High Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Assessment of Current High Stock Market Valuations

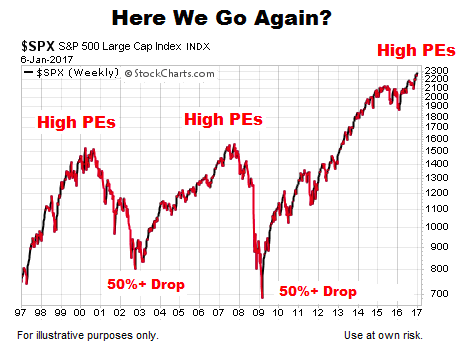

BofA's analysis of current high stock market valuations utilizes several key metrics to gauge the market's health. They meticulously compare current valuations to historical averages, identifying potential overvaluation or undervaluation in specific sectors. This approach provides a comprehensive understanding of the market's overall health and potential risks.

- Valuation Metrics: BofA employs various metrics, including the widely used Price-to-Earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (Shiller PE), to assess the market's valuation. These metrics provide different perspectives on the market's inherent value, considering historical earnings and inflation.

- Historical Comparisons: By comparing current P/E ratios to historical averages spanning various market cycles, BofA can identify potential deviations from historical norms. This helps determine whether current valuations represent a bubble or a justified reflection of underlying economic strength. For instance, they might compare the current Shiller PE to its average over the past 20 years to establish a benchmark.

- Sectoral Analysis: BofA's analysis extends beyond broad market indices. They delve into individual sectors, identifying those exhibiting signs of overvaluation (potentially ripe for a correction) and those appearing undervalued (presenting potential opportunities). For example, they might highlight the technology sector as potentially overvalued while pointing towards undervalued opportunities in the energy or healthcare sectors. [Insert a hypothetical chart or graph illustrating BofA's sectoral analysis here].

Factors Contributing to BofA's Relatively Calm Stance

Despite acknowledging high stock market valuations, BofA hasn't issued an overly alarmist warning. Their relatively calm stance stems from a careful consideration of several macroeconomic factors.

- Interest Rate Environment: BofA's assessment considers the current and projected interest rate environment. While higher interest rates typically put downward pressure on stock valuations, the pace and magnitude of increases significantly influence the market's reaction. A gradual increase may be more easily absorbed than a sharp, unexpected surge.

- Inflation Expectations: Inflation plays a crucial role. High and persistent inflation can erode corporate earnings, impacting stock valuations. BofA's analysis includes detailed forecasts of inflation trends and their likely effects on corporate profits and investor sentiment.

- Economic Growth Projections: Strong economic growth can support higher stock valuations, offsetting the impact of other factors. BofA’s forecasts for GDP growth and employment rates are factored into their valuation assessments. Data points supporting these projections should be included.

BofA's Recommendations for Investors Facing High Stock Market Valuations

Navigating high stock market valuations requires a strategic approach. BofA suggests several measures to mitigate risks and potentially capitalize on opportunities.

- Diversification: BofA likely advises diversifying across asset classes (stocks, bonds, real estate) and geographical regions. This reduces the impact of any single sector or market downturn.

- Sector Rotation: Given BofA's sectoral analysis, they may suggest rotating investments from overvalued sectors into undervalued ones. This strategy aims to optimize returns while mitigating risks.

- Risk Management: Implementing risk management strategies, such as stop-loss orders or hedging, can help limit potential losses during market corrections. This aspect is crucial for navigating periods of high valuations.

Alternative Perspectives on High Stock Market Valuations

It's vital to acknowledge that not all analysts share BofA's perspective. Some financial institutions or experts might hold more bearish views, highlighting the potential risks associated with currently elevated valuations.

- Contrasting Views: Some analysts might argue that current valuations are unsustainable and predict a significant market correction. Others might focus on specific risks, like rising interest rates or geopolitical instability, as potential catalysts for a downturn.

- Potential Risks: High valuations increase the vulnerability to market corrections. Unexpected economic downturns, geopolitical events, or changes in monetary policy can trigger significant price declines.

Conclusion: Navigating High Stock Market Valuations – A Call to Action

BofA's analysis suggests a cautious optimism regarding high stock market valuations. While acknowledging elevated valuations, they highlight macroeconomic factors that could support current levels or moderate any potential declines. Their recommendations emphasize diversification, sector rotation, and robust risk management strategies. Understanding high stock market valuations is paramount for successful investing. Conduct thorough research, consult with a financial advisor to develop a personalized investment strategy that aligns with your risk tolerance and financial goals, and actively manage your portfolio to effectively navigate these challenging market conditions. Remember, effectively managing high stock market valuations requires vigilance and a proactive approach.

