Finding The Best Payday Loans With Guaranteed Approval Despite Bad Credit

Table of Contents

Understanding Payday Loans and Their Implications

Payday loans are short-term, high-interest loans designed to be repaid on your next payday. They're typically small loans, intended to bridge a short-term financial gap. While they offer quick access to funds, it's vital to understand both their advantages and disadvantages.

Advantages:

- Quick access to funds: Money is often available within 24-48 hours of approval.

- Easy application process: The application process is generally simpler than traditional loans.

Disadvantages:

- High interest rates: Payday loans carry significantly higher interest rates than other loan types, leading to a substantial increase in the total cost of borrowing.

- Potential for debt traps: If not managed carefully, the high interest rates can lead to a cycle of debt, making it difficult to repay the loan.

Understanding the Annual Percentage Rate (APR) is critical. This represents the total cost of borrowing over a year, including interest and fees. Always calculate the total repayment amount before accepting a payday loan to avoid unexpected financial strain.

Finding Reputable Lenders Offering Payday Loans for Bad Credit

Navigating the world of payday lenders requires caution. Not all lenders operate ethically. Choosing licensed and reputable lenders is paramount to protect yourself from predatory lending practices.

How to Identify Reputable Lenders:

- Check lender licensing and reviews: Ensure the lender is licensed in your state and check online reviews from other borrowers to gauge their experiences. Websites like the Better Business Bureau can be helpful resources.

- Compare interest rates and fees: Don't settle for the first offer you see. Compare interest rates, fees, and repayment terms from multiple lenders to find the best deal.

- Beware of lenders promising "guaranteed approval" without proper due diligence: While some lenders advertise "guaranteed approval," be wary of those who don't perform a proper credit check or assessment of your ability to repay.

- Look for transparent fee structures: Understand all fees upfront. Avoid lenders with hidden fees or unclear terms and conditions.

Strategies for Improving Your Chances of Approval

Even with bad credit, you can increase your chances of approval for a payday loan.

- Provide accurate income and employment information: Accurate information builds trust with the lender and demonstrates your ability to repay.

- Ensure your contact information is up-to-date: Accurate contact information ensures seamless communication throughout the loan process.

- Explore options like co-signers if available: A co-signer with good credit can significantly improve your chances of approval.

Responsible Borrowing Practices for Payday Loans

Payday loans, despite their convenience, can easily lead to a debt cycle if not handled responsibly. Borrow only what you absolutely need and create a repayment plan before you accept the loan.

- Create a detailed budget: Track your income and expenses to ensure you can comfortably repay the loan on time.

- Explore debt consolidation or credit counseling options: If you're struggling with multiple debts, consider debt consolidation or credit counseling to manage your finances more effectively.

- Only borrow what you can afford to repay: Never borrow more than you can reasonably repay on your next payday.

Legal Considerations and Consumer Protection

Several consumer protection laws exist to safeguard borrowers from unfair lending practices. Understand your rights and responsibilities as a borrower.

- Review the loan agreement carefully: Before signing any agreement, thoroughly read and understand all terms and conditions, including interest rates, fees, and repayment schedules.

- Understand your rights as a borrower: Familiarize yourself with your state's consumer protection laws regarding payday loans.

- Report any suspicious activity to the relevant authorities: If you encounter any fraudulent or unethical lending practices, report them to the appropriate consumer protection agencies.

Conclusion: Securing the Right Payday Loan Despite Bad Credit

Securing a payday loan with guaranteed approval despite bad credit requires careful research and responsible decision-making. By understanding the implications of these loans, choosing reputable lenders, and practicing responsible borrowing habits, you can navigate this financial tool effectively. Remember to compare lenders, check reviews, and always prioritize transparency and clear terms and conditions. Don't let a financial emergency overwhelm you; use the tips and resources in this article to make informed decisions and avoid financial pitfalls. Research and compare lenders carefully before applying for a payday loan to ensure you find the best option for your specific situation.

