High Stock Valuations And Investor Concerns: BofA's Reassurance

Table of Contents

BofA's Analysis of Current Market Conditions

BofA's analysis provides a nuanced perspective on the current market, addressing the concerns surrounding elevated stock prices. Their assessment considers several key factors influencing market performance and investor sentiment.

Strong Corporate Earnings Despite Economic Uncertainty

Despite looming economic uncertainty and predictions of a potential recession, BofA highlights the resilience of corporate earnings. Many companies have demonstrated surprising strength, exceeding expectations in recent quarters. This resilience isn't solely due to luck; several factors contribute to this positive performance. Companies have leveraged pricing power to offset inflationary pressures, implementing effective cost-cutting measures and streamlining operations to maintain profitability.

- Strong Q3 earnings surpass expectations. Many companies reported better-than-anticipated earnings in the third quarter of [Year], defying predictions of a significant slowdown.

- Resilience across multiple sectors. This strength isn't confined to a single industry; multiple sectors, including technology, consumer staples, and healthcare, showed impressive earnings results.

- Evidence of pricing power mitigating inflationary pressures. Companies with strong brands and market positions have been able to pass on increased costs to consumers, protecting profit margins. This pricing power demonstrates resilience in the face of economic headwinds.

The Role of Interest Rates in Stock Valuations

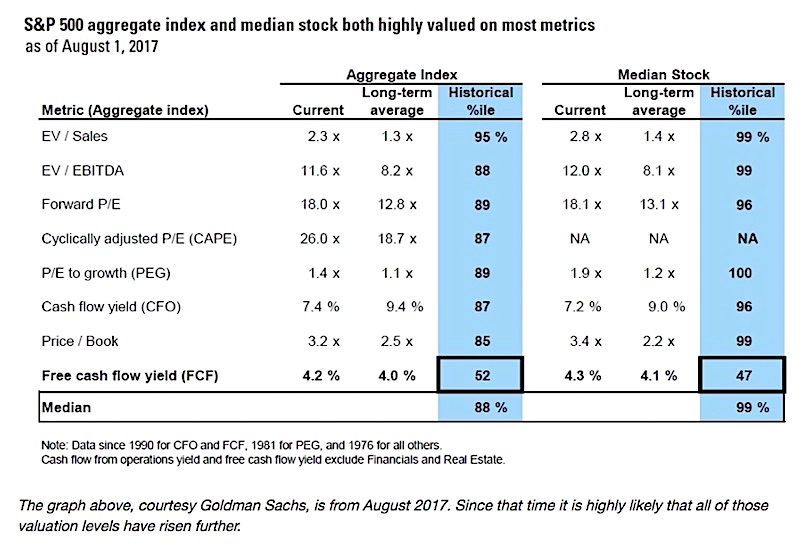

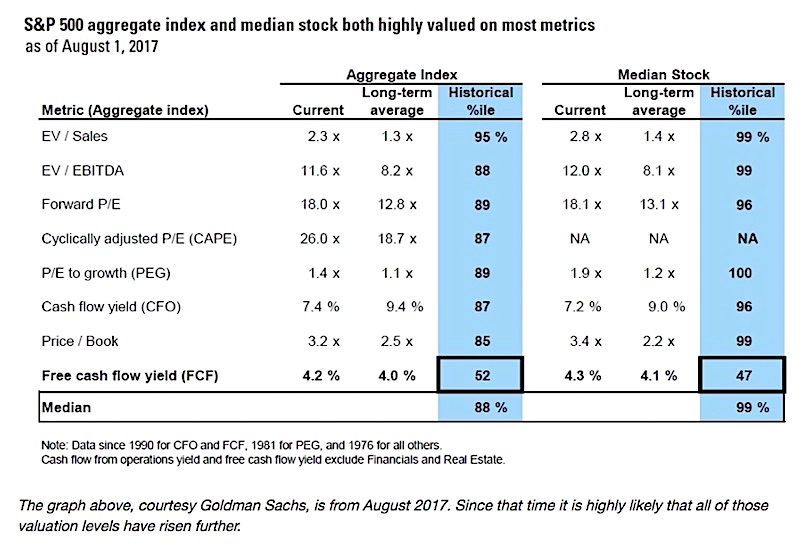

Rising interest rates are a significant factor influencing stock valuations. BofA acknowledges the impact of higher interest rates, explaining their influence on discount rates used in valuation models. Higher interest rates increase the discount rate, reducing the present value of future earnings. This, in turn, can put downward pressure on stock prices.

- Impact of interest rate increases on discounted cash flow models. Discounted cash flow (DCF) models are a common valuation tool, and increases in the discount rate directly impact the calculated intrinsic value of a stock.

