High Stock Market Valuations: BofA's Reasons For Investor Calm

Table of Contents

BofA's Rationale: Strong Corporate Earnings and Profitability

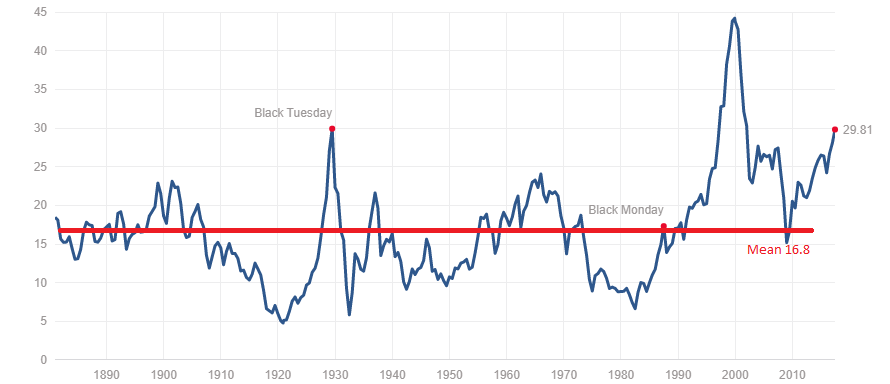

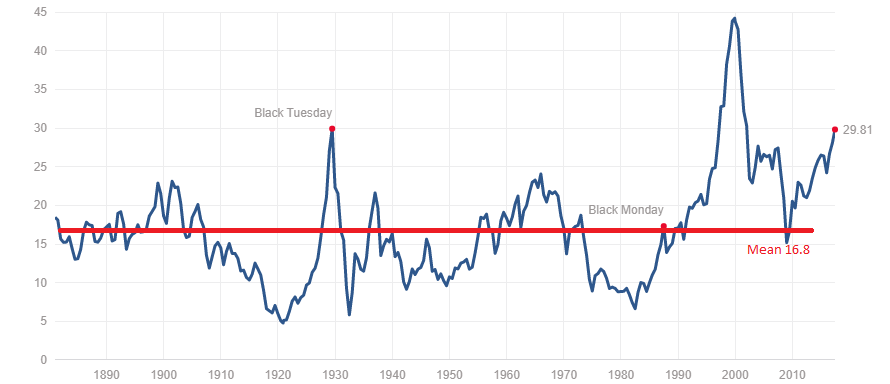

BofA points to robust corporate earnings as a primary justification for the current high valuations. They argue that strong revenue growth and improved profit margins are providing a solid foundation for supporting current stock prices, even at these elevated levels. This contrasts with some analysts who express significant concern about high stock market valuations relative to historical norms.

- High levels of corporate profitability are exceeding expectations. Many S&P 500 companies are reporting earnings significantly above analyst estimates, suggesting underlying strength in the economy and resilience in corporate performance.

- Consistent earnings growth is outpacing inflation in many sectors. While inflation remains a concern, strong revenue growth in several sectors is outpacing inflationary pressures, protecting profit margins and supporting stock prices. This is particularly true in sectors less sensitive to interest rate hikes.

- Strong balance sheets across various companies mitigate risk. Many corporations have strengthened their balance sheets in recent years, providing a cushion against economic headwinds and reducing the likelihood of widespread defaults or bankruptcies. This improved financial health contributes to investor confidence.

- Analysts' earnings revisions remain positive, indicating future growth potential. Despite the high valuations, many analysts are continuing to revise their earnings estimates upward, suggesting that the positive momentum in corporate profits is expected to continue. This sustained positive outlook bolsters the argument for maintaining current market valuations.

The Role of Interest Rates and Inflation in BofA's Assessment

BofA's assessment also considers the intricate interplay of interest rates and inflation. While acknowledging the challenges posed by rising interest rates and persistent inflation, BofA's analysis might suggest a belief that inflation is peaking or that the Federal Reserve's monetary policy is successfully navigating the economy toward a "soft landing." This nuanced perspective is key to understanding their relatively calm market outlook.

- The Federal Reserve's monetary policy and its influence on the market. BofA carefully monitors the Federal Reserve's actions, considering the impact of interest rate hikes on economic growth and inflation expectations. Their analysis may consider the effectiveness of the Fed's efforts to cool the economy without triggering a recession.