Featured Posts

-

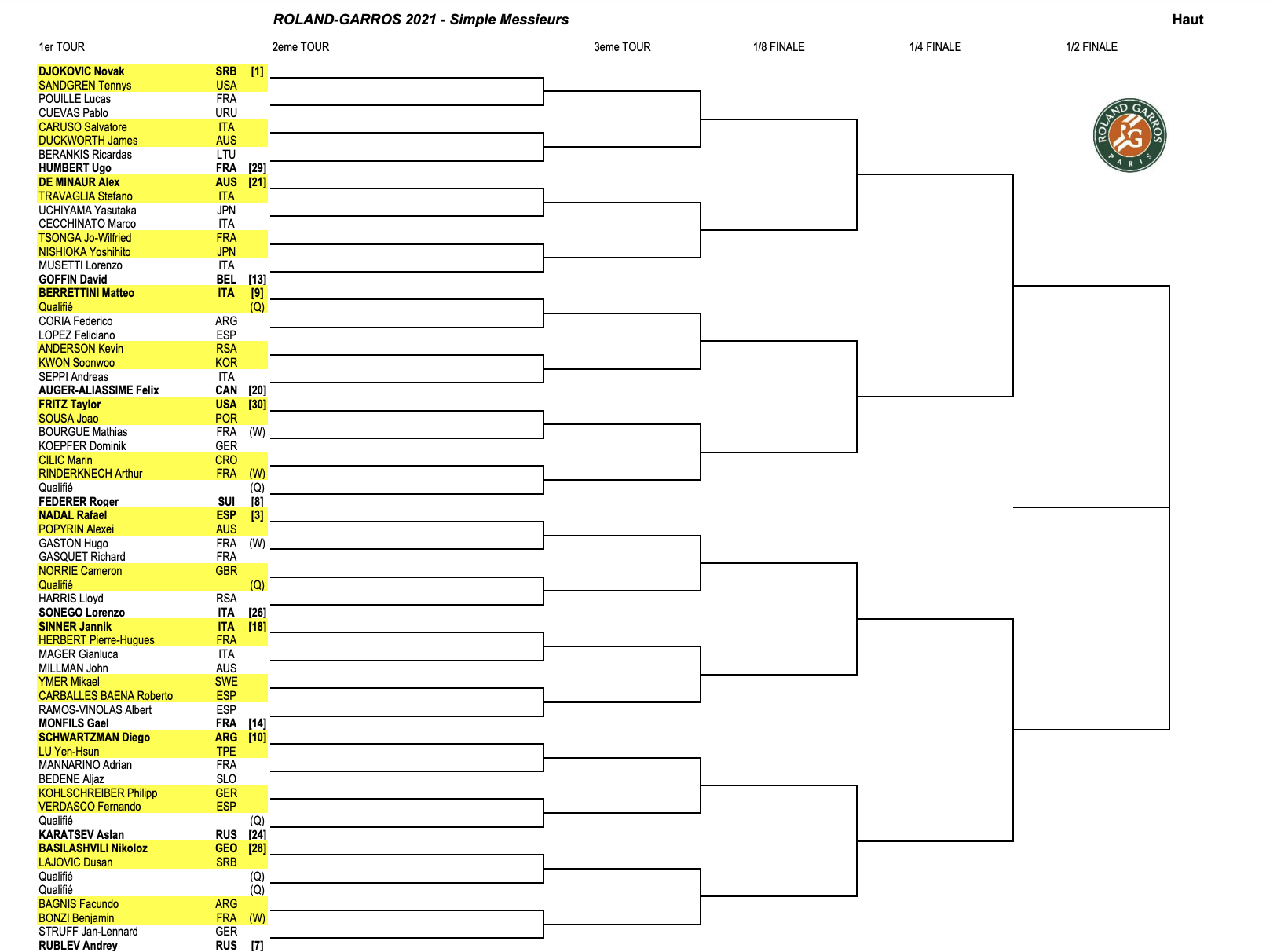

French Open Draw Sinner In Demanding Top Half

May 28, 2025

French Open Draw Sinner In Demanding Top Half

May 28, 2025 -

Drought Forecast Spring 2024 Echoes 1968s Dry Conditions

May 28, 2025

Drought Forecast Spring 2024 Echoes 1968s Dry Conditions

May 28, 2025 -

Arsenals New Signing Keown Hints At Surprise Striker Acquisition

May 28, 2025

Arsenals New Signing Keown Hints At Surprise Striker Acquisition

May 28, 2025 -

Pope Leo Xiv And Tennis Pro Jannik Sinner A Memorable Meeting

May 28, 2025

Pope Leo Xiv And Tennis Pro Jannik Sinner A Memorable Meeting

May 28, 2025 -

Sanctions Looming Trumps Response To Deteriorating Russia Ties

May 28, 2025

Sanctions Looming Trumps Response To Deteriorating Russia Ties

May 28, 2025

Latest Posts

-

Un Tenista Argentino Declara A Marcelo Rios Como Una Leyenda Del Tenis

May 30, 2025

Un Tenista Argentino Declara A Marcelo Rios Como Una Leyenda Del Tenis

May 30, 2025 -

Marcelo Rios La Idolatria Inesperada De Un Tenista Argentino

May 30, 2025

Marcelo Rios La Idolatria Inesperada De Un Tenista Argentino

May 30, 2025 -

Confesion Impactante Tenista Argentino Revela Su Admiracion Por Marcelo Rios

May 30, 2025

Confesion Impactante Tenista Argentino Revela Su Admiracion Por Marcelo Rios

May 30, 2025 -

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025 -

Odiado Tenista Argentino Su Impactante Confesion Sobre Marcelo Rios

May 30, 2025

Odiado Tenista Argentino Su Impactante Confesion Sobre Marcelo Rios

May 30, 2025