- BofA's projections for future interest rate movements. BofA's analysis incorporates their projections for future interest rate hikes, offering insights into the potential impact on stock prices. Their forecasts provide a crucial element in understanding the overall market outlook.

- Potential implications for different stock sectors. The impact of interest rate changes varies across different sectors. BofA likely detailed the differential impact on various industries, helping investors tailor their strategies accordingly. Growth stocks, for example, tend to be more sensitive to interest rate changes than value stocks.

Addressing Investor Concerns about High Stock Valuations

Many investors remain wary despite positive earnings reports. BofA directly addresses these concerns, offering justifications for current price levels and suggesting strategies for managing risk.

BofA's Justification for Current Price Levels

BofA argues that current high stock valuations, while seemingly elevated, are justifiable when considering long-term growth potential. They emphasize the importance of looking beyond short-term market fluctuations and focusing on the long-term prospects of companies and the overall economy.

- Long-term growth prospects outweigh short-term volatility. BofA likely highlighted specific sectors or companies poised for significant long-term growth, suggesting that current valuations reflect future earnings potential.

- Specific examples of undervalued sectors or companies cited by BofA. Identifying specific sectors or companies that BofA believes are currently undervalued provides concrete support for their argument. This targeted approach helps investors make more informed decisions.

- Emphasis on long-term investment strategies. BofA likely stressed the importance of a long-term investment horizon, recommending investors avoid impulsive reactions to short-term market fluctuations. Patience and a long-term outlook are crucial in navigating market volatility.

Mitigation Strategies for High Stock Valuation Risks

Even with BofA's reassurance, the inherent risks associated with high stock valuations remain. To mitigate these risks, BofA likely suggested strategies for managing portfolios effectively.

- Diversification across asset classes. Diversifying investments across different asset classes, such as bonds, real estate, and alternative investments, can help reduce overall portfolio risk.

- Importance of a well-defined risk tolerance. Understanding and adhering to one's risk tolerance is paramount. Investors should only invest in assets aligned with their risk profile.

- Strategies for managing portfolio risk in a volatile market. BofA likely provided actionable strategies, such as rebalancing portfolios regularly or employing stop-loss orders, to manage risk effectively.

Conclusion

BofA's analysis offers reassurance to investors concerned about high stock valuations. While acknowledging market uncertainties, their perspective highlights the resilience of corporate earnings and the importance of considering long-term growth potential. By understanding BofA's assessment and implementing appropriate risk mitigation strategies, investors can navigate the current market conditions more effectively. Remember to conduct your own thorough research and consider consulting with a financial advisor before making any investment decisions concerning high stock valuations and related market conditions.