Featured Posts

-

Conciliatory Trump Remarks Boost Gold Prices

Apr 25, 2025

Conciliatory Trump Remarks Boost Gold Prices

Apr 25, 2025 -

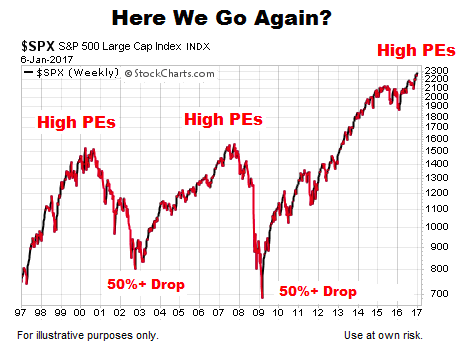

The La Palisades Fire A List Of Celebrities Who Lost Their Homes

Apr 25, 2025

The La Palisades Fire A List Of Celebrities Who Lost Their Homes

Apr 25, 2025 -

Spider Man 4 Casting News Sadie Sink And The Mcus Jean Grey

Apr 25, 2025

Spider Man 4 Casting News Sadie Sink And The Mcus Jean Grey

Apr 25, 2025 -

Easter Holiday Destinations In The North East Your Perfect Itinerary

Apr 25, 2025

Easter Holiday Destinations In The North East Your Perfect Itinerary

Apr 25, 2025 -

Severe Weather Alert Icy Roads Create Hazardous Driving In Okc

Apr 25, 2025

Severe Weather Alert Icy Roads Create Hazardous Driving In Okc

Apr 25, 2025

Latest Posts

-

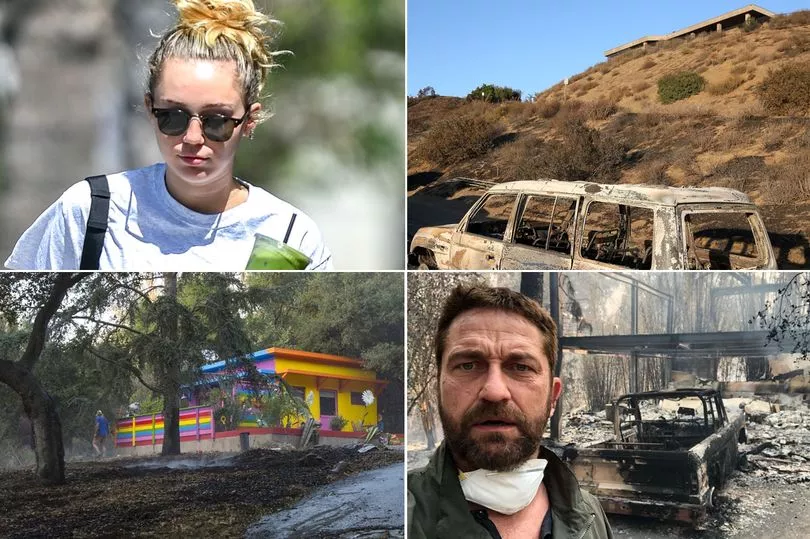

The Health Benefits Of Asparagus A Deep Dive Into Vitamins Minerals And More

Apr 30, 2025

The Health Benefits Of Asparagus A Deep Dive Into Vitamins Minerals And More

Apr 30, 2025 -

Is Asparagus Healthy Exploring The Nutritional Powerhouse And Its Impact On Your Well Being

Apr 30, 2025

Is Asparagus Healthy Exploring The Nutritional Powerhouse And Its Impact On Your Well Being

Apr 30, 2025 -

Asparagus Your Comprehensive Guide To Health Benefits And Nutritional Value

Apr 30, 2025

Asparagus Your Comprehensive Guide To Health Benefits And Nutritional Value

Apr 30, 2025 -

Cdu Spd Coalition Talks Begin Key Issues And Potential Outcomes

Apr 30, 2025

Cdu Spd Coalition Talks Begin Key Issues And Potential Outcomes

Apr 30, 2025 -

How Healthy Is Asparagus Unveiling The Benefits Of This Nutrient Rich Vegetable

Apr 30, 2025

How Healthy Is Asparagus Unveiling The Benefits Of This Nutrient Rich Vegetable

Apr 30, 2025