Hedge Fund Investments In Norwegian Cruise Line (NCLH) Stock: A Deep Dive.

Table of Contents

Analyzing Hedge Fund Activity in NCLH

Understanding the activity of hedge funds in NCLH requires identifying key players and tracking the timing of their investments. This provides valuable insights into market sentiment and potential future movements.

Identifying Key Hedge Fund Investors

Publicly available information on hedge fund holdings is often limited due to regulatory constraints and confidentiality agreements. However, by analyzing SEC filings (like 13F forms in the US) and press releases, we can sometimes identify prominent investors. It's important to note that this information may be delayed and not always completely transparent.

- Example 1 (Hypothetical): Let's assume that "Alpha Fund Management" held approximately 5 million shares of NCLH as of Q2 2023, with an estimated investment date around Q4 2022. Alpha Fund is known for its value investing strategy, focusing on undervalued assets with strong potential for growth.

- Example 2 (Hypothetical): "Beta Capital Partners," known for their more aggressive growth investing style, might have acquired a smaller stake (e.g., 2 million shares) at a later date, perhaps in Q1 2023, possibly betting on a specific strategic initiative by NCLH.

- Example 3 (Hypothetical): A distressed debt investor like "Gamma Investments" could be interested in NCLH's debt instruments if the company faced financial difficulties, aiming to profit from restructuring or turnaround scenarios.

Identifying these funds, their investment styles, and their holdings is a crucial first step in understanding the overall sentiment towards NCLH within the hedge fund community.

The Timing of Hedge Fund Investments

Analyzing the timing of hedge fund investments in NCLH is critical. Significant events often influence these decisions.

- Key Date (Hypothetical): October 2022 - Alpha Fund initiates its position in NCLH following a significant drop in the stock price due to concerns about rising fuel costs.

- Key Date (Hypothetical): February 2023 - Beta Capital increases its stake after NCLH announces a successful new marketing campaign targeting a younger demographic.

- Key Date (Hypothetical): June 2023 - A negative earnings report leads to a sell-off, with some hedge funds reducing their positions.

Correlating these investment decisions with specific news events allows for a more nuanced understanding of the market forces driving hedge fund activity related to NCLH stock.

Understanding the Rationale Behind Hedge Fund Investments in NCLH

Hedge funds don't invest randomly. Their decisions are based on rigorous analysis of a company's financial performance, market trends, and future growth potential.

NCLH's Financial Performance & Valuation

To understand hedge fund interest in NCLH, we need to examine its financial health.

- Revenue Growth: Analysis of NCLH's historical and projected revenue growth is key, assessing factors such as passenger numbers, average ticket prices, and onboard spending.

- Profitability: Key metrics like net income margin and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) help gauge the company’s profitability.

- Debt Levels: High levels of debt can be a concern, impacting the company's financial flexibility. The debt-to-equity ratio is a useful indicator of financial leverage.

- Valuation Metrics: The Price-to-Earnings (P/E) ratio is a crucial indicator of how the market values NCLH relative to its earnings. Comparing this to competitors provides valuable context.

By assessing these metrics, we can determine whether hedge fund investments are driven by a belief in NCLH's intrinsic value or a speculative bet on future performance.

Market Trends and Industry Outlook

The broader cruise industry landscape heavily influences investment decisions.

- Economic Conditions: Recessions and economic downturns can significantly impact travel spending, affecting demand for cruises.

- Fuel Prices: Fluctuations in fuel prices are a major cost factor for cruise lines, directly influencing profitability.

- Geopolitical Events: Global events such as pandemics or political instability can disrupt travel patterns and consumer confidence.

- Competition: The competitive landscape, with players like Carnival and Royal Caribbean, plays a significant role.

Implications of Hedge Fund Involvement for NCLH Stock

Hedge fund activity can significantly influence NCLH's stock price and corporate strategy.

Impact on Stock Price Volatility

Large hedge fund purchases or sales can create significant buying or selling pressure, leading to increased price volatility.

