Types of Finance Loans

Finance loans come in many forms, each designed for specific purposes and financial situations. Choosing the right type of loan is crucial for your success.

Personal Loans

Personal loans are unsecured or secured loans used for various purposes, including debt consolidation, home improvements, or unexpected expenses. Interest rates vary depending on your creditworthiness.

- Pros: Relatively quick application process, flexible repayment terms.

- Cons: Higher interest rates compared to secured loans, potential impact on credit score if missed payments occur.

- Secured vs. Unsecured: Secured loans require collateral (like a car or savings account), offering lower interest rates. Unsecured loans don't require collateral but often come with higher interest rates.

- Typical Loan Terms: Personal loans typically range from 1 to 7 years.

Business Loans

Securing funding for your business requires understanding different business loan options.

- Small Business Loans: Designed for startups and small businesses, these loans can finance equipment, inventory, or operating expenses.

- SBA Loans: Backed by the Small Business Administration, these loans offer favorable terms and lower interest rates.

- Lines of Credit: Provide access to funds as needed, offering flexibility for managing cash flow.

- Collateral: Often requires collateral, such as business assets or personal guarantees.

- Business Plan: A comprehensive business plan is essential for demonstrating your business's viability and securing a loan.

- Loan Amounts and Repayment Schedules: Vary greatly depending on the lender and the borrower's financial situation.

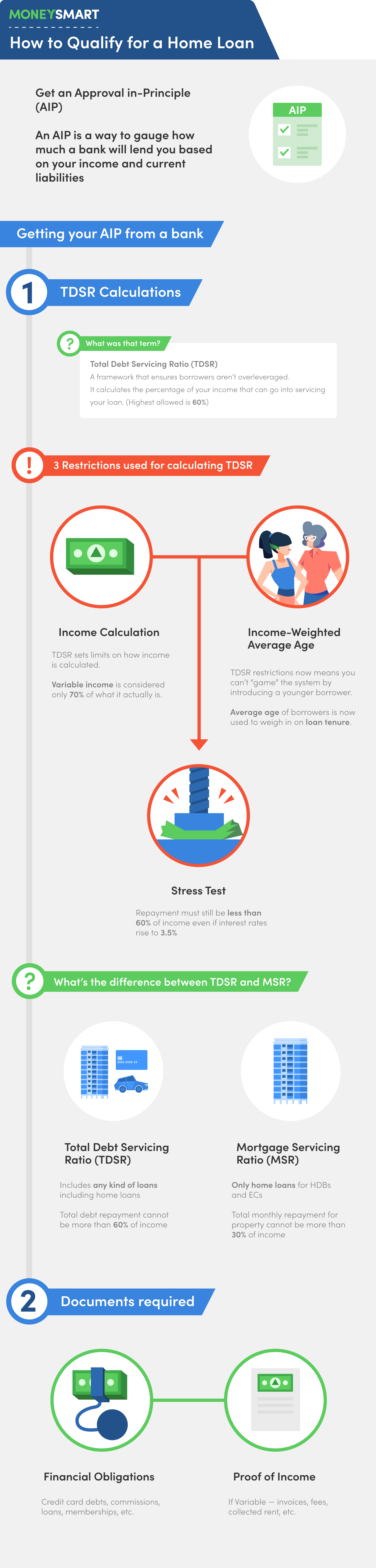

Mortgages

Mortgages are loans specifically for purchasing a home. Understanding different mortgage types is crucial.

- Fixed-Rate Mortgages: Offer consistent monthly payments throughout the loan term.

- Adjustable-Rate Mortgages (ARMs): Interest rates fluctuate, potentially leading to changing monthly payments.

- FHA Loans: Backed by the Federal Housing Administration, requiring lower down payments.

- VA Loans: Offered to eligible veterans and military personnel, often requiring no down payment.

- Pre-Approval Process: Getting pre-approved helps you understand your borrowing power and strengthens your offer when buying a home.

- Factors Influencing Interest Rates: Credit score, loan term, and down payment significantly influence interest rates.

- Closing Costs: Expect additional fees at closing, including appraisal fees, title insurance, and more.

Auto Loans

Financing a vehicle requires understanding auto loan options and interest rates.

- New vs. Used Car Loans: Interest rates often differ depending on the vehicle's age and condition.

- Loan Terms and Repayment: Typical loan terms range from 3 to 7 years, influencing monthly payments.

