Foot Locker Stock Outlook: Analyzing The Potential Impact Of Nike's Q3 Results

Table of Contents

Nike's Q3 Results: A Deep Dive

Nike's Q3 results are a crucial barometer for the entire athletic footwear and apparel sector. Analyzing key performance indicators (KPIs) from the report is vital to understanding the potential impact on Foot Locker. We need to examine sales growth, gross margins, and inventory levels to gauge the overall health of the Nike brand and its potential implications for its retail partners.

-

Sales figures for key product categories: A breakdown of sales across running shoes, basketball shoes, apparel, and other categories reveals consumer preferences and market trends. Strong performance in key categories signals positive prospects for Foot Locker, which heavily relies on these product lines. Conversely, weak sales could indicate potential headwinds for Foot Locker's revenue.

-

Impact of supply chain disruptions and inflation on Nike's profitability: Nike, like many companies, has faced challenges related to supply chain disruptions and rising inflation. Analyzing how these factors have affected Nike's profitability is critical. Increased costs passed on to retailers could squeeze Foot Locker's margins, impacting its profitability and consequently its stock price.

-

Nike's direct-to-consumer (DTC) strategy and its implications for retailers like Foot Locker: Nike's growing DTC strategy, focusing on online sales and its own branded stores, could potentially impact Foot Locker's sales volume. Understanding the extent of this shift and its implications for Foot Locker's revenue stream is paramount when assessing Foot Locker stock. A successful DTC strategy for Nike might lead to less reliance on traditional retailers like Foot Locker.

These KPIs translate directly to Foot Locker's potential future performance. Strong Nike sales generally translate to stronger sales for Foot Locker, while weak Nike performance typically foreshadows weaker results for Foot Locker.

Foot Locker's Dependence on Nike

Foot Locker's financial health is significantly tied to Nike's success. Understanding the extent of this dependence is crucial for assessing Foot Locker stock. Quantifying the percentage of Foot Locker's revenue derived from Nike products provides a clear picture of this relationship.

-

Analysis of Foot Locker's diversification strategy and its other key brand partnerships: While Nike is a dominant partner, Foot Locker has attempted to diversify its brand portfolio. Analyzing the performance of other brands and partnerships helps to understand the robustness of Foot Locker's business model beyond its reliance on Nike. The success of these diversification efforts will play a major role in mitigating the risk associated with Nike's performance.

-

Assessment of Foot Locker's ability to mitigate the risk associated with relying heavily on a single supplier: Foot Locker's ability to manage the risk associated with its heavy reliance on Nike is a critical factor. Effective inventory management and strategies to promote alternative brands are key elements in reducing this risk.

-

Examination of Foot Locker's inventory management practices in relation to Nike products: Effective inventory management is crucial for Foot Locker. Overstocking of Nike products, particularly if Nike experiences weaker sales, could lead to significant losses for Foot Locker.

The historical correlation between Nike's performance and Foot Locker's stock price is strong, highlighting the inherent risk and opportunity connected to this relationship. Investors need to consider this correlation when evaluating Foot Locker stock.

Market Sentiment and Investor Expectations

Investor sentiment surrounding Nike significantly influences the perception of Foot Locker stock. Positive sentiment towards Nike tends to boost confidence in Foot Locker, while negative sentiment has the opposite effect.

-

Overview of recent news and events impacting Foot Locker's stock price: Recent news and events directly impacting Foot Locker's stock price, including financial reports, partnerships, and market trends, must be considered. These events, both positive and negative, significantly influence investor sentiment.

-

Examination of trading volume and volatility in Foot Locker stock: Analyzing trading volume and price volatility can provide insights into investor confidence. High trading volume often reflects increased interest and potential price fluctuations, reflecting sensitivity to Nike’s performance.

-

Discussion of potential catalysts for future stock price movements: Identifying potential catalysts, such as new product launches, marketing campaigns, or changes in consumer preferences, helps in predicting future price movements. These catalysts, coupled with Nike's performance, will significantly influence Foot Locker's future trajectory.

Analyst ratings and price targets for Foot Locker after Nike's Q3 results provide valuable insights into market expectations. Understanding these expectations is crucial for assessing the investment potential of Foot Locker stock.

Alternative Investment Strategies

While Foot Locker stock is a significant player in the athletic footwear and apparel industry, investors should consider alternative investment opportunities within the same sector. Exploring publicly traded companies with potentially stronger growth prospects or less dependence on a single brand provides diversification opportunities. This could include examining competitors or companies focusing on different segments of the athletic market.