- Increased Liquidity: High levels of hedge fund involvement can enhance market liquidity, making it easier for other investors to buy or sell NCLH shares.

- Price Swings: Conversely, rapid shifts in hedge fund positions can cause dramatic price swings, creating both opportunities and risks for other investors.

Influence on NCLH's Corporate Strategy

Hedge funds, with their significant holdings, may exert influence on a company's strategic direction.

- Pressure for Profitability: Activist hedge funds may pressure management to improve profitability through cost-cutting measures or strategic changes.

- Changes in Capital Allocation: Hedge funds may advocate for changes in how the company allocates capital, such as increasing dividends or repurchasing shares.

Conclusion

Hedge fund investments in Norwegian Cruise Line (NCLH) stock are driven by a complex interplay of factors, including NCLH's financial performance, broader market trends in the cruise industry, and the unique investment strategies of individual hedge funds. Analyzing the timing of these investments, alongside NCLH's financial health and the overall outlook for the cruise sector, provides valuable insights into potential future stock price movements. While hedge fund activity can contribute to market liquidity and potentially influence corporate strategy, it's vital for investors to conduct thorough due diligence before making any investment decisions. For investors interested in understanding the complexities of hedge fund investments in Norwegian Cruise Line (NCLH) stock, further research into the specific strategies of individual hedge funds and a comprehensive analysis of the cruise industry's financial landscape are crucial. Careful assessment of financial statements and market trends is paramount before engaging in any investment strategy related to NCLH stock.

