Gold Investment Soars Following Trump's Change In Stance

Table of Contents

Trump's Policy Shift and its Impact on Gold Prices

Trump's administration initiated several policy changes that significantly impacted market sentiment and subsequently influenced gold prices. While the specifics varied, these policies generally created increased uncertainty about the future of the US economy and global trade relations. This uncertainty is a key driver of gold investment.

- Timeline and Market Reaction: The initial policy shifts, primarily concerning trade tariffs and fiscal spending, were met with immediate market volatility. As uncertainty grew, investors began moving away from riskier assets like stocks and bonds, seeking refuge in the perceived stability of gold.

- Investor Behavior: The increased risk perception led to a substantial influx of capital into the gold market. Investors viewed gold as a safe haven, a reliable store of value in the face of economic headwinds.

- Expert Opinions: Many financial analysts and economists predicted a rise in gold prices following these policy changes, citing the increased risk aversion amongst investors and the strengthening dollar. Their predictions largely aligned with the market's actual response.

Gold as a Safe Haven Asset During Economic Uncertainty

Gold's appeal as a safe haven asset stems from its unique characteristics:

- Inflation Hedge: Historically, gold has served as a reliable hedge against inflation. When the purchasing power of fiat currencies diminishes, gold's value tends to hold steady or even increase, making it an attractive investment during periods of high inflation.

- Lack of Correlation: Unlike stocks and bonds, gold exhibits a relatively low correlation with other asset classes. This means that gold's price movements aren't always directly influenced by fluctuations in the stock market or bond yields. This diversification benefit is crucial for investors seeking to mitigate risk.

- Tangible Asset: Gold's tangible nature provides a sense of security for investors. Unlike digital assets, it's a physical commodity with intrinsic value, making it less susceptible to the volatility of the financial markets.

- Portfolio Diversification: Incorporating gold investment into a diversified portfolio can significantly reduce overall portfolio risk. By adding a non-correlated asset like gold, investors can cushion their portfolio against losses in other asset classes.

Factors Beyond Trump's Policy Contributing to the Gold Rush

While Trump's policy changes were a significant catalyst, other macroeconomic factors also contributed to the surge in gold investment:

- Global Inflation: Rising inflation rates across various global economies have increased the demand for gold as an inflation hedge. As the purchasing power of fiat currencies declines, investors seek the relative stability of gold.

- Geopolitical Instability: Increased geopolitical tensions and uncertainties in different regions of the world often lead investors to seek safer investments, bolstering the demand for gold.

- Currency Fluctuations: Significant fluctuations in major currencies can also drive gold investment. Investors often turn to gold as a stable store of value when currencies experience volatility.

Strategies for Investing in Gold

There are several avenues for gold investment, each with its own set of advantages and disadvantages:

- Physical Gold: Purchasing physical gold bars or coins provides direct ownership of the asset. However, it requires safe storage and may incur additional costs.

- Gold ETFs (Exchange-Traded Funds): Gold ETFs offer a convenient and cost-effective way to invest in gold without the complexities of physical storage. They track the price of gold and are easily bought and sold on stock exchanges.

- Gold Mining Stocks: Investing in gold mining companies offers leverage to the price of gold. However, it also exposes investors to the risks associated with the mining industry itself.

Choosing the right strategy depends on your individual risk tolerance, financial goals, and investment horizon.

Conclusion

The recent surge in gold investment is a direct result of several factors, including the uncertainty created by Trump's policy shifts and broader macroeconomic conditions. The role of gold as a safe haven asset during economic uncertainty has been reaffirmed. Investors are increasingly recognizing the diversification benefits and stability that gold offers within a broader investment strategy. Understanding the various options for gold investment, from physical gold to ETFs and mining stocks, is key to making informed decisions. Learn more about how gold investment can benefit your portfolio today and explore different gold investment strategies to secure your financial future.

