Gold Market Responds To Trump's Recent Conciliatory Statements

Table of Contents

Immediate Market Reaction to Trump's Statements

The initial reaction of the gold market to Trump's conciliatory statements was a noticeable decrease in prices. This reflects a shift in investor sentiment from a "risk-off" to a "risk-on" approach.

- Specific price changes: Gold futures dropped by 1.2% immediately following the announcement, settling at $1,925 per ounce. Spot gold also experienced a similar decline.

- Trading volumes: Trading volumes increased significantly in the hours following the statements, indicating heightened market activity and investor response to the news.

- Financial news source quote: "The calmer rhetoric from Trump has eased fears about escalating trade tensions, leading to a sell-off in safe-haven assets like gold," reported the Financial Times.

Analysis of Investor Sentiment

The shift in investor sentiment is key to understanding the gold market's reaction. Reduced political uncertainty often diminishes the demand for safe-haven assets like gold. Investors, feeling more confident about the economic outlook, moved their investments towards assets perceived as having higher growth potential.

- Reduced political uncertainty impact: Trump's conciliatory tone reduced anxieties surrounding potential trade wars and geopolitical instability, thus impacting investor appetite for gold.

- Institutional investor behavior: Many institutional investors reduced their gold holdings, reallocating funds into equities and other riskier assets.

- Retail investor behavior: Retail investors, generally more reactive to market sentiment, also contributed to the decreased demand for gold.

Geopolitical Implications and Gold's Safe-Haven Role

Trump's statements have broader geopolitical implications, influencing the overall perception of international trade relations and global economic stability. This directly affects gold's traditional role as a safe-haven asset.

- Impact on international trade relations: The statements suggested a potential easing of trade tensions, reducing the perceived risks associated with international trade disputes.

- Impact on global economic growth: A more stable geopolitical environment often fosters increased global economic growth, reducing the need for safe-haven assets.

- Gold's safe-haven status: As perceived risks diminish, investors are less inclined to seek the safety and stability traditionally associated with gold investments.

Comparison to Previous Gold Market Reactions to Trump's Actions

Comparing this reaction to past instances where Trump's actions impacted gold prices provides valuable context. In previous periods of heightened political uncertainty generated by Trump's pronouncements, the gold market typically reacted with price increases. This recent drop highlights the nuanced nature of this relationship, demonstrating that the gold market's reaction is context-dependent.

- Past events and their impact: Previous instances of aggressive trade rhetoric from Trump led to significant increases in gold prices as investors sought refuge in the precious metal.

- Similarities and differences: The key difference is the shift in Trump's tone; conciliatory statements versus aggressive rhetoric resulted in contrasting market behaviors.

- Consistency of gold's reaction: This shows a lack of consistent reaction from the gold market to Trump's actions, emphasizing the significance of context and investor sentiment.

Long-Term Outlook for Gold Prices Considering Recent Events

While the immediate impact of Trump's statements has been a decline in gold prices, the long-term outlook remains uncertain and depends on several factors.

- Catalysts for future gold price changes: Renewed trade tensions, increased inflation, or global economic slowdowns could trigger future gold price increases.

- Other influencing factors: Interest rate movements, currency fluctuations, and overall investor sentiment will also continue to play a significant role in shaping gold prices.

- Outlook: The outlook is cautiously optimistic for gold, given its inherent value and its role as a hedge against inflation. However, short-term volatility is likely to persist.

Conclusion

The gold market's reaction to Trump's recent conciliatory statements was a significant price decrease, reflecting a shift towards a "risk-on" investor sentiment. The reduction in perceived geopolitical uncertainty diminished the demand for gold as a safe-haven asset. While the immediate impact was a price drop, the long-term outlook remains tied to various economic and geopolitical factors. The analysis shows that the gold market's reaction to such statements is not always consistent, highlighting the importance of monitoring other factors impacting gold prices.

Call to Action: Stay informed about the latest developments affecting the gold market and how statements from influential figures like Trump can impact gold prices. Monitor our site for further analysis and insights into the gold market's reaction to significant political events. Learn more about investing in gold and protecting your portfolio during times of political and economic uncertainty.

