High Stock Market Valuations: A BofA Analysis And Reasons For Investor Calm

Table of Contents

BofA's Valuation Analysis and Key Findings

Bank of America recently published a report expressing concerns about elevated stock market valuations. Their analysis utilized several key metrics to assess market health, focusing primarily on price-to-earnings ratios (P/E), price-to-sales ratios (P/S), and other relevant valuation multiples. These multiples compare a company's stock price to its earnings or sales, providing an indication of how expensive the market is relative to its underlying fundamentals.

- Specific P/E ratios cited by BofA: While the exact figures vary depending on the specific index and methodology used, BofA's analysis likely highlighted P/E ratios significantly above historical averages. For example, they may have pointed to a S&P 500 P/E ratio considerably higher than the long-term average of approximately 15-16.

- Comparison to historical P/E ratios: The report likely compared current P/E ratios to those observed during previous market cycles, including periods of both robust growth and market corrections. This historical context is crucial for understanding the degree of overvaluation.

- BofA's assessment of potential overvaluation risks: BofA's conclusion likely emphasized the heightened risk of a market correction or even a more significant downturn given the elevated valuations. They may have highlighted the vulnerability of the market to negative news or shifts in economic conditions.

- Mention any specific sectors identified as overvalued: BofA's report might have identified specific sectors, such as technology or consumer discretionary, as exhibiting particularly high valuations and therefore posing higher risk.

Factors Contributing to Investor Calm

Despite BofA's warnings of high stock market valuations, investor sentiment remains relatively buoyant. Several factors contribute to this apparent disconnect between valuation concerns and market behavior.

- Low interest rates and their impact on investment decisions (low-rate environment): Persistently low interest rates make bonds and other fixed-income investments less attractive, driving investors towards higher-yielding assets like stocks, even at elevated valuations. This low-rate environment fuels the search for yield.

- Strong corporate earnings and projected growth (strong earnings growth): Strong corporate earnings, particularly in certain sectors, provide a degree of justification for the higher stock prices. Positive earnings growth projections further bolster investor confidence.

- Positive economic indicators and expectations (economic growth outlook): Positive economic data, such as strong GDP growth or low unemployment rates, often translates into higher stock valuations as investors anticipate future corporate profits. A positive economic growth outlook reinforces investor optimism.

- Inflation expectations and their effect on stock valuations: While inflation can be detrimental, moderate inflation expectations can actually support higher stock prices. Investors may view stocks as a hedge against inflation, leading to increased demand even with high valuations.

- The role of quantitative easing and other monetary policies: Central bank policies, such as quantitative easing (QE), which involve injecting liquidity into the market, can artificially inflate asset prices, including stocks. These monetary policies can influence investor behaviour and risk appetite.

- Increased investor confidence despite potential risks: A general sense of optimism and increased risk tolerance among investors can lead them to overlook valuation concerns, focusing instead on the potential for further growth.

Potential Risks Associated with High Valuations

While investor calm prevails, it's crucial to acknowledge the inherent risks associated with investing in a market with high valuations.

- Increased vulnerability to market corrections or crashes: Highly valued markets are inherently more vulnerable to sharp corrections or even crashes, as even a small negative shock can trigger a significant price decline.

- Lower potential for future returns compared to less expensive markets: Historically, periods of high valuations have been followed by periods of lower returns. Investors may experience diminished returns compared to periods when they entered the market at lower valuations.

- The impact of rising interest rates on stock valuations: Rising interest rates tend to negatively impact stock valuations, as higher borrowing costs make equities less attractive relative to bonds. A shift in interest rate policy could exert significant pressure on stock prices.

- Potential for increased volatility: Highly valued markets are often characterized by increased volatility, meaning that stock prices can experience larger and more frequent fluctuations.

- Risk of a market bubble bursting: The combination of high valuations and exuberant investor sentiment creates the potential for a market bubble, where prices become detached from fundamentals and eventually collapse.

Mitigation Strategies for Investors

Navigating a market with high stock market valuations requires a prudent approach.

- Diversification strategies to reduce risk: Diversifying across different asset classes (stocks, bonds, real estate) and sectors can mitigate the impact of a market correction in any specific area.

- Importance of a long-term investment horizon: A long-term investment horizon allows investors to weather short-term market fluctuations and benefit from the long-term growth potential of the market.

- Considering value investing approaches: Focusing on undervalued companies or sectors can offer protection against market corrections and potentially higher returns.

- Regular portfolio review and rebalancing: Regularly reviewing and rebalancing your portfolio ensures that your asset allocation remains aligned with your risk tolerance and investment goals.

- Seeking professional financial advice: Consulting with a qualified financial advisor can provide personalized guidance on navigating the complexities of high stock market valuations.