Featured Posts

-

Blue Ivy Carters Super Bowl Appearance Critics Slam Beyonce And Jay Z

Apr 30, 2025

Blue Ivy Carters Super Bowl Appearance Critics Slam Beyonce And Jay Z

Apr 30, 2025 -

Los Angeles Kings Beat Dallas Stars Fialas Point Streak Extends

Apr 30, 2025

Los Angeles Kings Beat Dallas Stars Fialas Point Streak Extends

Apr 30, 2025 -

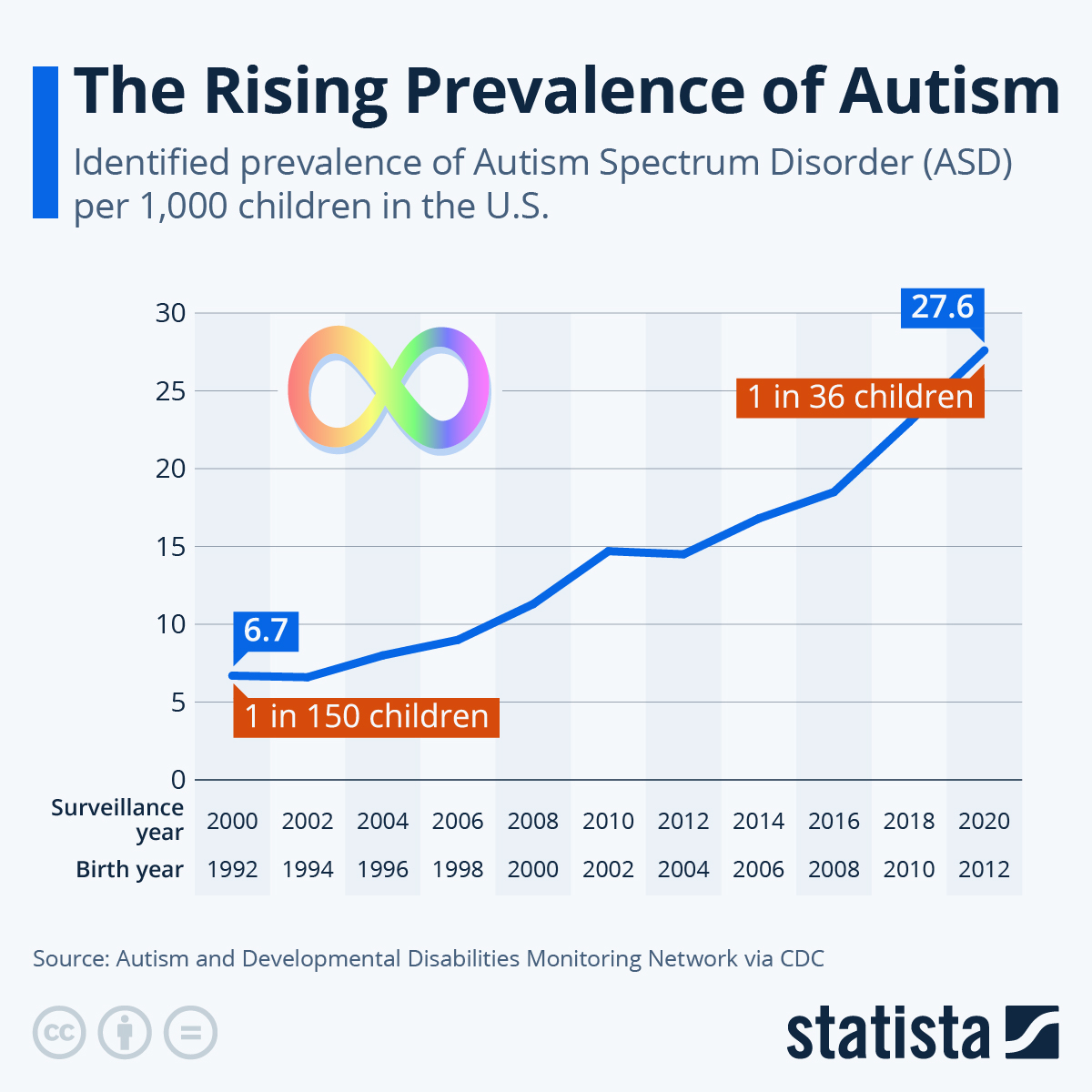

Increased Adhd Diagnosis Rates In Adults With Autism And Intellectual Disability A Research Overview

Apr 30, 2025

Increased Adhd Diagnosis Rates In Adults With Autism And Intellectual Disability A Research Overview

Apr 30, 2025 -

Goi Thau Cap Nuoc Gia Dinh Thuoc Ve Cty Tam Hop Sau Cuoc Thi Dau Cam Go Voi 6 Doi Thu

Apr 30, 2025

Goi Thau Cap Nuoc Gia Dinh Thuoc Ve Cty Tam Hop Sau Cuoc Thi Dau Cam Go Voi 6 Doi Thu