- Factors Influencing Loan Approval: Credit score, income, and the vehicle's value impact loan approval.

Student Loans

Student loans help finance higher education, but careful planning is crucial.

- Federal Student Loans: Offered by the government, these loans typically offer lower interest rates and more flexible repayment options.

- Private Student Loans: Offered by private lenders, these loans may have higher interest rates and less flexible repayment options.

- FAFSA: Completing the Free Application for Federal Student Aid (FAFSA) is the first step in accessing federal student loans.

- Interest Rates and Repayment Options: Interest rates and repayment plans vary based on the loan type and lender.

- Loan Forgiveness Programs: Some programs offer loan forgiveness for those working in public service or specific fields.

Eligibility Criteria for Finance Loans

Several factors determine your eligibility for finance loans. Understanding these criteria is vital for a successful application.

Credit Score Impact

Your credit score significantly impacts your loan approval chances and interest rates.

- Credit Score Calculation: Credit scores are calculated using your payment history, credit utilization, length of credit history, and credit mix.

- Improving Credit Score: Pay bills on time, keep credit utilization low, and maintain a healthy mix of credit accounts.

- Impact of a Low Credit Score: A low credit score can lead to loan denial or higher interest rates.

Income and Debt-to-Income Ratio (DTI)

Stable income and a manageable DTI are key factors in loan approval.

- Calculating DTI: Divide your monthly debt payments by your gross monthly income.

- Strategies for Improving DTI: Reduce debt, increase income, or both.

- Impact on Loan Approval: A high DTI can make it harder to secure a loan.

Collateral and Assets

For secured loans, collateral plays a crucial role in loan approval.

- Types of Acceptable Collateral: This can include homes, cars, savings accounts, or other valuable assets.

- Impact of Asset Ownership on Loan Approval: Owning assets increases your chances of securing a loan, especially a secured loan.

- Evaluating Your Assets: Understand the value of your assets and their potential use as collateral.

The Finance Loan Application Process

The application process involves several steps, from gathering documents to receiving funding.

Gathering Required Documents

Having the necessary documents ready streamlines the application process.

- Checklist of Necessary Documents: Income statements, tax returns, bank statements, proof of address, and more.

- Where to Find These Documents: Your employer, tax records, bank statements, etc.

- Tips for Organizing Your Documents: Keep everything organized and easily accessible.

Completing the Application

Accurate and complete application forms are crucial for a successful application.

- Online vs. In-Person Applications: Many lenders offer both online and in-person application options.

- Common Application Pitfalls: Inaccurate information, incomplete forms, and missing documentation.

- Tips for a Successful Application: Double-check for accuracy, ensure all required fields are complete, and keep copies of everything.

Loan Approval and Funding

The timeline for loan approval and funding varies depending on the lender and loan type.

- Factors Affecting Approval Time: Credit score, income, and the complexity of the loan application.

- What to Expect After Approval: You'll receive a loan agreement outlining the terms and conditions.

- Disbursement of Funds: Funds are typically disbursed after the loan agreement is signed and any required conditions are met.

Crucial Considerations Before Applying for Finance Loans

Careful planning and research are crucial for making informed decisions.

Comparing Loan Offers

Comparing loan offers from multiple lenders helps you secure the best terms.

- Using Online Comparison Tools: Several websites offer tools to compare loan offers from different lenders.

- Understanding APR: Annual Percentage Rate (APR) reflects the total cost of the loan, including interest and fees.

- Evaluating Loan Terms: Compare interest rates, fees, repayment periods, and other terms.

Budgeting and Repayment

Creating a realistic budget and repayment plan is essential for successful loan management.

- Creating a Repayment Budget: Ensure your monthly payments fit comfortably within your budget.

- Understanding Loan Amortization: Amortization schedules show your monthly payments and how much of each payment goes towards principal and interest.

- Managing Unexpected Expenses: Build a buffer into your budget to handle unexpected expenses.

Avoiding Loan Scams

Be aware of common loan scams and take steps to protect yourself.

- Recognizing Red Flags: Unusually low interest rates, upfront fees, and high-pressure tactics are red flags.

- Verifying Lender Legitimacy: Research lenders thoroughly and check their credentials with regulatory bodies.

- Protecting Personal Information: Never share sensitive personal information unless you're sure you're dealing with a legitimate lender.