Conclusion

BofA's analysis highlights significant concerns regarding high stock market valuations, presenting a potential risk for investors. However, factors like low interest rates, strong corporate earnings, and a positive economic outlook contribute to investor calm. While these factors offer some support for current valuations, the potential for market corrections and lower future returns remains a significant risk. Understanding these nuances – low interest rates, strong corporate earnings, the potential for increased volatility – is crucial for informed investment decisions. Continue to monitor economic indicators, diversify your portfolio, and seek professional advice to manage your investments effectively in this environment of high stock market valuations. Learn more about navigating high stock market valuations by exploring our other resources.

Featured Posts

-

Gaza Captives The Untold Stories Of Idf Soldiers

May 26, 2025

Gaza Captives The Untold Stories Of Idf Soldiers

May 26, 2025 -

Paris Roubaix Fan Who Threw Bottle At Van Der Poel Surrenders To Police

May 26, 2025

Paris Roubaix Fan Who Threw Bottle At Van Der Poel Surrenders To Police

May 26, 2025 -

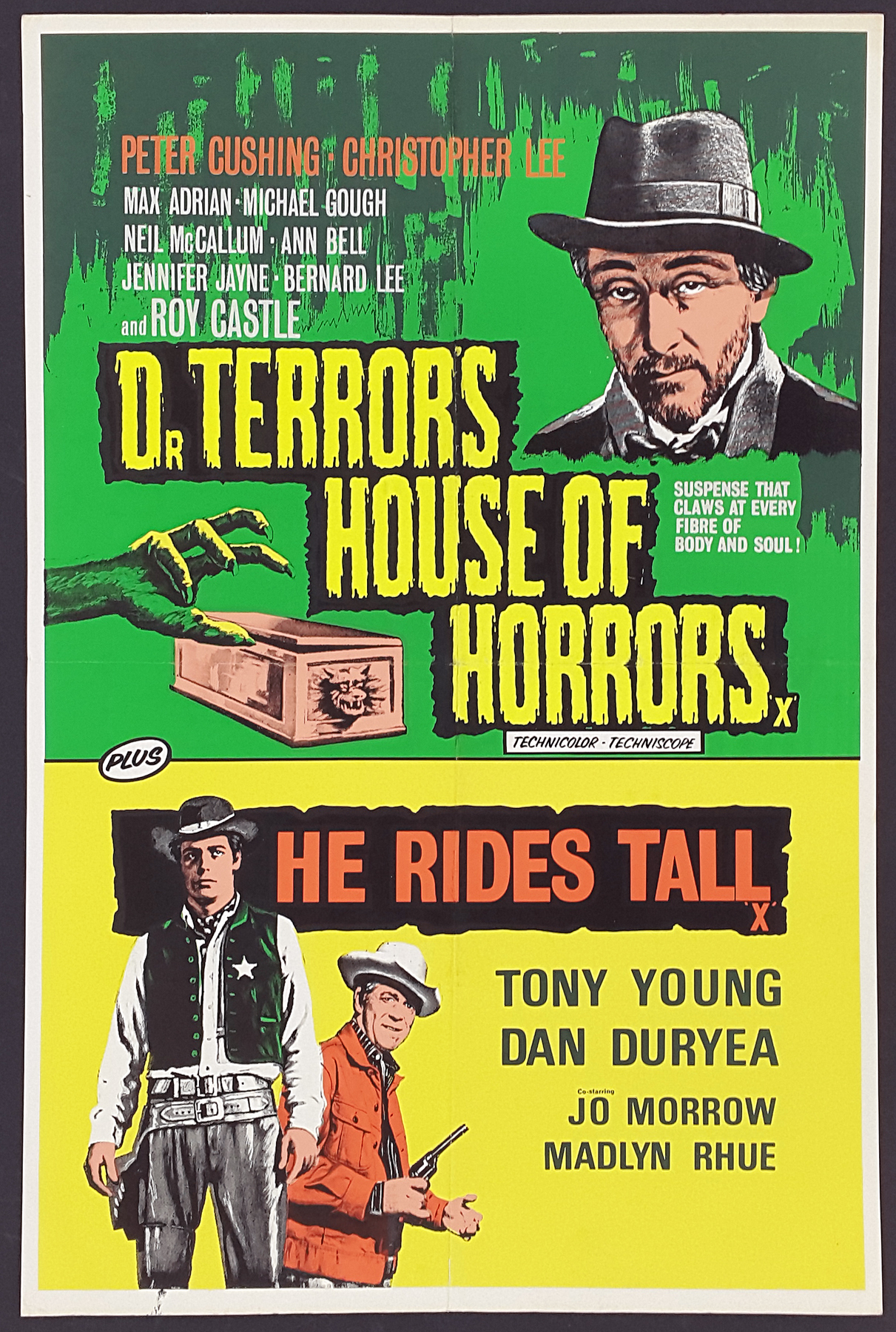

Exploring Dr Terrors House Of Horrors What To Expect