Featured Posts

-

Oilers Vs Canadiens Morning Coffee Predictions And Bounce Back Potential

May 05, 2025

Oilers Vs Canadiens Morning Coffee Predictions And Bounce Back Potential

May 05, 2025 -

Singapores General Election The Ruling Party Faces Its Biggest Challenge

May 05, 2025

Singapores General Election The Ruling Party Faces Its Biggest Challenge

May 05, 2025 -

Obsessive F1 Ceo Stefano Domenicalis Impact On Formula Ones Global Expansion

May 05, 2025

Obsessive F1 Ceo Stefano Domenicalis Impact On Formula Ones Global Expansion

May 05, 2025 -

Meet The Jockeys Vying For Kentucky Derby 2025 Victory

May 05, 2025

Meet The Jockeys Vying For Kentucky Derby 2025 Victory

May 05, 2025 -

Palestinain American Family Attack 53 Year Sentence For Hate Crime

May 05, 2025

Palestinain American Family Attack 53 Year Sentence For Hate Crime

May 05, 2025

Latest Posts

-

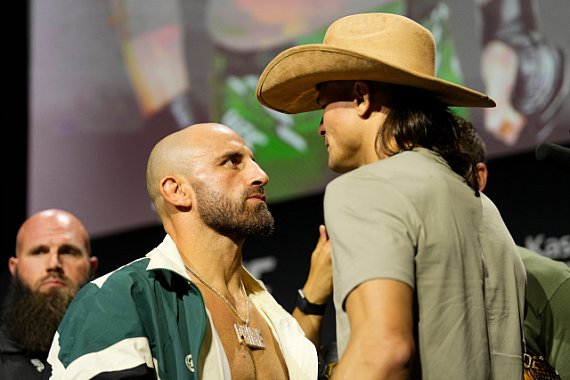

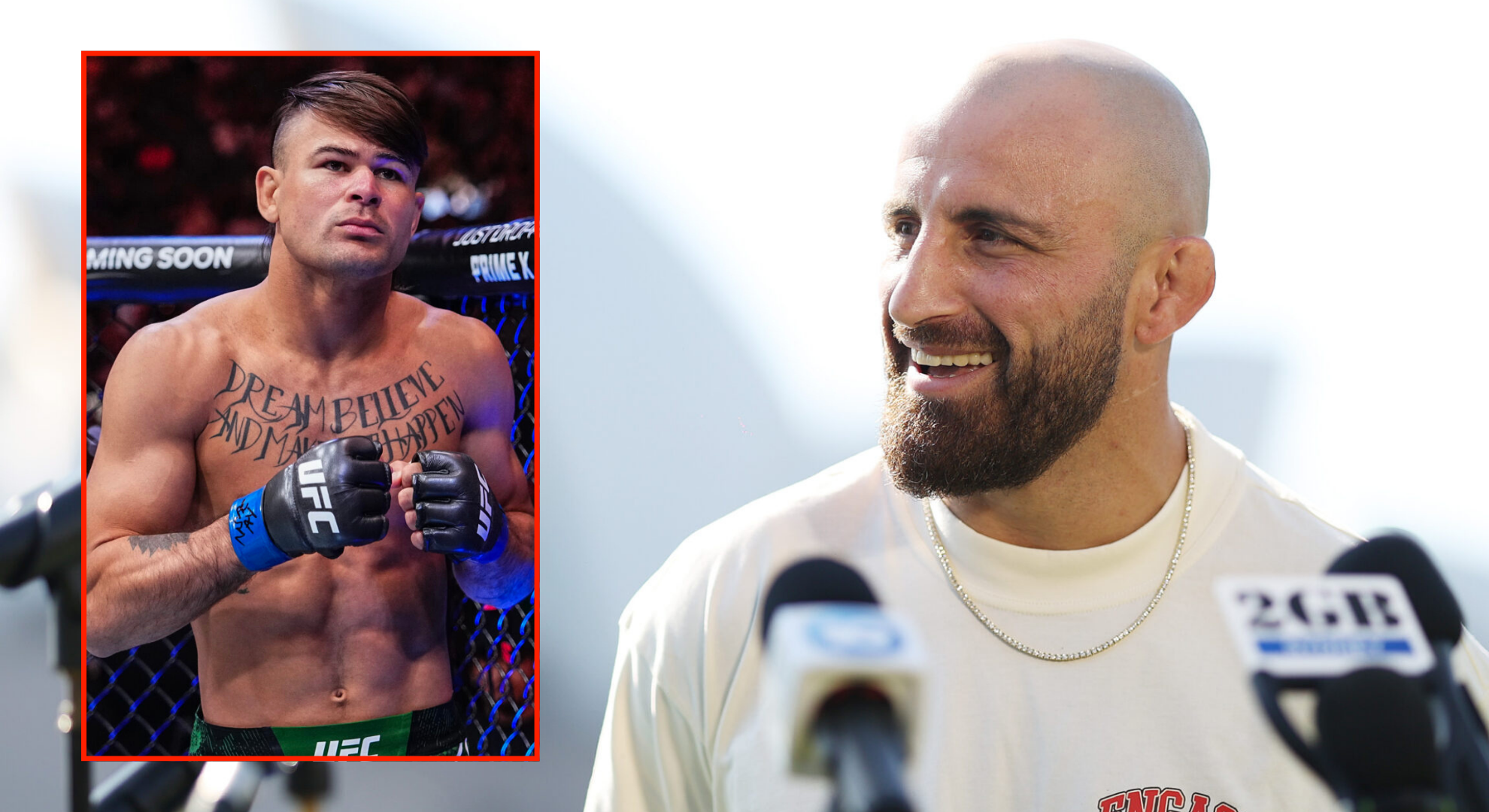

Ufc 314 Ppv Everything You Need To Know About Volkanovski Vs Lopes

May 05, 2025

Ufc 314 Ppv Everything You Need To Know About Volkanovski Vs Lopes

May 05, 2025 -

Ufc 314 Fight Card Volkanovski Vs Lopes Who Won And Lost

May 05, 2025

Ufc 314 Fight Card Volkanovski Vs Lopes Who Won And Lost

May 05, 2025 -

Ufc 314 Volkanovski Lopes Headliner And Complete Fight Card

May 05, 2025

Ufc 314 Volkanovski Lopes Headliner And Complete Fight Card

May 05, 2025 -

Ufc 314 Complete Results And Analysis Of Volkanovski Vs Lopes Fight Card

May 05, 2025

Ufc 314 Complete Results And Analysis Of Volkanovski Vs Lopes Fight Card

May 05, 2025 -

Alexander Volkanovski Vs Diego Lopes Ufc 314 Ppv Event Preview

May 05, 2025

Alexander Volkanovski Vs Diego Lopes Ufc 314 Ppv Event Preview

May 05, 2025