Apr 30, 2025 -

Watch Untucked Ru Pauls Drag Race Season 17 Episode 8 Free Streaming Options

Apr 30, 2025

Watch Untucked Ru Pauls Drag Race Season 17 Episode 8 Free Streaming Options

Apr 30, 2025

Latest Posts

-

Doctor Whos Ncuti Gatwa Pitches Gillian Anderson For Villain Role

Apr 30, 2025

Doctor Whos Ncuti Gatwa Pitches Gillian Anderson For Villain Role

Apr 30, 2025 -

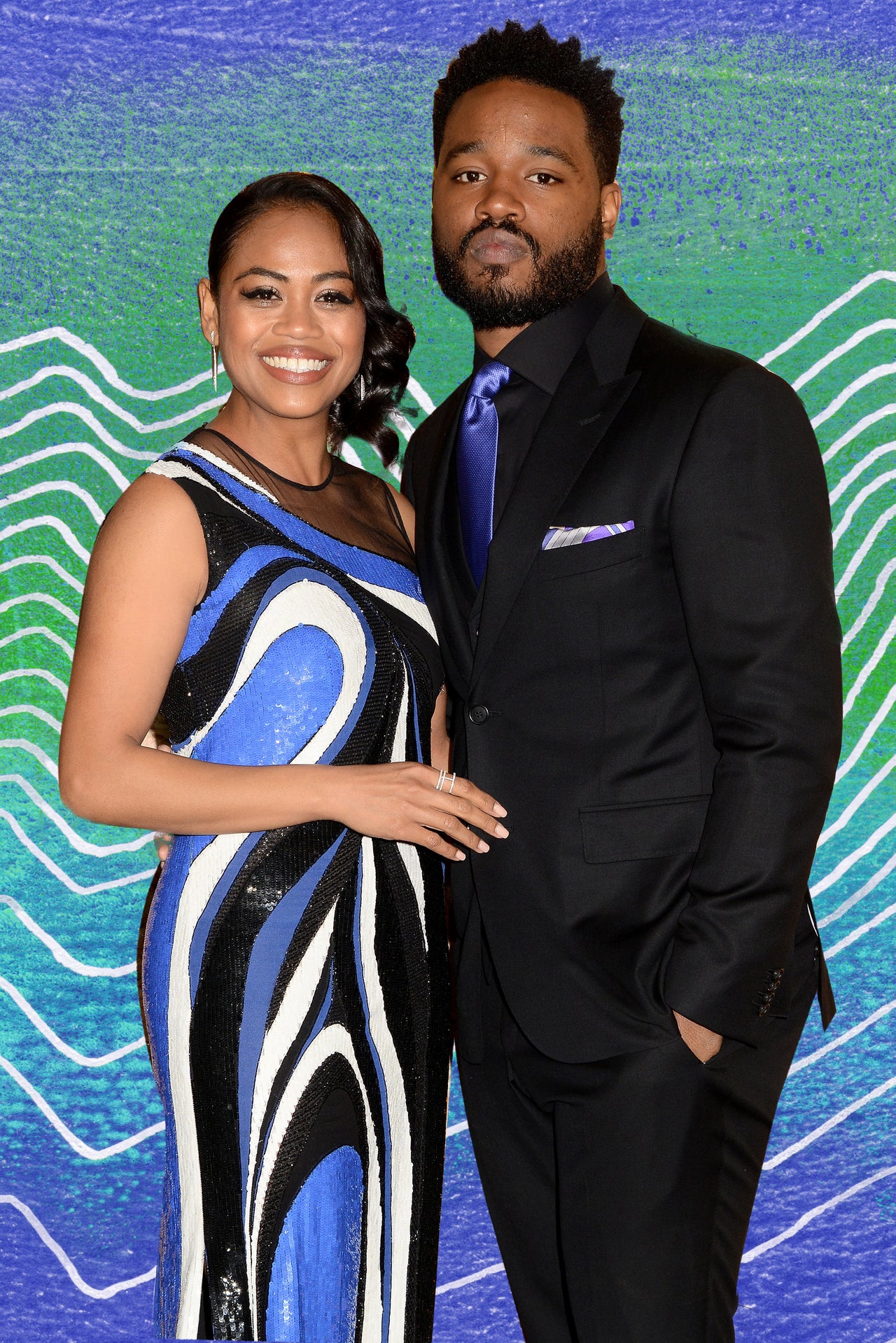

Un Nouveau X Files Par Ryan Coogler Possibilites Et Defis

Apr 30, 2025

Un Nouveau X Files Par Ryan Coogler Possibilites Et Defis

Apr 30, 2025 -

Could Gillian Anderson Be The Next Doctor Who Villain Ncuti Gatwas Choice

Apr 30, 2025

Could Gillian Anderson Be The Next Doctor Who Villain Ncuti Gatwas Choice

Apr 30, 2025 -

X Files Ryan Coogler A La Realisation D Un Nouveau Depart

Apr 30, 2025

X Files Ryan Coogler A La Realisation D Un Nouveau Depart

Apr 30, 2025 -

Gillian Anderson As Doctor Who Villain Ncuti Gatwas Casting Wish

Apr 30, 2025

Gillian Anderson As Doctor Who Villain Ncuti Gatwas Casting Wish

Apr 30, 2025