Conclusion

Nike's Q3 results will undoubtedly have a significant bearing on the outlook for Foot Locker stock. While Foot Locker's dependence on Nike presents inherent risks, understanding the interplay between these two companies, coupled with an analysis of broader market trends and investor sentiment, is crucial for making informed investment decisions regarding Foot Locker stock. Careful consideration of the factors discussed above, including Nike's financial performance, Foot Locker's diversification strategies, and market sentiment, is essential for navigating the complexities of this dynamic sector. Therefore, further research into Foot Locker stock and a thorough analysis of Nike's Q3 report are strongly recommended before making any investment decisions. Remember to always conduct your own thorough due diligence before investing in Foot Locker stock or any other security.

Featured Posts

-

Los Angeles Dodgers Recall Top Prospect Hyeseong Kim

May 15, 2025

Los Angeles Dodgers Recall Top Prospect Hyeseong Kim

May 15, 2025 -

Tonights Nhl Game Maple Leafs Vs Blue Jackets Prediction And Betting Odds

May 15, 2025

Tonights Nhl Game Maple Leafs Vs Blue Jackets Prediction And Betting Odds

May 15, 2025 -

Knicks Fans Petition Replacing Lady Liberty With Jalen Brunson

May 15, 2025

Knicks Fans Petition Replacing Lady Liberty With Jalen Brunson

May 15, 2025 -

Dwyane Wades Take On Jimmy Butlers Miami Heat Departure

May 15, 2025

Dwyane Wades Take On Jimmy Butlers Miami Heat Departure

May 15, 2025 -

Dodgers Minor League System A Focus On Kim Outman And Sauer

May 15, 2025

Dodgers Minor League System A Focus On Kim Outman And Sauer

May 15, 2025

Latest Posts

-

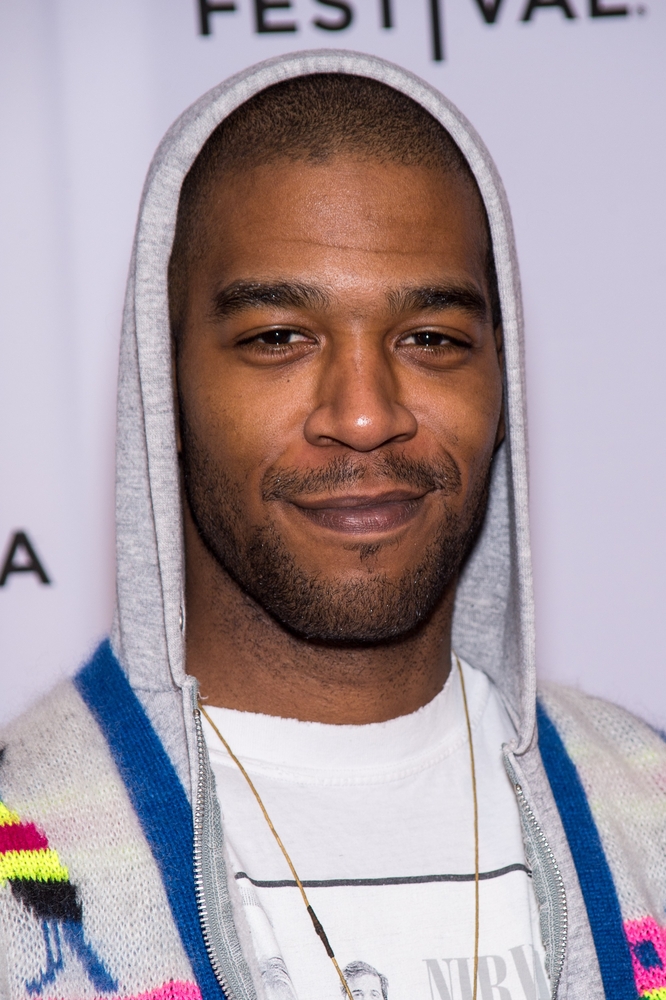

High Value Auction Results For Kid Cudis Possessions

May 15, 2025

High Value Auction Results For Kid Cudis Possessions

May 15, 2025 -

Major Upgrade Complete Telford Steam Railway Station Platform Reopens

May 15, 2025

Major Upgrade Complete Telford Steam Railway Station Platform Reopens

May 15, 2025 -

Auction Of Kid Cudis Personal Items Reaches Unexpected Highs

May 15, 2025

Auction Of Kid Cudis Personal Items Reaches Unexpected Highs

May 15, 2025 -

Telford Steam Railway Station Platform Restoration Complete

May 15, 2025

Telford Steam Railway Station Platform Restoration Complete

May 15, 2025 -

Record Breaking Sale Of Kid Cudis Personal Effects

May 15, 2025

Record Breaking Sale Of Kid Cudis Personal Effects

May 15, 2025