May 26, 2025

Exploring Dr Terrors House Of Horrors What To Expect

May 26, 2025 -

New Details Emerge Mercedes Investigates Lewis Hamilton Update

May 26, 2025

New Details Emerge Mercedes Investigates Lewis Hamilton Update

May 26, 2025 -

Decoding The F1 Drivers Press Conference A Comprehensive Guide

May 26, 2025

Decoding The F1 Drivers Press Conference A Comprehensive Guide

May 26, 2025

Latest Posts

-

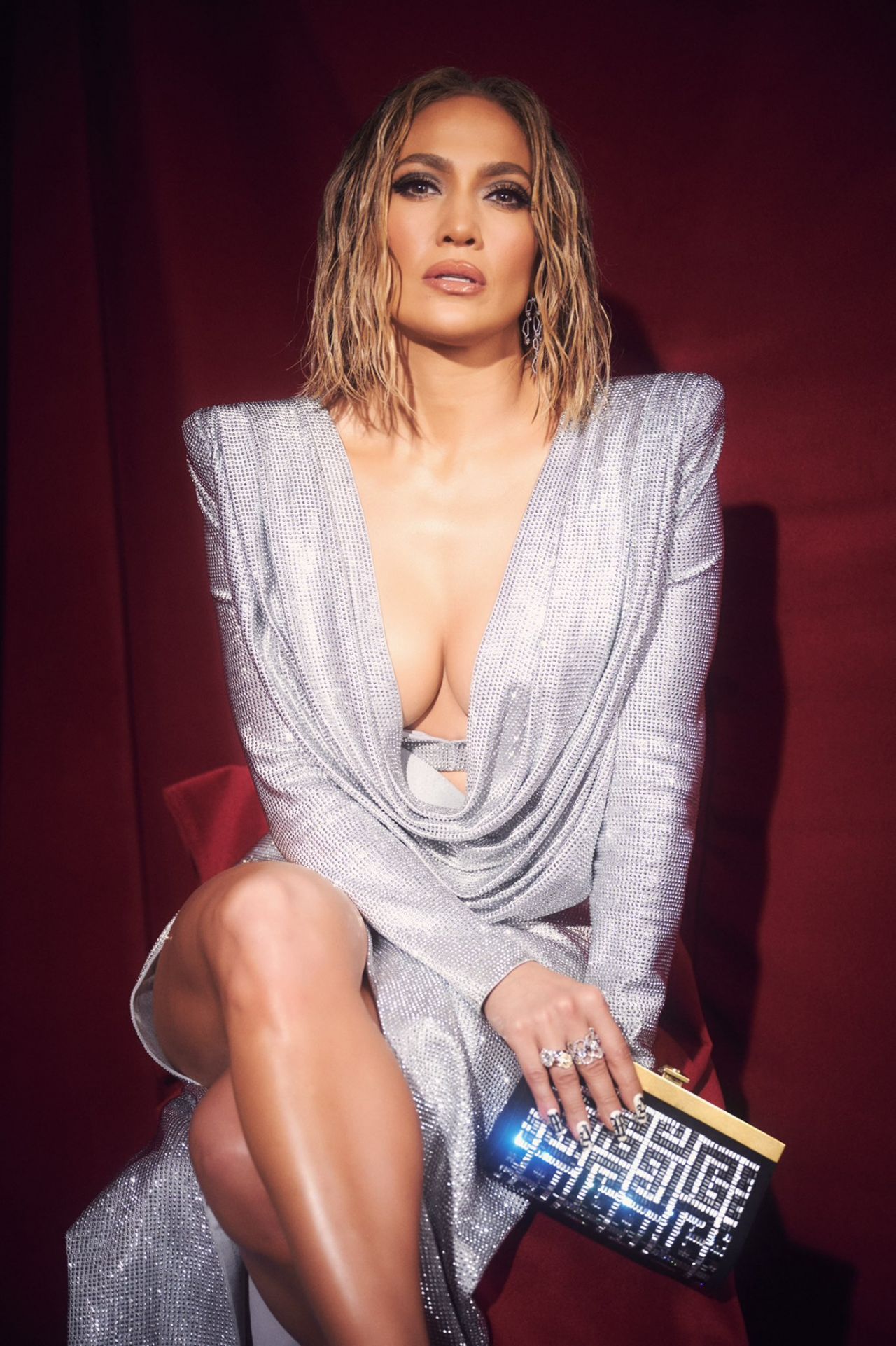

Jennifer Lopez To Host The 2025 American Music Awards

May 28, 2025

Jennifer Lopez To Host The 2025 American Music Awards

May 28, 2025 -

Jennifer Lopez American Music Awards Host For May Ceremony

May 28, 2025

Jennifer Lopez American Music Awards Host For May Ceremony

May 28, 2025 -

Amas Nominations K Pop Representation With Rose Rm Jimin Ateez And Stray Kids

May 28, 2025

Amas Nominations K Pop Representation With Rose Rm Jimin Ateez And Stray Kids

May 28, 2025 -

See Whos Starring In The Dubbo Championship Wrestling Musical

May 28, 2025

See Whos Starring In The Dubbo Championship Wrestling Musical

May 28, 2025 -

American Music Awards 2024 Jennifer Lopez Set To Host In May

May 28, 2025

American Music Awards 2024 Jennifer Lopez Set To Host In May

May 28, 2025