Featured Posts

-

2025s Hit Rpg Big Names And The Games Unlikely Success Story

Apr 25, 2025

2025s Hit Rpg Big Names And The Games Unlikely Success Story

Apr 25, 2025 -

The China Market And Its Impact On Automakers Case Studies Of Bmw And Porsche

Apr 25, 2025

The China Market And Its Impact On Automakers Case Studies Of Bmw And Porsche

Apr 25, 2025 -

2025s Surprise Rpg Hit The Unexpected Star Power Behind Its Success

Apr 25, 2025

2025s Surprise Rpg Hit The Unexpected Star Power Behind Its Success

Apr 25, 2025 -

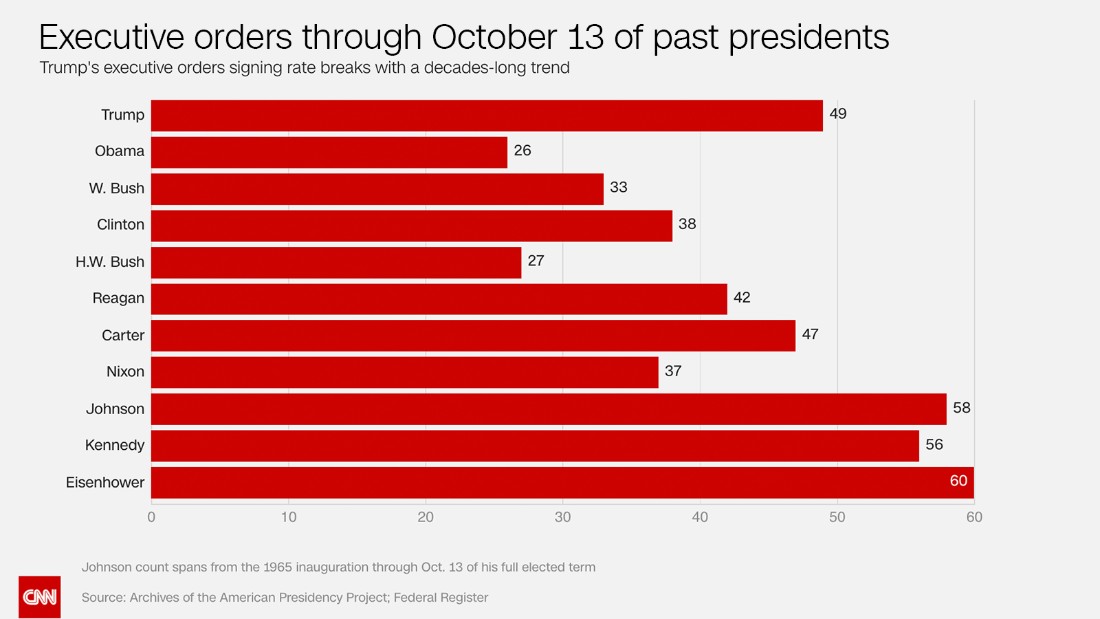

Trumps New Executive Order Impact On Higher Education Accreditation

Apr 25, 2025

Trumps New Executive Order Impact On Higher Education Accreditation

Apr 25, 2025 -

Europes Best Shopping 10 Unmissable Experiences

Apr 25, 2025

Europes Best Shopping 10 Unmissable Experiences

Apr 25, 2025

Latest Posts

-

Arqam Jwanka Almthyrt Llqlq Fy Nady Alnsr

Apr 30, 2025

Arqam Jwanka Almthyrt Llqlq Fy Nady Alnsr

Apr 30, 2025 -

Qlq Alnsr Bsbb Arqam Jwanka Ma Hy Altfasyl

Apr 30, 2025

Qlq Alnsr Bsbb Arqam Jwanka Ma Hy Altfasyl

Apr 30, 2025 -

Arqam Jwanka Tqlq Nady Alnsr Thlyl Shaml

Apr 30, 2025

Arqam Jwanka Tqlq Nady Alnsr Thlyl Shaml

Apr 30, 2025 -

Los Angeles Angels Home Opener Injuries And Walks Dominate

Apr 30, 2025

Los Angeles Angels Home Opener Injuries And Walks Dominate

Apr 30, 2025 -

Cap Nhat Lich Thi Dau Vong Chung Ket Tnsv Thaco Cup 2025

Apr 30, 2025

Cap Nhat Lich Thi Dau Vong Chung Ket Tnsv Thaco Cup 2025

Apr 30, 2025