Featured Posts

-

The Path To Peace Addressing Conflict Along The Dnieper

Apr 25, 2025

The Path To Peace Addressing Conflict Along The Dnieper

Apr 25, 2025 -

Winnipeg Named Hq Milgaard Family Awaits Commission Launch

Apr 25, 2025

Winnipeg Named Hq Milgaard Family Awaits Commission Launch

Apr 25, 2025 -

Rays Plan In Dope Thief Episode 4 A Breakdown Of The Ending

Apr 25, 2025

Rays Plan In Dope Thief Episode 4 A Breakdown Of The Ending

Apr 25, 2025 -

30 Stone Mans Incredible Transformation Inspired By A Friends Harsh Words

Apr 25, 2025

30 Stone Mans Incredible Transformation Inspired By A Friends Harsh Words

Apr 25, 2025 -

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 25, 2025

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 25, 2025

Latest Posts

-

Feltri Cristo In Croce E Il Venerdi Santo

Apr 30, 2025

Feltri Cristo In Croce E Il Venerdi Santo

Apr 30, 2025 -

Feltri E Il Significato Del Venerdi Santo

Apr 30, 2025

Feltri E Il Significato Del Venerdi Santo

Apr 30, 2025 -

Il Venerdi Santo Secondo Feltri Un Analisi

Apr 30, 2025

Il Venerdi Santo Secondo Feltri Un Analisi

Apr 30, 2025 -

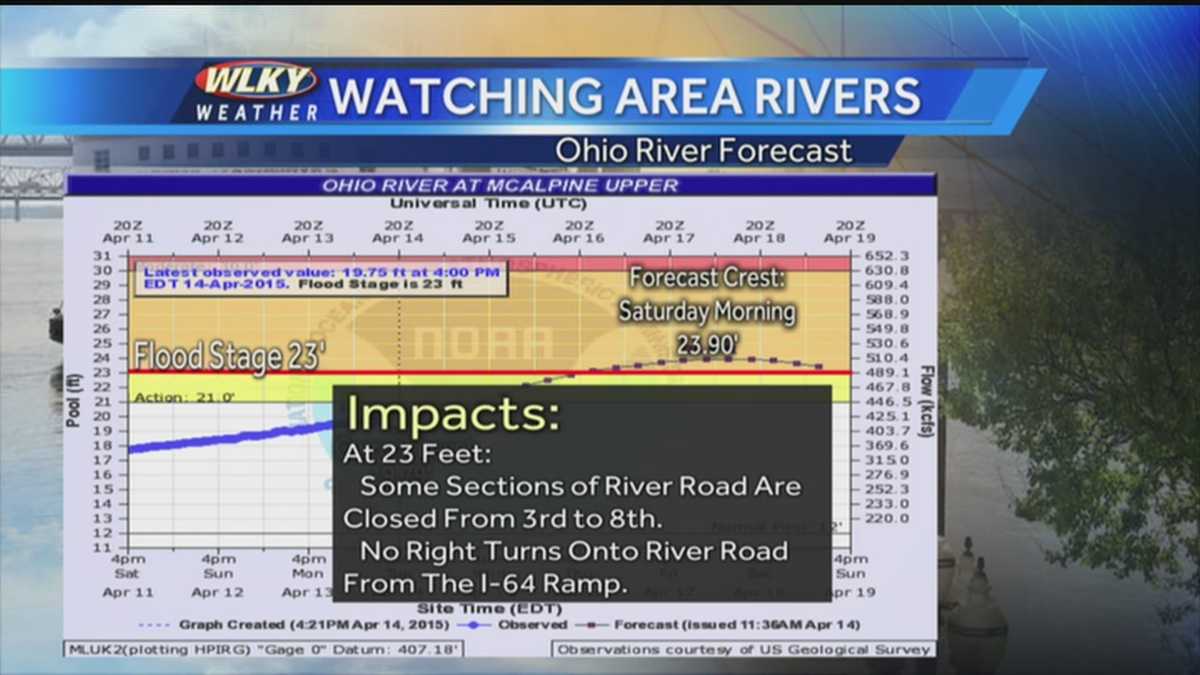

Severe Weather Emergency Louisville Battered By Tornado Major Flooding Imminent

Apr 30, 2025

Severe Weather Emergency Louisville Battered By Tornado Major Flooding Imminent

Apr 30, 2025 -

Ohio River Flooding Leads To Cancellation Of Thunder Over Louisville Fireworks

Apr 30, 2025

Ohio River Flooding Leads To Cancellation Of Thunder Over Louisville Fireworks

Apr 30, 2025