Conclusion

Understanding different types of finance loans, eligibility criteria, and the application process is essential for securing the funding you need. Remember to compare loan offers, create a realistic repayment budget, and protect yourself from loan scams. Choosing the right financing options can make a significant difference in achieving your financial goals. Ready to secure the finance loans you need? Start by researching lenders and comparing loan offers today! Make informed decisions about your financing options and achieve your financial goals.

Featured Posts

-

Alcaraz And Zverev Missed Opportunities While Sinner Shines

May 28, 2025

Alcaraz And Zverev Missed Opportunities While Sinner Shines

May 28, 2025 -

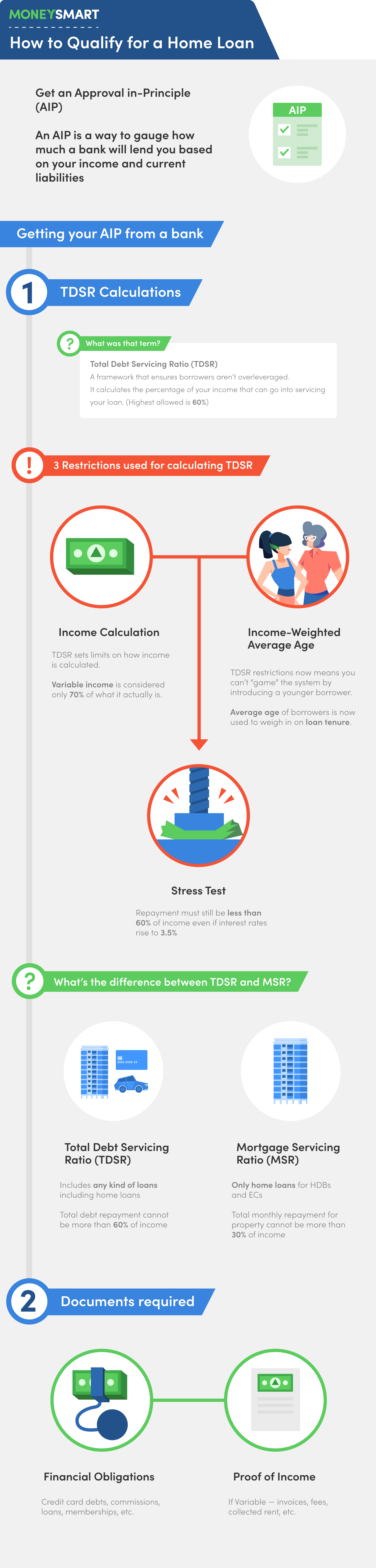

Hugh Jackman And Ryan Reynolds A Friendly Rivalry Revealed

May 28, 2025

Hugh Jackman And Ryan Reynolds A Friendly Rivalry Revealed

May 28, 2025 -

Paul Skenes And The Pirates Larger Problem Bob Nuttings Ownership

May 28, 2025

Paul Skenes And The Pirates Larger Problem Bob Nuttings Ownership

May 28, 2025 -

Padres Unbeaten Streak Merrills Home Run A Key Factor

May 28, 2025

Padres Unbeaten Streak Merrills Home Run A Key Factor

May 28, 2025 -

Kasatlantas Baru Polresta Balikpapan Akp Djauhari Pimpin Sholat Subuh

May 28, 2025

Kasatlantas Baru Polresta Balikpapan Akp Djauhari Pimpin Sholat Subuh

May 28, 2025

Latest Posts

-

Alcarazs Hard Fought Victory Securing The Monte Carlo Masters Title

May 30, 2025

Alcarazs Hard Fought Victory Securing The Monte Carlo Masters Title

May 30, 2025 -

Alcaraz Claims Monte Carlo Masters Title Despite Tough Competition

May 30, 2025

Alcaraz Claims Monte Carlo Masters Title Despite Tough Competition

May 30, 2025 -

Alcaraz Wins First Monte Carlo Masters Title After Challenging Week

May 30, 2025

Alcaraz Wins First Monte Carlo Masters Title After Challenging Week

May 30, 2025 -

330 000 Marketing Contract Via Rails Shift To High Speed Rail In Quebec

May 30, 2025

330 000 Marketing Contract Via Rails Shift To High Speed Rail In Quebec

May 30, 2025 -

Definitys Strategic Acquisition Of Travelers Canadian Operations

May 30, 2025

Definitys Strategic Acquisition Of Travelers Canadian Operations

May 30, 2025