- The relationship between inflation rates and stock valuations. BofA’s analysis incorporates the complex relationship between inflation and stock market performance. While high inflation can erode corporate profits and depress valuations, a controlled decline in inflation might support current market levels.

- The potential for a "soft landing" and its impact on stock prices. The prospect of a soft landing – a scenario where the economy slows down without falling into a recession – is a crucial factor in BofA's assessment. A soft landing could support continued earnings growth and justify higher valuations.

- Bond yields and their correlation with equity valuations. BofA likely compares bond yields to equity valuations to assess relative attractiveness. If bond yields remain relatively low despite interest rate hikes, it could suggest that equity investments still offer competitive returns, justifying higher stock prices.

Long-Term Growth Potential and Technological Innovation

BofA's positive outlook incorporates a long-term perspective, emphasizing the significant role of technological innovation and secular trends. This focus on future growth prospects helps explain their willingness to maintain a relatively positive view, even in the face of current high valuations.

- Key secular trends driving long-term growth. BofA likely identifies secular trends, such as the increasing adoption of artificial intelligence, the growth of renewable energy, and the expansion of e-commerce, as factors supporting long-term market growth.

- The impact of disruptive technologies on various industries. BofA's analysis considers how disruptive technologies are reshaping different sectors, leading to the emergence of new industries and opportunities for growth.

- The potential for growth in emerging markets. BofA might highlight the substantial growth potential in emerging markets, offering further diversification and opportunities for higher returns, balancing the concerns of high stock market valuations in developed markets.

- Long-term prospects for specific sectors. Their analysis might delve into the long-term prospects of specific sectors, identifying those that are likely to benefit from ongoing technological advancements and secular growth trends.

Addressing the Risk of High Valuations: BofA's Mitigation Strategies

BofA acknowledges the inherent risks associated with high stock market valuations. They advocate for proactive risk management strategies to mitigate potential losses. This approach is crucial in understanding their position on current market conditions.

- The importance of diversification across different asset classes. BofA likely emphasizes the benefits of diversifying investments across various asset classes, including stocks, bonds, and real estate, to reduce overall portfolio risk.

- Strategies for identifying undervalued stocks within a high-valuation market. Even in a high-valuation market, BofA may highlight techniques for identifying undervalued companies with strong growth potential. This approach emphasizes value investing principles within a higher-valuation environment.

- Defensive investment strategies to protect against market downturns. BofA likely advises investors to consider defensive investment strategies, such as investing in low-volatility stocks or increasing cash holdings, to protect portfolios during potential market downturns.

- Potential use of hedging strategies to reduce portfolio risk. Employing hedging strategies, such as options or short selling, can help mitigate potential losses during periods of market volatility.

Conclusion

This article explored BofA's reasoning behind its relatively calm stance on high stock market valuations. Factors such as strong corporate earnings, the potential for a managed economic slowdown, long-term growth prospects, and proactive risk management strategies contribute to their positive outlook. While high stock market valuations present inherent risks, understanding BofA's analysis can help investors make informed decisions. Conduct your own thorough research and consider consulting a financial advisor before making any investment choices related to high stock market valuations. Don't hesitate to explore further analysis of high stock market valuations to build a robust investment strategy.

Featured Posts

-

Dzherard Btlr 8 Godini S Osinovenoto Mu Blgarsko Kuche

May 13, 2025

Dzherard Btlr 8 Godini S Osinovenoto Mu Blgarsko Kuche

May 13, 2025 -

How Retailers Broke The Doom The Dark Age Street Date And The Resulting Spoiler Fallout

May 13, 2025

How Retailers Broke The Doom The Dark Age Street Date And The Resulting Spoiler Fallout

May 13, 2025 -

Eva Longoria 50 Evesen Bikini Alakja Es Szepsegapolasi Titkai

May 13, 2025

Eva Longoria 50 Evesen Bikini Alakja Es Szepsegapolasi Titkai

May 13, 2025 -

Tory Lanezs Verbal Assault On Lawyer In Megan Thee Stallion Lawsuit

May 13, 2025

Tory Lanezs Verbal Assault On Lawyer In Megan Thee Stallion Lawsuit

May 13, 2025 -

Cassie Venturas Pregnancy Red Carpet Debut With Husband Alex Fine At Mob Land Premiere

May 13, 2025

Cassie Venturas Pregnancy Red Carpet Debut With Husband Alex Fine At Mob Land Premiere

May 13, 2025